And Other Highlights from the March Jobs Report

The fuel for the “Great Resignation” is a complete reassessment of work itself, which to no surprise has impacted workplace satisfaction scores. The ebb and flow of ratings and review data mirrors the up and down sentiment of today’s worker. They are re-evaluating their jobs. More than 60% of them are considering other work opportunities. And over 90% of them are consulting ratings and reviews before accepting a job according to Glassdoor® Research.

Uniformly, workplace satisfaction is declining thus far in 2022. There is no silver bullet to correct, and this is a complex topic. Employers and workforce strategists can gain insights using the power of analytics. This is a pervasive problem with no industry left untouched. However, employers and workforce analysts do not have to wring their hands. Business analytics and in particular text analytics can help surface correctable insights at the employer level.

Market-Driven Workplace Satisfaction Data

Workplace satisfaction and employer reputation data provide extensive input to what is going on with today’s worker. Employer reputation and workplace satisfaction are two sides of the same coin. Workplace satisfaction represents the worker and career perspective whereas employer reputation grades the perception of the employer by its employees.

The problem with going to sites like Glassdoor® and Indeed® is that they provide very limited context. The data is presented at a given point in time and provides no historical context or benchmarks. In our TalentView solution, we capture and visualize Glassdoor® and Indeed® review and rating data monthly and over time so we can get a much better perspective of the insights it provides.

Workers are not Getting Happier

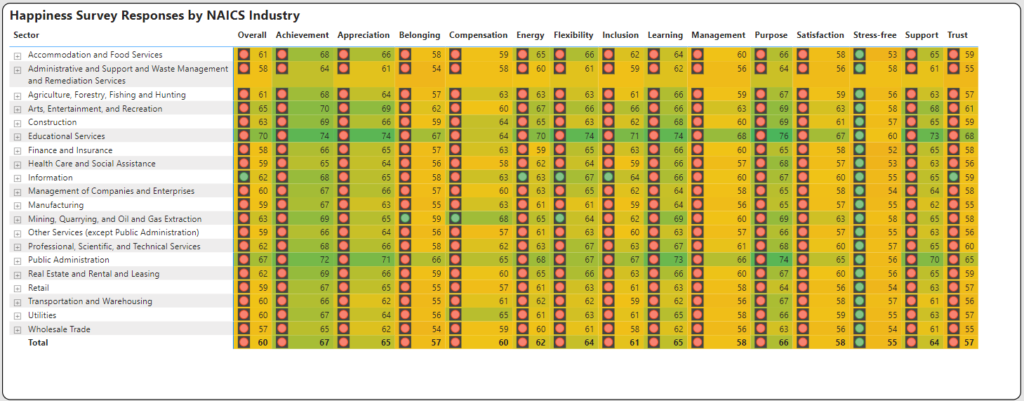

The Indeed® Happiness Survey claims to be the largest of its kind in measuring workplace happiness. It has fifteen categories of workplace happiness measured on a 100-point scale.

We benchmarked Q1 2022 Happiness Survey scores to Q4 2021 across thousands of employers. We then aggregated that data by industry and category. As shown below, every industry experienced decline in Q1 in the Happiness Survey across most categories. The red traffic light indicates a decline in the score from the previous quarter.

The only exception is the Stress-Free category, which has an upward trend indicated by the green color. This category is relatively new to the survey (and introduced during a pandemic). Historically it has had the lowest ratings and so it was due to rise.

Glassdoor and Indeed Reviews Echo Ratings Decline

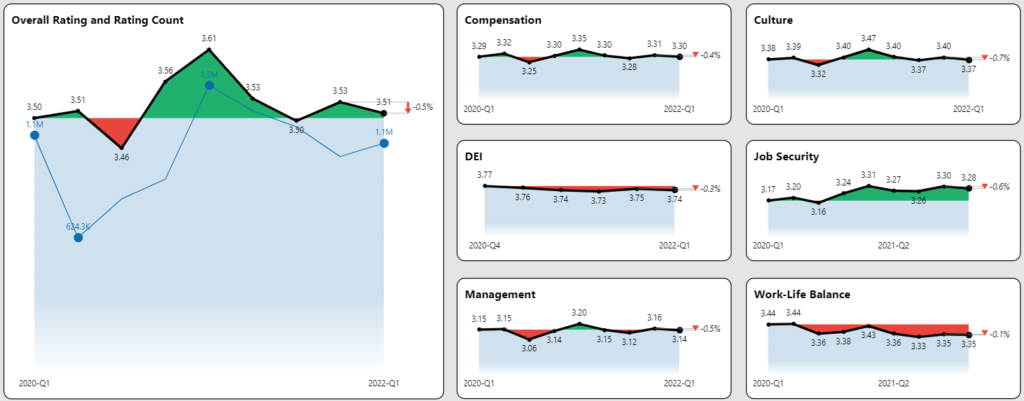

We analyzed millions of ratings from Glassdoor and Indeed over time from January of 2020 to the present. The results from Q1 by major category are shown below.

The ratings decline over the last quarter was not monumental. All were under 1% change. However, the fact that all ratings were down is concerning.

- Management is the lowest rated category.

- Work-Life Balance has had the largest decline during the pandemic.

- Job Security increased during the pandemic as employers hired back, but is now declining.

Sentiment is Substantially Worse

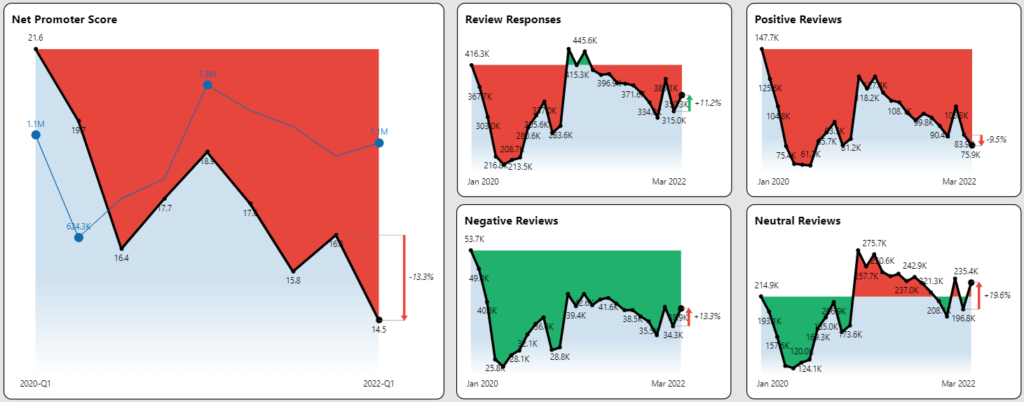

Ratings can be fickle, but sentiment scoring unlocks patterns in the review text. Using text analytics, we measure the sentiment of each review and categorize it into positive, negative and neutral sentiment. We also then compute a net promoter score, which is the percentage of positive scores over negative scores.

- The number of reviews that have a positive score declined significantly during the pandemic and is now close to a low water mark in Q1.

- Negative reviews also had declined during the pandemic, but have now crept back up. In other words, reviewers are expressing themselves more negatively.

- The number of neutral reviews scores peaked in the middle of 2021, and has now jumped up again in Q1.

Net Promoter Score measures the percentage of employees that are fans. It is calculated as the percentage of positive over negative reviews. Neutral reviews are not factored in. Net Promoter Score is now at a low water mark since the pandemic began. However, it is not because workers are disgruntled – it is more apathy and lack of contentment that is fueling this score.

Opinion Mining and Fixing the Problems

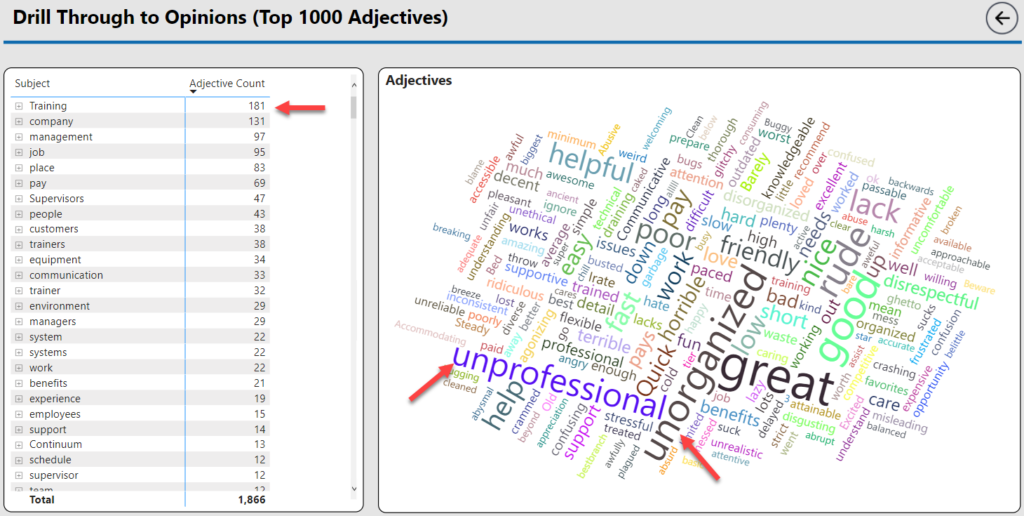

Employers do not need to throw up their hands. Opinion mining can raise issues that are fixable. Opinion mining looks at combinations of words in subject-adjective pairs.

For example, we did a simple opinion analysis of one of the lowest rated employers. Our analysis shows that training is the top subject and adjectives that surfaced indicate employees think the company is unprofessional and unorganized. An easy fix? Perhaps.

March Jobs Report Shows Improvement

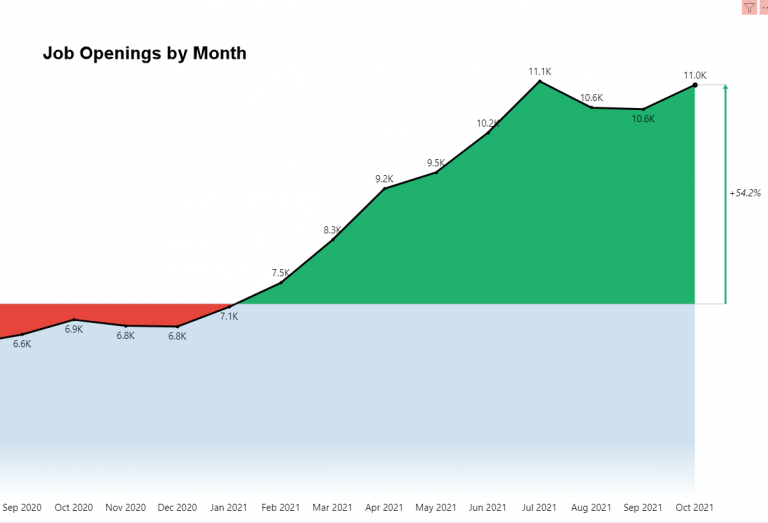

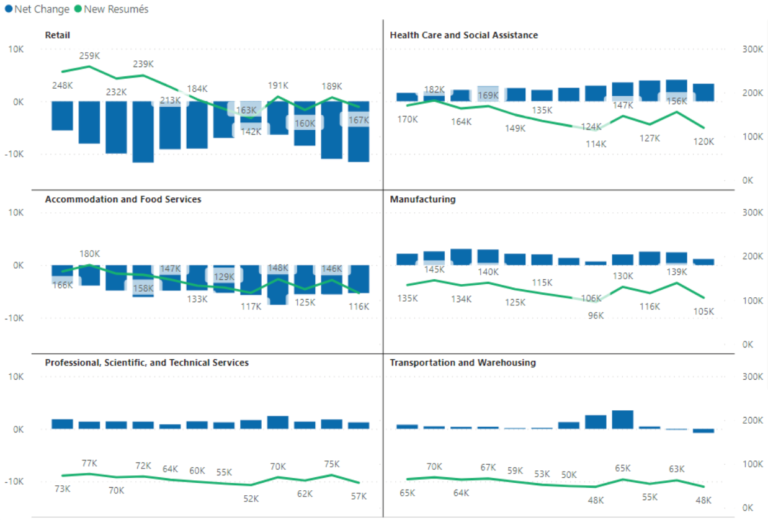

The March jobs report showed significant improvement, even though a few market challenges still exist such as quit rates. Highlights include:

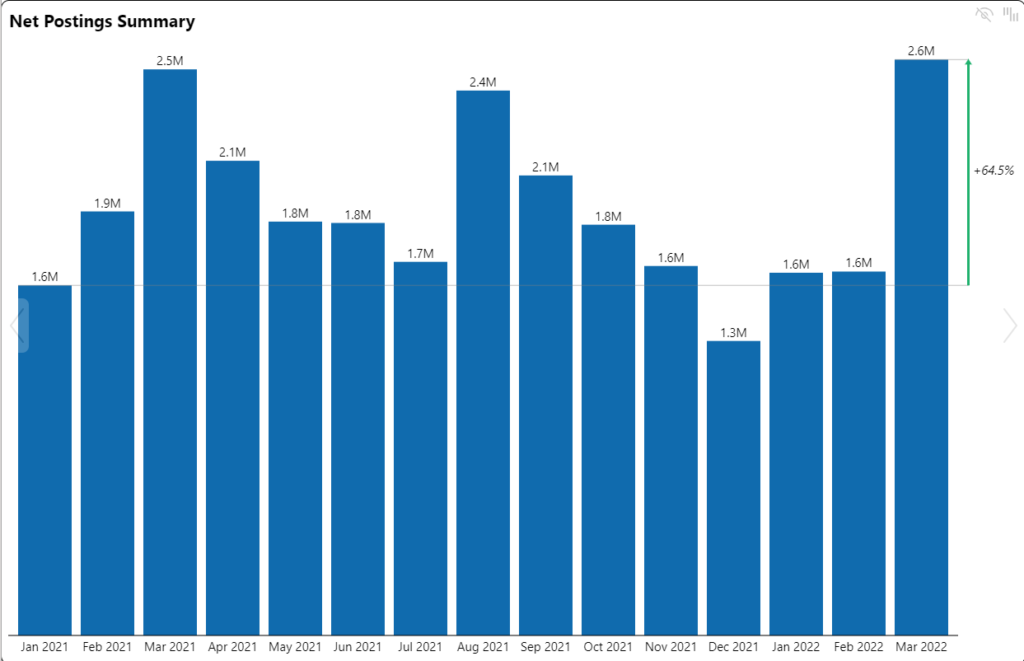

- Posting volume increased 65% from February and reached a two-year high (see graph below).

- Remote work increased substantially and is now over 3% of all jobs.

- Nearly 1 in 4 postings were flagged as urgent indicating pressing demand.

- Open postings increased while open days declined for the third straight month, both positive signs and a reversal from 2021 trends.

- Quit rates remain elevated and job openings remain at or near record levels. Some industries experienced a resurgence in quit rates after improvement.

- Hiring increased across most industries.

Get More Jobs Report Insights

Sign up to watch our Jobs Report Video for even greater insights on this topic and receive supplemental reports and market data.

This is the sixth blog post in a seven-part series about the current state of the workforce and jobs and labor market and more importantly how to respond. The role of market-based analytics is so crucial to understanding the unfolding of remote work.

See the full report at “The State of the Workforce and What You Can Do About It“. This white paper is automatically available to subscribers of our free jobs reports.

Employer Reputation Insights

Public Insight provides an employer branding and reputation insights module as part of our TalentView talent analytics solution. Monitor employer reputation, branding, DEI and market perception based on the latest in employer ratings and sentiment analysis of employer reviews. TalentView enables employers to benchmark and compare against your regional and industry competitors.

Watch a demo and learn more about employer reputation insights.