The November Jobs Report continues to be a mixed scenario. Yet there are signs of getting to market stability. Unemployment rates continue to decline and are now at pre-pandemic levels of 4.4%. Further hiring remains strong with 6.5 million hires which is 500,000 to 1 million above historical levels. In addition, quit rates are showing signs of finally subsiding. However, job openings have ticked back up above record levels indicating jobs are not being filled and the number of open days in postings increased yet again.

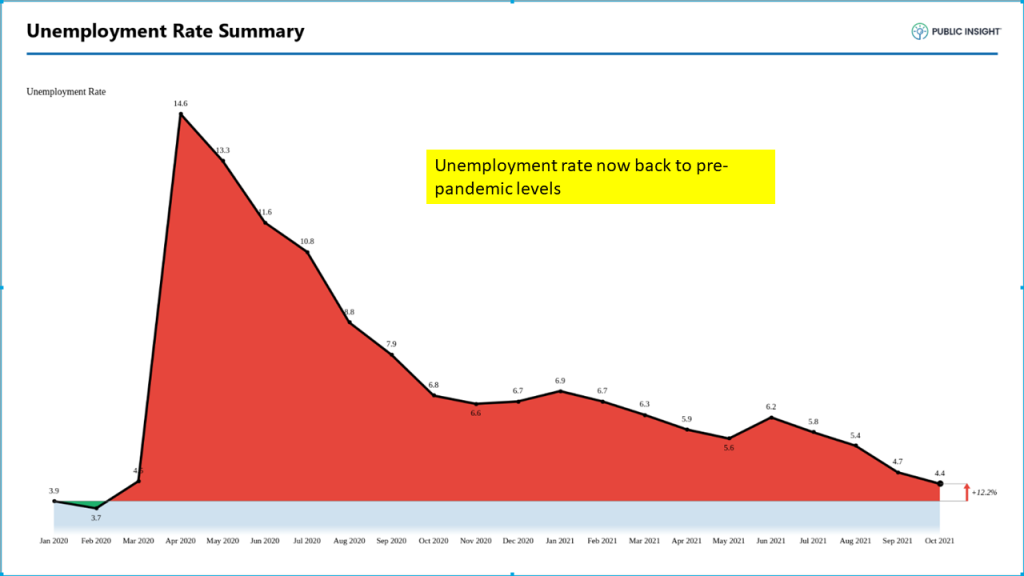

Unemployment Down to 4.4%

Unemployment continues to tick down and is now in the pre-pandemic neighborhood of 4.4%. The graph below shows the positive trend since the April 2020 height of 14.6%. Initial and continuing unemployment claims actually ticked up slightly in October, but are still in the vicinity of pre-pandemic levels.

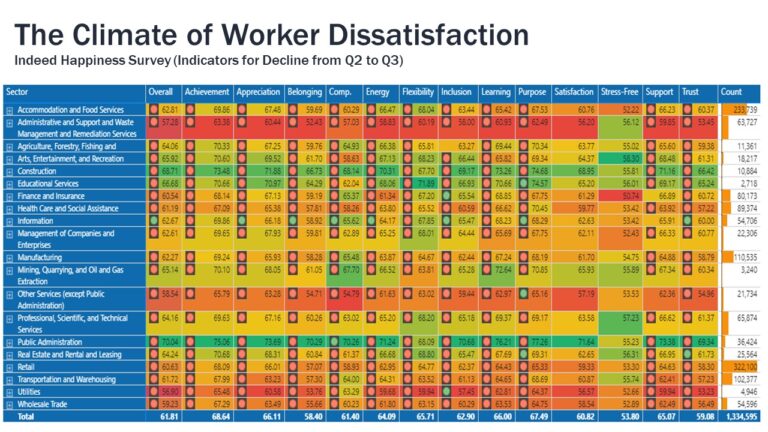

Are Quit Rates Finally Declining?

Quit rates reached a peak of 3.0% in October nearly a full percentage point above the normal level of 2.2 to 2.4%. In November, the quit rates subsided to 2.8%. What is especially encouraging is that the quit rates declined the most in the industries hardest hit. Accommodation and food services and leisure and hospitality industries had meaningful declines as shown in the graph below.

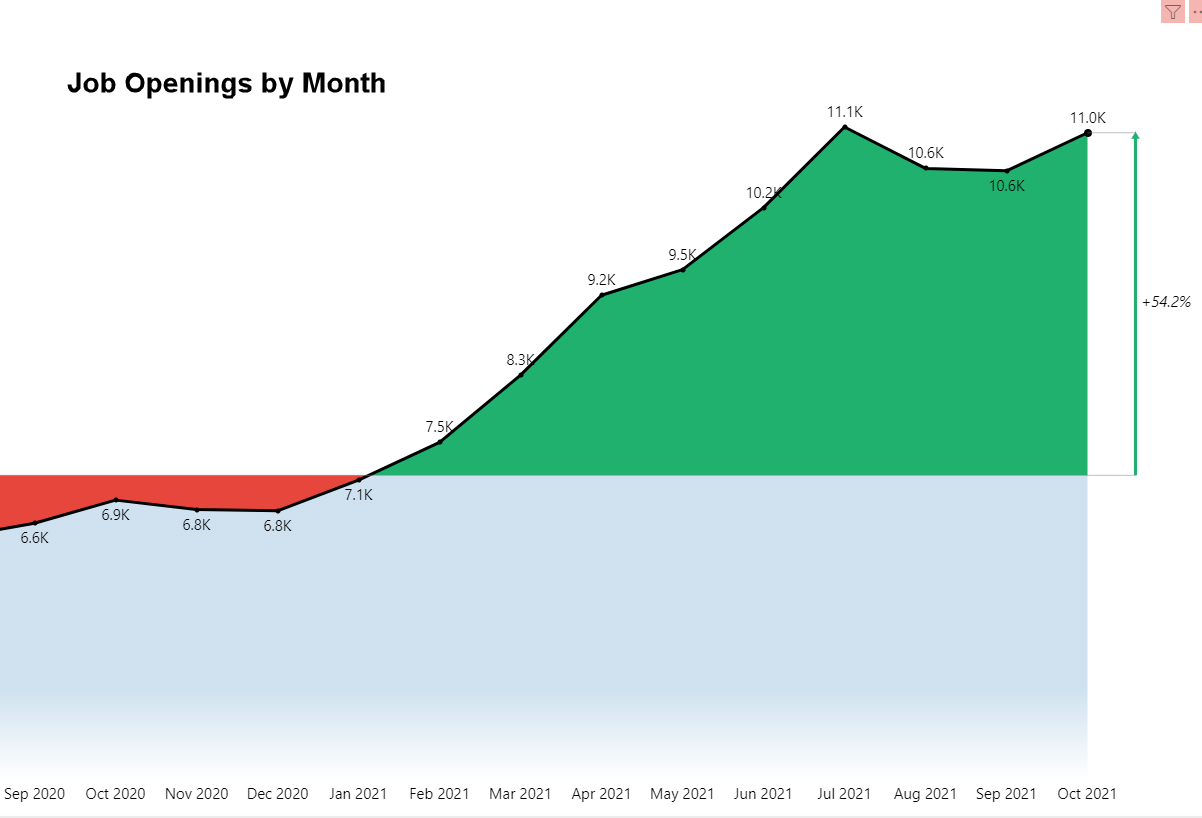

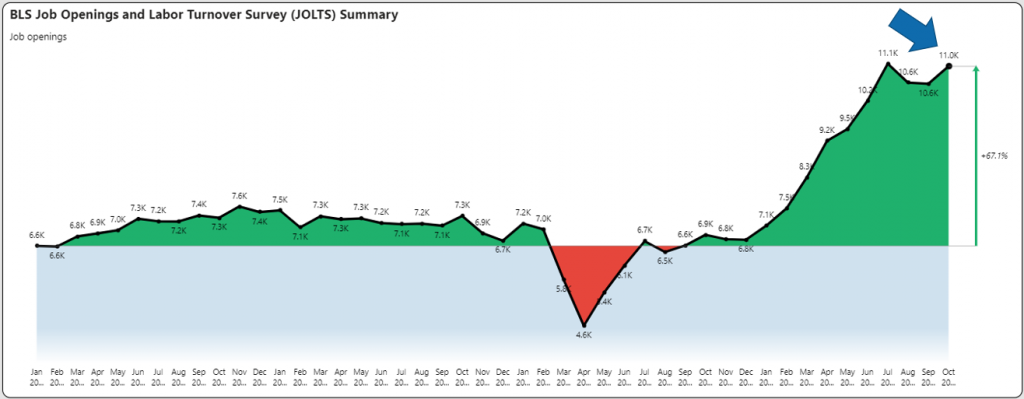

Job Openings Surge Up

Job openings remain at record levels and after two months of decline have surged back up to 11 million. By perspective, this is 50% above the pre-pandemic levels as shown in the following graph. Another way of looking at it is that there are now 100 job postings available for every 60 people on unemployment. However, one million people have left the labor force since the pandemic. Part of the challenge of filling these open jobs is to convince those people to re-enter the job market.

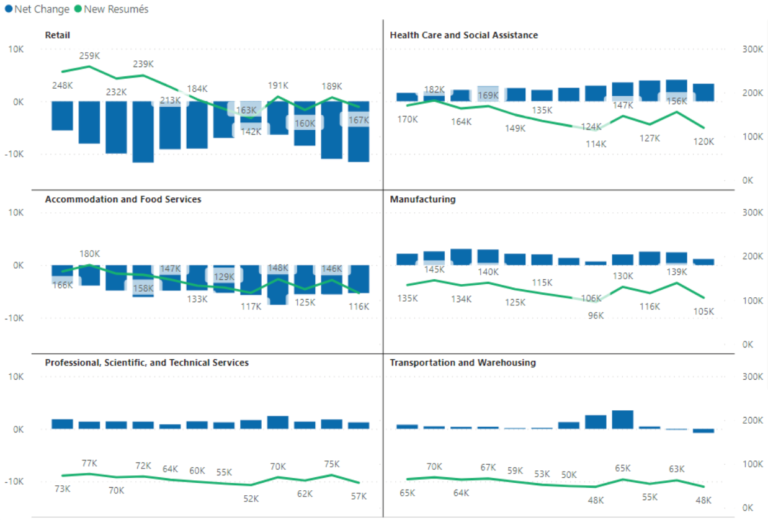

Job Postings Flat

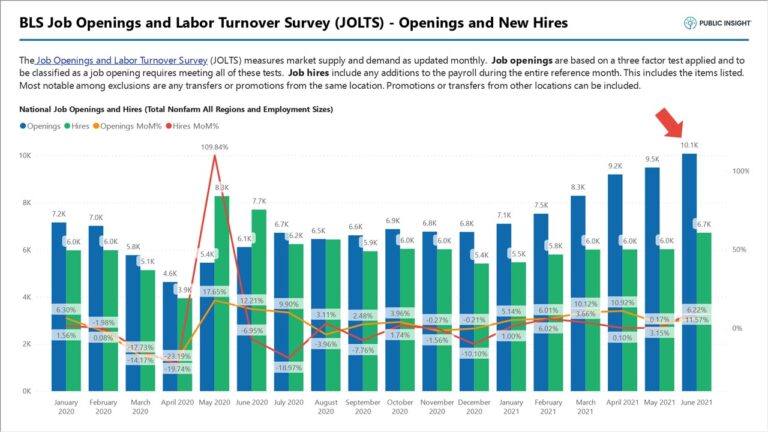

There is little question that the continued challenges of filling open jobs is trickling down to new job posting activity. Indeed® Job postings in November were down 9.6% from October, but after factoring in repostings (repeated ads) they were flat. Thirty-two percent of October job postings have been reposted.

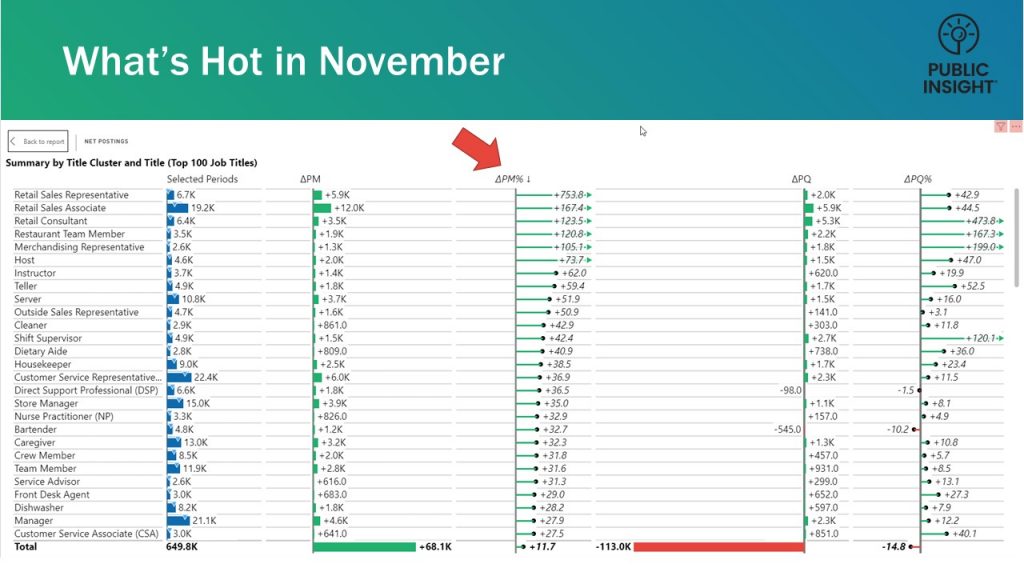

New hot jobs are primarily around retail. The top three job titles for percentage growth are in retail sales positions as shown below.

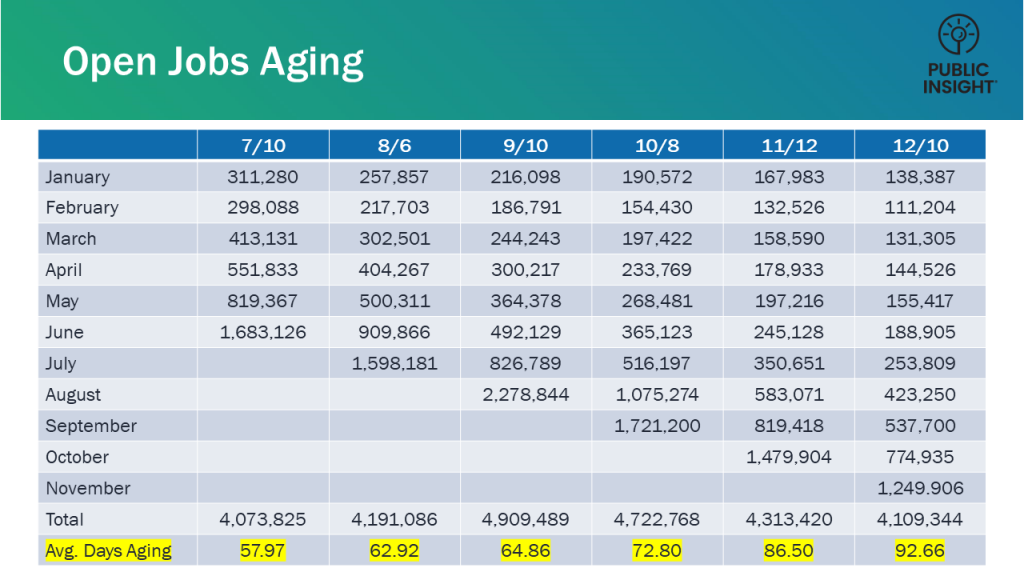

Open Days Increases to 93 days

Open postings have declined the past four months. However, the aging of open job postings has jumped from 58 days in July to 93 days now. Some jobs have moved fairly quickly while others have lagged. For example, there are still half a million open postings from the first quarter.

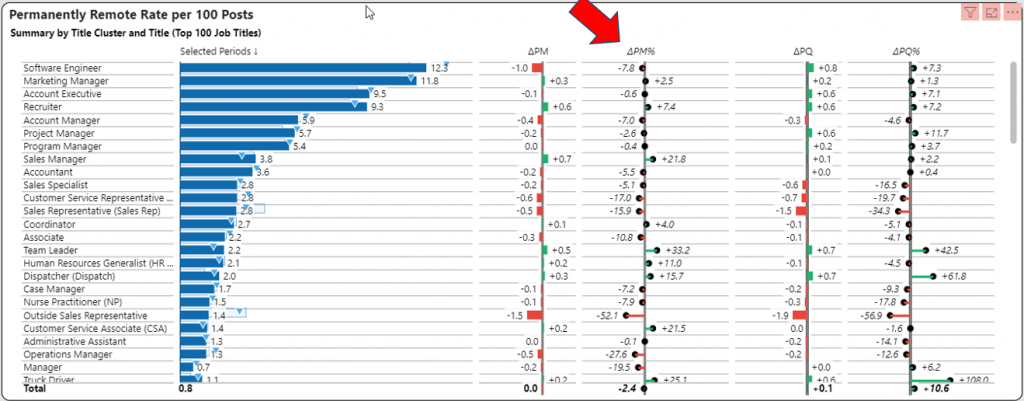

Remote Postings in Decline

The current data does not show that remote postings are increasing. In fact, remote postings are declining and currently sit at summer 2021 levels. Further when you look at the top remote positions, they remain flat as shown in the graph below. Software engineers for example were 13.3% remote in October and 12.3% in November. The only job title experiencing significant increase in remote work are recruiters.

This does not contemplate hybrid environments, which seem to be the solution many are moving towards. One thing that is clear however is that employers are transitioning to some form of permanent structure. Even with the emergence of COVID-19 variants like Omicron, temporary remote arrangements have declined under 1%. In other words, very few employers are recreating temporary work arrangements at this point.

Ad Rate Compensation Declines

Another area that is somewhat surprising is that posted (ad rate) compensation continues to decline. This could easily be the mix of posted jobs, but compensation is 7.1% below the summer peak and just 4.5% above January levels. These increases do not provide sufficient cover for cost-of-living changes. It is entirely possible that there will be another spike of compensation increases as we head into 2022.

Get More November Jobs Report Insights

Sign up to watch our Jobs Report Video for even greater insights and receive supplemental reports and market data.