Our April 2023 jobs report shows trends in supply/demand of job seekers compared to job postings continue to impact Health Care and Professional and Scientific industries, which are seemingly always in short supply. Over the past 12 months, there is about a 25-35% shortage of workers to fill these positions. Net workforce migration changes show declines in new workers entering some industries could pose serious long-term problems.

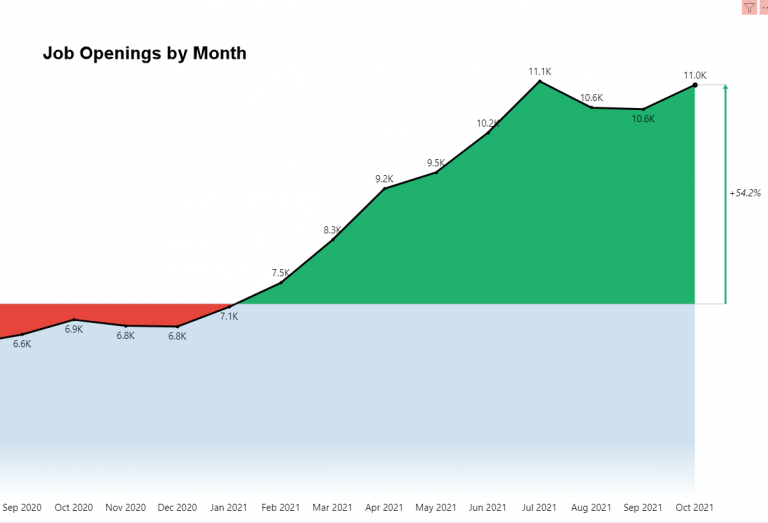

There is continued “easing” of the market. BLS reported job openings declined to 9.6 million from an adjusted value of 10 million, but remain 33% above pre-pandemic levels. Hiring levels have eased to pre-pandemic levels. We have not seen as yet any evidence of wide-scale layoffs and unemployment remains near historic lows.

In the past we may have viewed the current market as cause for celebration. But in today’s economic climate and job market, it seems like no one is truly overjoyed by the current market. I think it is because the market is much more complex than it was historically. It is not homogenous, but a very discrete collection of parts each with their own issues. We dive into a few of these issues in this month’s post including supply/demand imbalances and net migration by sector and the current remote and hybrid remote trends.

Health Care Can’t Get Enough Workers

During the Great Resignation much attention was focused on the entry level workers and getting people back to customer-facing positions. However, there is still plenty of supply of these workers and the positions are getting easier to fill.

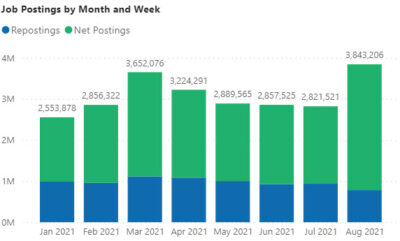

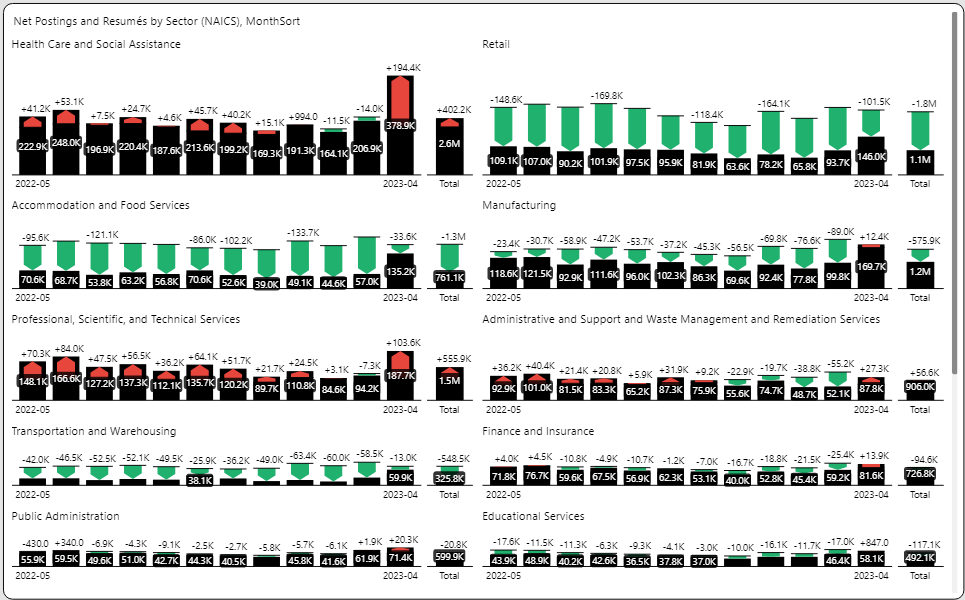

The graph below generated from our TalentView solution displays the current status of supply and demand by sector. The black bar below is job postings (adjusted by an April improvement in our collection process). The green bar shows the job seekers exceeding the posting volume. The red bar indicates a shortage of workers.

Health Care and Professional and Scientific industries are seemingly always in short supply. Over the past 12 months, there is about a 25-35% shortage of workers to fill these positions.

Retail and Accommodation and Food Services have an abundance of workers despite a mass exodus of workers during the pandemic. Wages have increased making it easier to fill these positions.

Ultimately parity of job postings with job seekers (a job for everyone who wants it) seems like a reasonable goal. But this is happening very unevenly.

Decline in New Workers and Exodus of Existing Workers – Workforce Migration Insights

My first job was making fries at Nathan’s Famous Hot Dogs. I never thought I would have a career in fry making. Hospitality, retail, and food service is the consummate first job for many people. Our economy relies on new workers in these areas. They come in and then usually rapidly move out.

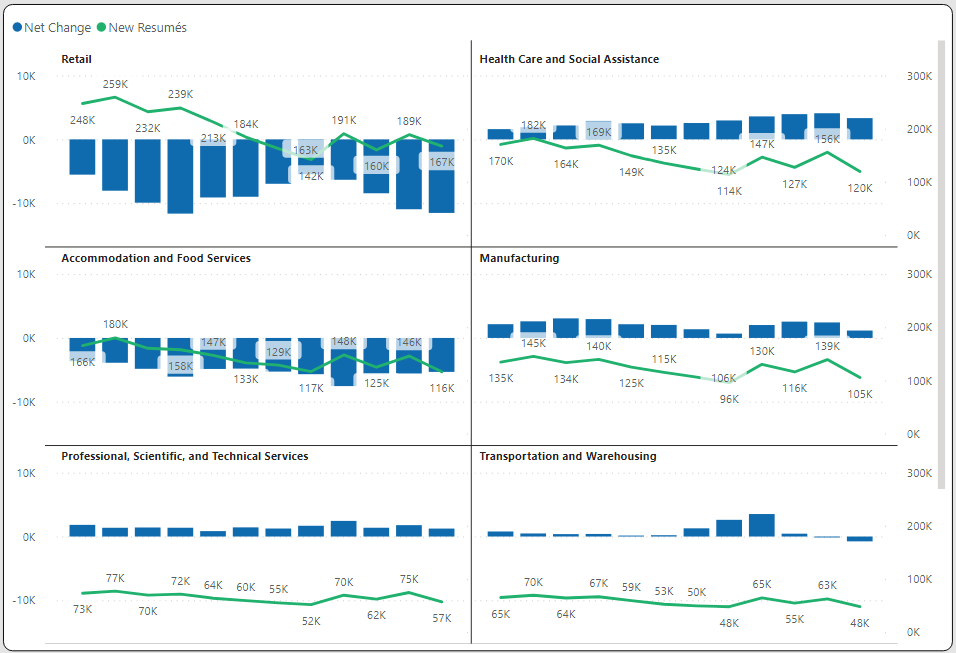

The pandemic forced many people out of these industries and the replenishment has come down. In the graph below, we show the net migration change (blue bar) alongside new job seekers (green line) by sector from May 1, 2022 to April 30, 2023. Obviously, retail and accommodation and food services lose workers, but they are replenished by new workers. The declining slope of new workers in these other industries seems to be cause for alarm.

In addition, health care while gaining transfers from other industries has had declining numbers of new entrants into the industry. This has impacted the supply/demand balance we see above.

Hybrid Continues Slow but Steady Growth

There has been a lot of press recently about the return of workers to the office. However, workers have expressed a desire for hybrid work arrangements and employers are reluctant to push for full-time return. As a result, hybrid continues to go up even while permanent remote continues to go down.

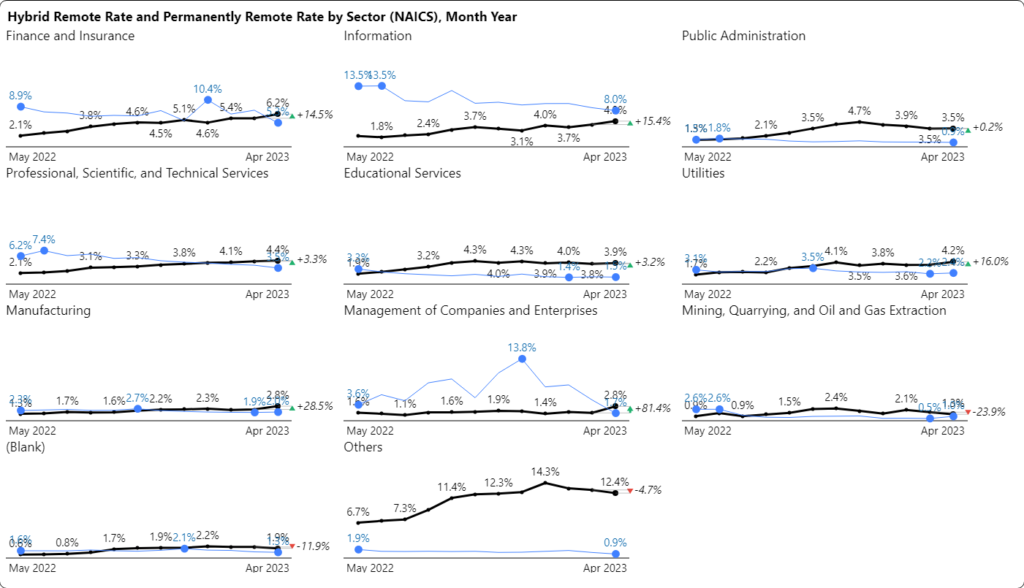

The graph below shows the continued increase in hybrid work arrangements across sectors where it applies. The black line shows the hybrid change by month while the blue line shows the change by month for permanent remote. Finance and insurance and information are the two primary sectors with hybrid remote work and both have doubled the rate of remote work.

Remote Work by Occupation

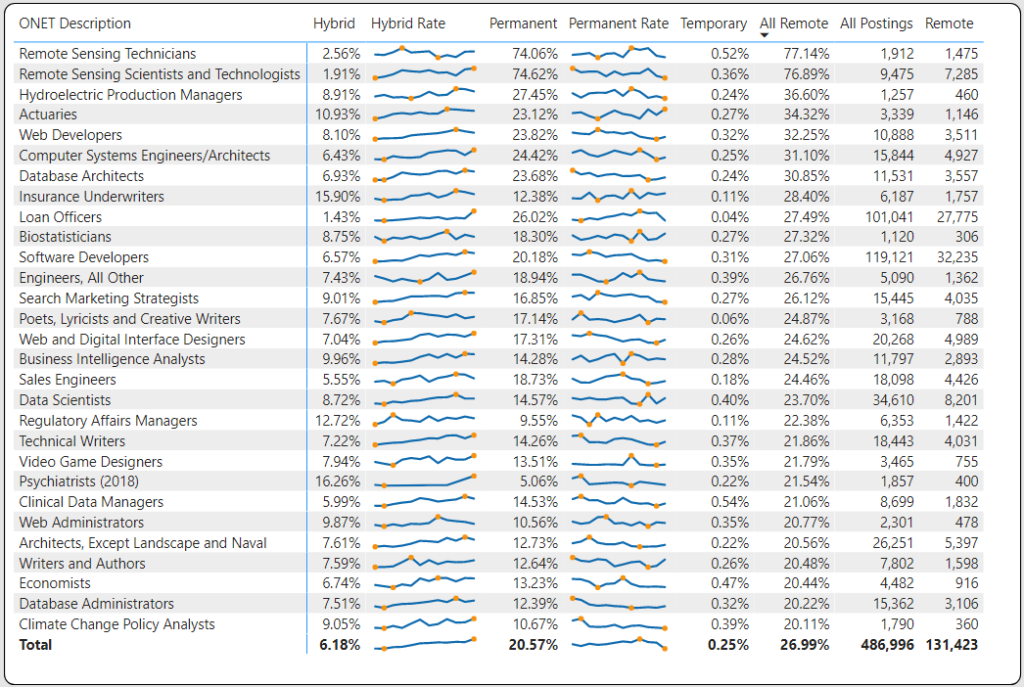

Many occupations will continue to default to remote work. This is probably a permanent change. The table below shows the top occupations (by O*NET code) that have at least 20% remote work. The sparklines show the change by month from May 1, 2022 to April 30, 2023. Remote work in these positions continue to go up and hybrid remains the preferred choice where applicable.

Get More April 2023 Jobs Report Insights

Sign up to watch our Jobs Report Video for even greater insights on this topic and receive supplemental reports and market data every month.

These insights were generated from our TalentView job market data and analytics solution.