Job postings are sluggish, which is contributing to a slow market rebound. During the course of 2021, the job market seemed to signal that a market rebound was right around the corner. That ended up not being the case and to overcome market sluggishness, a wide swath of industries needs to stabilize.

This is the second post in a seven-part series about the current state of the workforce and jobs and labor market and more importantly how to respond. The role of market-based analytics is so crucial to this step.

This series is based on a newly released white paper “The State of the Workforce and What You Can Do About It“. This white paper is automatically available to subscribers of our free jobs reports.

Slowing Posting Volumes

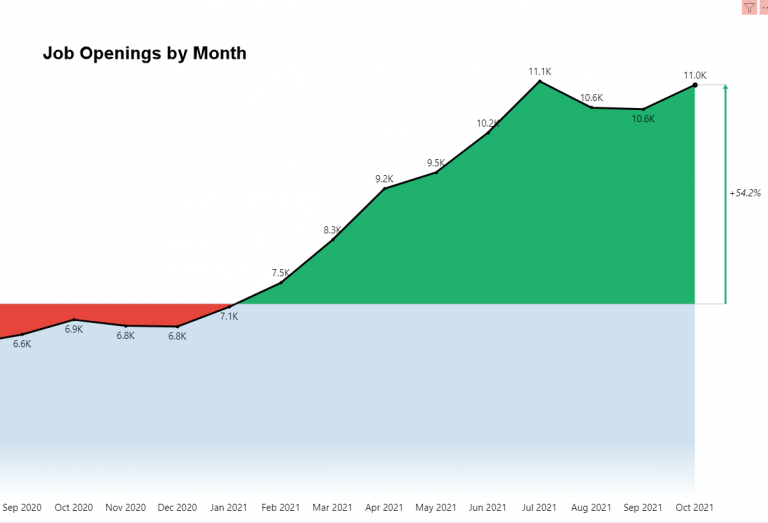

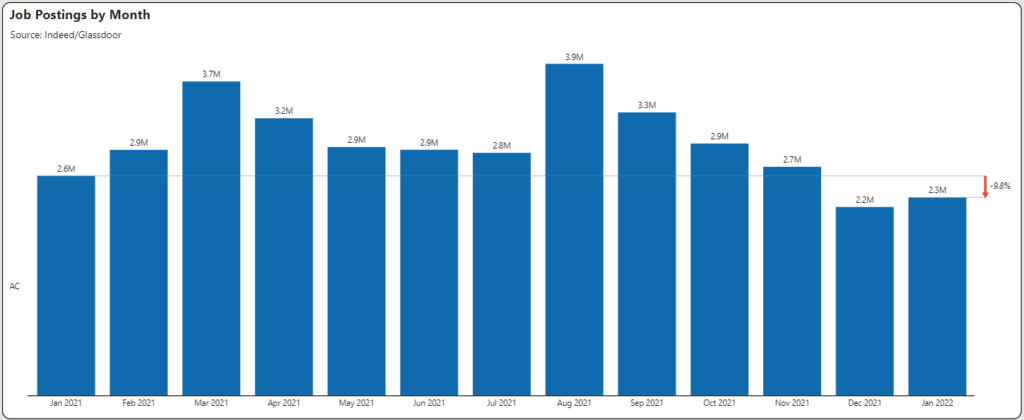

Entering 2021, job postings jumped through the roof. Over 9 million jobs were posted on Indeed® during the first quarter. In particular, March alone showed 3.6 million postings. Unfortunately, postings are simply advertisements and if the advertisements aren’t effective in doing the job, then the advertisements will eventually slow and dry up.

The problem of filling jobs puts a damper on continued job growth. As we learned in the last post, there are way more job openings currently than people that have signaled they want them. Employers have tried every trick in the book. In the second quarter, it was signaling urgency as one in the jobs were marked urgent. Then came promises of bonuses which made a negligible difference and only produced a mini bidding war.

January 2022 shows the market ultimately in correction with postings down about 10% from 2021 and down 41% from the August peak.

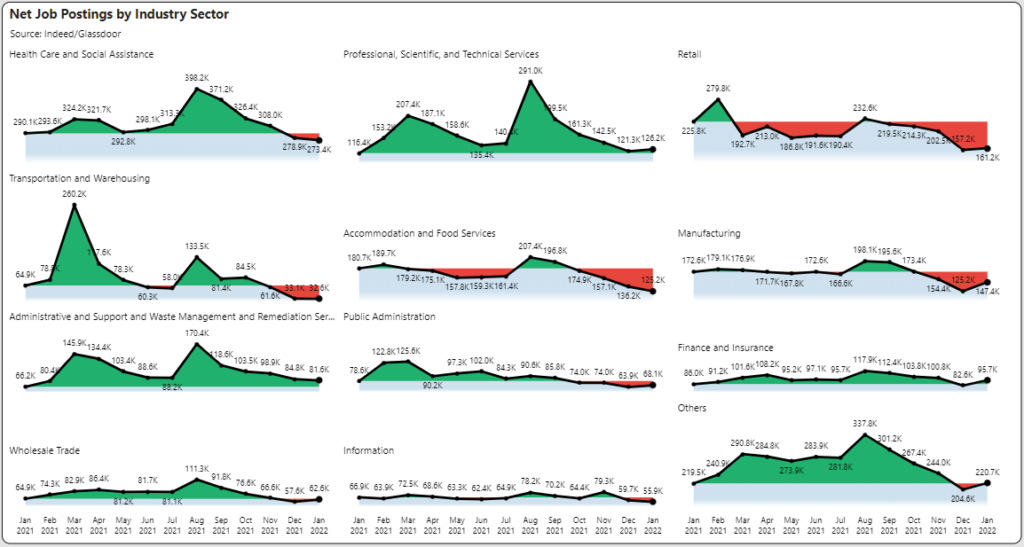

Unfortunately, this sluggishness cuts across industry sectors as shown in the graph below.

Employers Adjust to a New Normal

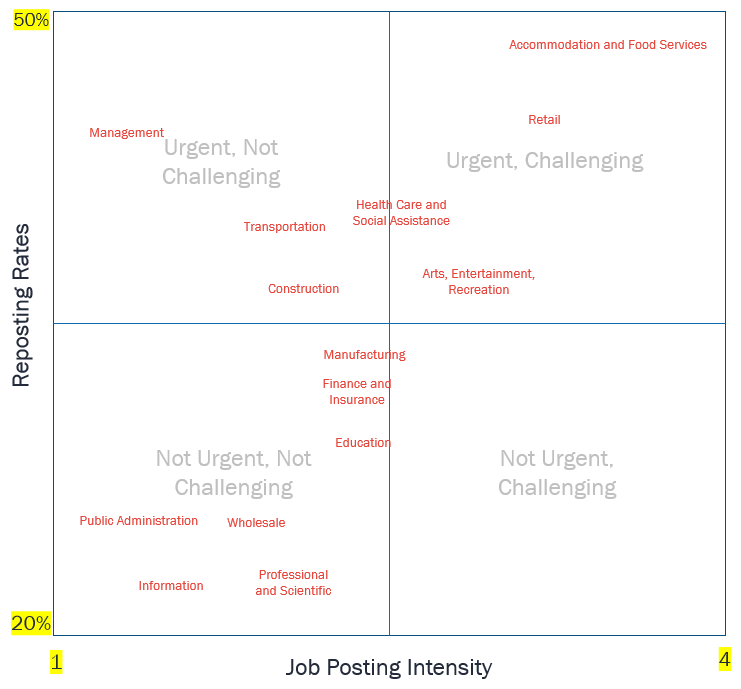

Employers made a tremendous effort to win the recruitment battle. One in three advertisements were reposted and many were reposted multiple times (“job posting intensity”). Consumer facing industries during the pandemic practically begged workers to come back.

The following matrix compares industry sector using the measures of reposting rates and job posting intensity. Job postings with a high reposting rate typically above 50% are indicative of broader industry challenges of hiring workers. Job postings with a high job posting intensity also adds the element of the difficulty of filling jobs. A high job posting intensity may signal specific strategic difficulties in filling positions.

Consumer Facing Industries Face Biggest Challenges

Consumer facing industries continue to face the biggest challenges. These industries have very high reposting rates well above 50% and often must post an ad multiple times (job posting intensity greater than 3). This was most evident early in 2021 but then leveled off as the year progressed as these industries realized the new normal. The new normal may involve reduction in service rather than continuing to post the same jobs over and over.

White Collar Industries Have Most Flexibility

On the opposite end of the spectrum, industries such as Information, Professional and Scientific are not facing industry wide challenges and in fact with remote work options may have additional sourcing opportunities.

Cyclical Industries Face Spikes

Transportation and Construction are highly cyclical industries that have had spikes in repostings. Because of the shortness of seasonal hiring, there simply isn’t enough lapsed time to place the same ads multiple times.

To some level, this is also the case with Healthcare. Healthcare had spikes in care due to COVID-19. In addition, Healthcare must often post high percentages of jobs, yet doesn’t have the luxury of long-term multiple posts of the same ad.

Have Job Postings Turnover Reached Bottom

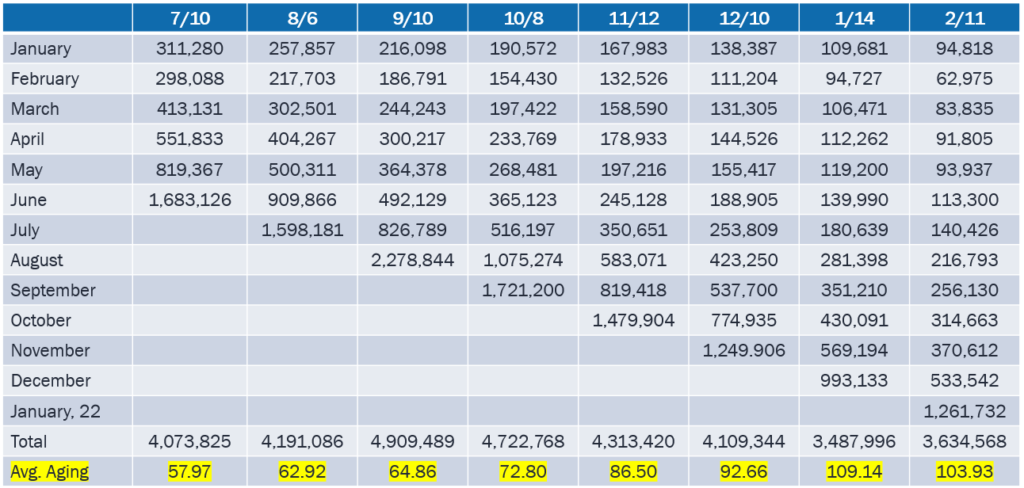

There is some evidence that we have in fact reached the bottom. We have been tracking both the estimated fill days based on ads as well as the current number of open days.

The number of open days has finally plateaued after continuous monthly declines. A second cause for encouragement is that the number of jobs in the aging has increased. The combination of lower days in aging and higher number of open jobs is encouraging even if the raw numbers (greater than 100 days) is not cause for celebration.

What Has to Happen?

In order for the market to gain momentum, job turnover must accelerate. Additional headwinds such as inflation make that even harder.

- Consumer facing industries must return to predictability (i.e., no more shutdowns).

- Healthcare work must stabilize so that healthcare workers don’t go for the exits.

- Employers must adapt recruiting strategies to deal with the new normal:

- Examine alternative workforces and “hidden workers”

- Reskill and upskill workers

- Employers must create an attractive work environment that encourages and attracts workers to return.

Next post coming soon…which job posting strategies worked during 2021 and which ones didn’t?

Get More Jobs Report Insights

Sign up to watch our Jobs Report Video for even greater insights on this topic and receive supplemental reports and market data.

See Public Insight at the HR Technology Virtual Conference

Attend the Public Insight discussion and demonstration on “Workforce Migration: Market Insights for Recruiting” and learn how to discover and motivate the hidden workforce on March 2 from 2:00-2:45 PM ET. Register for this free conference!