The October 2022 jobs report market data indicates there are still lots of jobs with nowhere to go. Put another way, volume remains at or near record levels (quantity), but jobs are not getting filled timely (quality). The mid-point of advertised compensation increased 2.3% from the previous quarter, however, the average pay range actually tightened during October and is now approaching a two year low. The question is…How long will these trends this last?

JOLTS Data Suggests a Healthy Labor Market

Despite recession concerns, JOLTS data indicates the labor market seems to be as healthy as ever.

- Job openings increased 4.3% to 10.7 million. This is still a whopping 40+% over pre-pandemic levels.

- Despite news of large layoffs (e.g. Meta, Twitter), layoffs remain 30+% below pre-pandemic levels.

- Quit rates have actually eased closer to normal levels and have held steady at 2.7%

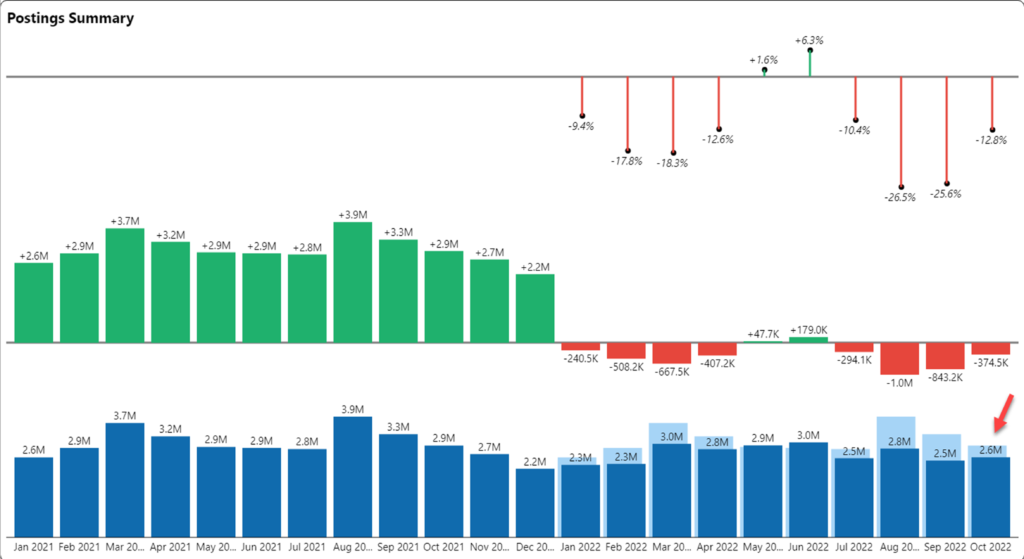

Postings Data Suggests Stagnation

Job postings have consistently underperformed last year. In eight of the previous ten months of 2022, job postings were below 2021 levels. Even worse, the last four months have shown double-digit declines as shown in the graph below – declines by percentage are displayed in the top row, by volume in the middle row, and an overlay vs prior year in the bottom row.

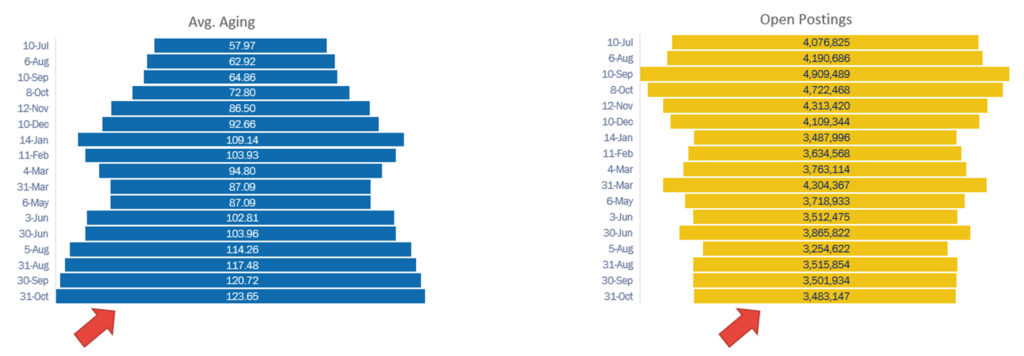

Average Number of Days for Open Postings is Over Four Months

This would be ok if the jobs were getting filled, but they are not. We track the number of days reflected in open job postings and this number has been showing a steady decline. The average number of days reflected in these postings has increased to 124 days or a little over four months as shown in the blue graph below.

Workforce Erosion and Retreat

From a broader labor perspective, the pool of workers remains tight. The labor force participation rate ticked down slightly in October and unemployment claims remain extremely low. Currently there remains to be over two job openings for every unemployed worker.

Market signals are extremely powerful in revealing the number of job seekers. In our TalentView platform, we identify job seekers in the market by looking at resumé updates and changes. Generally if a person updates their resumé, they have provided a market signal that they are an active job seeker.

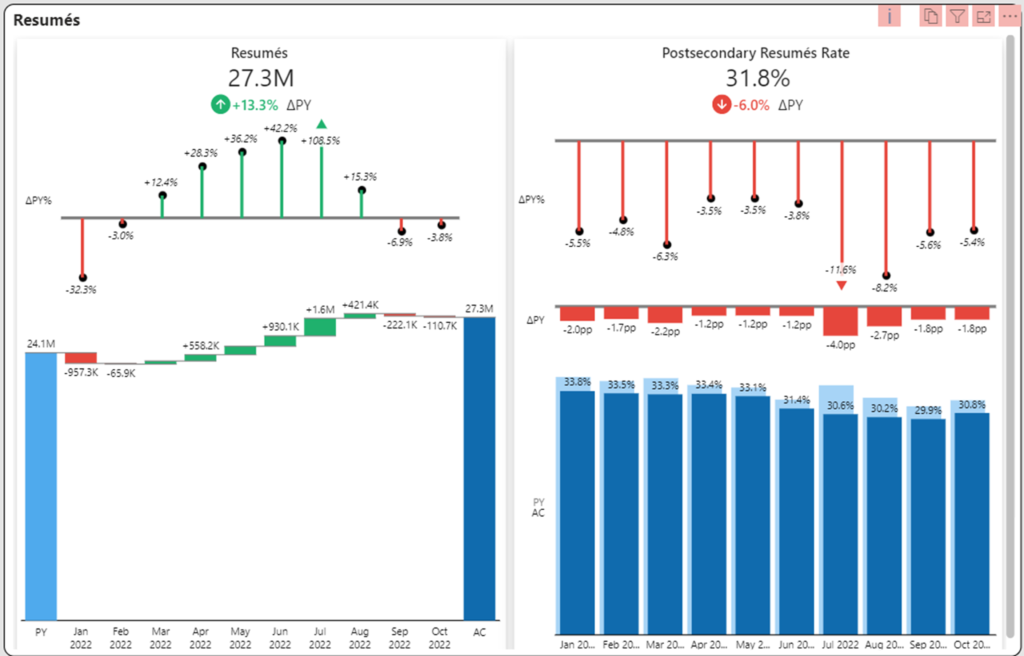

Job Seekers Have Not Returned En Masse

The number of job seekers that have signaled they are active is up 13.3% in 2022 vs. 2021 as shown below. The problem is that this number should be much higher given the extensive layoffs that occurred for much of 2020. After climbing significantly during the summer months, it is now flat or declining. Further, the data suggests that the percentage of resumés with college degrees is actually declining. The percentage of resumés with an identified postsecondary credential has moved from 33% to 31% and has trended down all year.

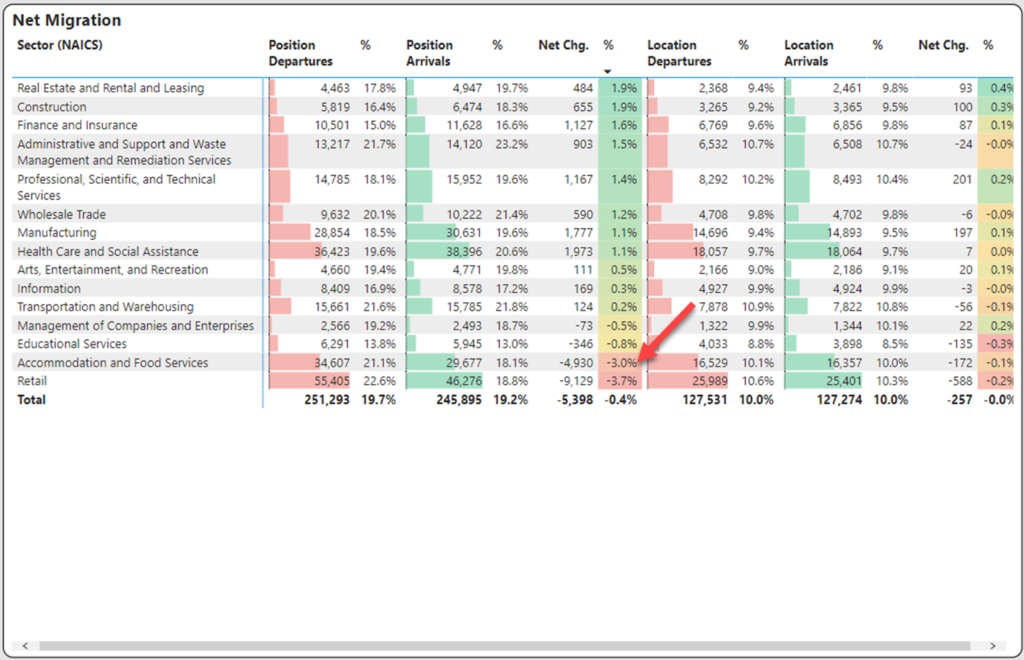

Workers Exiting Consumer Facing Industries

One of the most under-the-radar shifts that has occurred as a result of the pandemic has been the mass exodus of workers out of face-to-face industries. Retail and food services have taken it on the chin. The table below shows the shift in worker migration. Net migration is the number of arrivals over departures. Retail and food service industries both experienced a 3% erosion based in net migration as shown in the table below.

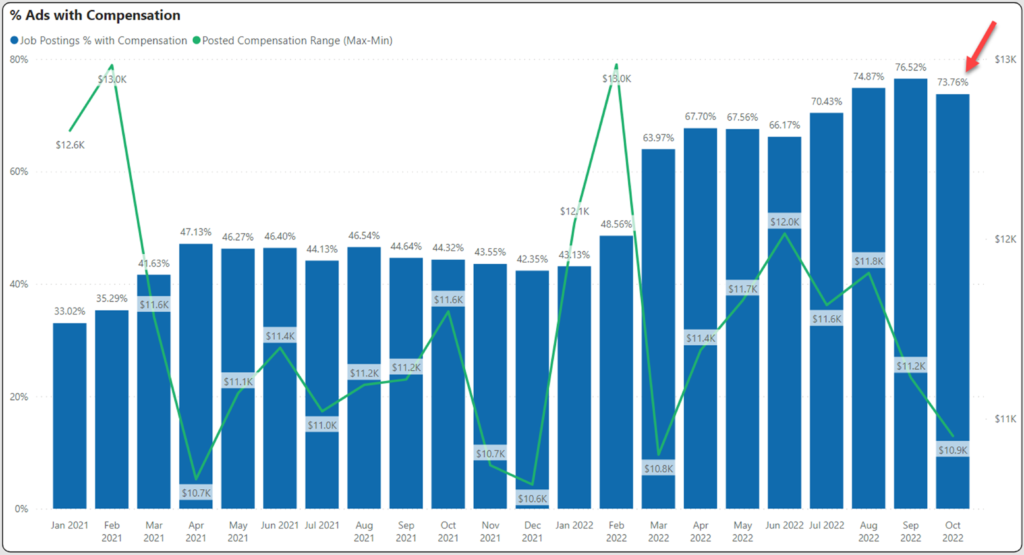

Modest Wage Gains and Pay Transparency Leveling Off

October 2022 jobs report shows some decent wage gains as the mid-point of advertised compensation increased 2.3% from the previous quarter. Wages are up approximately 8% from 2021 pretty much just keeping pace with inflation.

Pay transparency after dramatically increasing in the early months of 2022 has leveled off in October. The percentage of jobs with an advertised rate currently stands at just under 74%. One of the concerns about advertised compensation has been that the pay ranges would increase. The graph below superimposes the percentage of ads with compensation against the pay range. The average pay range actually tightened during October and is now approaching a two year low.

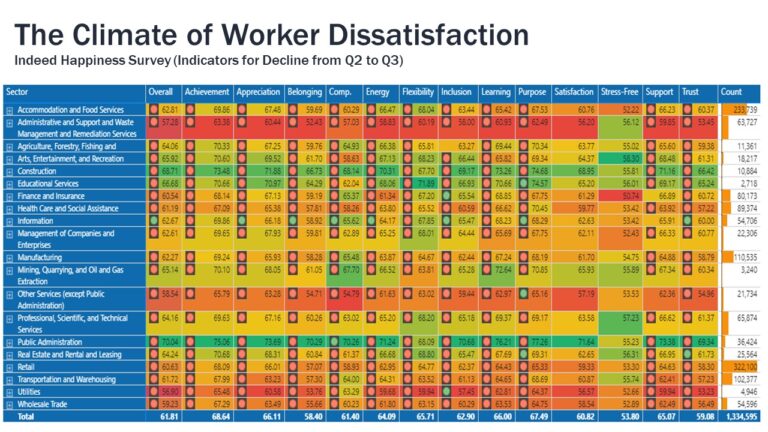

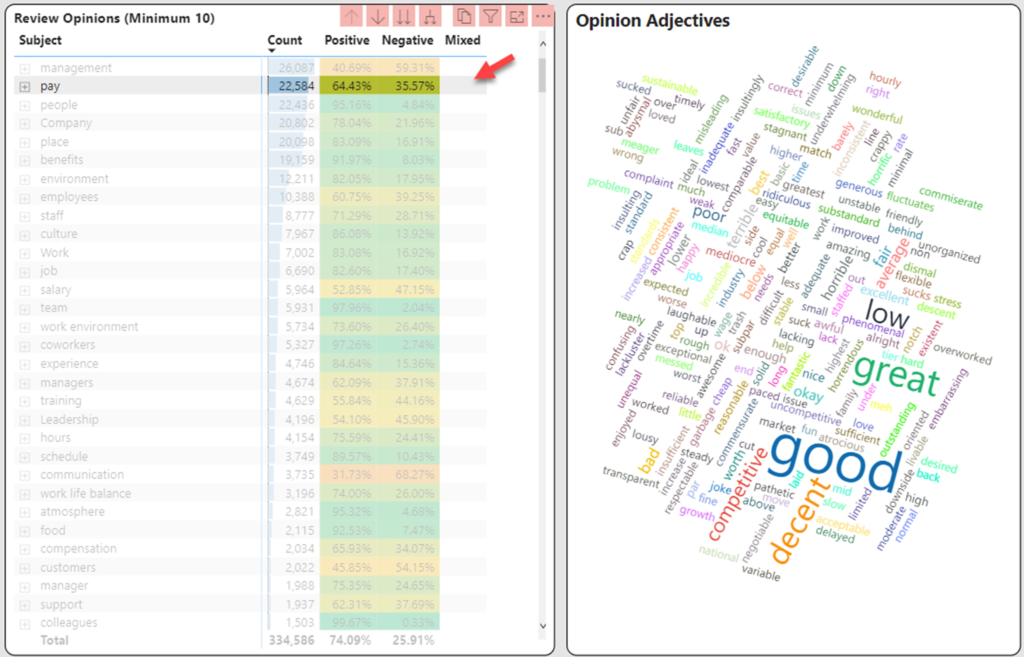

Pay is Becoming Increasingly Important to Workers

Pay was cited as the second most frequently mentioned subject as we mined data from October reviews as shown in the following table. This is significant from several perspectives.

In the past, pay was usually cited well below other subjects such as management, company, people or culture. Also when it was mentioned, it was overwhelmingly mentioned as a positive. It has now moved to a much more balanced perspective. This could be a signal that pay has become increasingly important in our current economic climate.

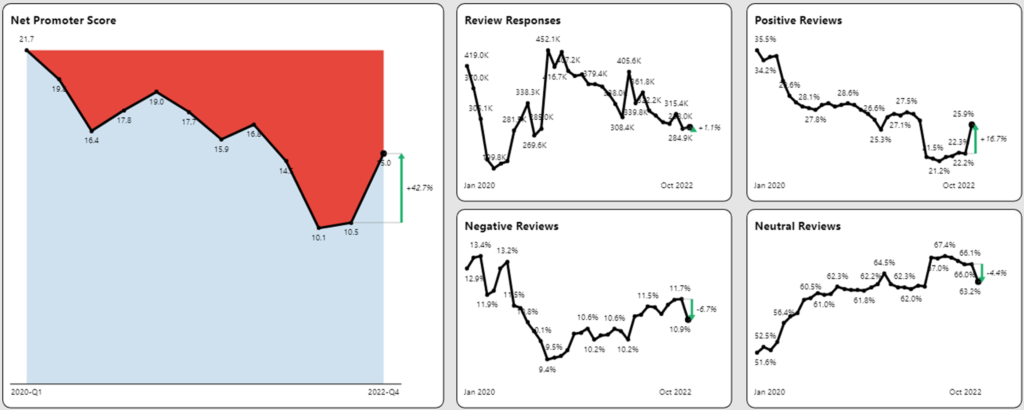

Worker Sentiment Improving

Despite the concerns over pay, worker sentiment as a whole is improving after months of decline. The number of positive reviews for October increased 17% to 26%. This is still substantially below pre-pandemic levels, but moving in the right direction. Similarly, the number of negative and neutral reviews have declined. While balancing positive and negative reviews, the net promoter score has substantially improved to 15, but again still low from pre-pandemic levels.

Get More October 2022 Jobs Report Insights

Sign up to watch our Jobs Report Video for even greater insights on this topic and receive supplemental reports and market data every month.