The November 2022 Jobs Report shows that the job market continues to be an enigma. Job openings remain over 40% above pre-pandemic levels, and the estimated average number of days to fill a posting increased 12 days to 135 days. This means the average job posting factoring in reposting is over four and a half months. The jobs that continue to be the hardest to fill are the ones that historically have been the easiest to fill.

The data reveals imbalances in supply and demand of labor. The number of active resumés would suggest a healthy supply, but these resumés are shifting and are not in the areas of greatest need.

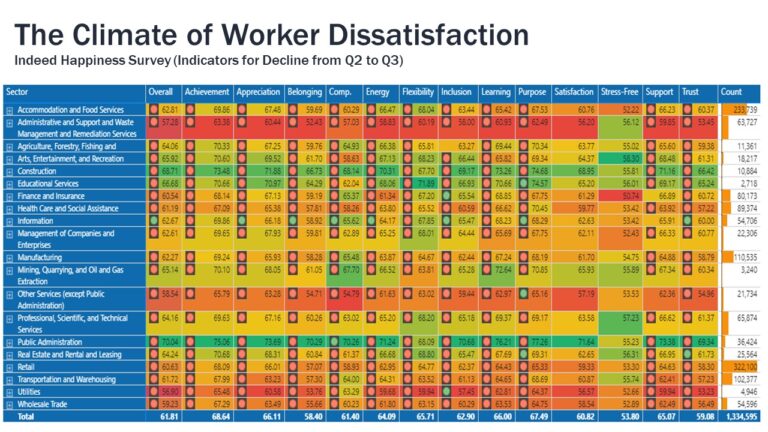

BLS Data Suggests Market Still Strong

The JOLTS data shows some signs of market easing, but by historical standards still very strong.

- Job openings decreased to 10.4 million, but still well above pre-pandemic levels.

- Layoffs also remain in record low territory despite news of recent layoffs.

- Quit rates declined to pre-pandemic territory at 2.6%.

- The number of hires did decline to 6 million, which is approaching pre-pandemic levels.

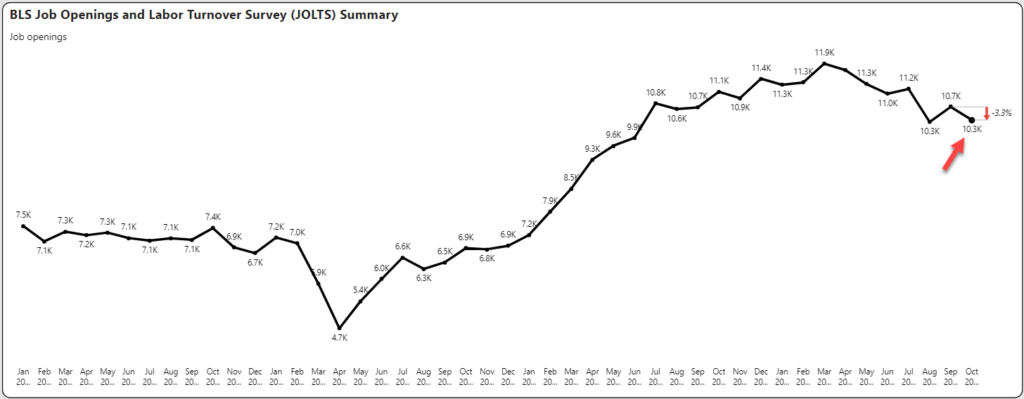

Postings Data Reveals Continuing Quality Problems

Job postings continued the string of declines. Postings have declined in nine of the previous eleven months. November job postings were down 4% from last year, which is an improvement over the previous three months double digit declines as shown in the vertical lines in the graph below. Postings for the most part have remained flat as we near the end of the year.

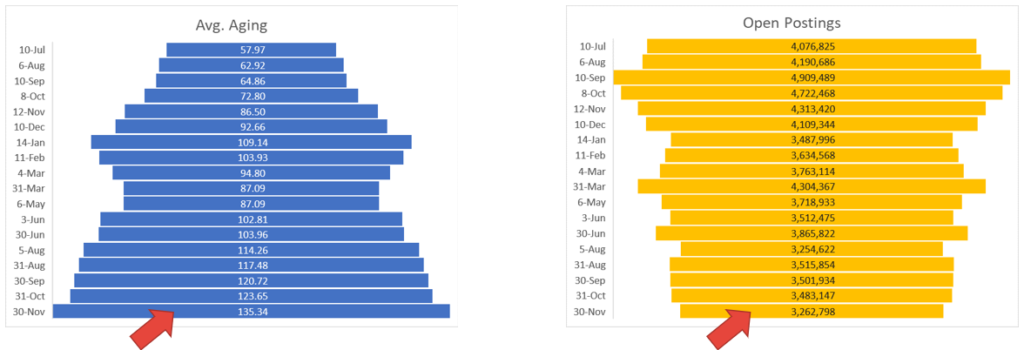

Average Days for Open Postings is 135 Days

The quality of postings could be the reason why jobs remain open. The average number of days in open postings is 135 days, an increase of 12 days vs last month. This continues a trend of both decline in number of open postings AND an increase in the number of days contained in those postings. The number of open postings is now down 33% from the peak of September 2021.

The Supply and Demand Problem

It has been widely documented that there are over two job openings for every unemployed worker. But I would suggest the problem is deeper than this. Whole industries are seeing a substantial exodus of workers and while other industries are experiencing continued supply/demand imbalances.

Market signals are extremely powerful in revealing the number of job seekers. In our TalentView platform, we identify job seekers in the market by looking at resumé updates and changes. Generally if a person updates their resumé, they have provided a market signal that they are an active job seeker.

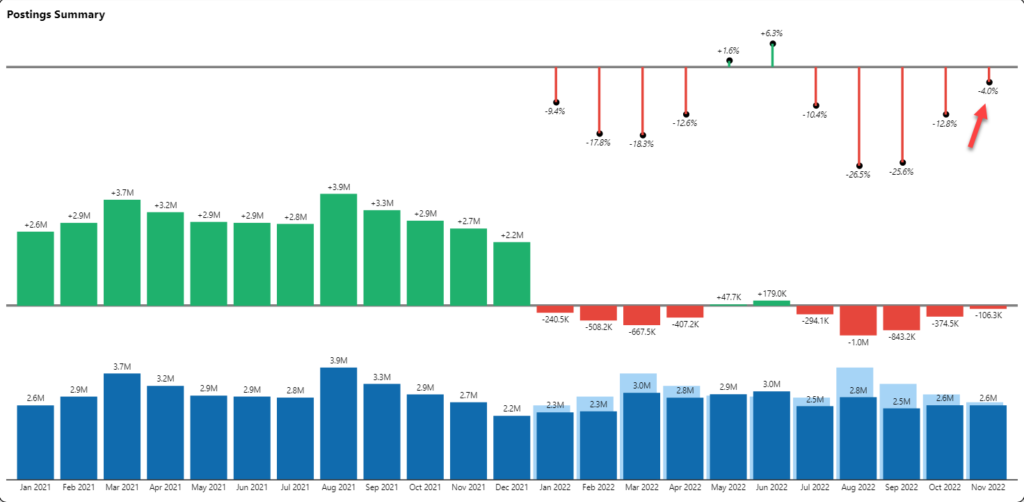

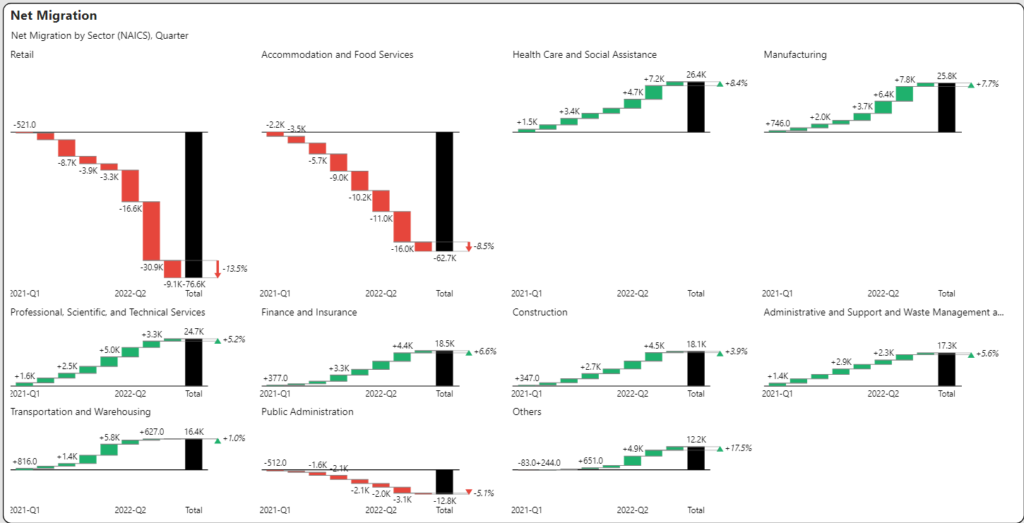

Customer-Facing Industries Seeing Exodus of Workers

Workers have chosen to leave industries that are customer-facing. The graph below shows the net migration of workers (bars in red) across the leading industry sectors. Retail and Food Service have shown an exodus of workers for months now. This net migration of workers may not be recoverable.

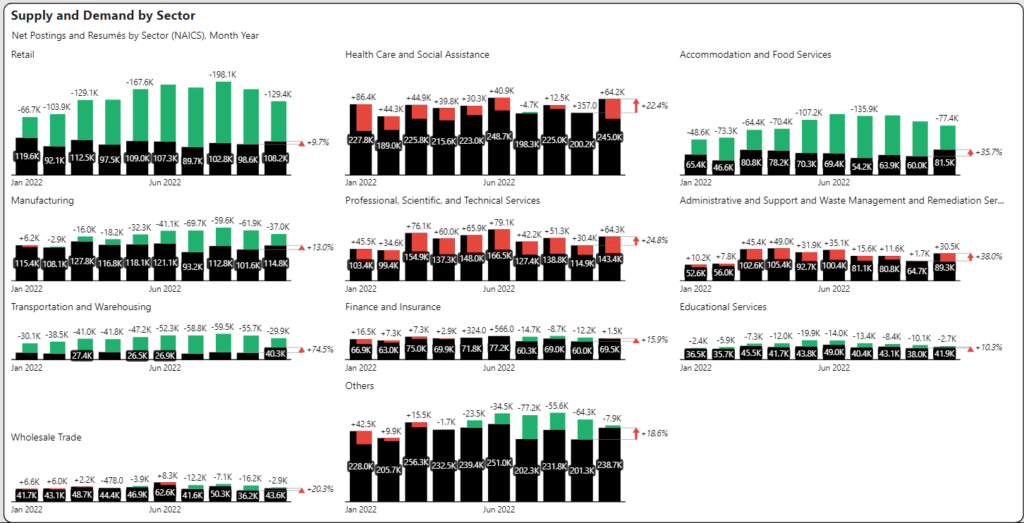

Supply/Demand Issues by Sector

Despite the exodus of workers in customer-facing industries, there does appear to be plenty of workers out there. The graph below shows job postings in black and resumés based on last employer (to indicate industry) superimposed in red or green. Green indicates sufficient supply while red indicates worker shortage. The most problematic industry for filling jobs is health care where there simply aren’t enough skilled workers to cover posting volume. Professional jobs also show significant lag.

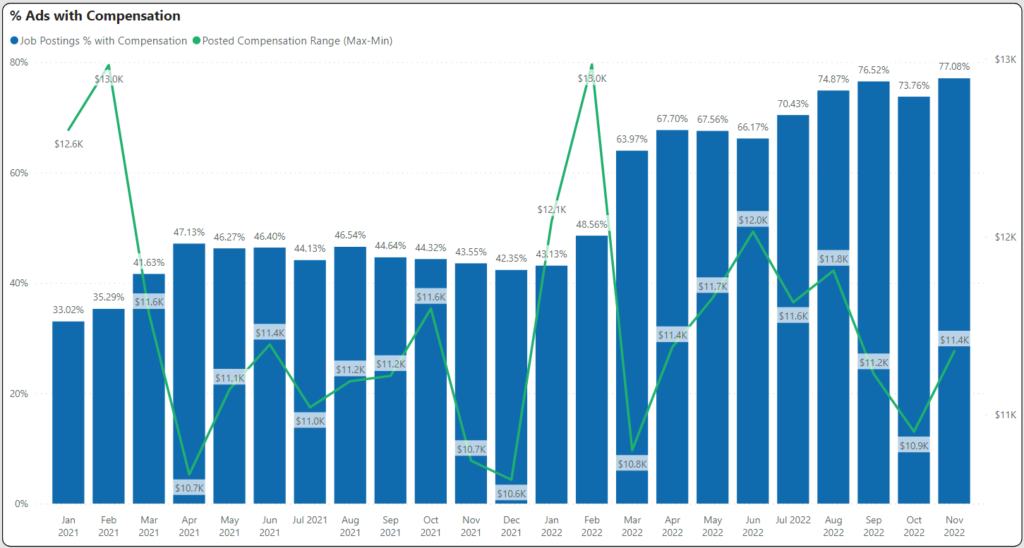

The Pay Transparency Train Continues

Pay transparency remains a major factor that employers are dealing with. The percentage of job postings with an advertised compensation increased to 77% after declining slightly in October. One of the concerns about advertised compensation has been that the pay ranges would increase. The graph below superimposes the percentage of ads with compensation against the pay range. Pay ranges remain in line with levels in 2021.

Get More November 2022 Jobs Report Insights

Sign up to watch our Jobs Report Video for even greater insights on this topic and receive supplemental reports and market data every month.