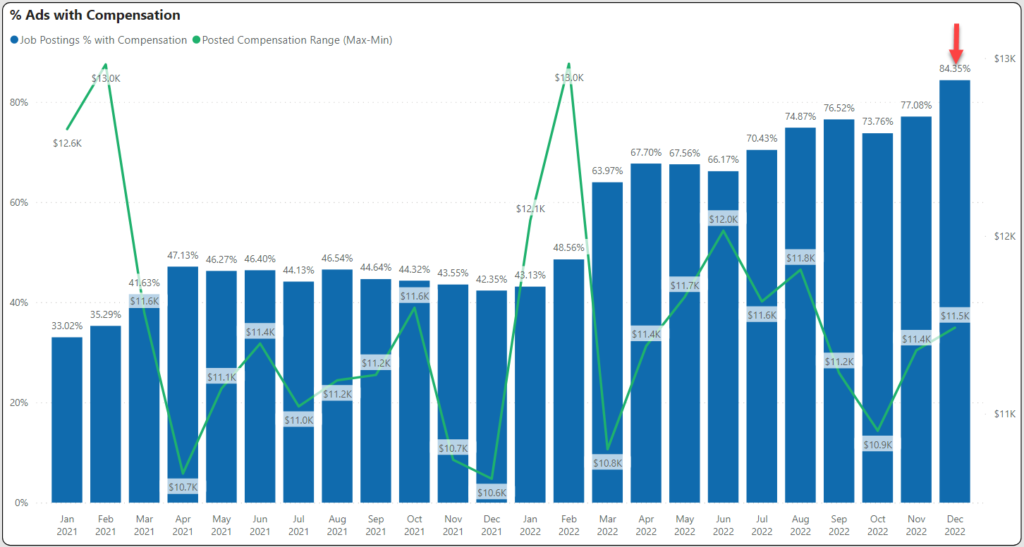

In the December 2022 jobs report we see that the number of job postings with advertised pay rates has doubled compared to a year ago. Only four in ten job ads in 2021 included pay vs. eight in ten job ads in 2022. Between regulations, job board requirements, and simply market expectations, pay transparency is a trend that is here to stay.

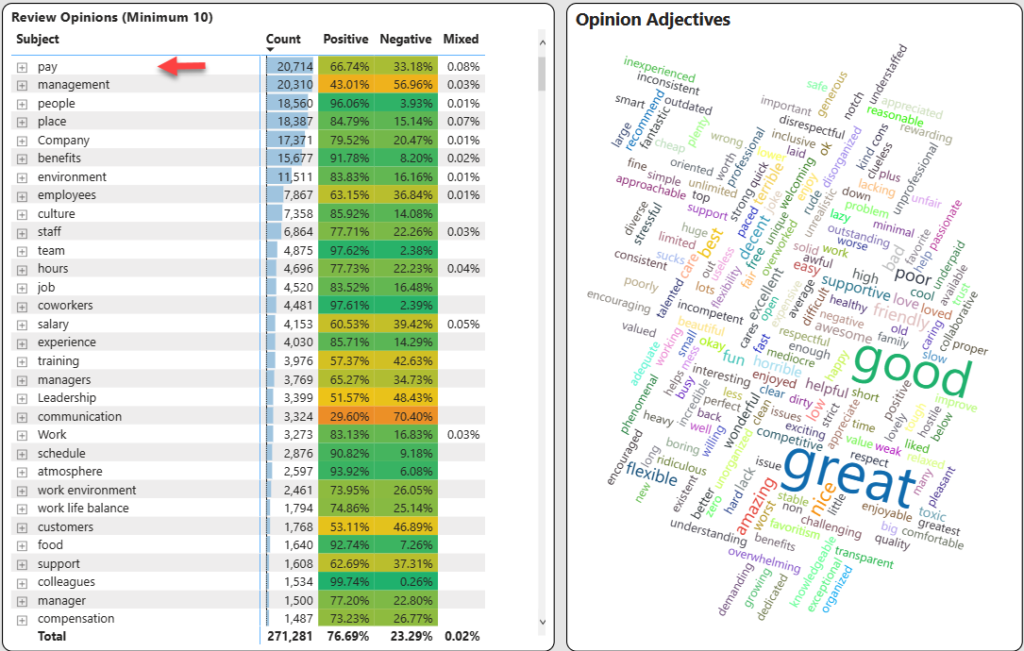

But it goes beyond that. In 2021 compensation was seventh in importance as a subject in employer reviews. In November and December 2022, compensation had risen to number one. Whether it is due to inflation or the increased scrutiny of pay transparency, it is clear that pay is way more important than it has been.

Pay Transparency Approaches 100%

The number of job postings with disclosed pay has doubled over the course of 2022. The number of job postings with pay in December reached 84% of all jobs. This is exacerbated by the position of job boards such as Indeed who take a strong position in favor of pay disclosures.

Surprisingly, pay ranges have not materially changed despite the increase in jobs with advertised pay. The theory was that if employers were required to disclose pay, they would artificially bump up the pay range (the difference between the low and high disclosed pay). The graph below shows the weighted average pay range in the line graph against the percentage of jobs with advertised pay. The pay range at $11,500 is 22% of the midpoint of pay ranges. While pay ranges can vary widely among job titles, the composite pay range remains reasonably small.

Pay Increases in Importance

In 2021, pay ranked seventh in importance based on the TalentView textual analysis of Indeed/Glassdoor reviews. I used to say that pay was table stakes. If you didn’t pay well, it was a mitigating factor. But if you did pay well, it wasn’t a driving force. With high inflation, this has started to change. In November and December’s reviews, pay and compensation ranked as the highest subject as shown in the table below. Note also that benefits is now sixth on the list.

Our discovery is that employers are doing a pretty good job of responding to the need to increase pay. The percentage of reviews that show positive sentiment for pay increased from 62% to 66% over the course of 2022. This level of positive sentiment is comparable to 2021 where pay wasn’t nearly as important.

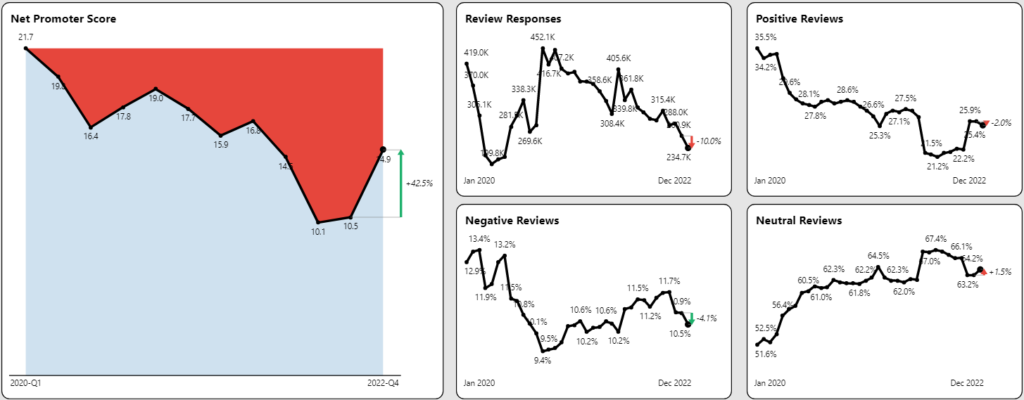

Employer Reputation Making a Comeback

During the course of the pandemic perception of employers declined significantly bottoming out in the summer of 2022. But the two recent quarters have shown an increase in net promoter score based on sentiment scoring as shown below.

Net promoter score is calculated as the difference as a percentage between positive and negative reviews. A raving fan would be a 100 while a completely dissatisfied review would be -100. Pre-pandemic scores of 22 as shown above declined all the way to 10 during the summer, but has now rebounded to nearly 15. The numbers still are not something to boast about but they appear headed in the right direction.

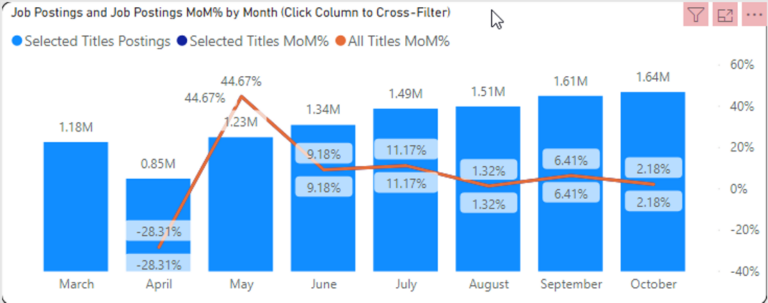

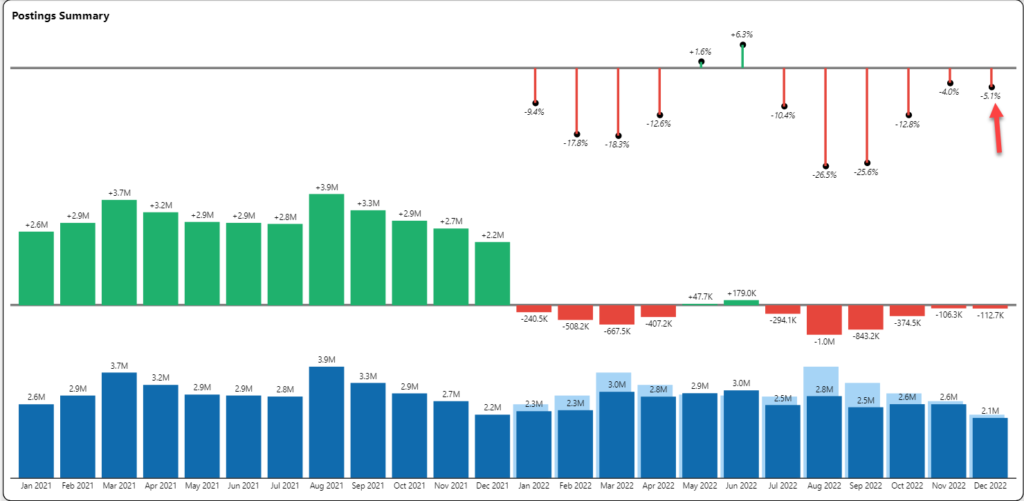

Job Postings Slide Continues

While the JOLTS data would suggest the job market to be still strong, job postings tell a different story. Postings year-over-year volume has declined in ten of the previous twelve months as shown below. December 2022 postings were five percent below those of December 2021.

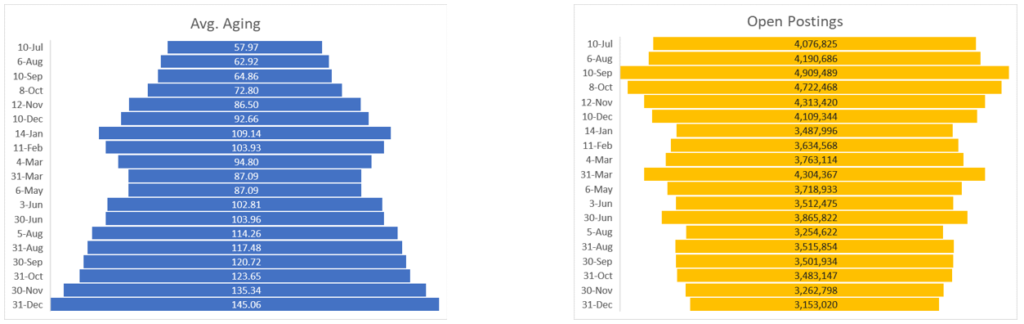

Open Postings Aging Increases to 145 Days

Quality also continues to be a major issue. The average number of days in open postings increased yet again in December to 145 days, an increase of 10 days from November. This continues a trend of both decline in number of open postings AND an increase in the number of days those postings are open. The number of open postings is now down 35% from the peak of September 2021.

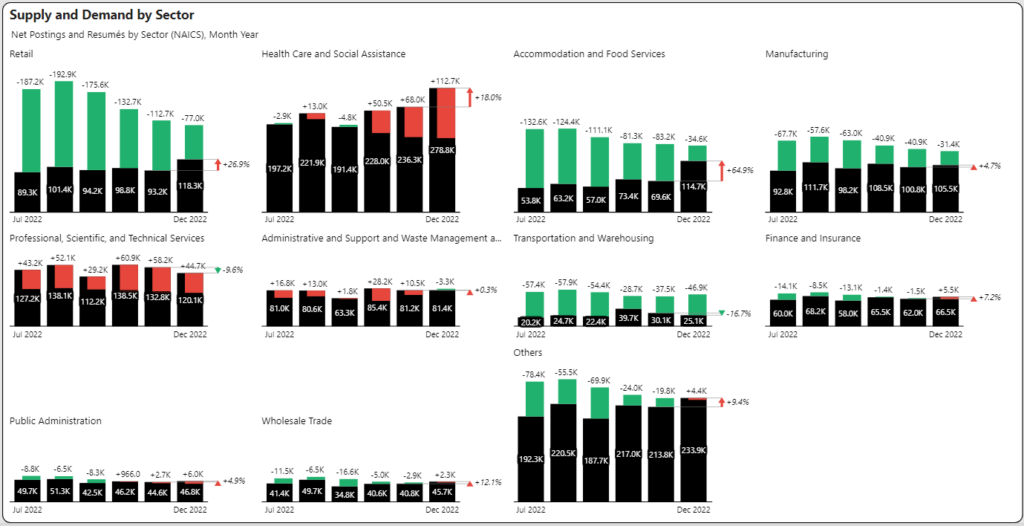

Market Supply and Demand Shifts

It has been widely documented that there are over two job openings for every unemployed worker. However, I would suggest the problem is deeper than this. Whole industries are seeing a substantial exodus of workers and while other industries are experiencing continued supply/demand imbalances.

Market signals are extremely powerful in revealing the number of job seekers. In our TalentView platform, we identify job seekers in the market by looking at resumé updates and changes. Generally if a person updates their resumé, they have provided a market signal that they are an active job seeker.

Healthcare Reveals Sense of Urgency

Much of the pandemic has focused on entry level workers in customer-facing industries such as retail and hospitality/food service. Despite the exodus of those workers, this really is a timing difference. There are still way more job seekers in those industry sectors than there are job postings.

However, the health sector is showing some signs of major imbalances. The graph below shows job postings in black and resumés based on last employer (to indicate industry) superimposed in red or green. Green indicates sufficient supply while red indicates worker shortage. The most problematic industry for filling jobs is health care where there simply aren’t enough skilled workers to cover posting volume. Professional jobs also show significant lag.

Get More December 2022 Jobs Report Insights

Sign up to watch our Jobs Report Video for even greater insights on this topic and receive supplemental reports and market data every month.