It’s time for our June jobs report as we find ourselves at the mid-point of a year unlike any other we will likely experience in our lifetime. It is apparent what should be a meteoric recovery is going to be clouded with fits and starts.

Labor Market Situation

There are 9.2 million job openings as of May (source: Jolts), which is essentially unchanged. These numbers remain at elevated levels.

What is adding fuel to the fire is the fact that we have abnormal numbers of quits. The number of quits in April was about 400,000 higher than normal levels.

The job market continues to do whatever is necessary to meet the demands of a resurgent economy. But it is clouded by remote policies, competition, childcare needs, and salary expectations.

Current Job Market Status

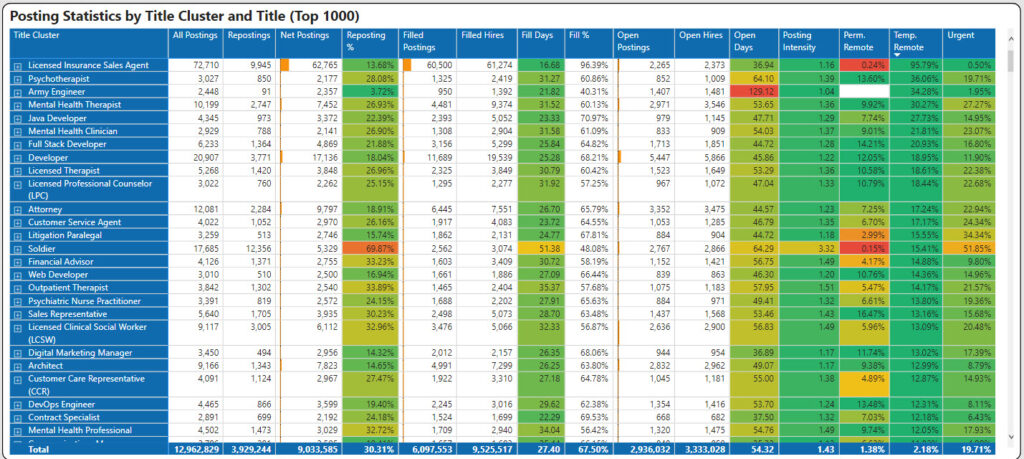

Insight for Work captures about 60-70% of all job market activity from Indeed® job postings, which provides a good proxy of the market. Here is a summary of the current status:

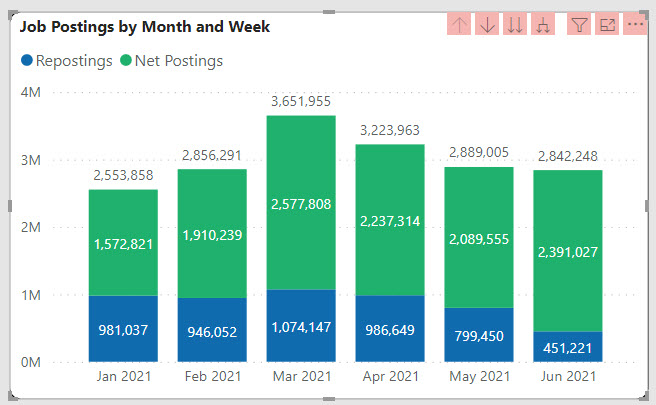

- June Job postings are flat at 2.8 million

- About 14-16% of job postings from Q1 remain open.

- The estimated number of days to fill for job postings through June is 27.5 days.

- However, there is still a large backlog of open jobs with a weighted average open of 58 days.

- Jobs in Q1 had to be reposted multiple times to be filled.

- About 20% of all job postings were marked as urgent indicating the severity of the need.

- On the positive front, job urgency diminished greatly in June.

Industry challenges remain with customer facing industries but seem to be improving modestly. Food services jobs are now getting filled. However, retail jobs still have a substantial backlog.

Compensation

What are employers doing to respond? Many are raising wages. The median wage for customer facing industries has increased 4-10% but seems to be leveling off.

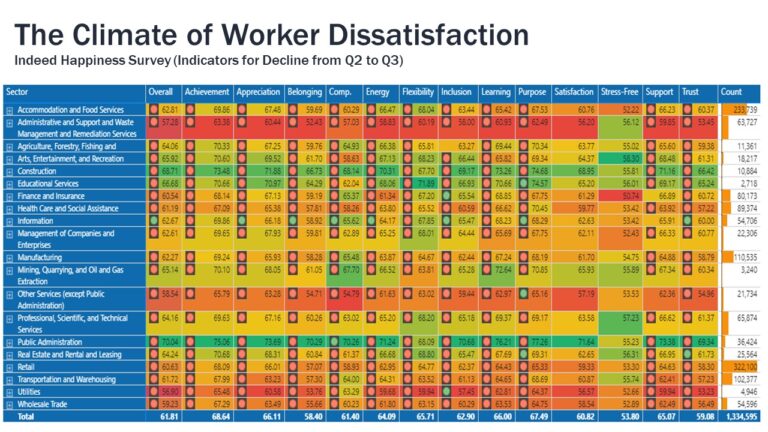

This is enough to get workers off of the sidelines, but not enough to increase worker satisfaction.

Cost of Living has increased 5.4% in June essentially wiping out the salary increases.

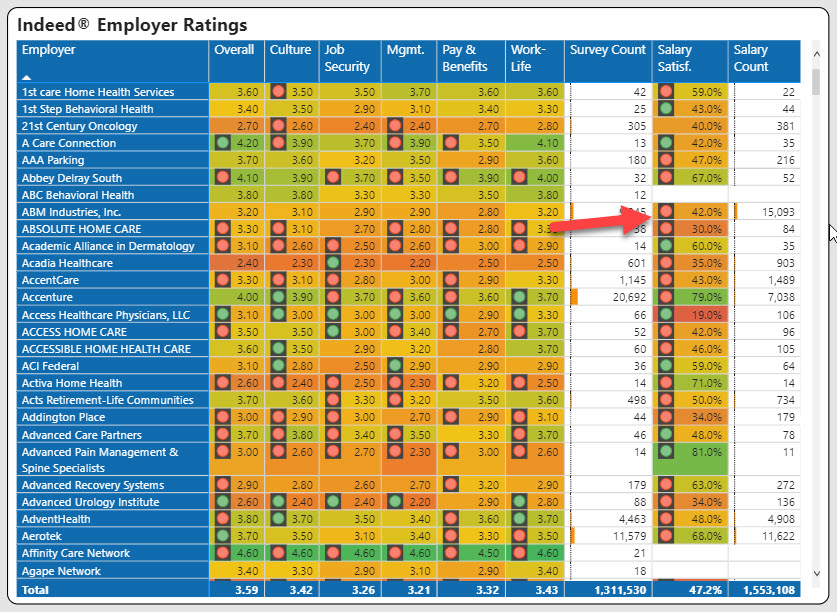

Salary satisfaction levels have significantly declined over the course of 2021 despite the wage gains. As you can see in the graph above, in a sample of healthcare professionals salary satisfaction scores the trend was much more negative than positive.

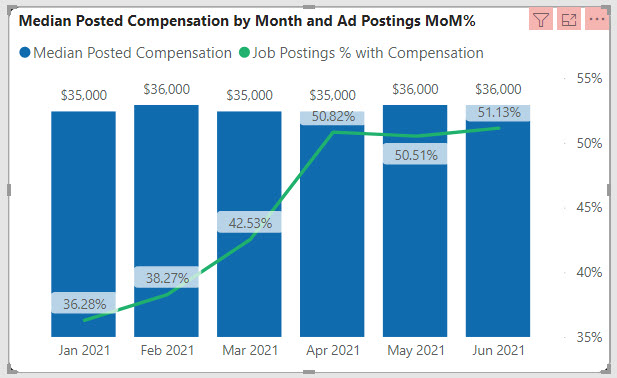

Employers continue to be aggressive in their postings. As shown in the graph above, the percentage of jobs posted with an ad rate increased 15% between January and April. This is a tactic (like the urgent indicator) to get workers hired.

Current State of Remote Work

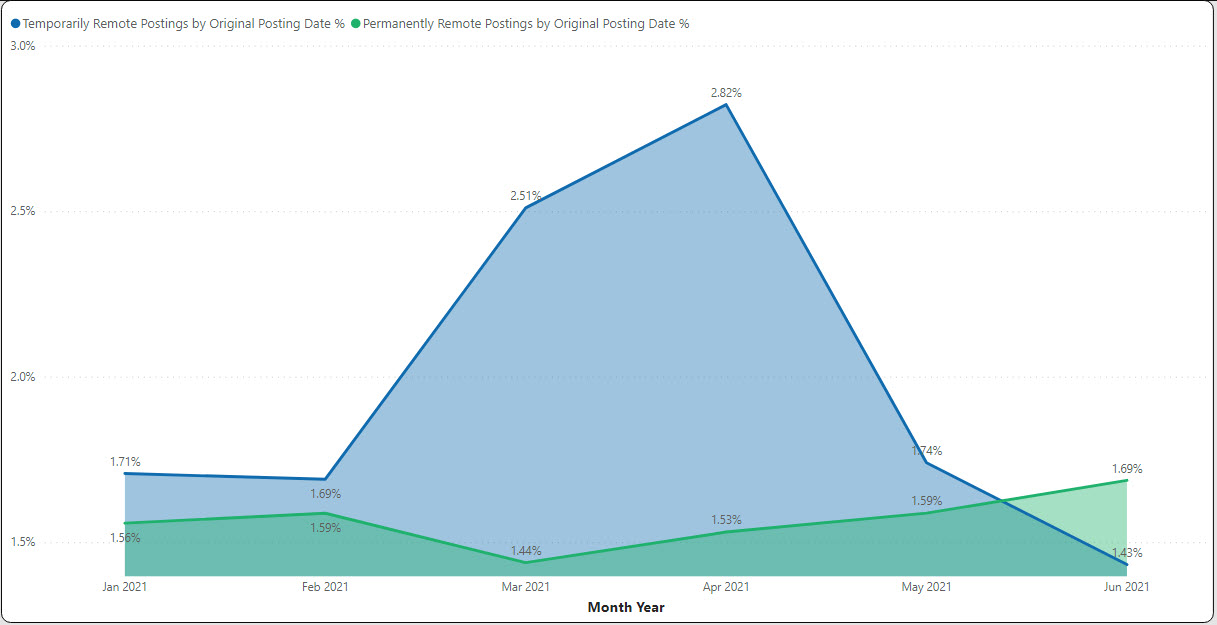

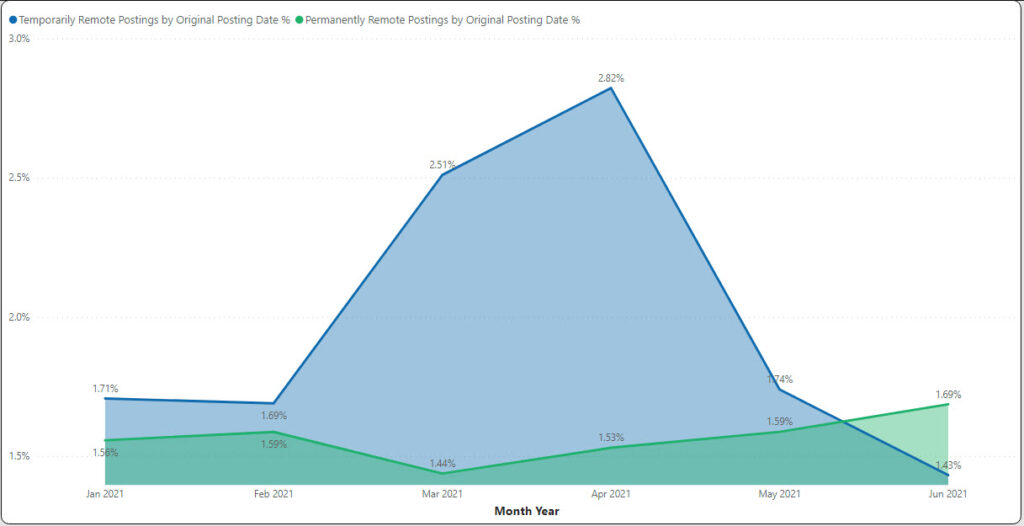

Remote work remains a fluid situation. Indeed categorizes remote work as either temporary or permanent.

The percentage of temporary remote workers (blue) has now declined below permanent remote workers (green) as shown in the following graph.

However, permanent remote work actually increased slightly in June.

Remote work will remain the negotiating bargaining chip to incentivize and retain workers.

Titles vary widely across remote workers. Professionals working in medical fields that did not require on-site treatment have the highest gap between temporary and permanent remote work.

The table below sorts the the top job postings by temporary remote percentage. Nearly a third of mental health workers were working remote, but less than 10% will stay permanently remote.

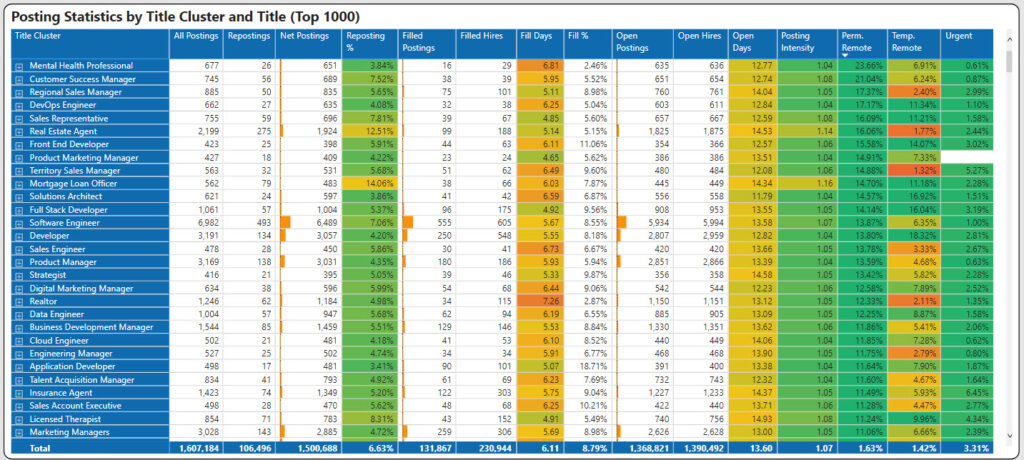

What about permanent remote workers? The table below again shows the top job postings but this time sorted by those with the highest percentage of permanent remote work. Further, we ran this listing for only June and July postings to date to get the most current data.

- As expected, information and knowledge workers have the highest percentage of remote work.

- These include software developers, sales agents, insurance agents, marketers, and talent acquisition professionals.

- But what title stands at the top? Mental health counselors albeit at only 677 job postings. Mental health in particular is a challenging field. Many stressors triggered by COVID-19 and insurance reimbursement of telehealth appointments have driven the demand. In order to fill these jobs, employers will have to create better work conditions.

The bottom line for the June jobs report is that remote work will simply continue the gigantic social experiment brought on by the pandemic. Employers hoping to attract and retain talent will need to be flexible and competitive in their work arrangements.

Watch the Video

Sign up to watch our June 2021 Jobs Report Video for even more great insights and receive future jobs reports and market data too.

About Insight for Work

Insight for Work is a jobs and labor market analytics application for rapidly analyzing market trends without any database knowledge. Insight for Work integrates and optimizes data from Indeed® and Glassdoor® platforms including:

- Job postings

- Resumés

- Skills and assessments

- Job requirements

- Employer profiles

- Compensation surveys

- Employer ratings and reviews

Insight for Work generates actionable insights for a changing market by leveraging the powerful Microsoft® Power BI platform. These insights help drive your growth and targeting strategies, accelerate talent acquisition, analyze employee satisfaction of your company and your competitors and assess in-demand skills and future jobs.