May job postings through last Friday continues a troublesome trend in the jobs report today. Employers in recovery industries appear unwilling to go all-in on the job market until there is better luck filling existing postings. They are taking increasingly creative and aggressive approaches to get talent.

Going into April, it looked like the US job market recovery was off to the races. The winning formula seemed to be:

High Unemployment + High Job Openings + Government Stimulus = Economic Boom

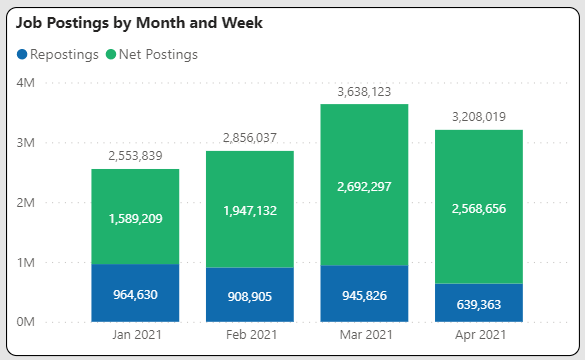

March job posting growth based on the Indeed® job posting platform and Insight for Work was up 27% over February and 42% over January. Further, postings were well ahead of pre-pandemic levels.

The April Jobs Gut Punch

Unfortunately, April was a relative gut-punch. April job posting numbers declined 12% from March (although still above February) as shown below.

Check out our insights and observations in the video blog (updated twice a month) by signing up for the free US Jobs Reports service.

Early indications are that May is simply not improving. Through May 14, we show about 1.3 million job postings. This projects to about 2.8 million monthly job postings for May. This is on par with February, but well below March and April. It is also only nominally above pre-pandemic levels.

Customer-Facing Industries Have Hiring Challenges

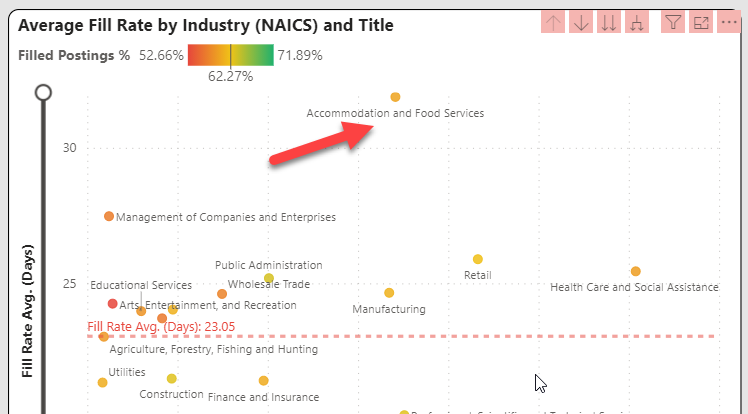

Customer facing industries are having huge hiring challenges. The estimated average fill days for employers in the accommodation and food service industry is over 30 days. It takes longer to fill many entry level jobs than professional jobs. In addition, retail and manufacturing are experiencing trouble filling positions as shown in the scatterplot below.

The current open job posting age of these industries is also above 50 days. There are multiple well-documented theories as to the reasons such as supplemental unemployment benefits and no child care. Until that changes expect employers to hit the brakes.

Will Compensation Levels Increase as a Result of the Jobs Report Today?

To date in 2021, compensation levels have not increased to attract workers. Median compensation for retail and accommodation industries is up 4%. This is encouraging, but hardly enough to get people onboard and may not be enough to overcome unemployment benefits. Many employers have promised sign-on bonuses and other perks to get people interested.

Employers know they now have to be aggressive. Historically, about 20-30% of job postings contain an advertised compensation rate. That number has increased substantially in the past 30 days or so. In April, nearly 50% of jobs in these industries now have a published compensation rate.

Upon closer examination of these job postings we see wide ranges of published wage rates of up to $20 and even $25 an hour. Will this push overall wage levels up? Costco, Walmart and others have announced plans for raising wage rates across the board.

About Insight for Work

Insight for Work is a jobs and labor market application for rapidly analyzing market trends without any database knowledge. Insight for Work integrates and optimizes data from job postings, hiring company profiles and ratings, compensation and benefit surveys, resumé profiles, skills and assessments, and government agency publications with the power of the Microsoft® Power BI business intelligence platform.