The May Jobs Report signals a continued tepid job market recovery. Earlier in the year employers were aggressively posting new positions, but have gradually eased on the accelerator and focused on filling existing openings. Consequently there are a record number of job openings but until the openings start getting filled, we are at a stalemate.

Employers posted 2.8 million jobs in May.

- This represents an 11% decrease from April and 22% decrease from the March peak.

- This is roughly comparable to February 2021 job posting activity.

- But only modestly above pre-pandemic levels.

Check out our insights and observations in the video blog (updated twice a month) by signing up to receive the free US Jobs Report service.

The Labor Conundrum

Continued unemployment claims remain 75% above pre-pandemic levels even though initial claims have finally reached pre-pandemic levels. Clearly there are workers on the sidelines.

There are also a lot of job openings. BLS job openings are now over 9 million, nearly twice the typical job openings level. Three months of this sustained activity will wipe out the deficit of layoffs from a year ago. When combined with large government stimulus, it should equal a rapid recovery.

Record unemployment + Strong job openings + Government stimulus = Rapid recovery

This formula simply has not materialized. Why?

Lagging Customer-Facing Industries

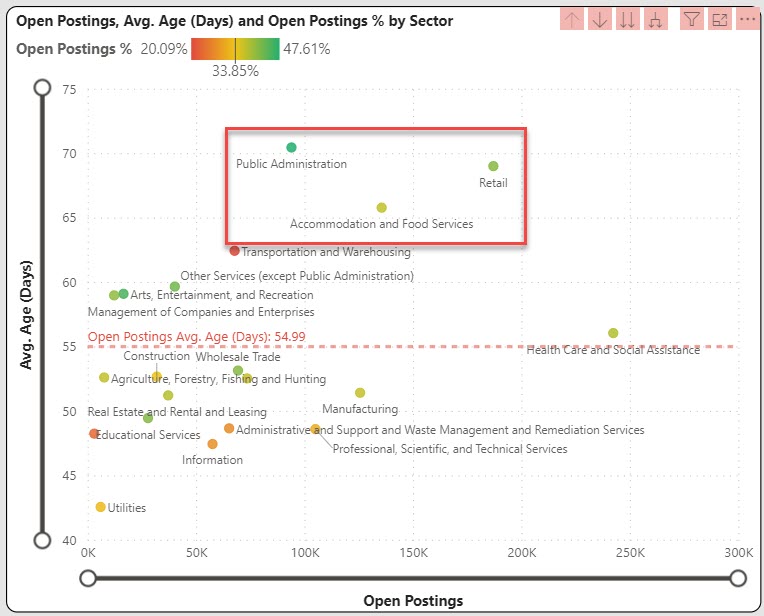

Retail and Accommodation/Food Service industries are historically rapid-turn industries, because employers hire entry level workers. In our topsy-turvy post-pandemic world, that has flipped. The scatterplot below shows the number of open postings by average age of the postings.

- The average posting age of these industries is above 60 days, which is well above the overall average of 55 days. Historically, we would expect these industries to be rapid-turn.

- In addition, the yellow-green indicator shows that a relatively high number of overall postings remain open.

- Employers in these industries have hit the brakes on new job postings until the existing postings are filled. New job postings are declining, not increasing.

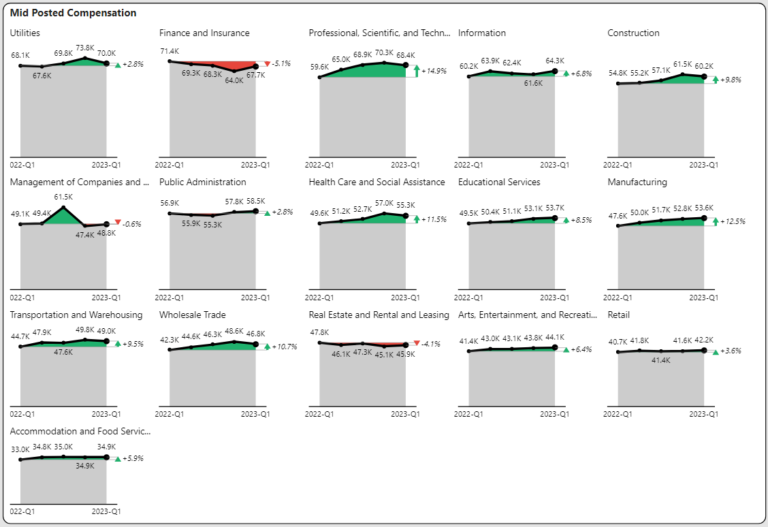

Improving Entry-Level Wages

Employers adjusted pretty quickly to the changing reality. From a business standpoint, that could include reducing hours or services. Obviously this is far from optimal. But they are also now showing a willingness to “sweeten the pot” to attract workers.

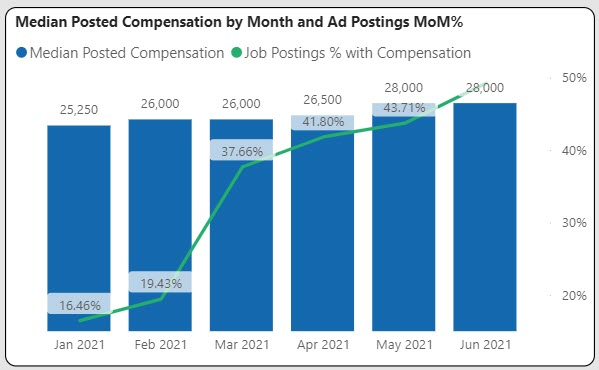

- The median compensation for food service workers jumped over 10% between January and May as the graph below shows.

- Employers are being aggressive in their advertising. The number of job postings with published compensation increased from 16% to nearly 50% as shown in the superimposed line graph below.

- Employers in these industries can no longer take a “Field of Dreams” approach to hiring where if you build it they will come.

Healthcare Supply/Demand Challenges

Healthcare continues to present the biggest challenges longer-term. The May Jobs Report shows healthcare support occupations show the highest supply/demand imbalance. Many more employers are looking for workers than those that are looking for work.

In addition, delivery drivers also remain in supply/demand imbalance. One significant difference is that a high percentage of drivers operate as a side gig and may not hold themselves out as drivers.

May Jobs Report – Video Blog

Check out out more insights and observations in the video blogs (updated twice a month) by signing up to receive the free US Jobs Report service.

About Insight for Work

Insight for Work is a jobs and labor market application for rapidly analyzing market trends without any database knowledge. Insight for Work integrates and optimizes data from job postings, hiring company profiles and ratings, compensation and benefit surveys, resumé profiles, skills and assessments, and government agency publications with the power of the Microsoft® Power BI business intelligence platform.