The May 2023 Jobs Report indicates that several months of job openings easing back to normal levels abruptly reversed course in the latest BLS data for April. Job openings increased to 10.1 million from an adjusted 9.7 million. Job openings now remain at 40% above pre-pandemic levels. Additionally, layoffs and discharges also took a nosedive to 1.6 million or 12% below pre-pandemic levels. Finally, the unemployment rate ticked down to historical lows at 3.1%.

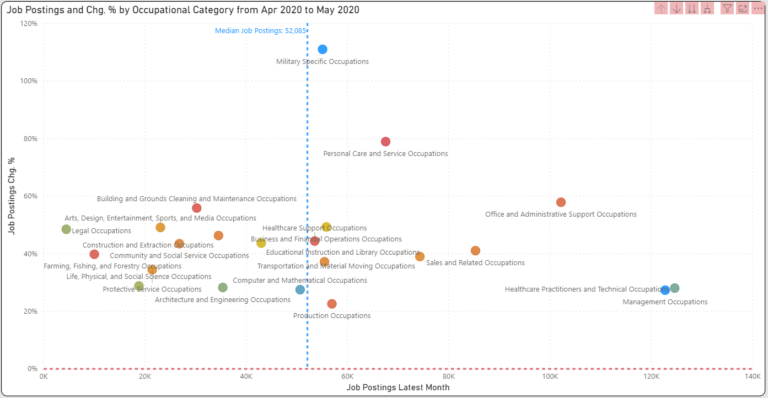

How aggressive are employers at filling these openings? The data suggests that they are not being aggressive at all. The job postings or advertisements for jobs simply do not reflect this level of job openings activity.

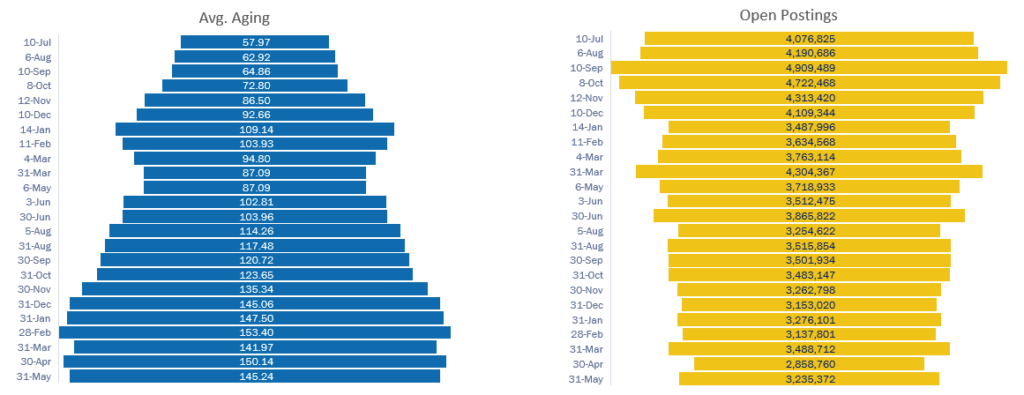

Job Postings Up in May, But Down from Last Year

The number of May open postings increased 13% compared to April and were down 13% vs. May 2022. The average age of May open postings is 111 days if you factor in repostings. The average age of May open postings without repostings is 145 days, which declined from 150 days in April.

More Posting Insights

New job postings for May rose 5% on a month-over-month basis, but are still 23% below the previous year. The new postings are in fact a significant amount of reposted jobs according to our analysis. Reposting rates have remained consistent over the past several quarters at 45%. This means that nearly half the jobs have been reposted at least once. Ads indicating urgency have stayed at 12%, meaning one in eight jobs is flagged as urgent. This is down from the 19% we saw a year ago.

Ongoing Supply/Demand Challenges

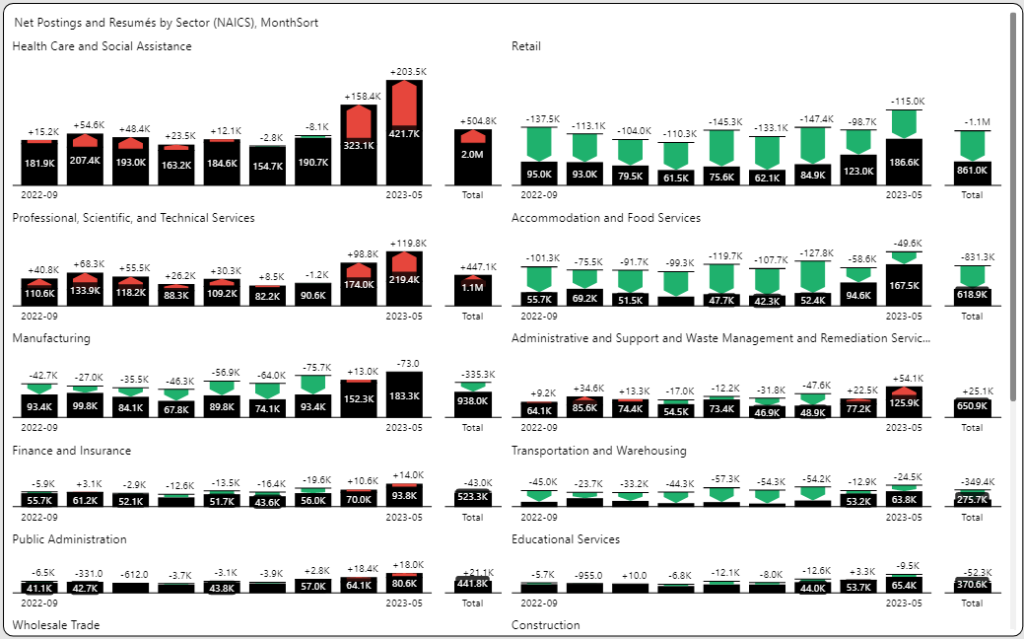

The graph below generated from our TalentView solution displays the current status of supply and demand by sector. The black bar below is job postings (adjusted by an April improvement in our collection process). The green bar shows the job seekers exceeding the posting volume. The red bar indicates a shortage of workers.

Health Care and Social Assistance and Professional, Scientific and Technical industry sectors are seemingly always in short supply. Over the past 12 months, there is about a 25-35% shortage of workers to fill these positions.

Retail and Accommodation and Food Services have an abundance of workers despite a mass exodus of workers during the pandemic. Wages have increased making it easier to fill these positions.

Ultimately, parity of job postings with job seekers (a job for everyone who wants it) seems like a reasonable goal. But this is happening very unevenly.

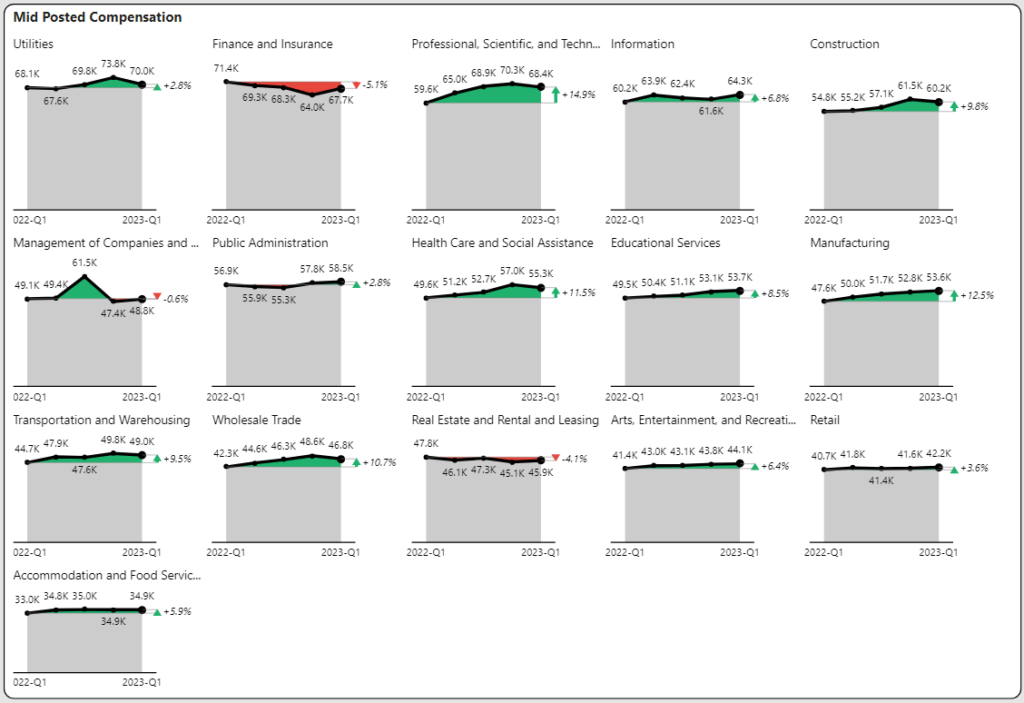

Compensation Increases Vary Significantly

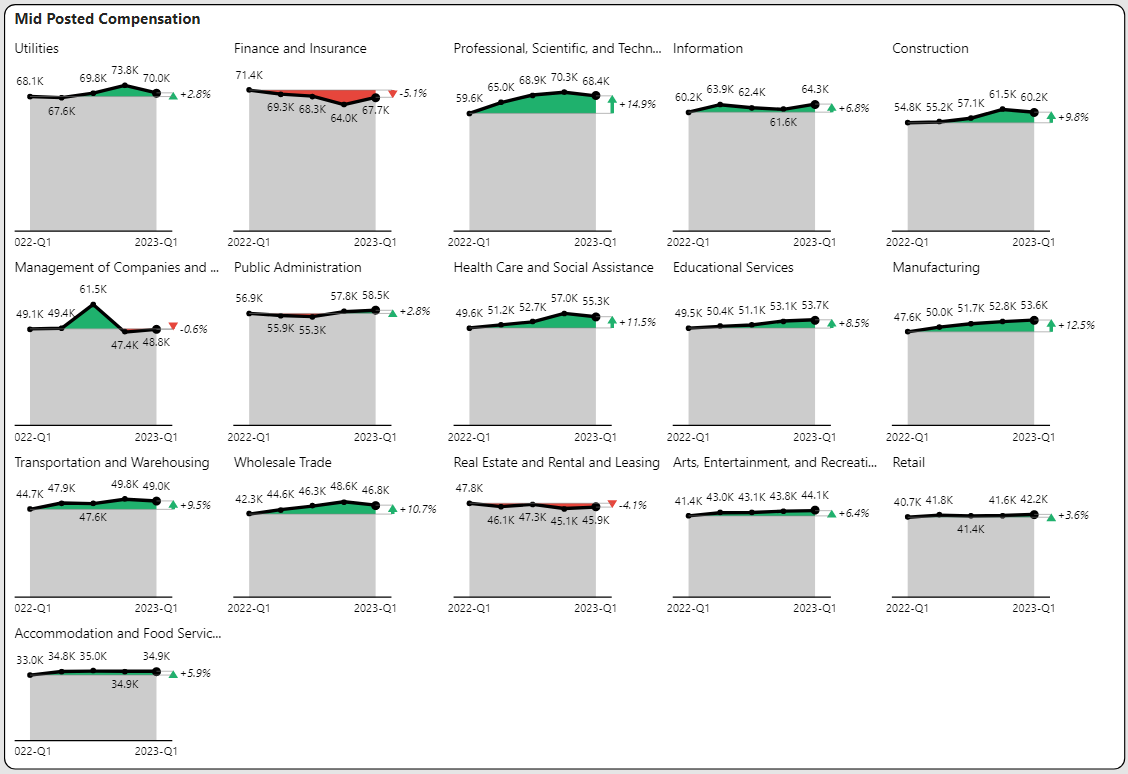

Inflation has resulted in pay adjustments for most industry sectors as shown below. However, the pay increases vary widely. The graph below shows the changes from the first quarter of 2022 through the first quarter of 2023.

Finance and Insurance and Real Estate industries have experienced pay decreases. Despite the press, the changes in Retail and Accommodation and Food Services went up 3.6% and 5.9% respectively. Health Care despite supply shortages increased only 11.5%. Manufacturing appears to be a big winner at 12.5%.

Pay Transparency Has Full Employer Participation

Pay transparency has been in the news for many months now and it is not going away. The percentage of jobs with some form of pay disclosure has remained consistently in the 82-85% range for several months.

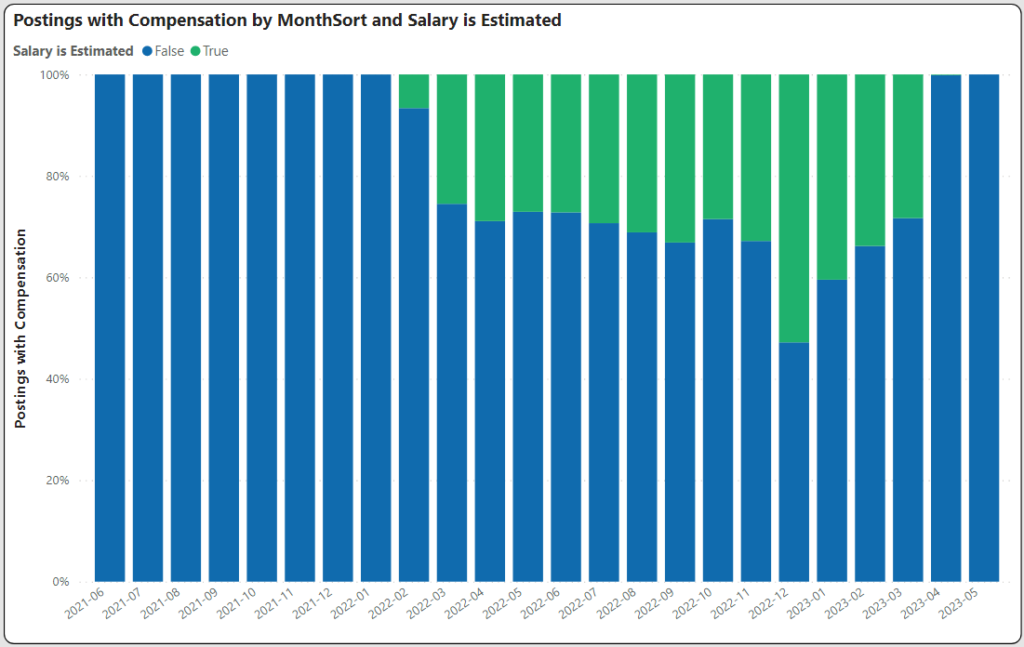

State and regional laws were not the only ones driving this changed behavior. Indeed® has taken a hardline stand that compensation will be estimated if employers do not disclose compensation. The graph below shows the percentage of ads with an estimated value (green) vs. employer provided value (blue).

Half of all jobs with compensation were estimated in December 2022. The salary ranges for these jobs were assigned a uniform wage band of 22-25% of the mid-point. In many cases these salaries were lower than employer assigned salaries, and yet in other cases they were actually higher.

After reaching bottom in December 2022, employers have increasingly participated. The last two months have shown nearly 100% participation. Wage ranges have remained informative (few jobs with very wide wage bands).

Get More May 2023 Jobs Report Insights

Sign up to watch our Jobs Report Video for even greater insights on this topic and receive supplemental reports and market data every month.

These insights were generated from our TalentView job market data and analytics solution. Learn more and watch a demo.