How to Understand and Use the Job Openings and Labor Turnover Survey (JOLTS) from the Bureau of Labor Statistics

The JOLT survey is a very underutilized set of data for job openings and labor turnover insights that describes the labor market in terms of unmet demand. Most of the news media seems to have a fixation on unemployment statistics. Unemployment is the yin to job openings yang. Unemployment focuses on who is out of work, while job openings tells us who is hiring. The Bureau of Labor Statistics (BLS) publishes the Job Openings and Labor Turnover Survey (JOLTS) every month. Public Insight optimizes this data in our Insight for Work analytics platform enabling fast and easy access to the data that matters to those in working in staffing, recruiting, human resources, career placement and counseling and workforce development.

Learn About JOLTS Through Our On-Demand Webinar

We have created a free, brief on-demand webinar to demonstrate how easy it is to use JOLTS data to make strategic business, career planning and academic programming decisions. You can give clients and students data-driven advice on ways to stand out in a competitive labor market with our Insight For Work platform. Additionally, you can put job seekers’ minds at ease by showing them exactly how the U.S. job market continues to rebound.

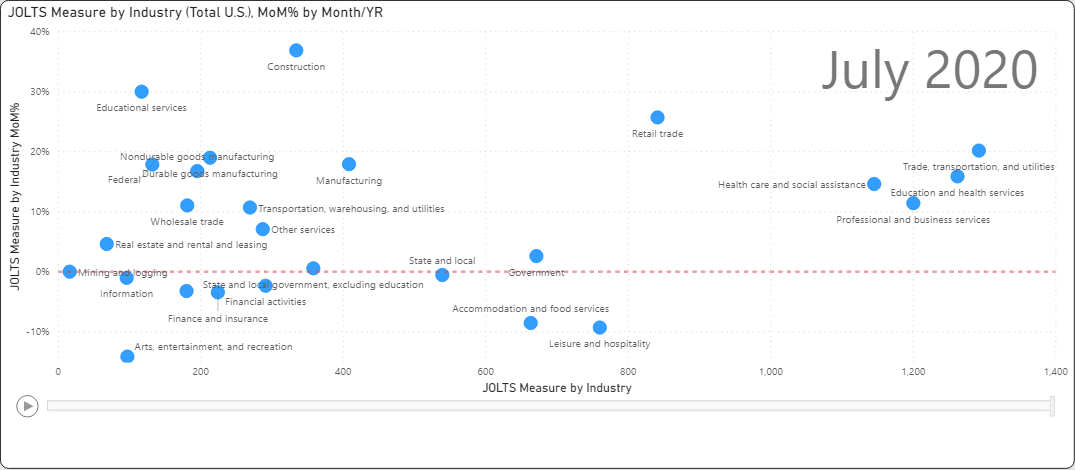

In this on-demand webinar, we teach you the basics about JOLTS data and how it impacts the tasks you perform daily. Furthermore, you will see how our self-service tools drive decision-making, transforming millions of data points into a visual snapshot of job openings and turnovers.

Insight For Work allows you to easily visualize data with just a few clicks. Whether you are looking for jobs and labor market trends by industry, title, region, or compensation, we’ve simplified the process of curating the best data into an easy to use on-demand analytics platform. These insights will help you work more efficiently and provide you with a competitive advantage.

Watch the free JOLTS On-Demand Webinar Now!

What is JOLTS? And What Does it Tell Us?

The primary purpose of JOLTS is to measure unmet labor demand.

- Prior to JOLTS, there was no effective way of measuring labor market demand.

- JOLTS addresses labor shortages at the national level by industry as well as the tightness of the labor markets.

- It is the parallel to unemployment measures. If unemployment is a measure of oversupply, JOLTS is a measure of unmet demand.

- JOLTS is an estimate – while it is not an exact science, JOLTS serves a predictor of the U.S. labor market.

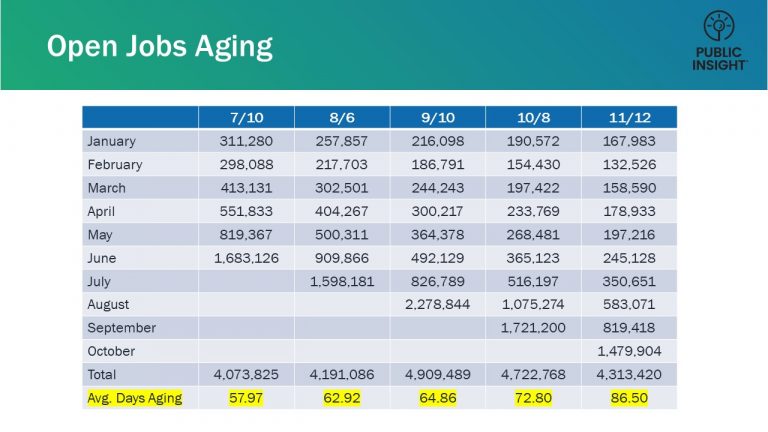

- Finally, JOLTS data is updated monthly with new data being released on or around the 10th of each month. The data released each month has a 40 day lookback period. For example, July 2020 data was released on September 9, 2020.

Watch the free JOLTS On-Demand Webinar Now!

Economists use JOLTS and unemployment data to compare the number of individuals out of work to the number of job openings. Currently, the number of job openings is on the rise (Source), while the number of individuals seeking unemployment is decreasing (Source). This is further evidence that the U.S. Job Market is recovering from the March 2020 fall off.

About the JOLTS Survey

- It is important to note that JOLTS is an estimate. The estimate is based on approximately 20,000 establishments culled from the 9.4 million establishments included in the Quarterly Census of Earnings and Wages (QCEW). The sample is stratified by ownership, region, industry sector, and establishment size.

- JOLTS uses a birth/death model which provides a one-year time lag from the start-up or birth until an establishment makes its appearance in the model. As with many BLS surveys, seasonal adjustments are made.

- Finally, BLS uses the Current Employment Statistics survey which is much larger at 145,000 establishments to make final adjustments to the JOLTS survey.

Components of JOLTS

JOLTS components are measured both in terms of values and as a rate. The rate is computed based on employment. Employment is defined as any persons on the payroll who worked or received pay for the pay period that includes the 12th of the month. This is consistent with other BLS reported data. The definition of who is employed is pretty broad and the exclusions are limited.

Job Openings

How do you define a job opening? There is a three-factor test applied and to be classified as a job opening requires meeting all these tests.

- First, a position must exist, and it must be available. It can be full-time, part-time, permanent, or temporary.

- Second, the job must start within 30 days regardless of whether a suitable candidate is found during that time.

- Finally, the employer must be actively recruiting from outside the establishment. This can vary but can include virtually any combination of digital or physical outreach. The barrier to reaching that test is not high.

People Hired

People hired include any additions to the payroll during the entire reference month. This includes the items listed. Most notable among exclusions are any transfers or promotions from the same location. Promotions or transfers from other locations can however be included.

People Who Left Their Jobs

Separations consist of Quits, Layoffs and Discharges, and Other Separations. Collectively this comprises the total separations. The primary difference between quits and layoffs is who initiates the separation. Layoffs can occur for many reasons. A key factor for a temporary layoff is whether it is expected to last beyond 7 days.

Industry and Regional Breakdowns

BLS releases monthly data nationally by select industry breakdowns at the NAICS sector level. In addition, the data is shown across industry (total nonfarm) by census region.

Establishment Size Class Data

In addition to the monthly data by national industry and census region, BLS releases quarterly estimates by establishment size at the national level.

Experimental State and Metro Area Estimates

Recently the BLS began releasing research estimates of state and metropolitan statistical area (or MSA) estimates. This data extends the analysis to a regional level across industry. The MSA estimates are currently provided through 2019 as one-time releases. State estimates are updated quarterly and BLS has given some indication that this data will continue to be updated. Announced changes to the data dictionary seem to imply that state and MSA estimates will continue to be provided.

JOLTS in Action

Click on the image below to see JOLTS data in action in the Insight for Work Interactive.

Watch JOLTS Webinar Now!

About Insight for Work

Insight for Work is a self-service analysis platform for the labor market. It combines data from job postings, hiring company profiles and ratings, compensation and benefit surveys, applicant and resumé profiles, and government agency publications with the power of the Microsoft® Power BI business intelligence platform. Instantly analyze occupation, industry, and company opportunities and trends to evaluate strategies and programs and prioritize resources.