On the surface, the February 2023 Jobs Report indicates the job market still appears relatively healthy. The Bureau of Labor Statistics JOLTS data shows job openings 50% above pre-pandemic levels, layoffs while up are still below average and unemployment remains low. In addition, last month we showed modest job posting growth.

There is more than meets the eye here. There are still headwinds that appear to be increasing. In a labor market unlike any other in our history, it is wrong to look at the same metrics in the exact same way.

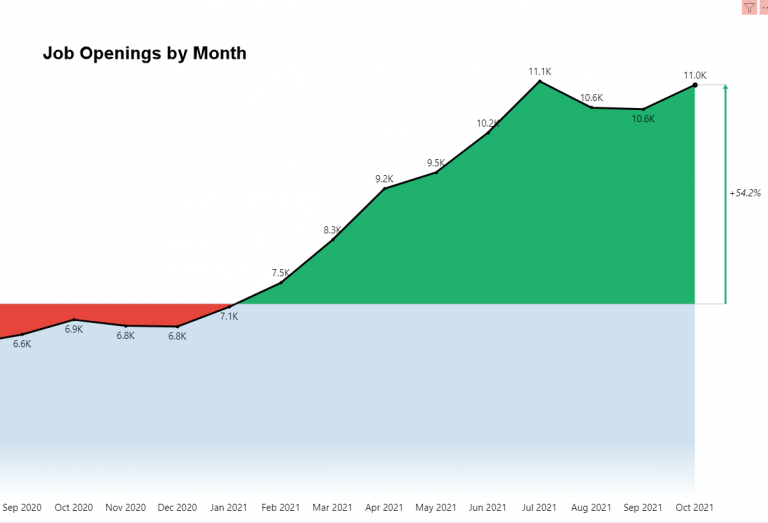

Job Openings – Is it Reality?

The 10.8 million job openings are still 50% above pre-pandemic levels. This just simply doesn’t feel right when we have seen declines in year-over-year postings in nine of the past twelve months. The Wall Street Journal recently published an article that goes into extensive depth of the methodology used by the Bureau of Labor Statistics (BLS). The data is based on a survey of 20,700 firms. By contrast, the Labor Department’s monthly payroll survey is based on reporting from 122,000 businesses and government agencies, representing approximately 666,000 individual worksites.

The reliability of the job openings estimates has declined in recent years, because fewer businesses have been responding to survey questions, said Paul Calhoun Jr., an economist at the Labor Department. The response rate for the survey fell to 30.6% last September from 56.4% in February 2020. The department increased its sample size in 2019, because of the declining response rates.

Posting Volume Tells a Different Story

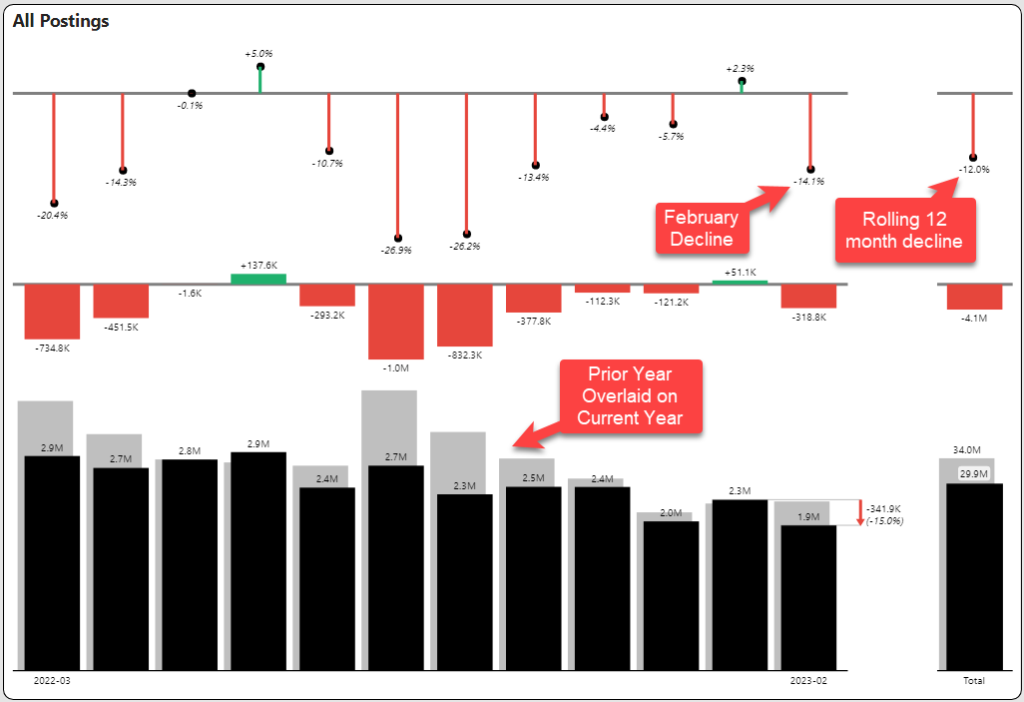

Through our TalentView solution, we analyze the market data measured by job advertisements or postings, which are much less bullish. Job posting growth on a rolling twelve-month basis is down 12% as shown below. February, a short month, is showing 14% year-over-year declines. The top line graph shows the year-over-year percentage declines while the bottom bar graph shows the current year (dark black) against the prior year (inline gray).

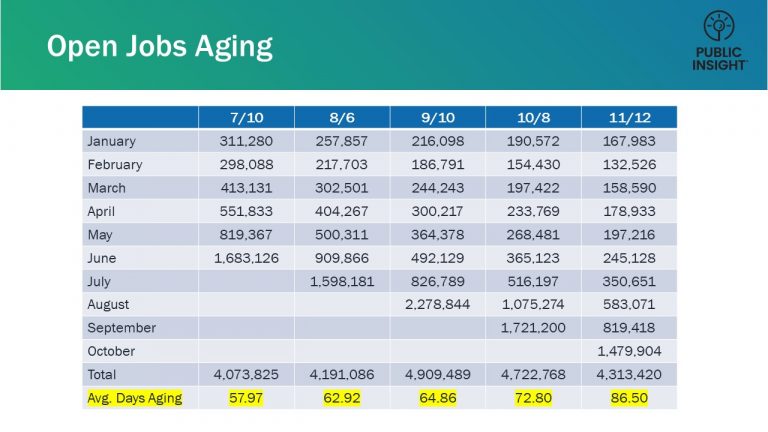

Quality Issues in Postings Continues

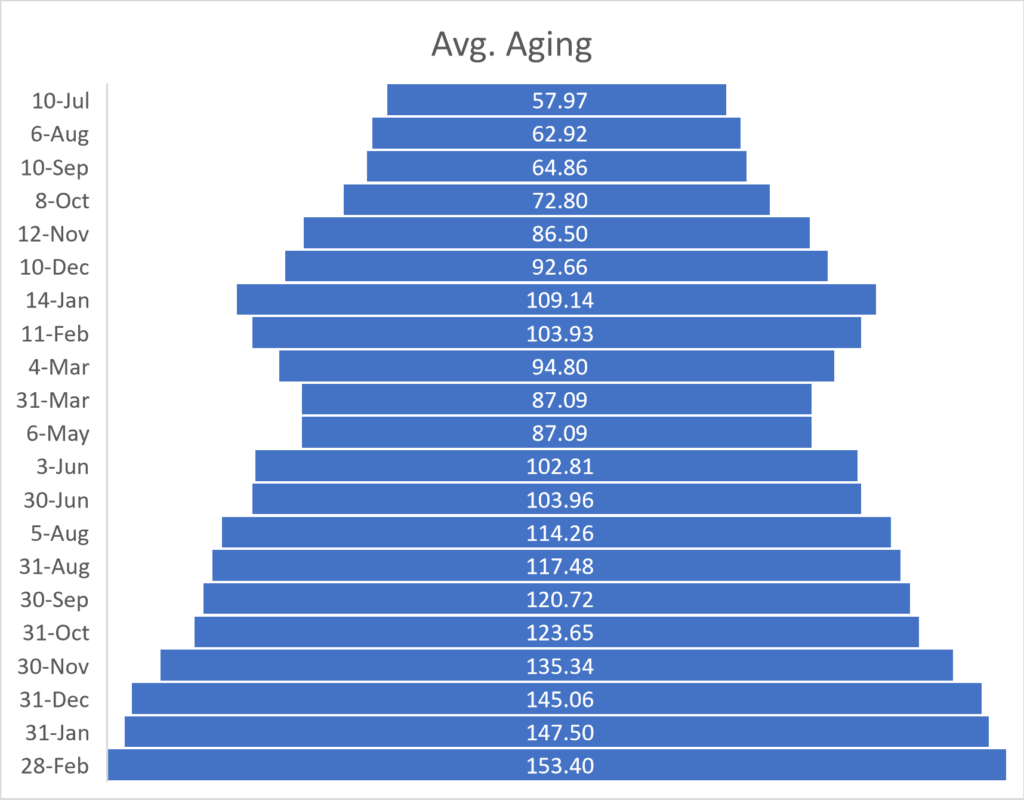

The average age of open postings has been in a freefall for a number of months. Last month we held out hope that the trend was moderating. Unfortunately, the number of open days in postings increased from 147 days to 153 days as shown below.

In addition, the number of open postings declined to 3.1 million, a 21-month low. The length of time an advertisement is on the market is tricky especially in a turbulent market. We arrive at the open posting age based on the first occurrence of a related job post or what we call the parent posting. One argument is that volume is so strong that employers are simply sitting on jobs or simply repeating the advertisement (evergreen ads). However, obvious evergreen ads are a very small percentage and impact at less than 2%.

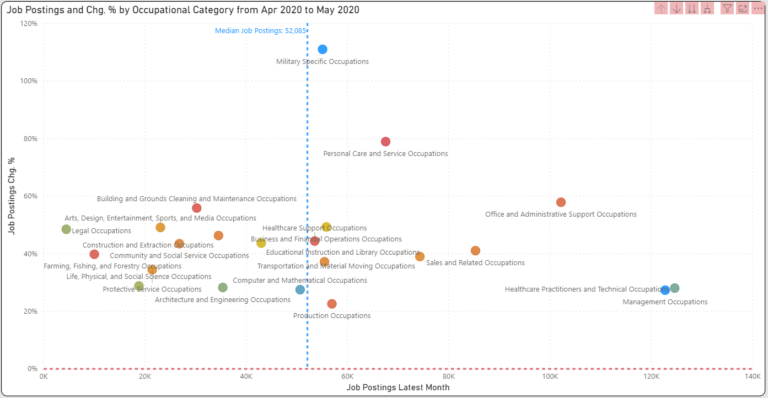

Supply/Demand Uneven Across Sectors

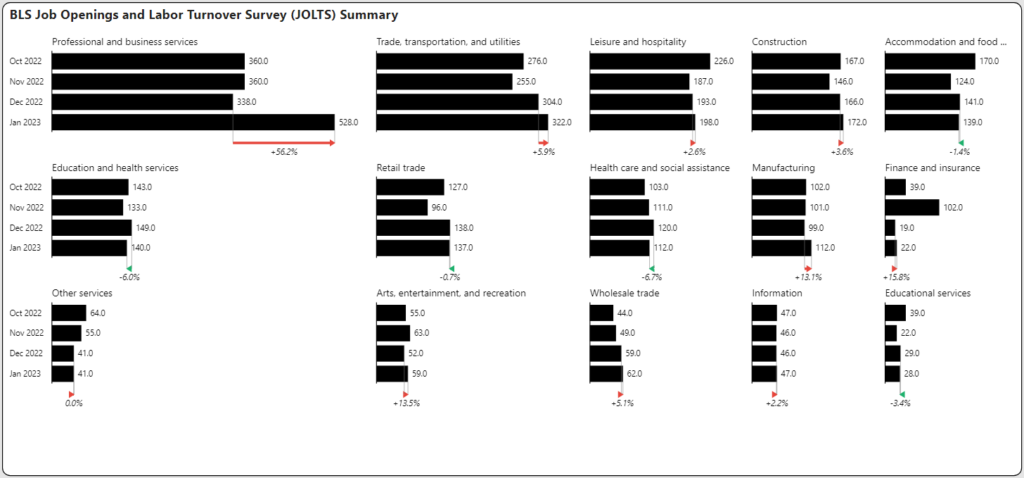

The immediate problem of the post-pandemic job market was filling entry level jobs. So many people exited any position that required face-to-face contact (e.g. accommodation and food services) that filling any job was challenging. This situation appears to be moderating as employers are becoming more aggressive and job seekers are more willing to re-enter these industries.

One of the measures of supply/demand is comparing job seekers (based on resumés) against job postings. The inline green bar below indicates the supply of job seekers exceeding demand (measured by job postings). There are still plenty of job seekers for entry level jobs in retail and accommodation and food services. On the other hand, the industries with a larger red inline bar (e.g., healthcare and professional services) have supply/demand that continues to be stressed with significantly more demand than there is supply.

Professional Layoffs – The Tip of the Spear

Up till now, layoffs have not been a big issue. However, January layoffs reported by the BLS spiked 16.7% to 1.7 million. However, upon further observation this appears to be very concentrated to the Professional and business services sector, which spiked 56% as shown below. Finance and insurance and manufacturing were the only other sectors with double-digit increases in layoffs. There appears to be plenty of demand for professional, scientific and technical workers as shown above.

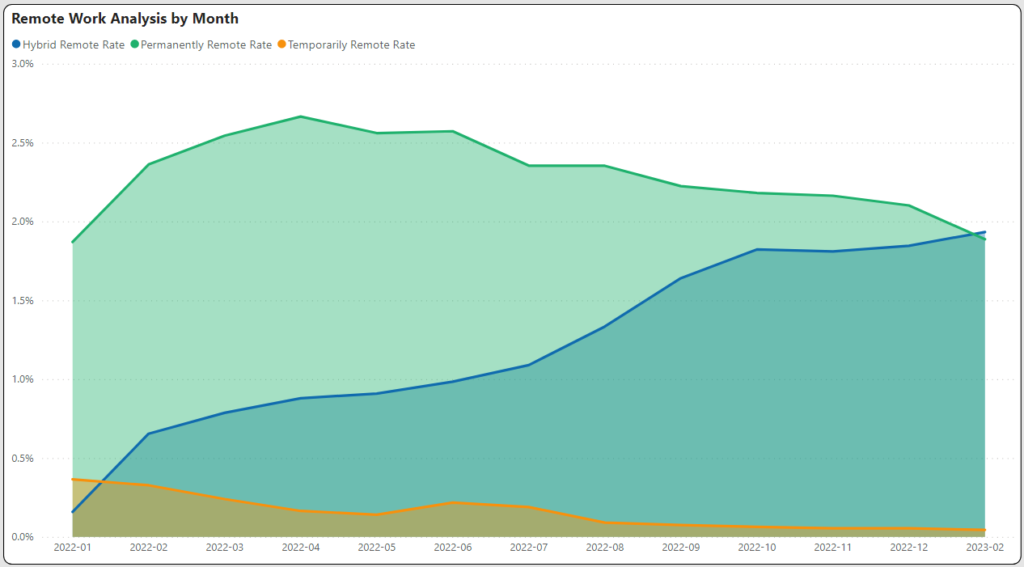

Hybrid Evolves as the Leading Form of Remote

Remote work continues to be a very fluid situation. One observation from the February data is that hybrid remote has now passed permanent or temporarily remote work as the primary form of remote work. Overall remote work has been moderating its upward trend for many months now.

Get More February 2023 Jobs Report Insights

Sign up to watch our Jobs Report Video for even greater insights on this topic and receive supplemental reports and market data every month.