The results from the June jobs report 2022 makes me think of when my kids were young, and they would ask “Are we there yet?” Usually this anticipates arriving at a positive destination. However, since we have been hit so hard by supply chain and inflation, we may be looking ahead to what appears to be a certain recession. Not so fast yet – the labor market while having its issues is not signaling a recession. Although this downturn is unlike any others we have experienced.

Labor and Posting Activity Remain High and Have Not Eased

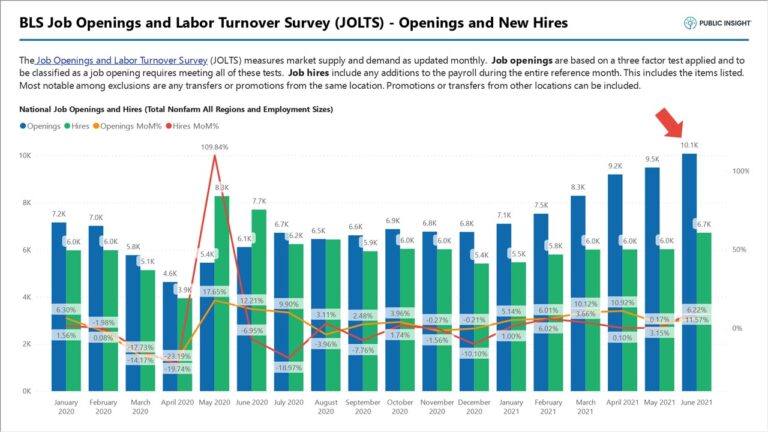

The Bureau of Labor Statistics JOLTS May data released yesterday shows minimal changes to already historic levels.

- Hires eased slightly, but still remain about 500k jobs above pre-pandemic levels.

- Job openings likewise have eased to 11.3 million, but are still in record territory.

- Quit rates have finally eased somewhat to 2.8% but are still above normal.

Despite the news highlighting sporadic company reductions and layoffs, unemployment claims remain at historic lows. There are now twice as many job openings as there are unemployed people.

So what is going on?

Less Workers in the Game Means More Unfilled Jobs

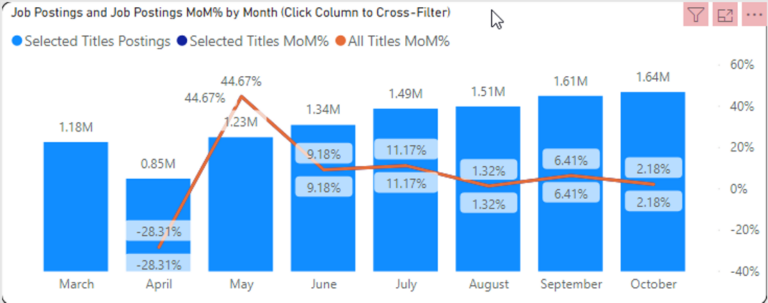

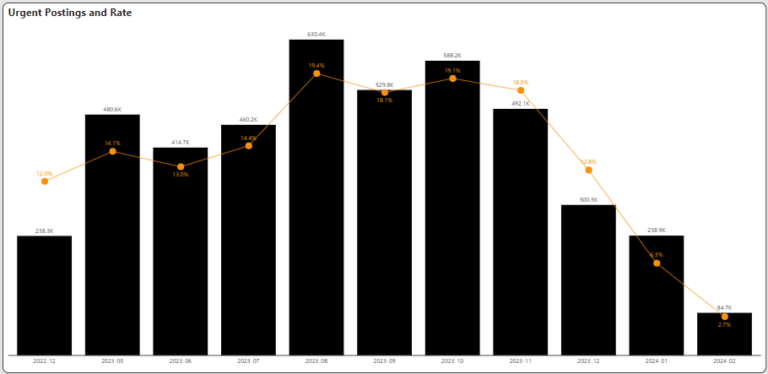

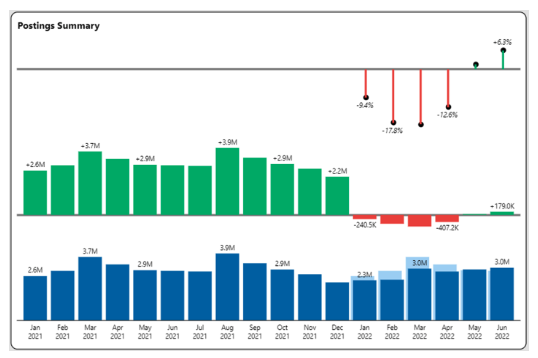

If this is a recession, it doesn’t behave like one. Employers are hiring and continue to struggle filling jobs. June jobs report 2022 indicates posting activity increased over 6% from 2021 levels (see below). However, the average age of open jobs remains above 100 days and is at the second highest level since January. Further, employers continue to signal desperation with one in five jobs flagged as urgent.

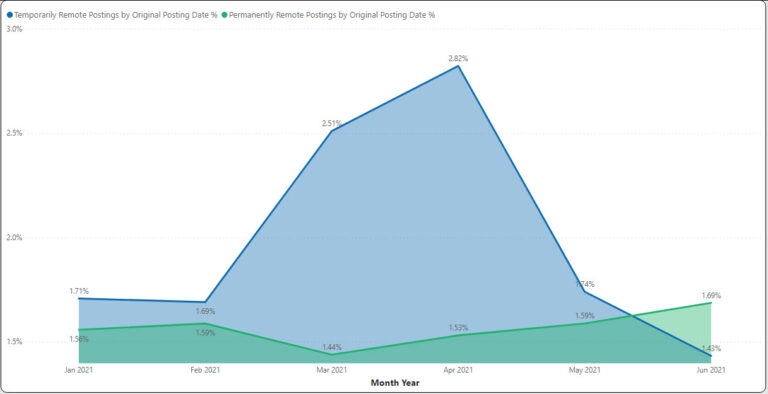

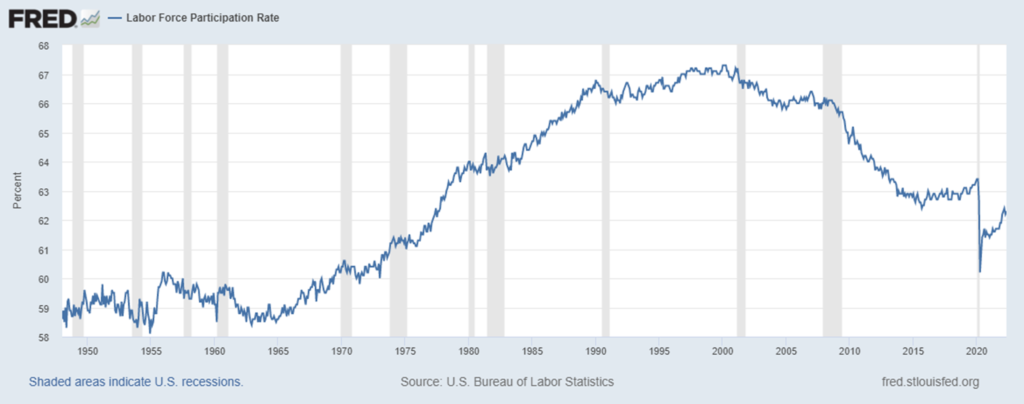

Workers are signaling that they are hesitant and passive. The labor force participation rate (the number of workers in the labor force divided by the employable population) as shown below is at a low level not seen since before 1980. A few percentage points off this measure can make a big difference.

Passivity in the Marketplace

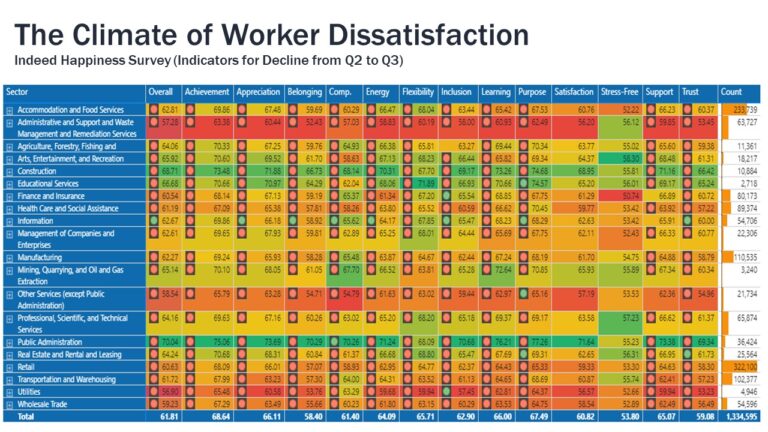

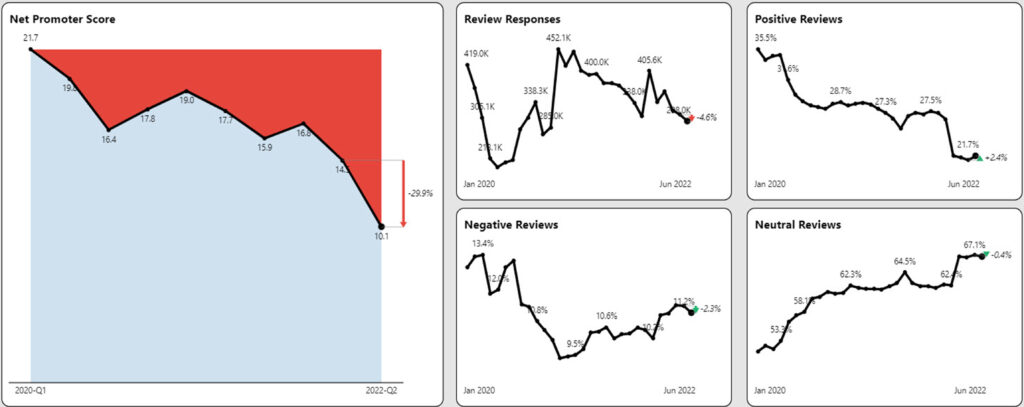

The pandemic forced life choices. Some equate it to a gigantic social experiment. We have been following workforce satisfaction using text analytics in our TalentView solution for months now and workers simply are not signaling their happiness in the job market.

- Employer ratings continue to go down.

- Positive sentiment expressed through reviews has declined to one in five.

- However negative sentiment has also remained low.

There is some evidence to indicate that the passivity may be bottoming out. As shown below the percentage of positive reviews ticked up while the number of negative reviews ticked down.

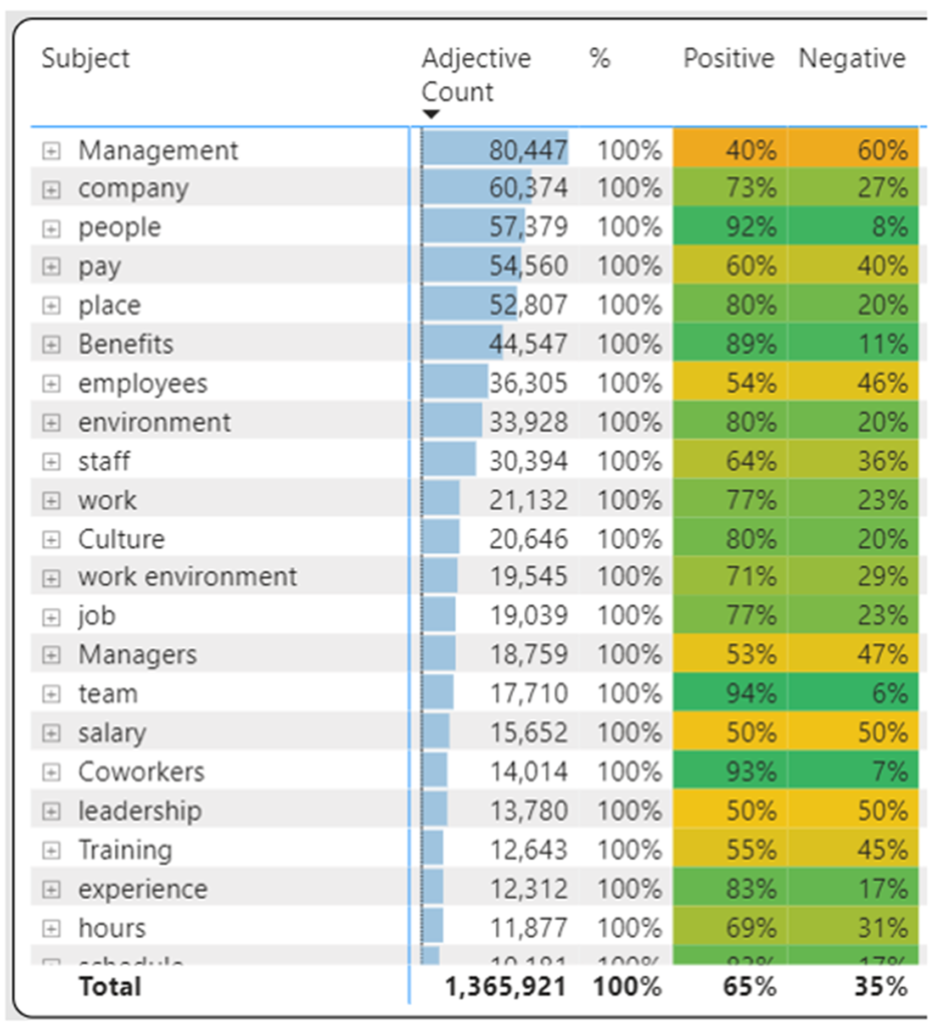

As we noted in last month’s blog, the immediate response is to say it is a compensation problem. But for the most part workers don’t cite compensation as a major part of the problem. The following subject/adjective pairs in June show that pay and benefits are fourth and sixth in importance. Further they are mentioned in a positive light.

Management is almost always at the top of the most cited subjects, but it is fairly balanced with 60% negative and 40% positive. People is very important and is the third most frequently cited subject. Further it is almost always mentioned in a positive light. That seems to conflict with the desire for remote work, which employers are tackling in various ways.

Are Workers Poised to Enter the Market?

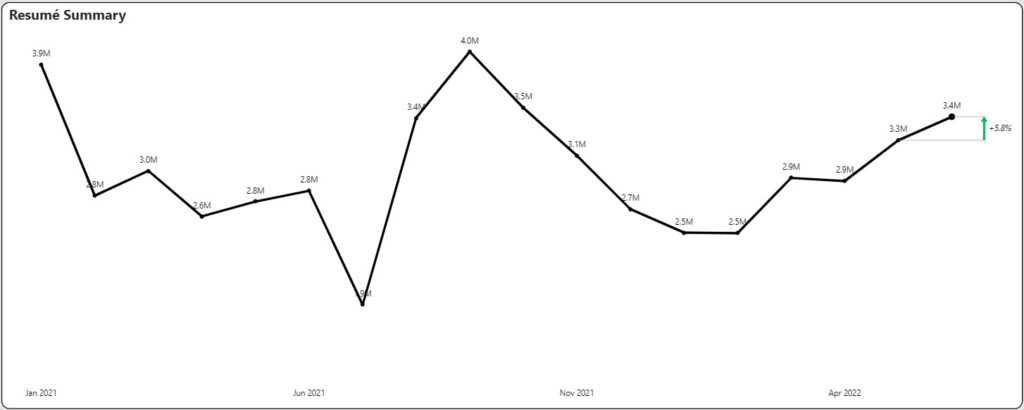

Resumé activity increased 10% and 6% in May and June respectively as shown below. This is below the number of resumés updated last fall, but is showing an encouraging trend. Further, the number of resumés updated went across industries.

Get More June Jobs Report 2022 Insights

Sign up to watch our Jobs Report Video for even greater insights on this topic and receive supplemental reports and market data every month.