Our February 2024 Jobs Report indicates the year continues to be off to a good and stable start. Aside from a couple of industries our key job market metrics (e.g., postings, comp, supply/demand, sentiment) are moderating across the job market landscape. One significant change we noticed was that Urgent Postings are way down.

Key Takeaways from the February 2024 Jobs Report

- The broader labor market has quietly eased into a stable pattern while certain industries such as technology and finance are still experiencing turbulence.

- Posting volume has ticked up modestly thus far in 2024 but still below 2023 levels.

- The level of urgency to fill jobs has diminished significantly from the initial post-pandemic response.

- Compensation increases have moderated as inflation has eased.

- It is still hard to fill jobs as fill days continues to go up although at a slower pace.

- Supply and demand has continued to moderate with health care being a notable exception.

- Employee sentiment is rebounding, but there are still warning signs for employers to watch.

Labor Market

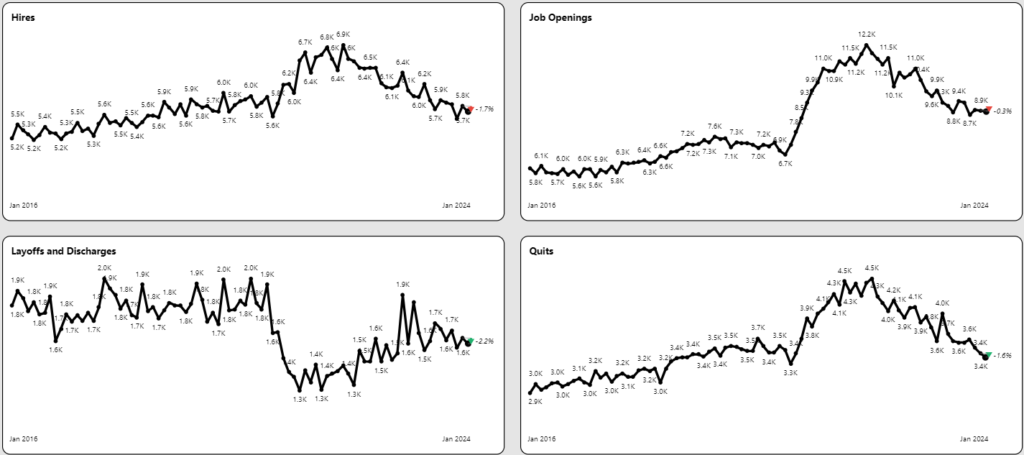

BLS Job Openings and Labor Turnover Survey (JOLTS) provides an overview of the labor market. This survey summarizes four primary metrics: hires, openings, quits, and layoffs and discharges.

We pulled back the lens a little further by looking at data going back to 2016 and gaining a historical perspective. We have eliminated 2020 as an outlier year to get the best perspective. BLS JOLTS is a month behind so this data is through November.

LABOR MARKET KEY TAKEAWAYS

- Hires declined 1.7% in January and continued to moderate to near historical levels.

- Openings were flat in January but remain 40% above historical norms.

- Layoffs and discharges declined 2.2% in January but remain 20% below historical norms.

- Quit rates declined 1.6% and are now in line with historical levels.

Job Postings

Urgent Postings are Declining

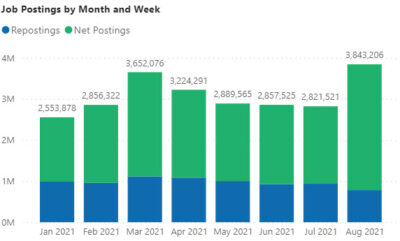

We finally saw posting volumes go up in January with volume increasing sequentially 18% from December. We are still evaluating volumes in February and thus far in March as we made a significant improvement to our collection process. These changes involved direct collection from employer pages as well as additional job types (e.g., part time, contract).

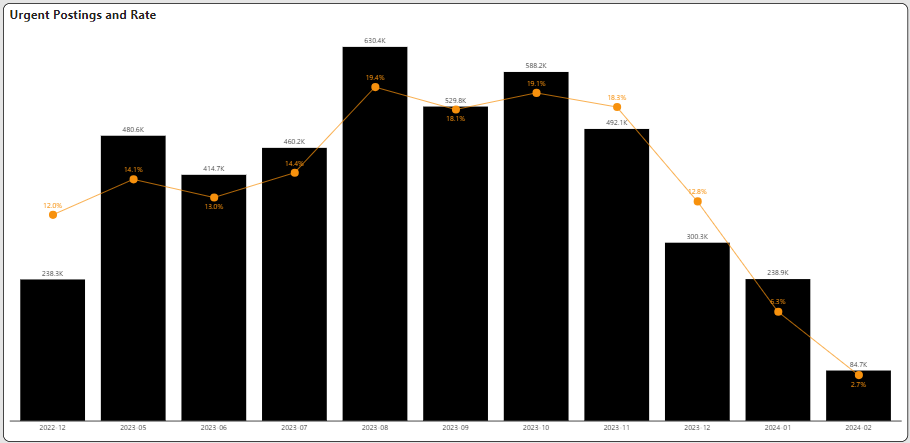

There is nowhere near the sense of urgency in the job market that we have seen over the past several years. The urgency rate has steeply declined. The urgency rate is a percentage of jobs that are flagged as urgent on Indeed. This continues a pattern that occurred throughout the latter half of 2023. The urgency rate spiked at 19% in the middle of summer 2023 and has dropped since then.

In addition, we have seen sponsorship rates also declining in early 2024. The sponsorship rate has declined from 29% in spring 2023 to just under 8% now.

Finally, Fair Chance Jobs showed an increase of 3.4% from January to February.

Fill Days

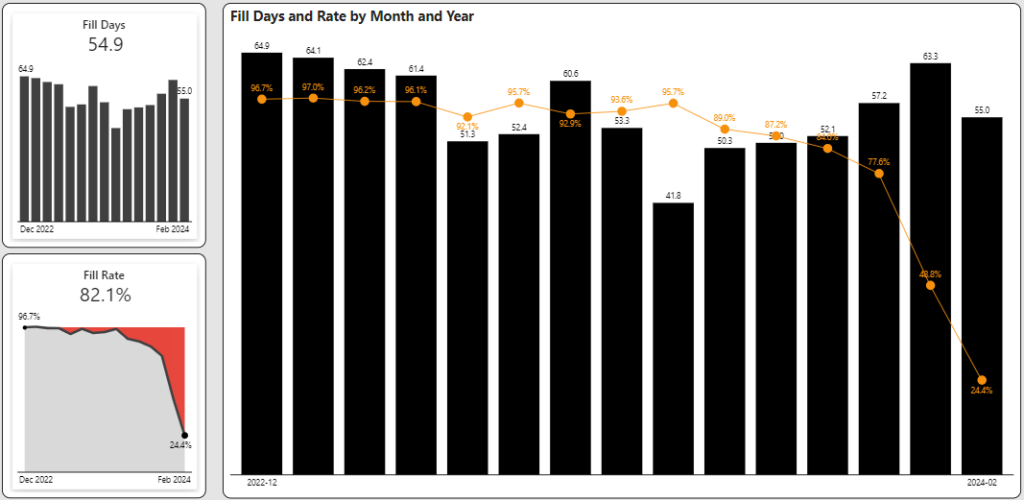

In TalentView we note a presumptive hire date and calculate estimated fill days based on the number of days from when a job ad is first posted (or the parent posting) to when it expires or is withdrawn. This metric is most applicable for months or quarters, which is the timeframe that most jobs are estimated to be filled.

The fill days by month (black bars) along with the percentage of ads that have been filled (orange line) are showed below. The newer ads have a lower fill rate.

The trend in recent months has shown improvement, but with a limited sample size based on the percentage of ads that are filled. Months that are now pretty much filled such as September through November have shown significant improvement vs. late in 2022 and early in 2023.

December 2023 and January 2024 unfortunately reversed that trend with fill days in the high fifties and low sixties respectively albeit with incomplete data.

Get More February 2024 Jobs Report Insights

Sign up to view our full Jobs Report for even greater insights on comp, supply/demand, employee sentiment, etc. and receive supplemental reports and job and talent market data every month.

What is TalentView?

Public Insight develops TalentView, a talent market intelligence solution that generated these insights. We offer flexible insights delivery via data integration, self-service analytics platform and reports service. Learn how TalentView can help inform/justify recruiting decisions, benchmark competitors, measure employer brand and identify sales opportunities for solution providers.

Schedule a meeting to discuss your use cases.