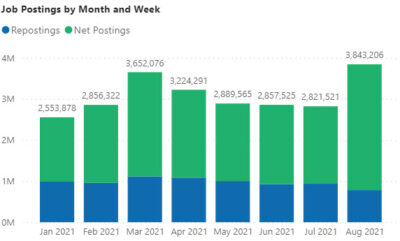

The August jobs report with the latest jobs and labor data is clearly a mixed bag. On the one hand, we added 3.8 million new Indeed® job postings in August compared to 2.8 million in June and July. Normally August is a lighter recruiting month so this would be welcome news. The challenge remains of filling these jobs.

Job Openings Continue to Smash Records

There are 10.9 million job openings according to the latest data from the Bureau of Labor Statistics. This continues the monthly trend of setting new job opening records. By comparison a normal pre-pandemic job openings level is between 5 and 6 million. Unfortunately new hire levels are not increasing at the same rate and in July there was a 4.2 million gap between hires and openings.

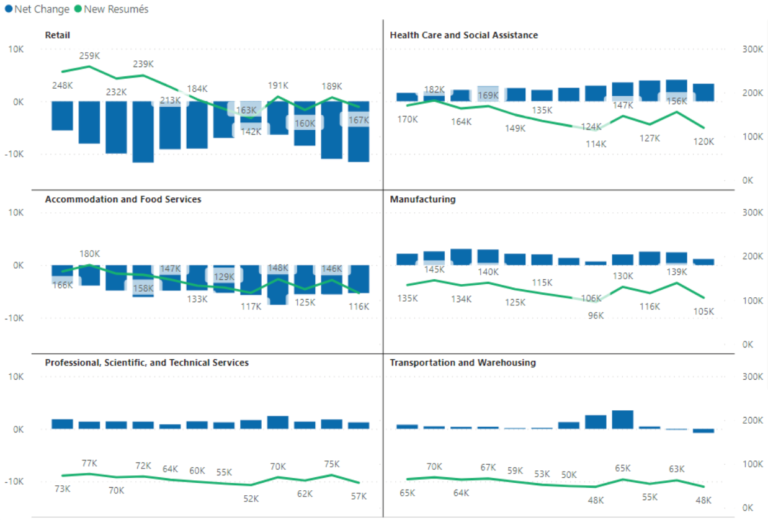

This gap is not helped by the continuing increase in quit rates. Normal quit rates are around 2%, but July was 2.7%. The market has rapidly devolved into what some have coined “The Great Resignation”. In August, 5.5 million job seekers and potential job seekers updated their resumés. Over the past year, we have seen about 1/3 of the entire labor force participation signal that they are looking for a job.

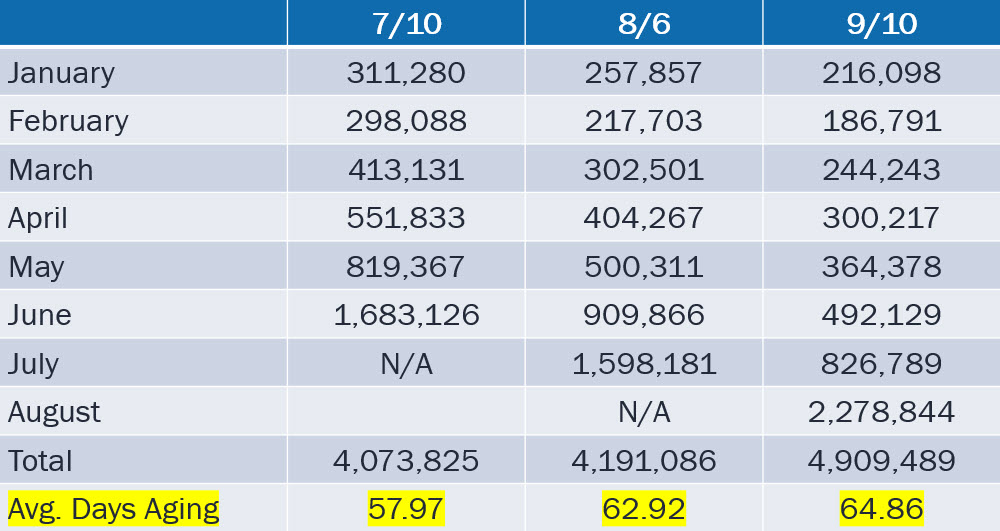

Open Job Postings Reach an Average of 65 Days

Consistent with the BLS data, the average number of open days for all job postings climbed from 58 days in July to 65 days as of last week. The number of open job postings has climbed 25% in the past several months. The challenge in filling jobs has broadened from customer facing industries in food and beverage to healthcare, government, and non-profits.

No single industry is immune from the hiring crisis. Employers that can offer remote work seem to be a little better off. For example, the number of open days drops to 53 for those industries where remote work is 10% or more of job postings.

The Summer of Our Workplace Discontent

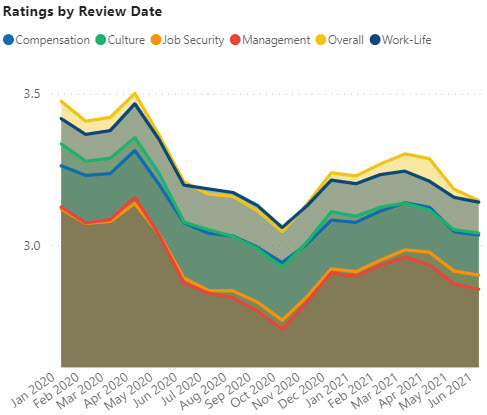

Why is there so much job movement? Workers want change after experiencing the disruption of the pandemic. Workplace satisfaction levels had bottomed out around October 2020 using ratings data and sentiment scores. It rebounded in March 2021 to near pre-pandemic levels before declining again as shown in the following graph generated by the Insight for Work platform .

The biggest gap in job satisfaction scores between pre and post-pandemic is in management and management is also the lowest rated category. With approximately 40% of reviews coming from from current employees, employers would be wise to look at this data as an opportunity to improve how employees feel about management and communicate progress.

Sign up for More Insights

Sign up to watch our August 2021 Jobs Report Video for even greater insights and receive supplemental reports and market data.