Our September 2022 jobs report reflects the job market being down from recored highs, however it is still way above pre-pandemic levels. The news has painted a grim picture of the labor market based on the latest JOLTS data, but we need to put things in perspective. There are a few troubling signs that we see from the latest TalentView data.

Openings Still Near Record Highs While Layoffs Remain Near Historic Lows

The Bureau of Labor Statistics JOLTS August data clearly shows an easing of a very hot job market. But we need to remind ourselves that we are coming off of historic highs. There is a lot to remain optimistic about especially in light of conflicting economic data.

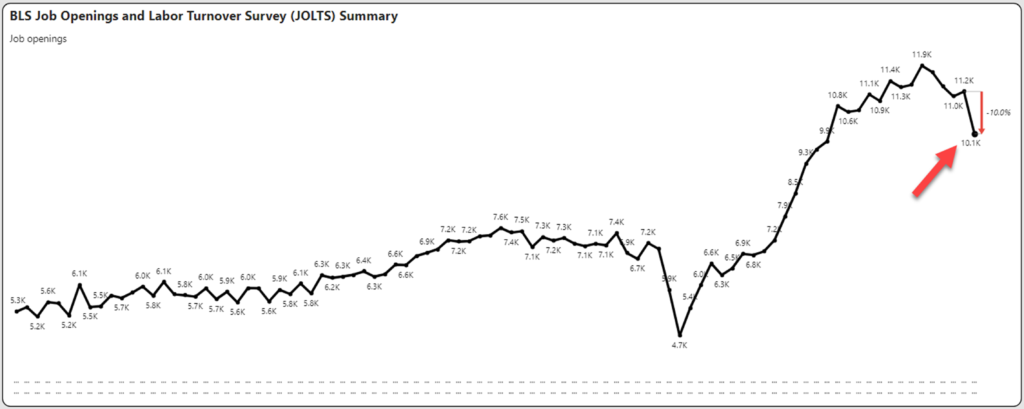

Job Openings and Hires

Job openings dropped 10% to 10.1 million compared to July 2022. This is now down 15% from the peak earlier this summer. However, it is still 60% above pre-pandemic levels. We have not quite reached the point where employers are pulling jobs from the market en-masse. Job openings have remained nearly 2x the number of unemployed workers. Further, hires have remained flat but are still 25% above pre-pandemic levels.

If we pull back the lens on job openings to see the data back to 2015, we can clearly see how high job openings truly are even with recent declines.

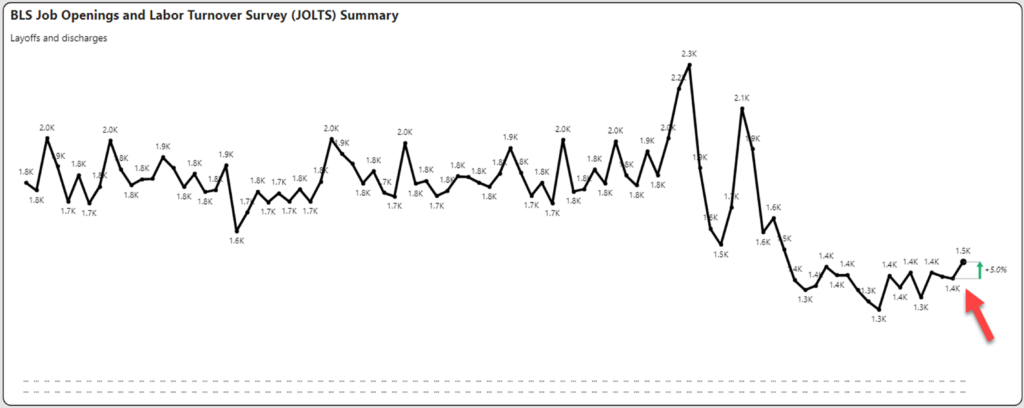

Layoffs, Discharges, and Quits

Again, the news highlights certain isolated events of layoffs and they did tick up 5% in August, but again near historic lows. Earlier in the summer we focused on the large jump in quit rates. In recent months quits had declined, but now the quit rate is remaining constant at an elevated level. Again, we pull back the lens to see historic lows in layoffs.

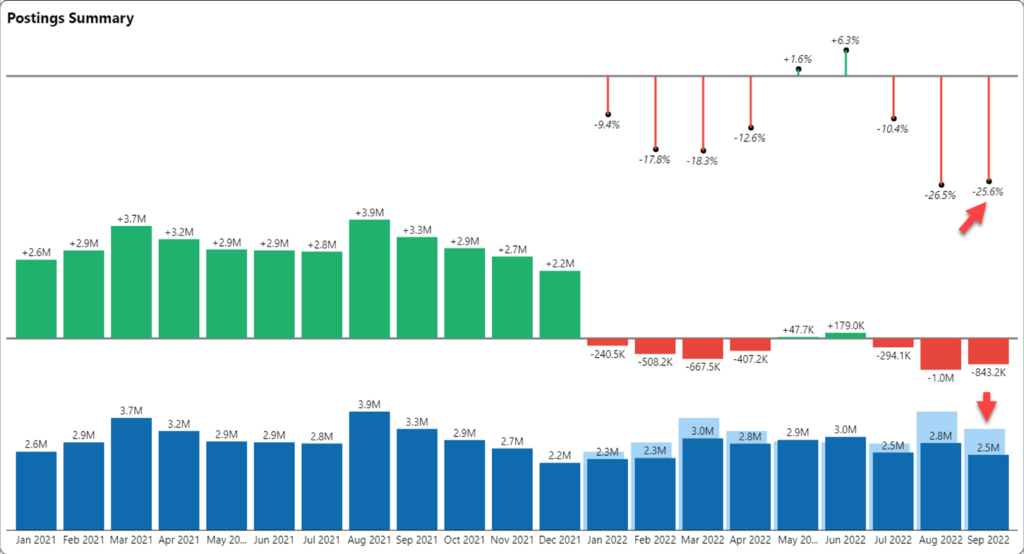

Job Postings Signal a Retreat

I see job postings as a better predictor of market activity than job openings. And job postings signal a market in retreat. Further the quality of the job postings is suspect.

Posting Volume Declines Sequentially and Year-over-Year

July job postings declined 13.8% from June and 10.4% from last July. Since the beginning of 2022, job postings have declined seven of nine months from the previous year as shown below. The top “dollypop” shows the percentage decline from the prior year which truly shows the extent. In the spring we were looking at 9-18% year-over-year declines and now we are looking at two straight months of 25+% declines.

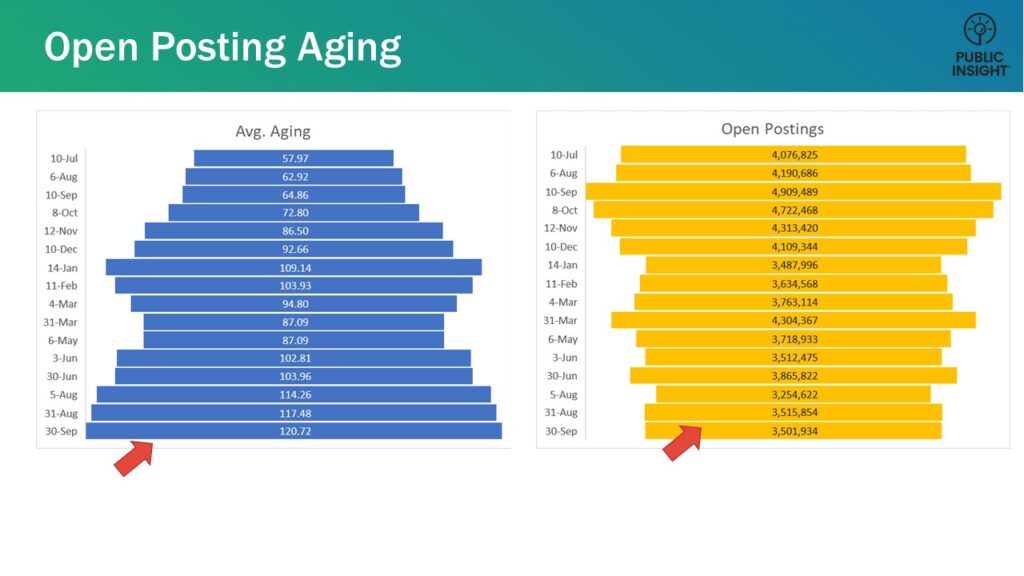

Open Postings Days Hits Four Months

Postings are not just a quantity problem – they are a quality problem. The number of open jobs postings has remained fairly steady at 3.5 million. This is down 25% from the peak, which was October last year.

However, the composition of these open jobs in days is now at over 120 days meaning that the average job posting takes over four months to fill. This is as high as we have seen it in over a year. Put another way – the quality of the job postings is suspect just like the quality of the over 10 million job openings reflected in the JOLTS report. If employers are unable to fill jobs, it is only a matter of time before they move on with alternative arrangements.

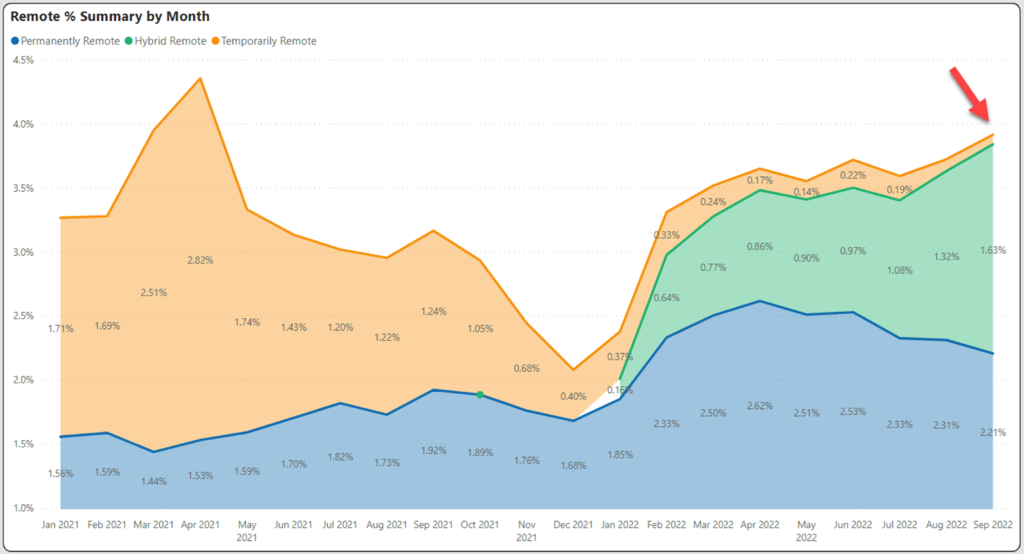

The Growing Divergence in Remote Work

The news we read around remote work is fairly polarizing. Either every job is moving to remote, or jobs are rapidly moving away from remote. Yes, both are right.

As a composite across all jobs, remote work is quietly leveling off. Remember large chunks of the labor market CANNOT be remote. This is why we still see rush hour traffic jams. The graph below shows the composition of identified remote postings using three categories – permanent, hybrid, and temporary. Hybrid continues to increase but not at a fast pace while permanent remote has now come down.

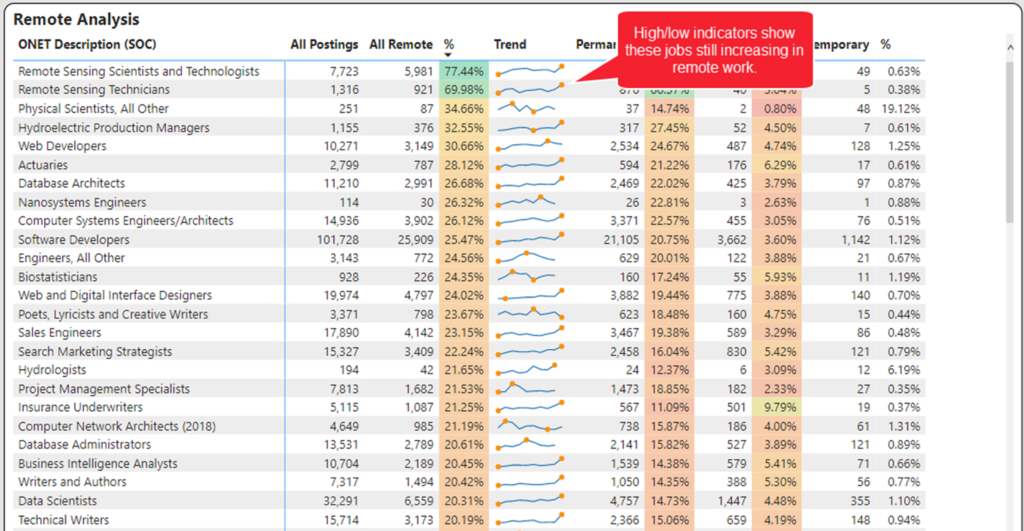

There are jobs that are now likely forever remote. The graph below shows the job postings by title where remote is greater than 20% in 2022. The sparkline identifies the high and low point trends and many of these job titles continue to show increases in remote as a percentage.

What this indicates is that certain jobs will continue to progress towards remote work and will soon be the norm. Other jobs that are on the remote work fence will likely revert to more office work or at least hybrid.

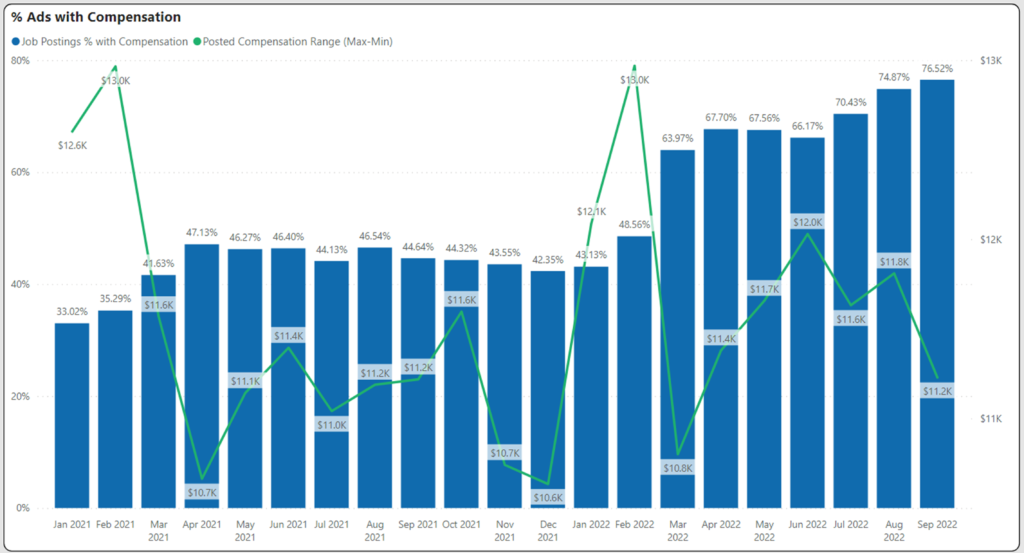

Pay Transparency is on the Rise – Wages Not Quite So

The mid-point of advertised compensation increased just 6% thus far in 2022. Inflation has not yet resulted in wholesale increases in wages. Time will tell as wages lag behind the economy. As we get closer to a new year we may see a substantial jump in advertised pay.

What is going way up is pay transparency. Just 18 months ago only 1 in 3 jobs had an advertised pay rate. Advertised wages are now approaching 8 in 10 jobs. What is encouraging is that employers don’t seem to be dancing around pay disclosure as ranges have remained fairly consistent. The graph below shows the percentage of jobs with pay ranges superimposed as a separate axis.

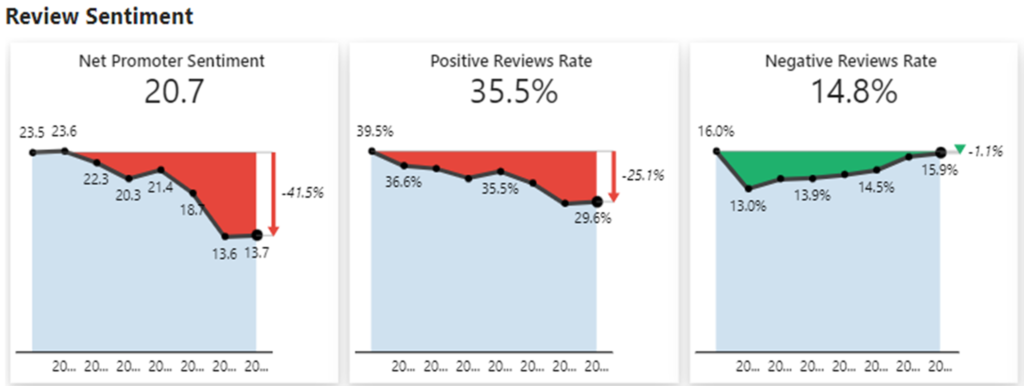

Worker Sentiment May Be Bottoming Out

We have blogged in recent months about the decline in worker sentiment. The worst of this seems to be over. Net promoter score (the percentage of positive reviews over negative reviews) using sentiment as a proxy was up slightly. Positive reviews have ticked up slightly offset by a recent rise in negative reviews. Overall, workers are lukewarm.

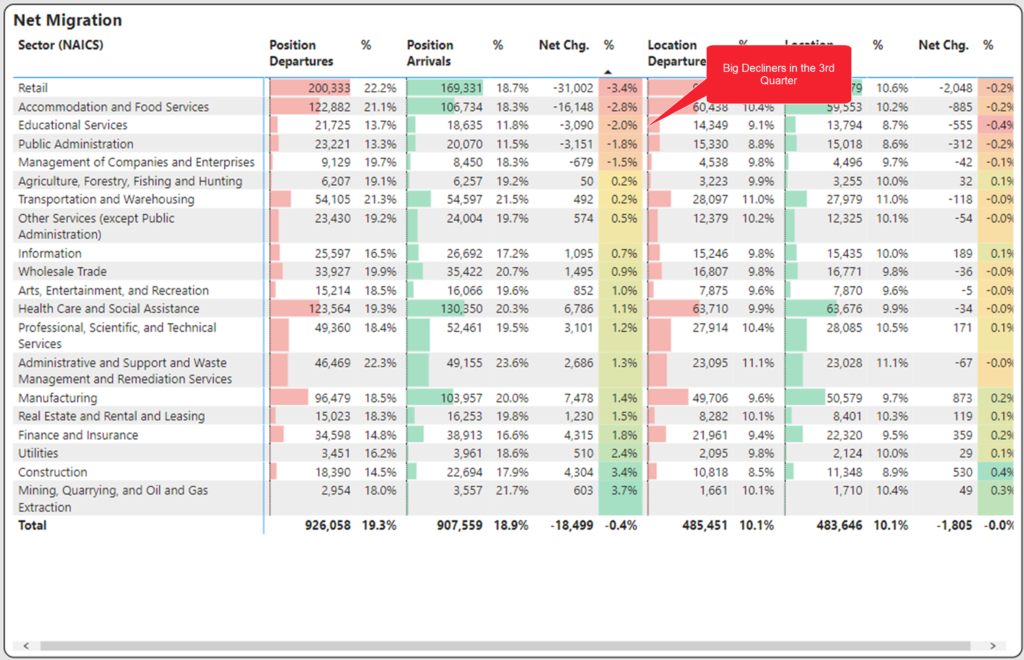

Exodus of Workers May be Permanent in Some Industries

Our Workforce Migration analysis is based on tracing changes to resumés over time. Roughly half a million resumés trigger a position and/or an employer change by month. This is 10-15% of the workforce every year. We look at the number of people exiting a position, which we call departures against the number that are new to a position, which we call arrivals. The net of those two is the primary metric. Retail led the exodus with 3.4% of resumés exiting out of the industry in the 3rd quarter.

As has been highlighted in the news, education is also taking a big hit. It remains to be seen whether this change is permanent or temporary. Recent pay adjustments in education may go a long way in reversing this tide.

Dan Quigg Selected for TATech 100

I was honored to be selected as part of the TATech 100 most influential Talent Acquisition Thought Leaders. TATech is a highly respected organization led by longtime HR industry thought leader Peter Weddle.

Public Insight Releases Latest TalentView Platform Update

We are extremely excited to release a massive update to our TalentView platform including our new API. Our API enables partners to integrate data and analysis into their application to increase the value of their solution offering.

TalentView Interactive enhancements include:

- Performance improvements now returns data up to 100x faster

- Smart slicers facilitate target selections to zero in rapidly on areas of interest

- Row groupings generate flexible table analysis with dynamic color coding of insights

- Key performance indicators (KPI) provide an instant snapshot of market movement

- Employer benchmarking across 150 market metrics

- Insights Lab makes self-service, customized analytics easier than ever

- Expanded workforce migration and compensation analysis

Get More September 2022 Jobs Report Insights

Sign up to watch our Jobs Report Video for even greater insights on this topic and receive supplemental reports and market data every month.