In the August 2023 Jobs Report we take a closer look at employer reviews and see what is driving employee satisfaction and net promoter score (NPS). In recent weeks we have focused on employee happiness through a series of LinkedIn video blogs. Employers in the post-pandemic era are wise to look at what is motivating their employees.

In this month’s blog, we also look at:

- Posting open days improved significantly as employers filled older positions.

- Supply and demand worsens in healthcare while customer-facing industries continue to improve.

- Urgency rates significantly increased in August principally in construction.

- Employer sentiment has not recovered to pre-pandemic levels.

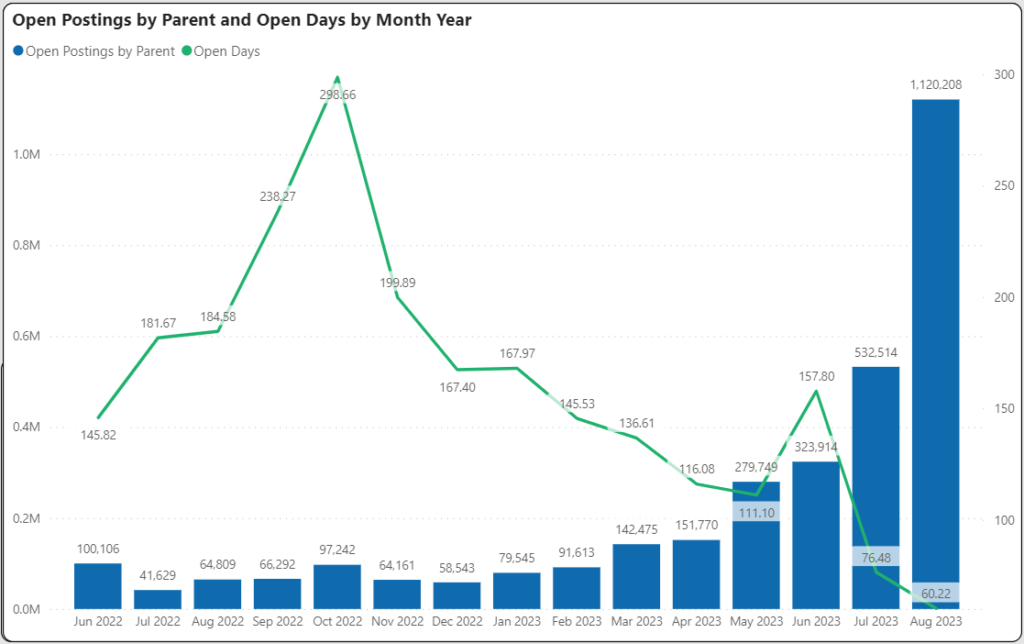

Posting Aging – Open Days Declines

Over the course of the pandemic recovery, job postings open days have been steadily rising. In August, the weighted average of open days over the last trailing 15 months declined from 127 days to 110 days.

The graph below shows the composition of open job postings aging in August. The aging is calculated based on the first (parent) posting date. August and July open postings age are significantly better/lower than July and June were.

Older job postings have estimated fill days for Q3 at 84 days and Q2 at 68 days. This is the highest since the fourth quarter of 2021. Older postings being filled is a sign that the job market is easing up.

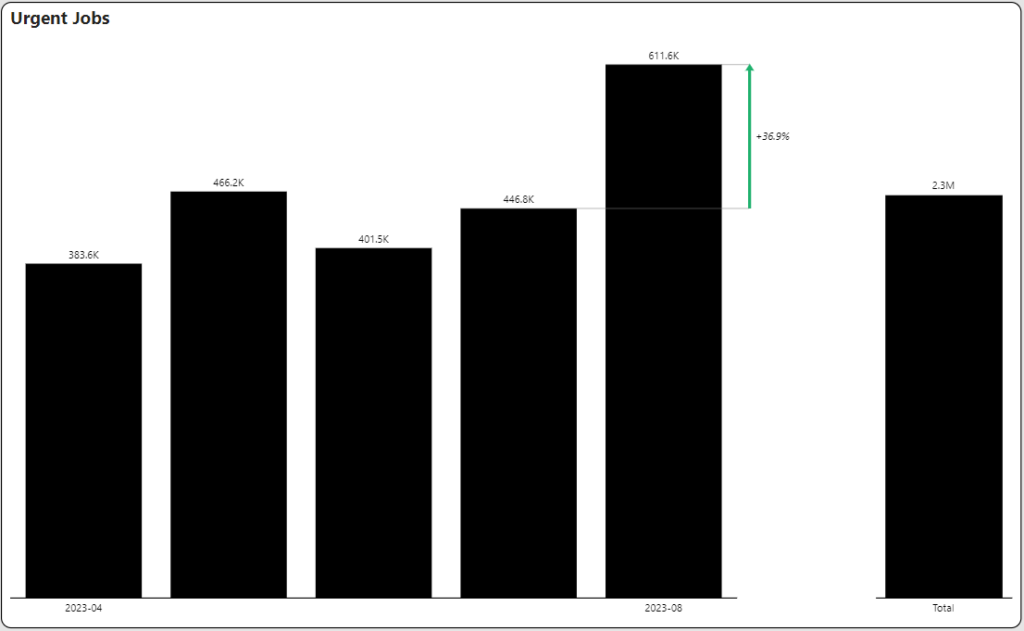

August Shows Rising Urgency Rates

Urgency rate is the percentage of postings flagged as urgent. This number has been as high as 40% but post-pandemic this rate has mostly been between 10%-20%. Recent months had shown flat or declining urgency. However, August showed a marked increase in postings flagged as urgent as shown below.

Construction jobs over the past month head the list with nearly one in three jobs in August being flagged as urgent.

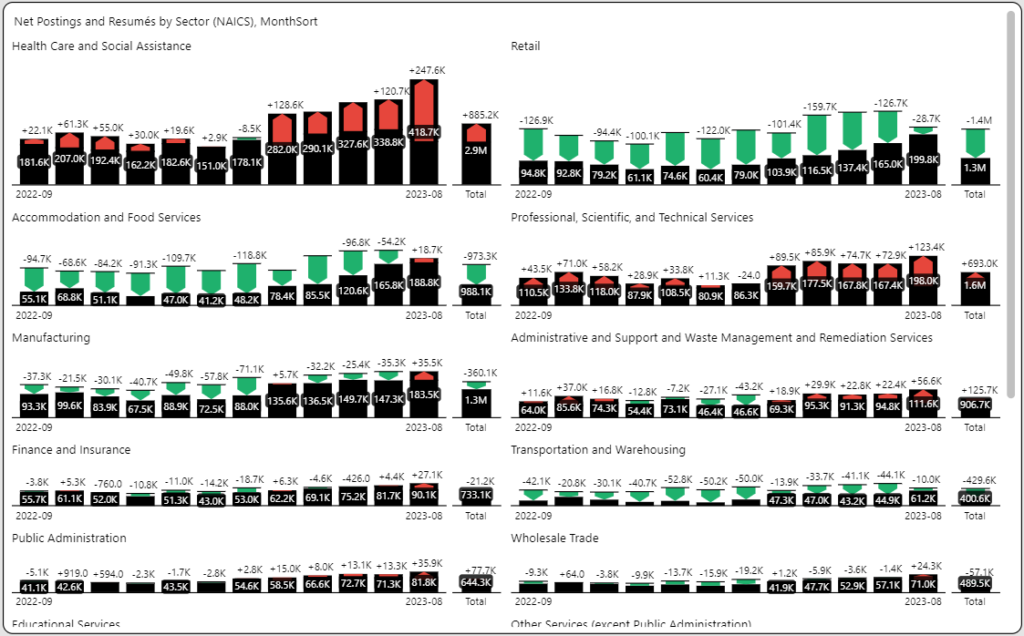

Health Care Supply and Demand Worsens

We highlighted the challenges with the supply and demand of Health Care jobs last month. Unfortunately, the situation seemingly is getting worse. In the graph below the inner black bar graph represents job postings and the outer colored bar is the number of active resumés. Red indicates a shortage of job seekers compared to postings and green indicates job seekers exceeding job postings. Our time horizon here is the past 12 months.

Health Care which was challenged going into August experienced a greater supply/demand imbalance with 2.5 times more job postings than published resumé updates during the period. For the past twelve months, there is over 30% less resumés than job postings. Also notable in this graph is that Accommodation and Food Services actually had less job seekers than there were job postings for the month of August.

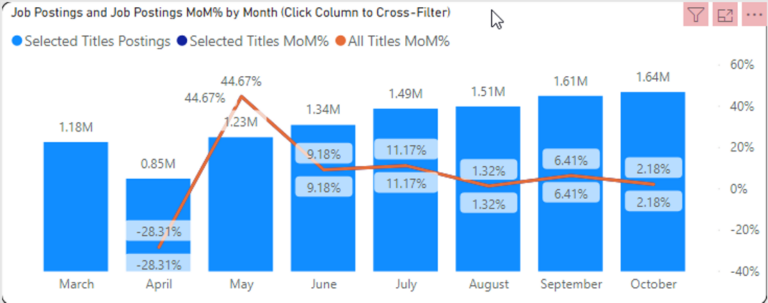

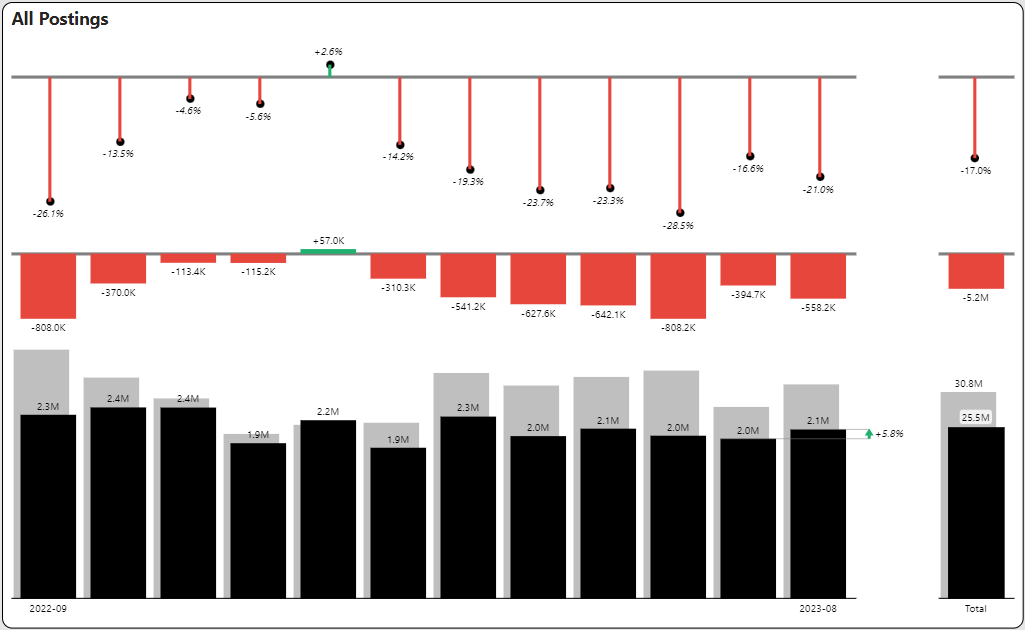

Posting Volumes – Increase in August

Job postings showed a year-over-year decline of 21% (thin red lines below is % change). Posting volumes have now declined in eleven of the past twelve months (red bars below is volume change) with double-digit declines in most of those months. However, a saving grace is that for the last few months postings have been flat and in August postings increased over July (black bars 2023, gray bars 2022).

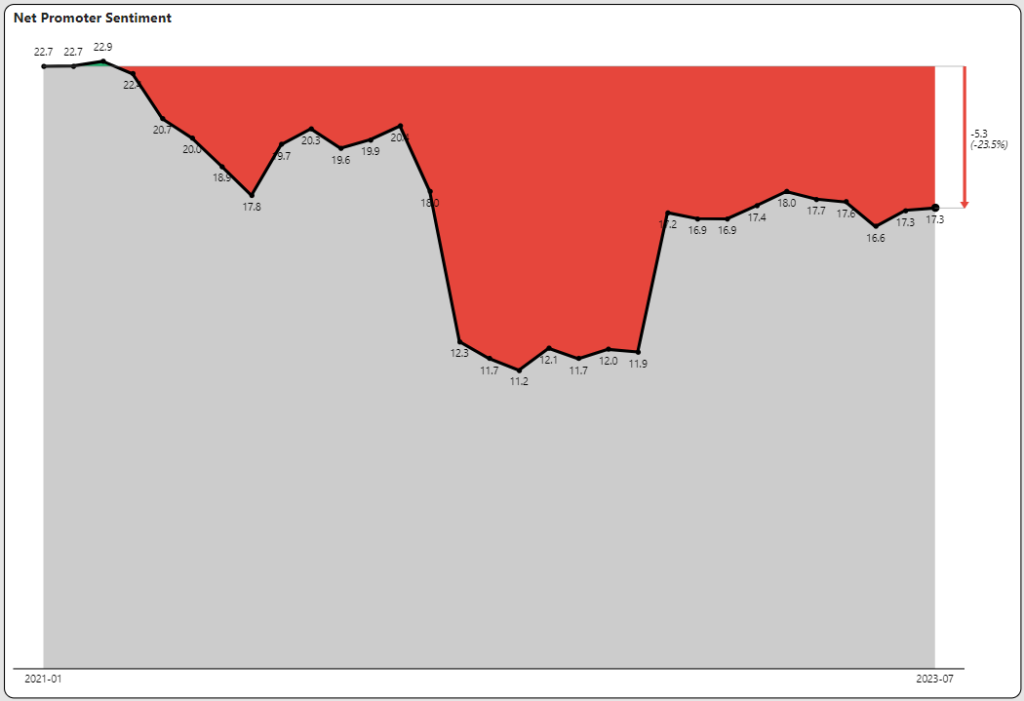

Understanding Workplace Happiness through Opinion Mining

Workplace sentiment has never recovered to pre-pandemic levels. Net Promoter Score (NPS) has been locked in at around 17 which is better than the bottom at 10, but much worse than pre-pandemic levels at 23. Net Promoter Score measures the percentage of promoters over detractors. An NPS score of 17 means that there are only slightly more promoters than there are detractors.

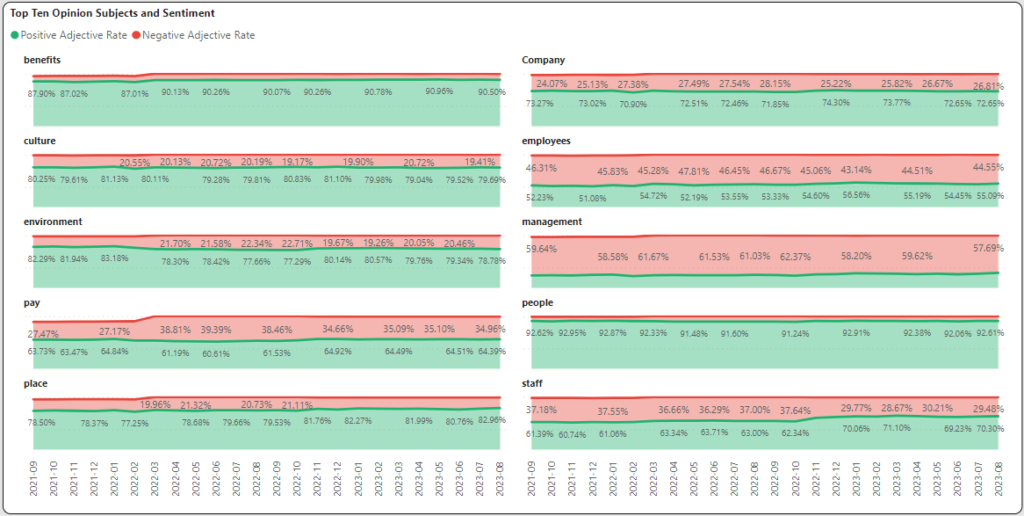

Opinion Mining Highlights Hot Employer Topics

In our video blog (sign up below), we go through the top ten subjects mentioned across all employer reviews using opinion mining. The split between positive and negative sentiment for the top ten subjects is shown below.

Pay and benefits are routinely not in the top three or four subjects mentioned in reviews. But they are vitally important. Pay showed a bump in negativity last year and has not recovered. On the positive side, “soft subjects” such as staff, culture, and people show strong positivity that continues to improve.

Get More August 2023 Jobs Report Insights

Sign up to watch our Jobs Report Video for even greater insights on this topic and receive supplemental reports and job and talent market data every month.

What is TalentView?

These insights were generated from our TalentView job market data and analytics solution. Integrate our job market data into your application, or use our self-service analytics platform. Learn how TalentView can help with talent sourcing, talent intelligence and business growth and watch a demo.