My first car was a Chevy Vega. For those old enough to remember, it was a tin can with wheels. It was the kind of car that when you arrived at the gas station, you said to the attendant (in the days of full-serve stations), “Fill it with oil and check the gas”. This was a car that definitely did not appreciate and you just hoped it got you from Point A to Point B. Assets such as houses and stocks are expected to increase in value over the long term but are subject to market fluctuations on the short-term.

Postsecondary institution degrees are supposed to fall into the safe bet for long-term appreciation. The value of a college degree plus work experience should be a growing combination. Of course, there is no real way of separating out the value of experience from the tangible value of a degree. Nevertheless, a degree is an asset that bears value that we expect will appreciate over time.

The College Scorecard database attempts to measure the value of a degree by interconnecting data from the Treasury against data from National Student Loan Data System. Each institution is measured using a sample size based on earned income six to ten years from entry date. Note entry date is used and not graduation date so the number of years from actual graduation is unknown.

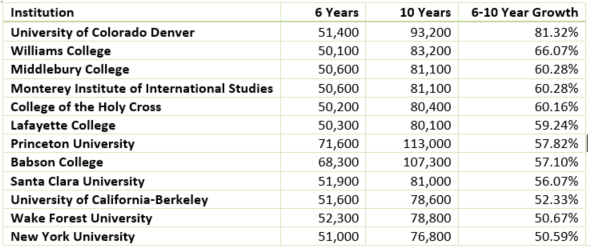

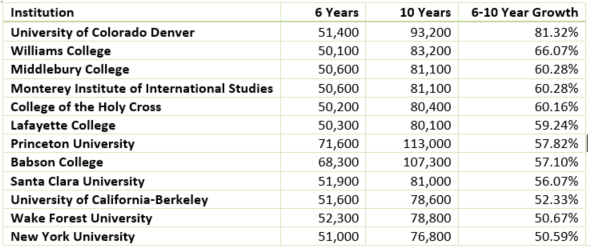

We looked at the mean earned income for students working and not currently enrolled for six and ten years from the date of entry by institution using the last reporting year of 2010-2011. We then calculated the differential between six and ten years to generate appreciation value.

Not surprisingly, the degrees with the most appreciation tend to be those with a medical concentration. Many of these reflected an earnings appreciation above 100%. Some institutions show high appreciation, but the starting point at six years is quite low. Others like Ivy League schools have a high starting point at six years, but the growth differential to ten years is not all that impressive. Given that, we filtered for those institutions that had a six year mean income of at least $50,000 and a growth from six to ten years of at least 50%. We also eliminated known medical institutions.

Surprisingly only twelve institutions met the test which are listed below. The highest value was a public institution, University of Colorado – Denver. Only one Ivy League school made the list. Schools range in size from small to large, from urban to rural. It seems the institutional appreciation potential has no set formula but no doubt is well earned.

You can download a spreadsheet of all institutions and their six and ten year earnings measurements as of the most recent measurement dates of 2010-11 by clicking on this link. We also calculated the growth appreciation between the six and ten year marks. Finally, the spreadsheet sorts and filters institutions according to their earnings values and growth rates.