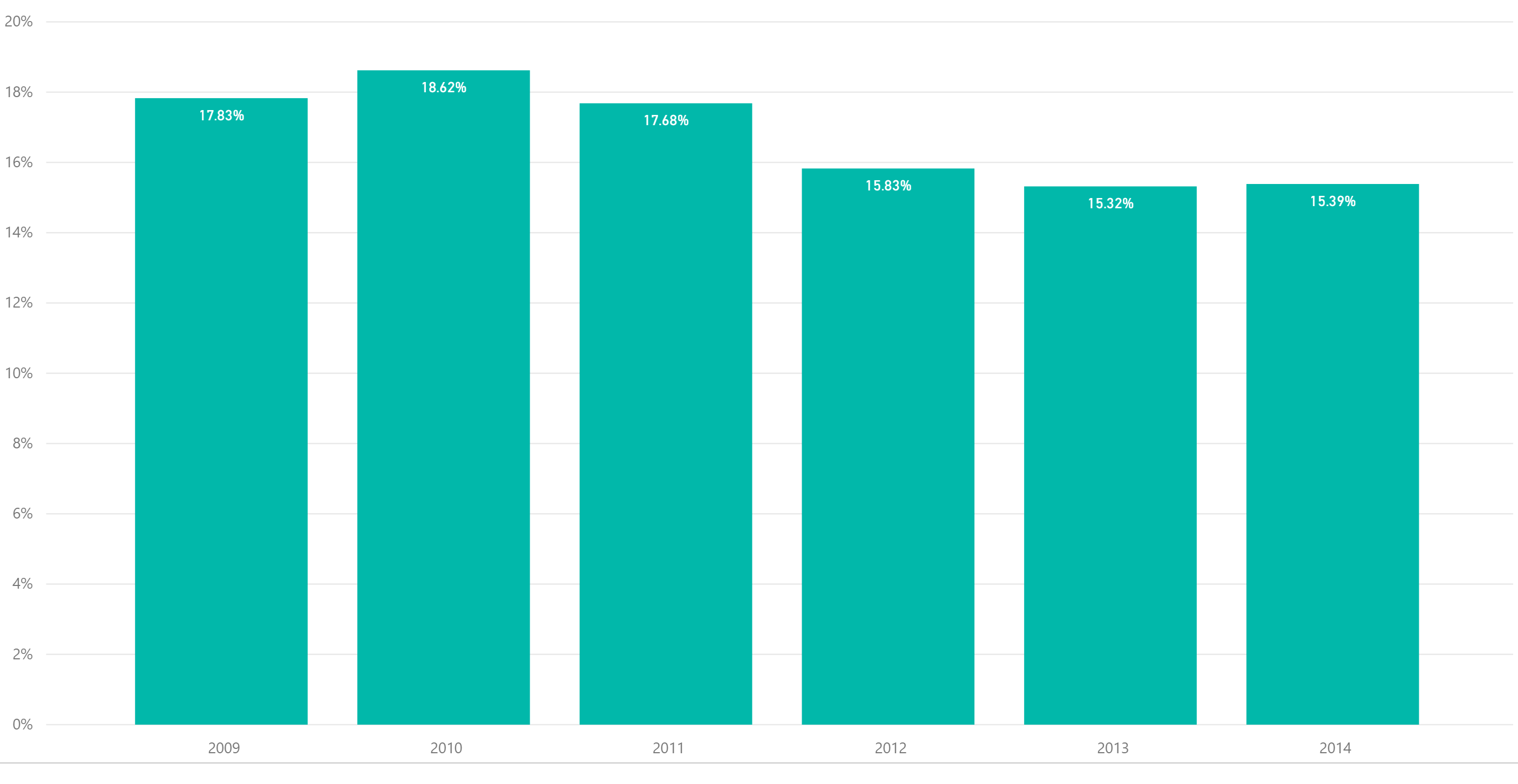

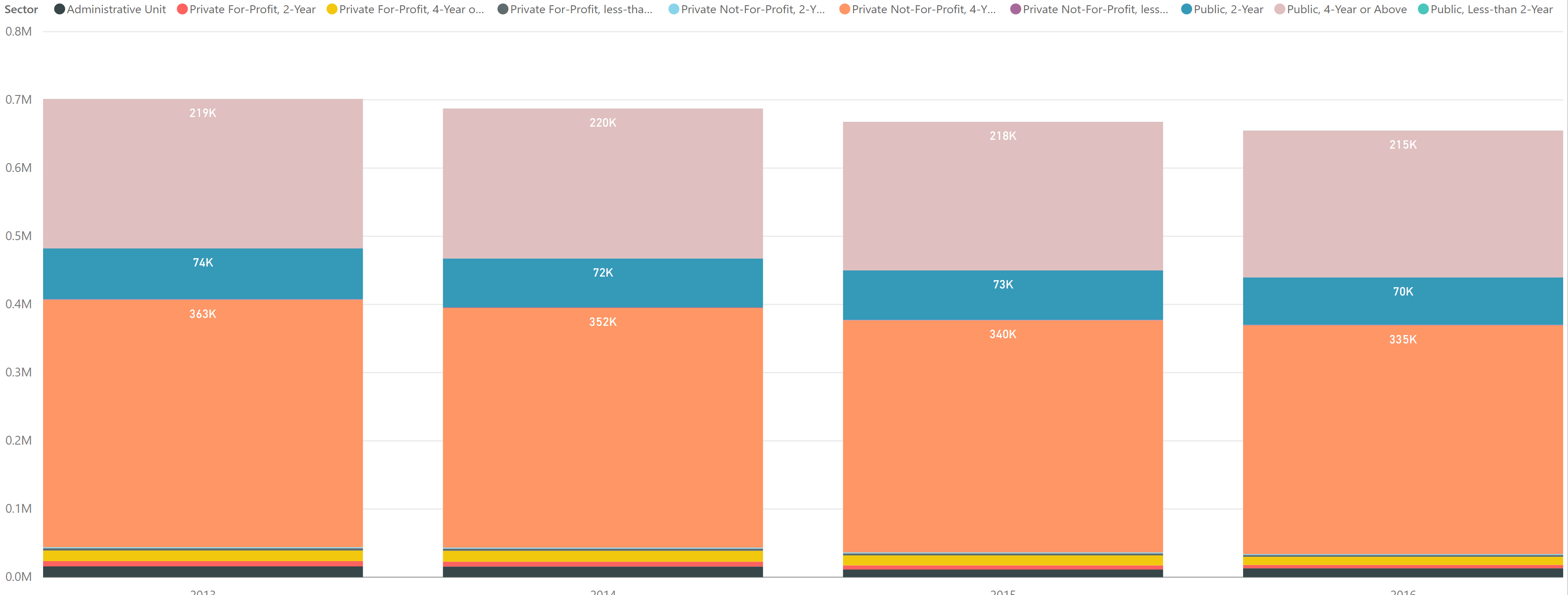

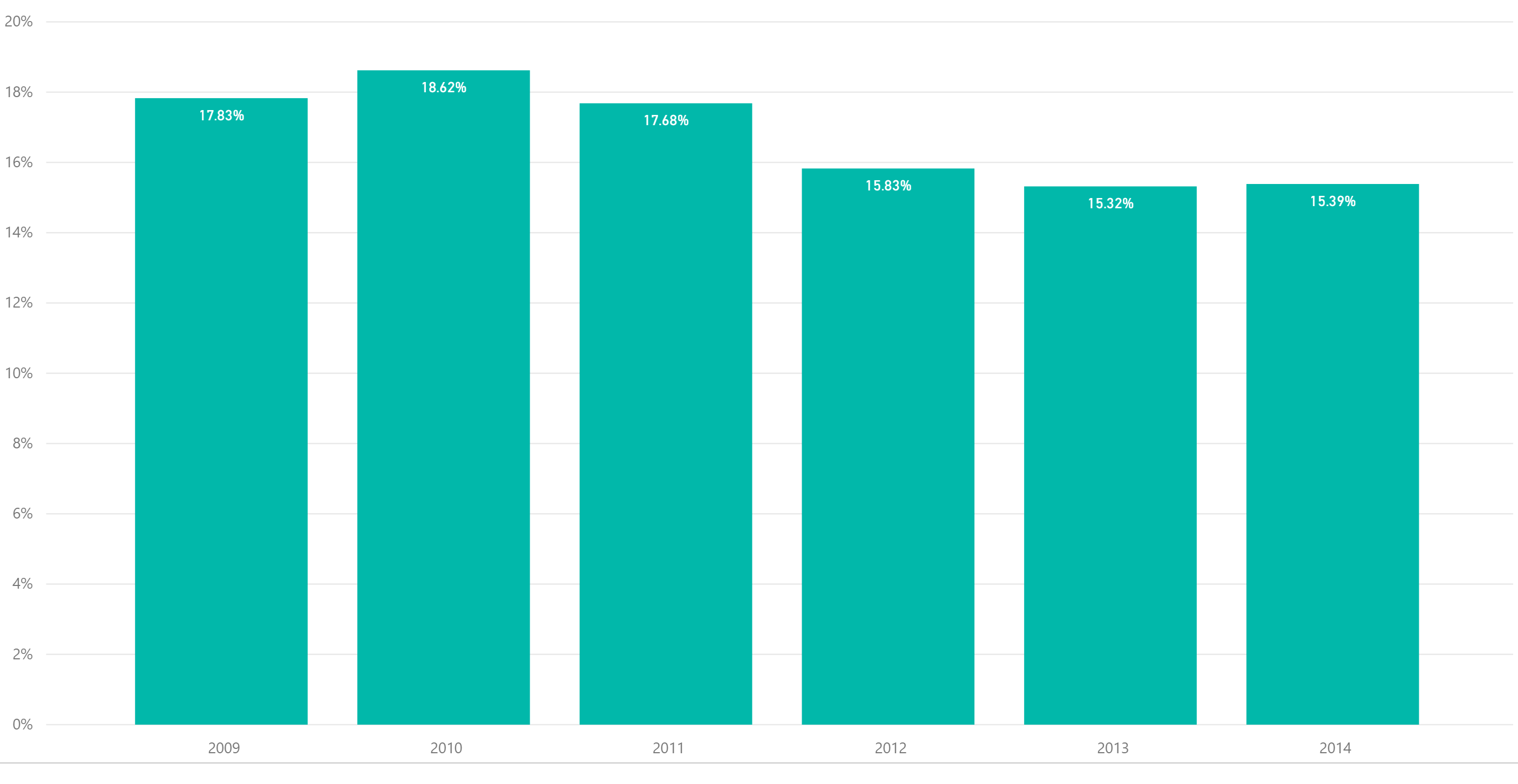

Last week we looked at student repayment rates and noted that longer-term repayment rates continue to decline for five and seven year repayment periods. Repayment rates are in essence a measure of optimism as it is the percentage of students who have made progress in paying down their student loans. This week, we are looking at measures of pessimism which are student default rates. The most recently published student default rates, when weighted for cohort size by institution, shows that student default rates were ostensibly flat from 2013 to 2014. Default rates are defined as a failure to repay a loan according to the terms agreed to in the promissory note. For most federal student loans, a default is if a payment has not been made in more than 270 days. The 2014 numbers represent about 630,000 borrowers in default.

Student Default Rates

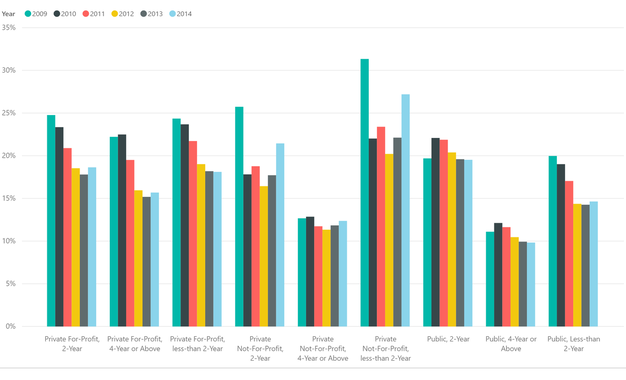

However when looking more closely at the default rates by sector, we noticed that the private non-profit under two year institutions show an alarming increase in default rates from 22-27%. However, it is less than 1% of the students in default and still an improvement from 2009 when it was over 30%. Most of the sectors appear to be flat in change. As noted previously, student default rates can be a moving target as loans can be refinanced. Default is often a last resort and therefore default rate is a lagging indicator.

Default Rates by Sector