The U.S. Department of Education announced yesterday the beginning of the process to rollback and rework Obama-era rules under the gainful employment regulations. These rules, which took years to enact, were designed to hold career-preparation programs accountable for the outcomes of their graduates. The announcement establishes rule making committees to revise these regulations. Consumer advocates, which lobbied hard for these rules will be understandably disappointed while this looks like an opportunity for career colleges.

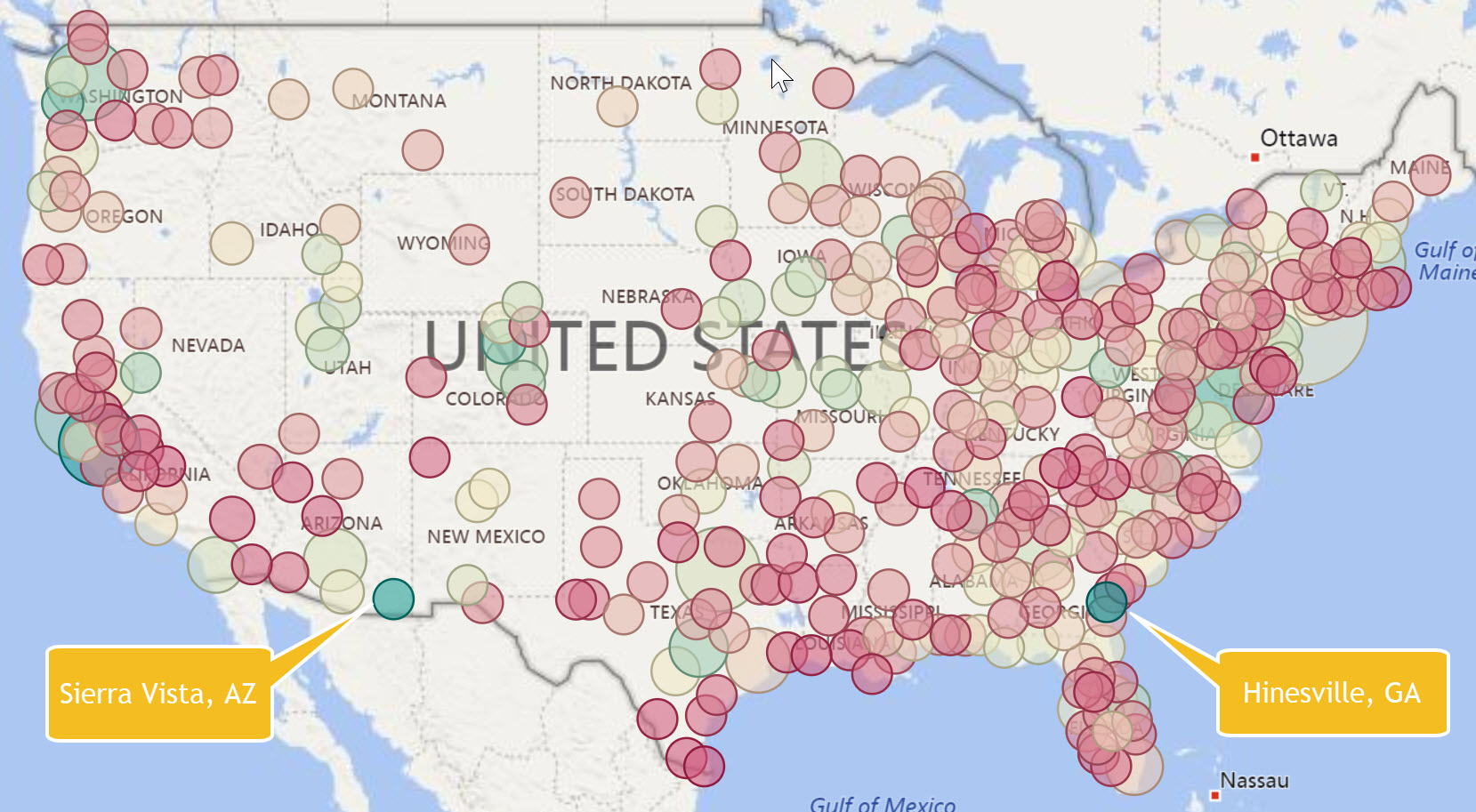

The U.S. Department of Education released just one year of data which we have included in the Public Insight Student Debt Interactive. Currently, if the estimated loan payments of a program’s graduates exceed 12% of their total income and greater than 30% of their discretionary income, then the program would risk losing federal student aid. A quick analysis of the data shows the following:

-

2639 institutions covering 518 programs reported data under the existing regulations.

-

348 Institutions failed the 12% debt-to-earnings test. A total of 1,426 institutions failed the 30% debt-to-earnings discretionary income test.

-

For these institutions, the student default rate per the last 2013 reported year was 16.3% compared to the composite student default rate across all institutions of 11.3%

-

The three-year repayment rate indicating progress in paying down student loans for the last reported 2015 year was 49.4% compared to the composite rate across all institutions of 61.9% (note there was a revision in this data that will be incorporated into the Public Insight Data Catalog and Student Debt Interactive for a U.S. Department of Education “coding error” that brings down the repayment rates across the various repayment timelines).

Where these regulations go from here and what to do with the results to date is clearly up in the air.