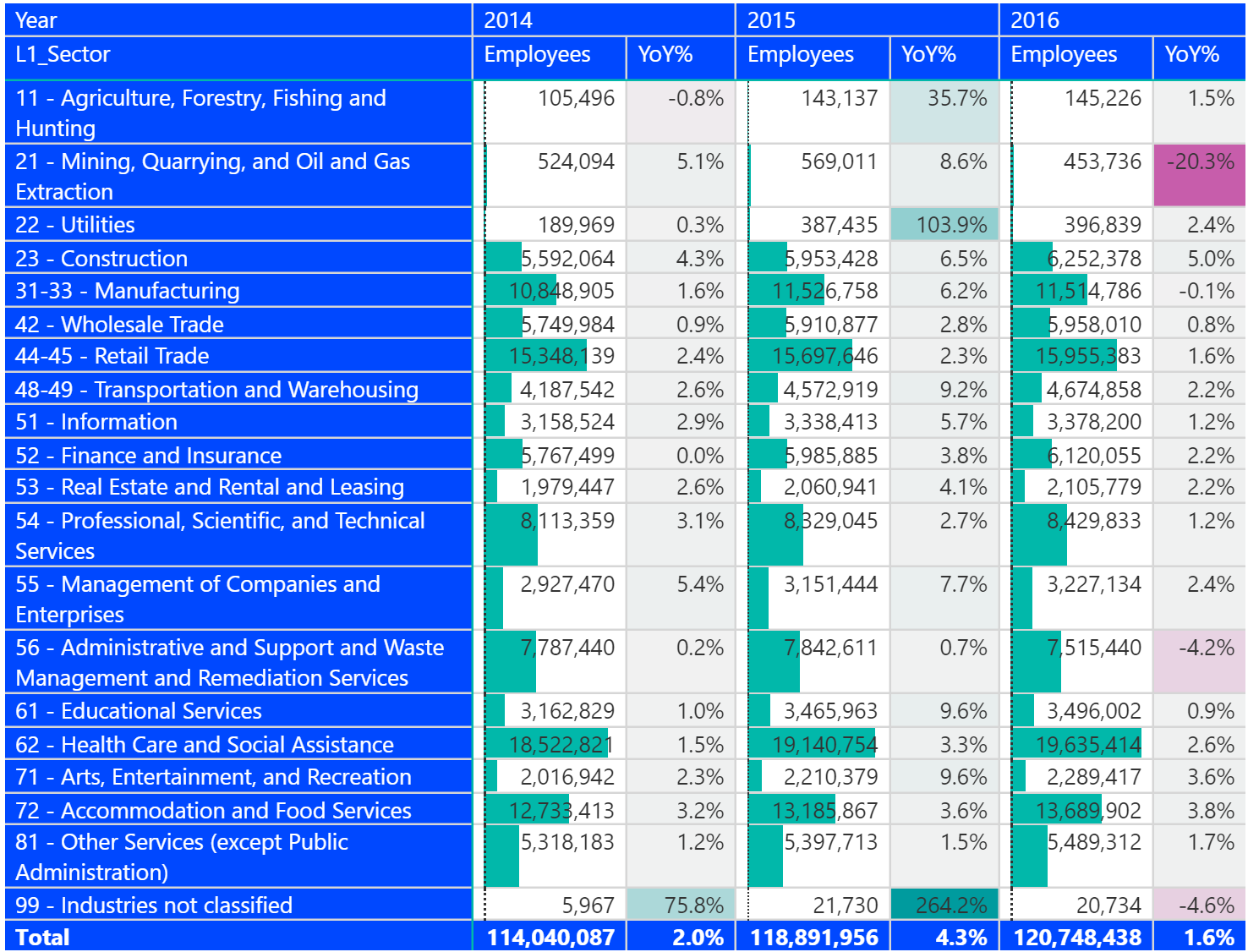

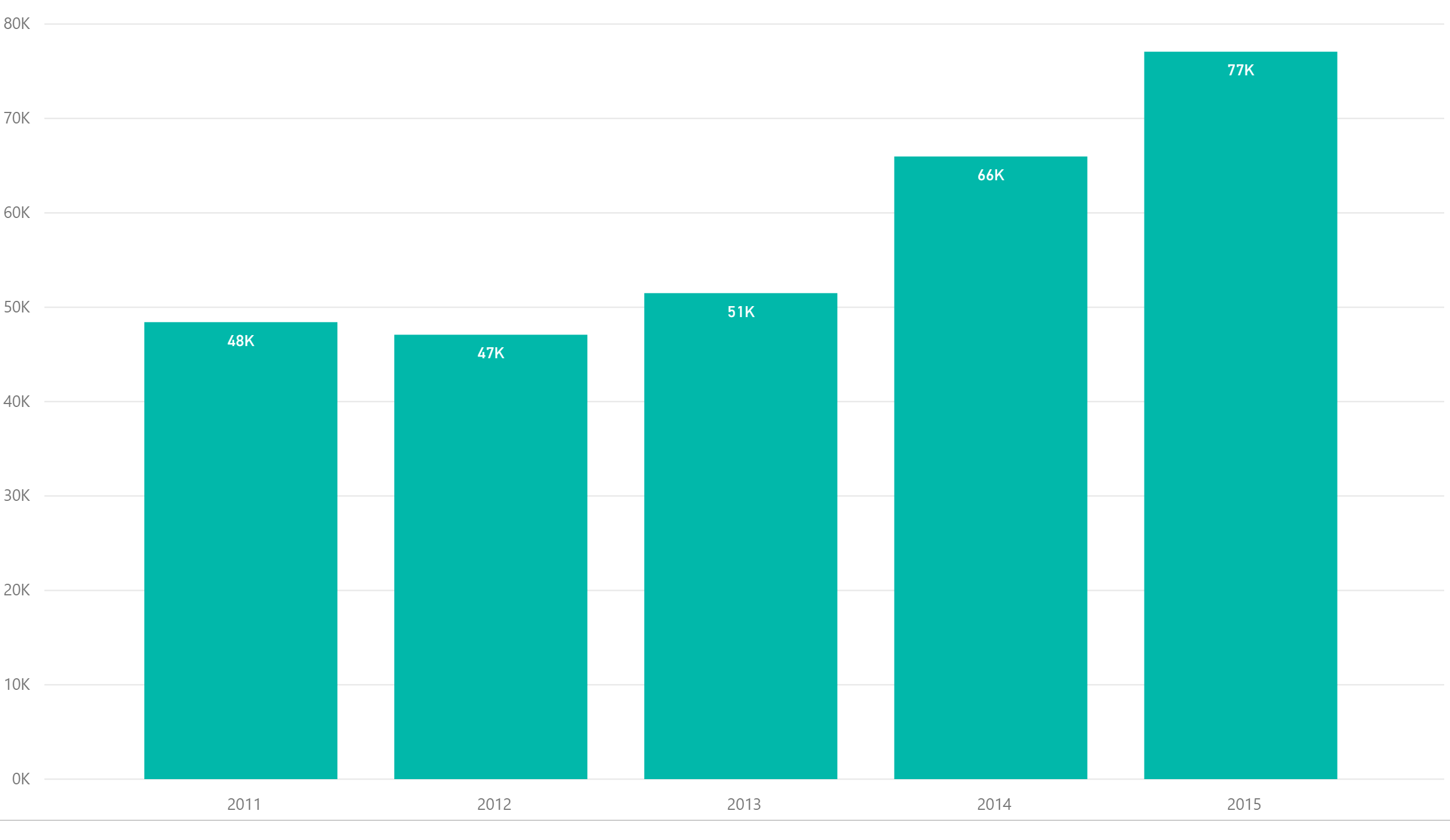

The building boom is officially back after a long hiatus. The number of construction employees increased 5% in 2016 according to the most recent County Business Patterns released by the U.S. Census. The sector however with the most number of new establishments is the Information sector (NAICS 51) which increased 5%. This sector may be flattening out though as the number of employees only increased 1.2% and payroll only increased 1.5%. Information industries include telecommunications and hosting services possibly indicating a rapid growth in new entrants to this emerging area. The fastest growing sectors by number of employees over the trailing three years is summarized in the table below.

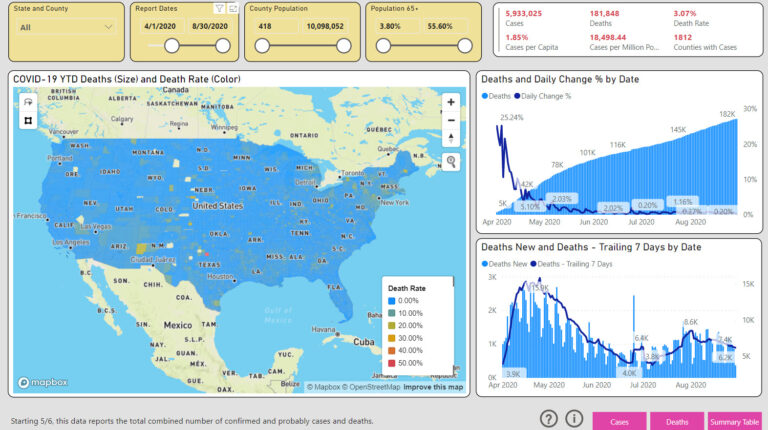

The business patterns data shows regional concentrations by county and zip code. For example, the health sector as a whole is fairly geographically diverse but within particular subsectors (nursing care for example), there are pockets of regional concentration.

We have updated the Business Patterns Interactive to include the latest data from the County Business Patterns data for 2016. The Business Patterns Interactive provides industry analysis at a county level using U.S. Economic Census data over a 5 year period for over 3,000 counties. The Interactive easily identifies industry growth for over 1,000 industries at regional and state level. This Interactive is a powerful support tool for institutional and program planning, and regional economic development. This update is automatically available to our subscribers. You can purchase this as an individual Interactive for $295 or as part of the Higher Education Institution library.