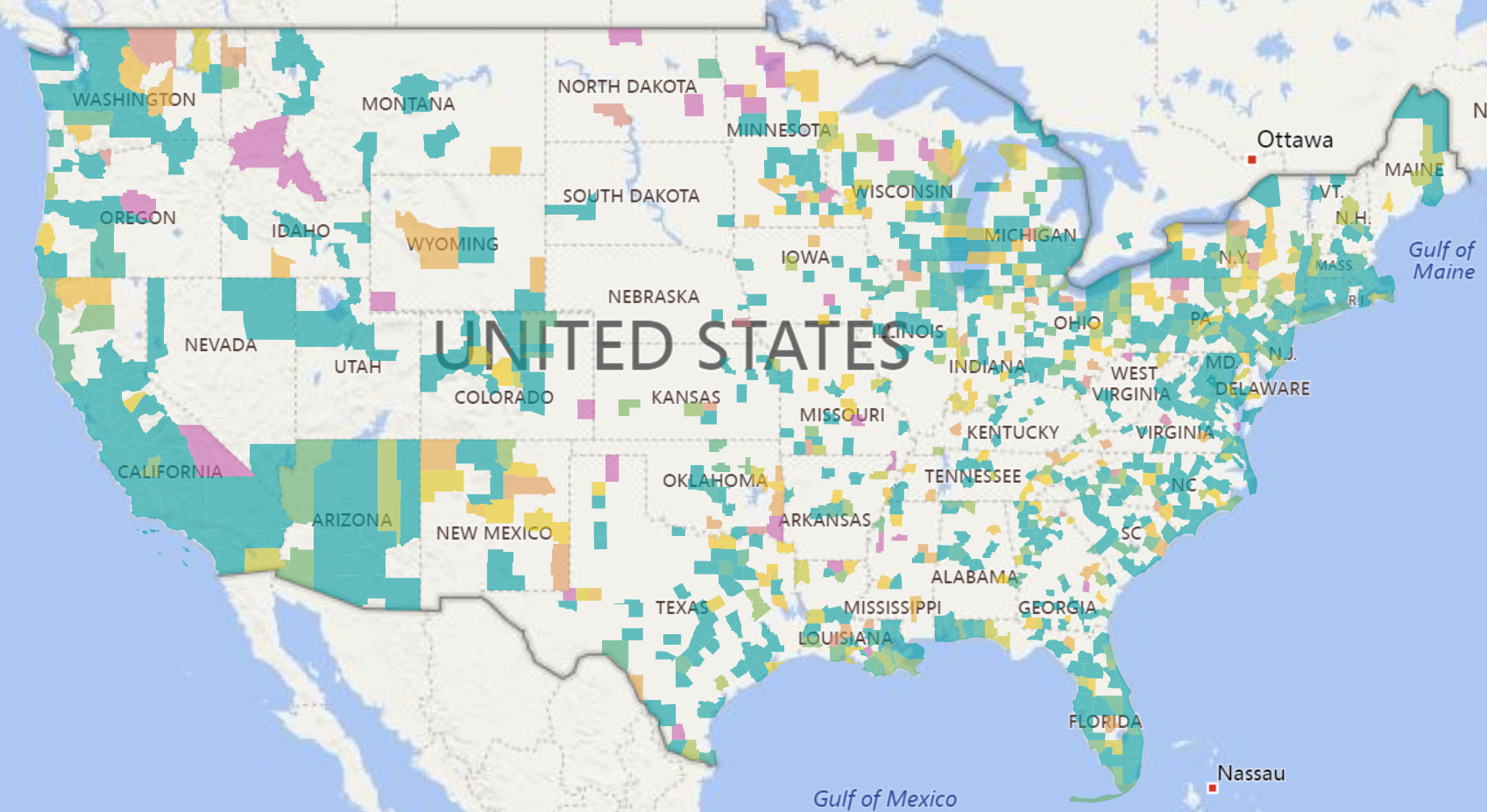

Moonlighting used to be a term that described a minority of people. If you moonlighted, you were supplementing your income. You either did it for extra cash or because you had to just to pay the bills. The freelance economy and the growth of the personal transportation industry alone have made many of us moonlighters and freelancers according to the latest Nonemployer Statistics released last month by U.S. Census.Gross receipts for transportation industries with NAICS codes of 4853 and 4859 have increased over 86% over the past four years. In spite of the economic boom we are in and low unemployment, these industries continued to show over 20% growth in gross business receipts from 2015 to 2016. The counties shown below in blue have receipts growth over four years of above 50% in these industries.

The Census defines a nonemployer business as one that has no paid employees, has annual business receipts of $1,000 or more ($1 or more in the construction industries), and is subject to federal income taxes. Most nonemployers are self-employed individuals operating very small unincorporated businesses, which may or may not be the owner’s principal source of income. Nonemployer statistics originate from Internal Revenue Service tax return information. This data is the companion to the County Business Patterns which covers employer businesses. In addition to the boom in the transportation industries, there has been steady upward growth in healthcare support and educational services. Interestingly, construction freelancing has leveled off with meaningful growth in employer payroll.