The U.S. Census recently released its 2015 Nonemployer Statistics. This data is the companion data set to the County Business Patterns. Nonemployer Statistics is an annual data set that provides county economic data for businesses that have no paid employees and are subject to federal income tax. The data consist of the number of businesses and total receipts by industry. Most nonemployers are self-employed individuals operating unincorporated businesses (known as sole proprietorships), which may or may not be the owner’s principal source of income.

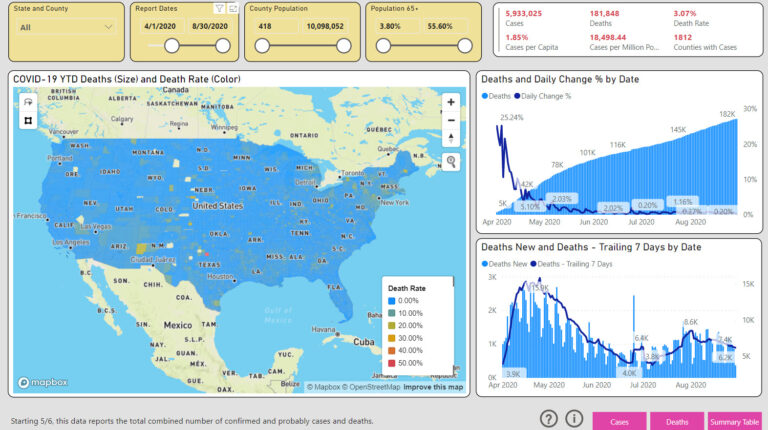

Self-employment continues to inch up. The number of nonemployer establishments increased 3.28% to 24.3 million in 2015. By comparison, the number of employer based businesses only increased 1.22% to 7.6 million. Thus, for every employer establishment in 2015 there are 3.2 small self-employed businesses. As a whole self-employment is still only $1.16 billion of receipts compared to annual payroll of $4.9 billion or 23%. As the nation has regained its footing, self-employment still continues to flourish.

-

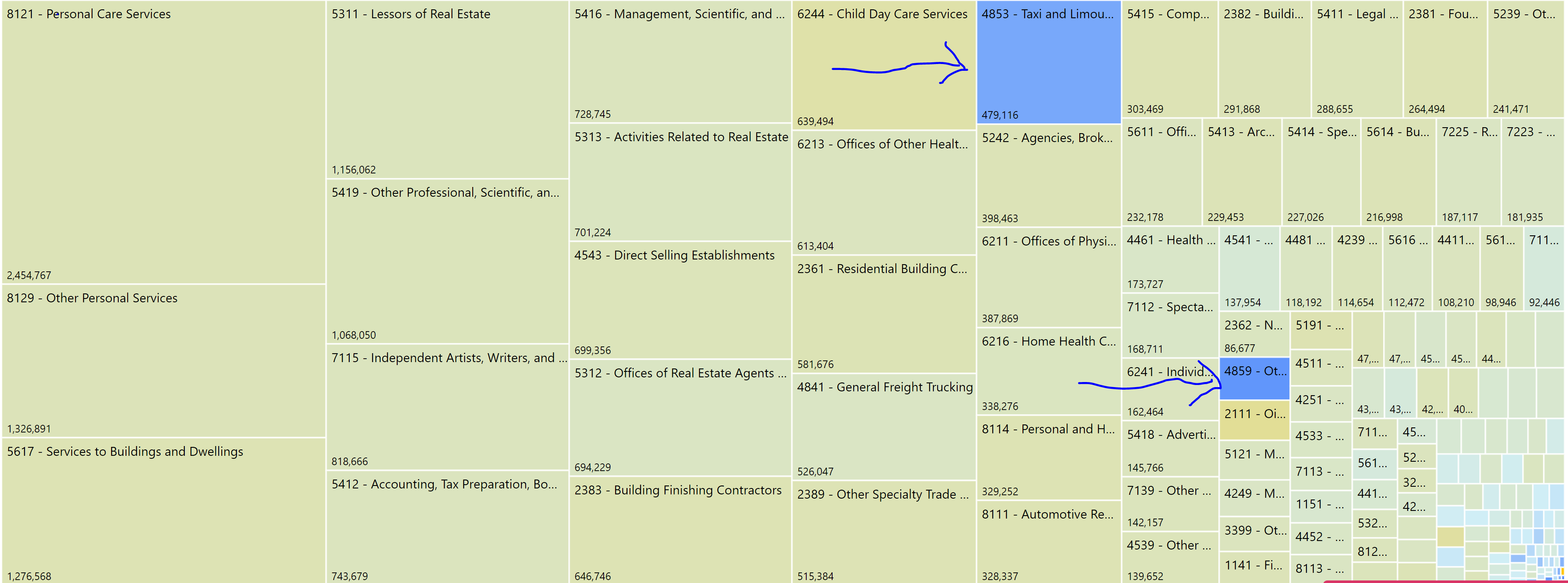

The top number of establishments for self-employment continues to be personal care services.

-

Of the top 10 number of self-employed industries, real estate comprises three of them. The number 11 ranked industry is also in real estate.

-

Real estate smokes the amount of self-employment gross receipts where it is nearly three times the next highest amount from personal care services. These types of businesses, for the most part, are your landlords.

-

Other notable top 10 self-employment professions include accountants, management consultants, and independent artists.

-

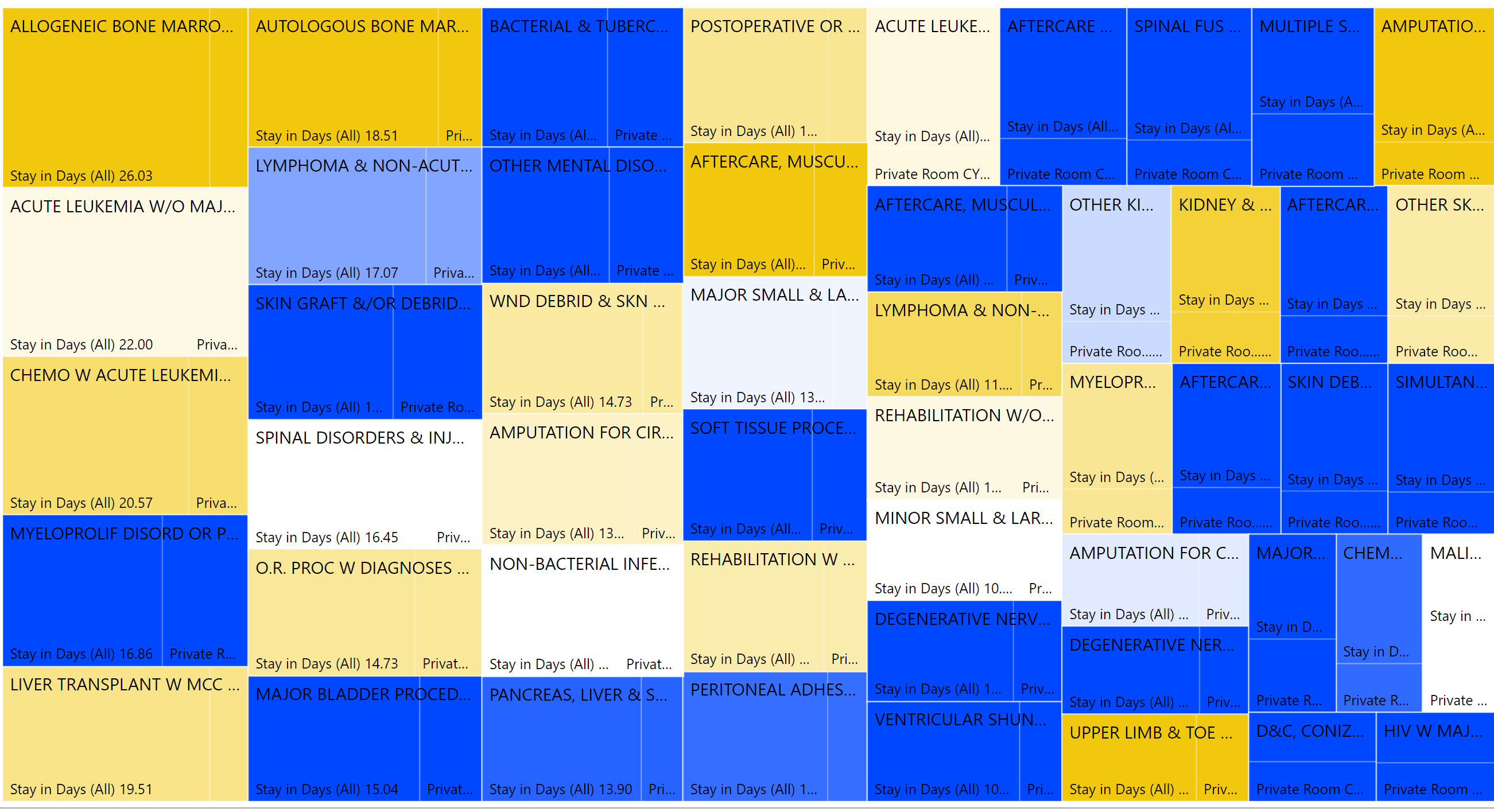

The highest growth area should not be a surprise – transportation (e.g. Uber and Lyft) are exploding with growth rates of betwen 60 and 70%. The tree map below shows the islands of growth (blue color) in the transportation industry.