The Huffington Post recently posted a very interesting article on gender debt disparity. The article notes that women hold nearly two-thirds of all student debt – a whopping $833 billion dollars. The article postulates that women also take longer to pay off the debt because they earn less than men.

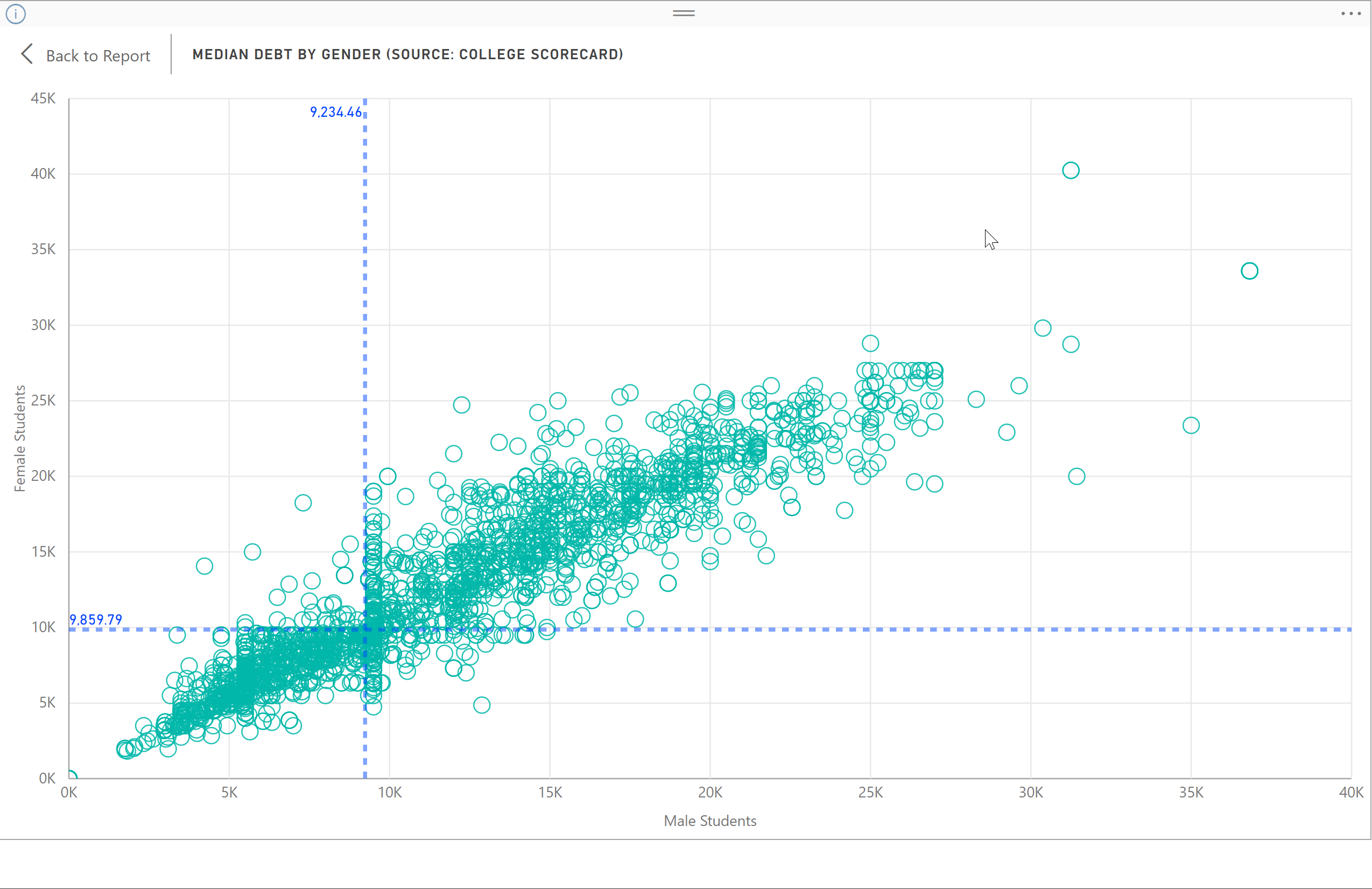

I wanted to see how that coincides with the student debt levels as reported by the U.S. Department of Education via the College Scorecard database. This database tracks the cumulative median loan debt and then disaggregates the debt by various factors including gender for approximately 6,000 institutions. The disaggregated data is profiled in the Public Insight Student Debt Interactive. You can also browse it for free using our Data Browser tool. The data, using a simple average across institutions, shows that women have a median debt level 6.7% higher than men ($9,859 vs $9,234). A scatterplot of the student loan mix is shown below. There are limitations to the data as this database only reports federal loan activity and not other loan sources such as Parent Plus loans.

The Huffington article makes the assumption that because women earn less, they take longer to pay off the student debt. But does it make them less reliable to pay down the debt? The College Scorecard database reports debt repayment rates again disaggregated by gender. The definition is very important. It is those that have entered repayment status and have made some progress in paying down their student loans which is something greater than $1 of principal. We used the three-year metric after entering repayment status.

While women may have more debt, they are nearly 3% (48% to 45%) more likely than men on average across all institutions to have made a dent in their loan. Again, we can see the distribution using the scatterplot below. I have to be honest and say this does not surprise me in the least. I spent five years going around the world in the infancy of the microfinance movement and women are notoriously better borrowers than men. Over 90% of micro loans worldwide are to women.