A hot topic, especially when new job projections come out, is whether the high growth jobs require much in the way of education. Jed Kolko at Indeed Hiring Labs did a very thorough job of analyzing projected occupational growth against their respective education requirements. His conclusion was that the slower or negative growth jobs require minimal education but the growth areas require further education. The article focuses on the typical education required, but the Bureau of Labor Statistics also provides educational attainment percentages for each occupation. We can blend the educational attainment rates against the projected growth rates and the median wage.

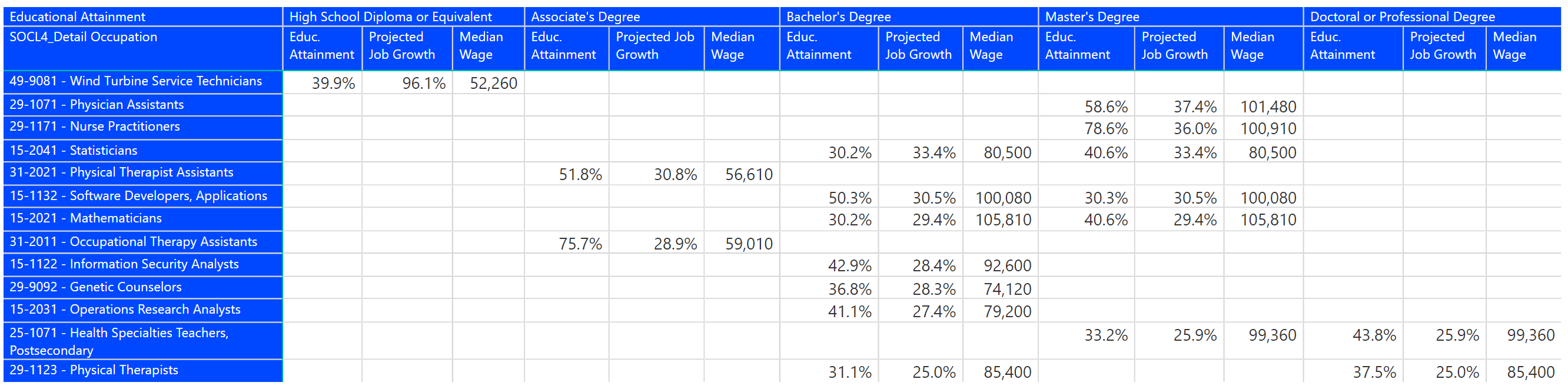

I modified the Degree-to-Jobs Interactive to organize the occupations into educational attainment buckets and looked at job growth and median wage. For example, I filtered for only those occupations that are expected to grow 20% without regard to median wage. This brought 12 occupations that only require a high school education. If I increase the minimum median wage to $40,000, I still get five occupations requiring no college education. However, if I increase the job growth rate to 25% and the minimum median wage to $50,000, 11 out of 12 occupations require a college education as shown below. This threshold seems to knock out high school only education levels.

We have created a new Free Interactive called Job Projections and Education on our site. You can fine-tune the filtered selections to select the parameters of the table. You can also sort and export the table. To access Free Interactives, you simply have to register. Free Interactives will show up at the bottom of the Interactives page as shown below. Simply click the view link to launch the Interactive.