Public Insight’s October 2025 Jobs Report summarizes market insights from the millions of job postings, resumé updates and employer ratings/reviews available in our TalentView talent market intelligence platform.

Summary Dashboard

Comparisons of Key Metrics from October to September, August, and July 2025 and to October 2024

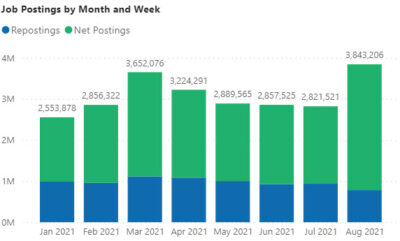

Postings

Posting Volume Declines YoY Continue

Some good news is that October postings had a slight increase of 2.7% compared to September. October job postings declined 25.7% from the same period last year to 2.65 million. As shown below, postings have declined each month in 2025 from the comparative period in 2024.

Industry Analysis

Every sector in 2025 has declined in postings from 2024. As noted above, there was some growth on a month-over-month basis. All, except for three sectors – Administrative and Support Services, Accommodation Services and Retail – showed monthly growth from September to October.

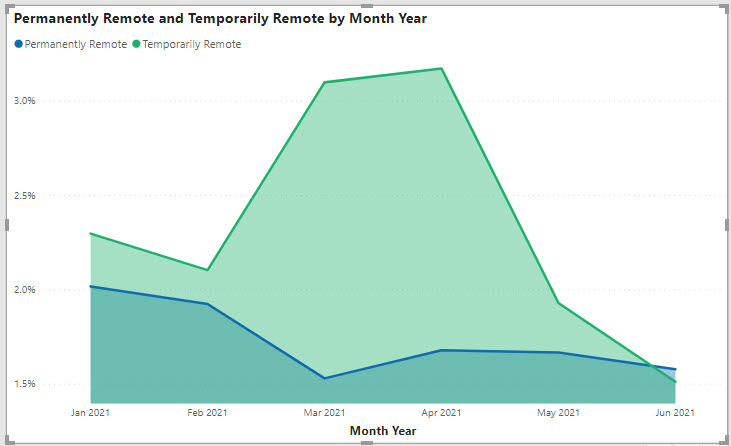

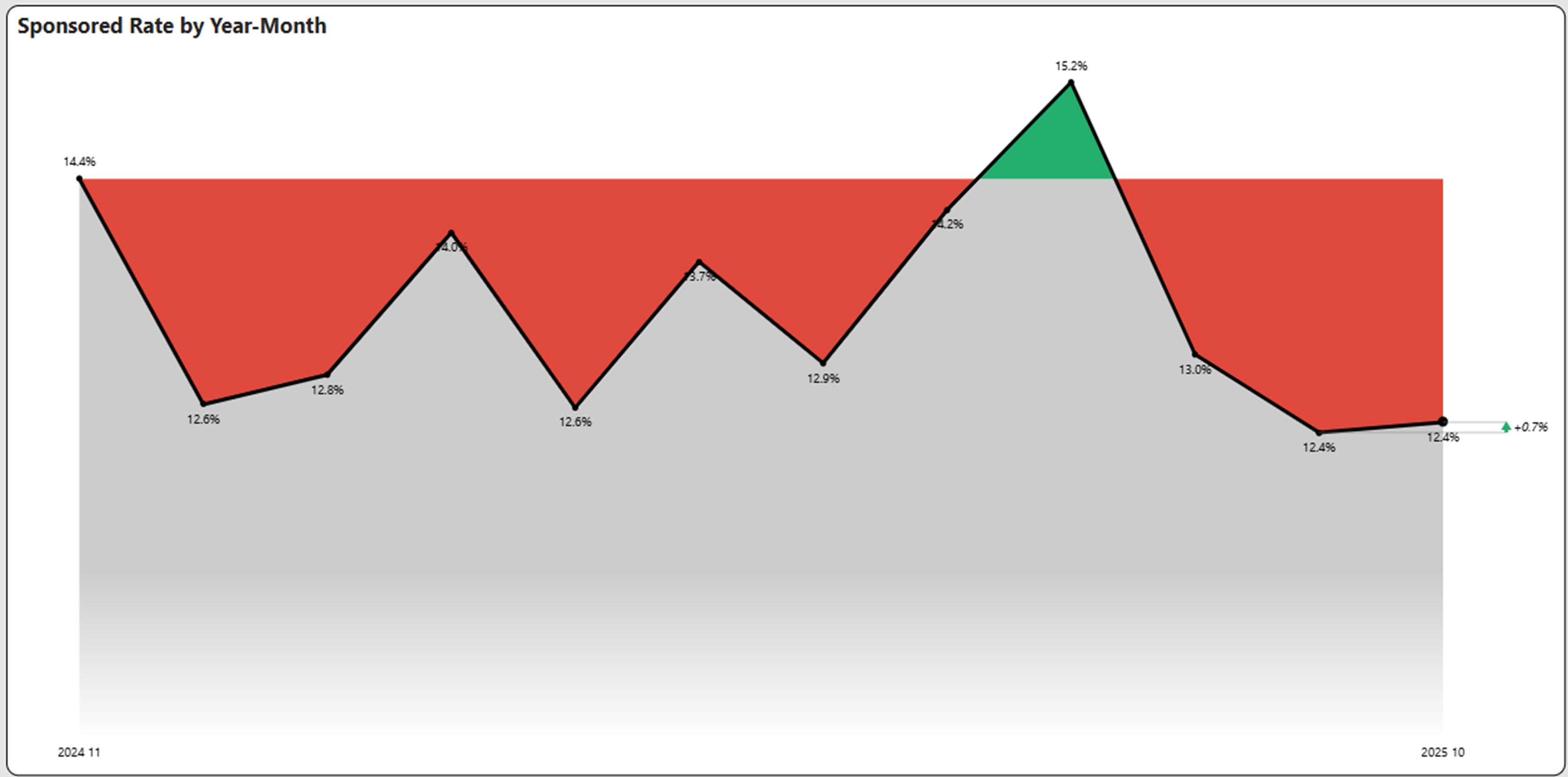

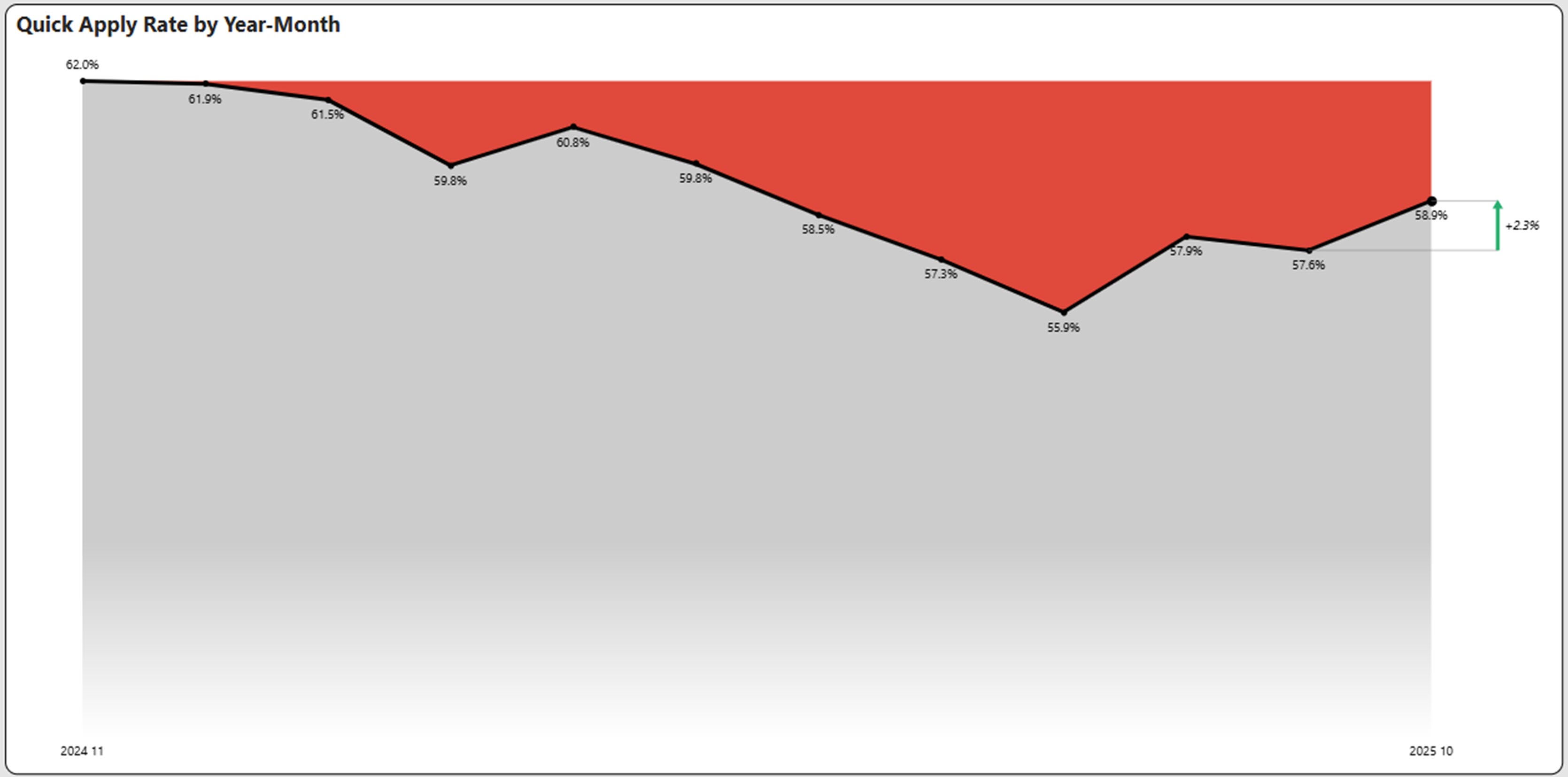

Sponsored and Quick Apply Rates Near Annual Lows

Sponsored rate is the percentage of job advertisements with a sponsor indicator. This is a measure of how active the job boards are. Sponsored rates were flat in October compared to September.

Quick apply rate is an indicator of whether an advertisement is promoted. It has shown some improvement in October and at 59% it is now solidly above the annual low.

Artificial Intelligence (AI) Advertised Skills Growth

Job attributes are categories of skills or credentials that are assigned to an individual job posting. We have flagged AI related categories and plotted the trailing 16-month growth as shown below.

AI skills while still a very small percentage of overall jobs show continued growth with a record 61.5% over July 2024.

The top AI skills are Python, Machine Learning, Natural Language Processing, and TensorFlow. Most AI skills are wrapped into broader job titles such as Software Engineer or Data Scientist. The Machine Learning Engineer job title continues to grow and is the third highest job title with AI skills.

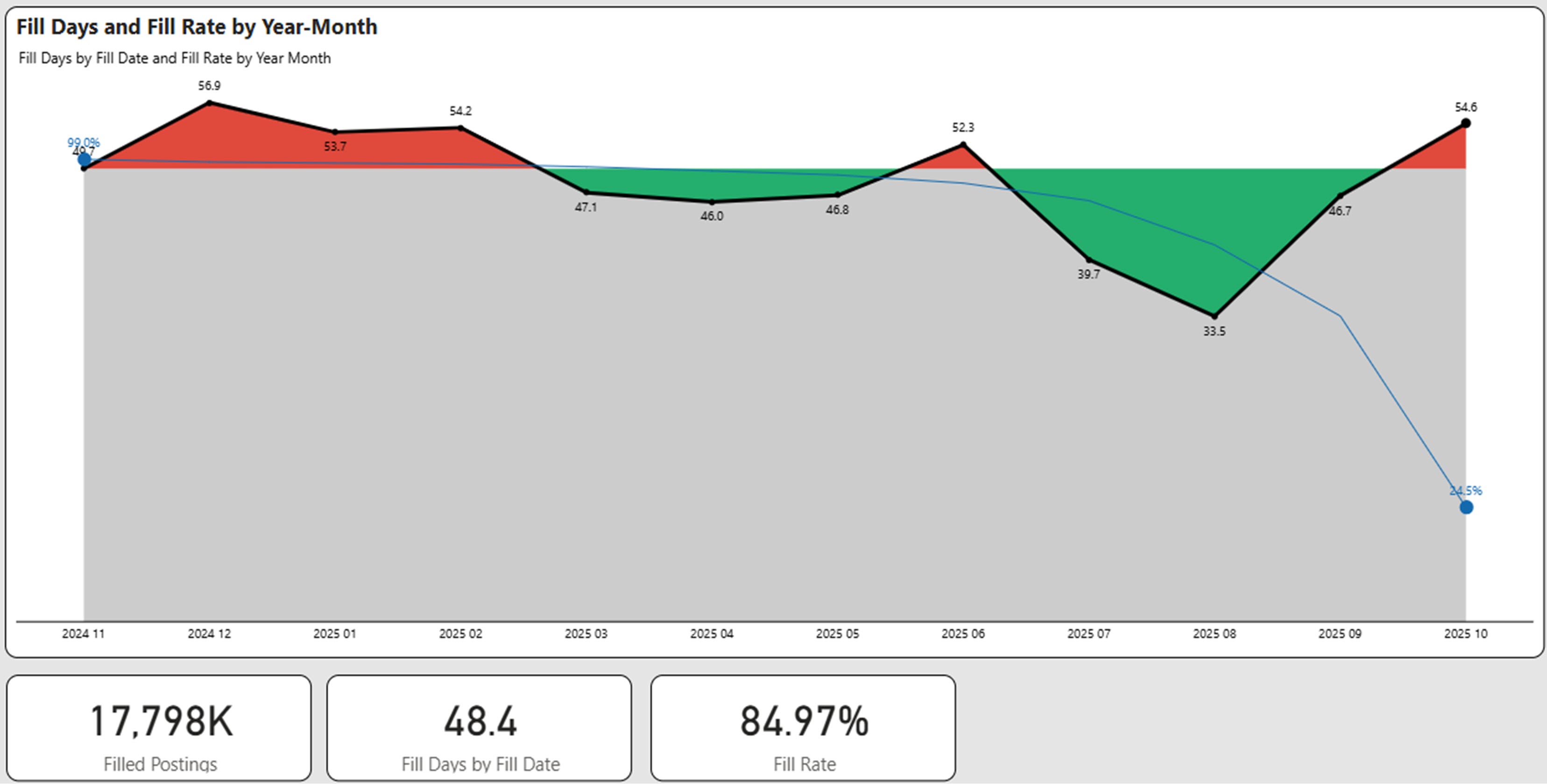

Fill Days Stays Flat While Fill Rate Increases

Fill days use ad expiration and ad removal to determine a presumptive hire. When measured over a prolonged period of time and over millions of postings it provides a strong glimpse of the overall market. Our time period is based on the trailing 12 months.

The fill days by month along with the percentage of ads (blue line) that have been filled are shown in the graph below. Obviously, the newer ads have a lower fill rate.

Fill days as a composite over the last 11 months was flat with 48.3 days in September compared to 48.4 days in October. The percentage of ads filled during this timeframe however significantly increased from 81.4% in September to 85.0% in October indicating more success in filling jobs over the time period.

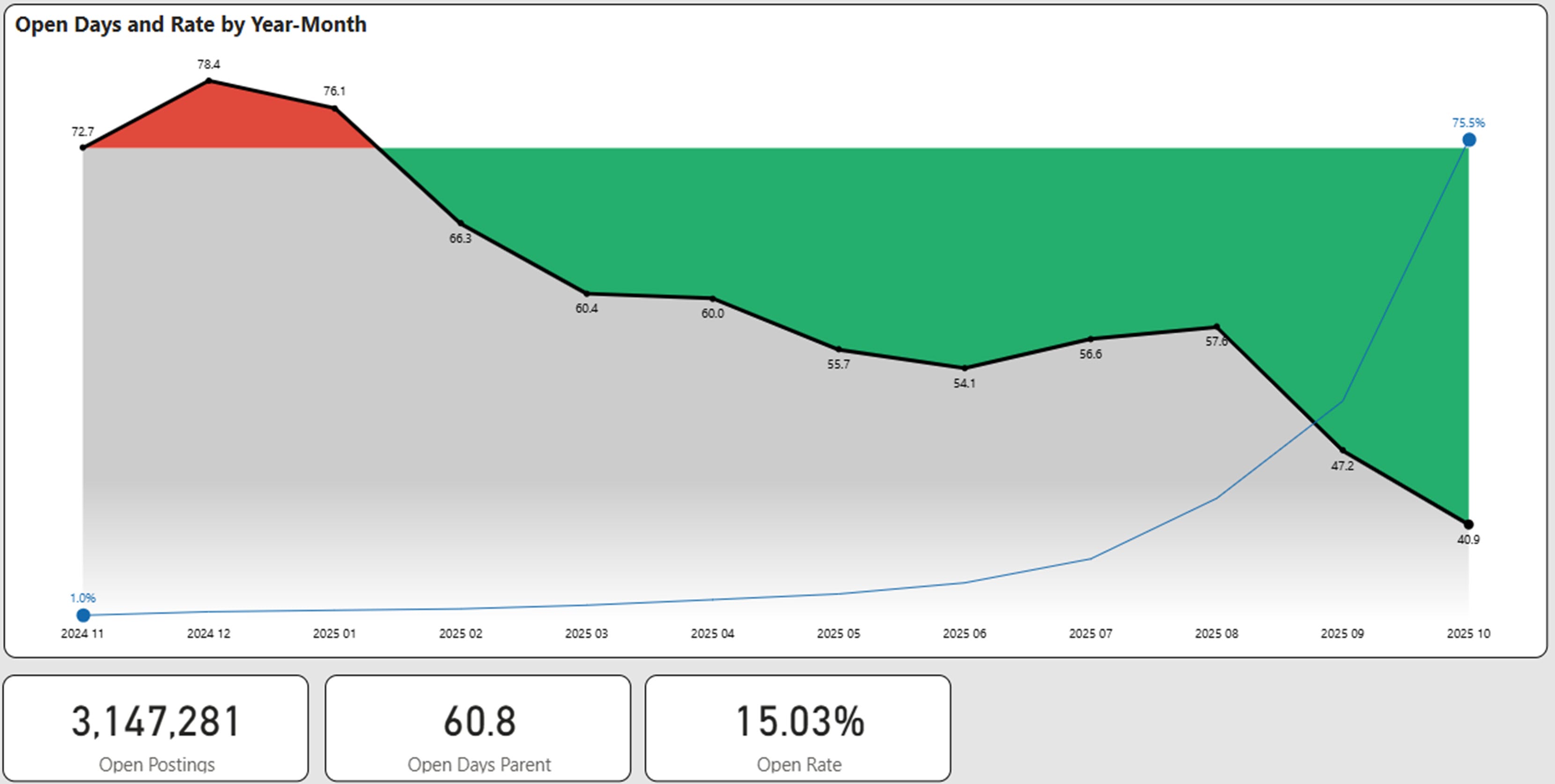

Open Days Improves Slightly While Open Jobs Decreases

Open days is the age of postings that are still determined to be open. We track every job posting uniquely and determine its fill status on a weekly basis. Generally, we have found 12 months to be a suitable time period to evaluate the age of open days. Older postings may distort the open days as they may represent “evergreen” postings. For this reason we eliminate implied evergreen ads that are older than one year.

The graph below shows the aging of open postings for the past 12 months. The composite of open days declined slightly from 61.4 days in September to 60.8 days in October. However, the percentage of open jobs decreased significantly from 18.6% to 15.0% and the number of open jobs for the trailing 12-month period decreased from 4.0 million to 3.1 million, a significant reversal from September.

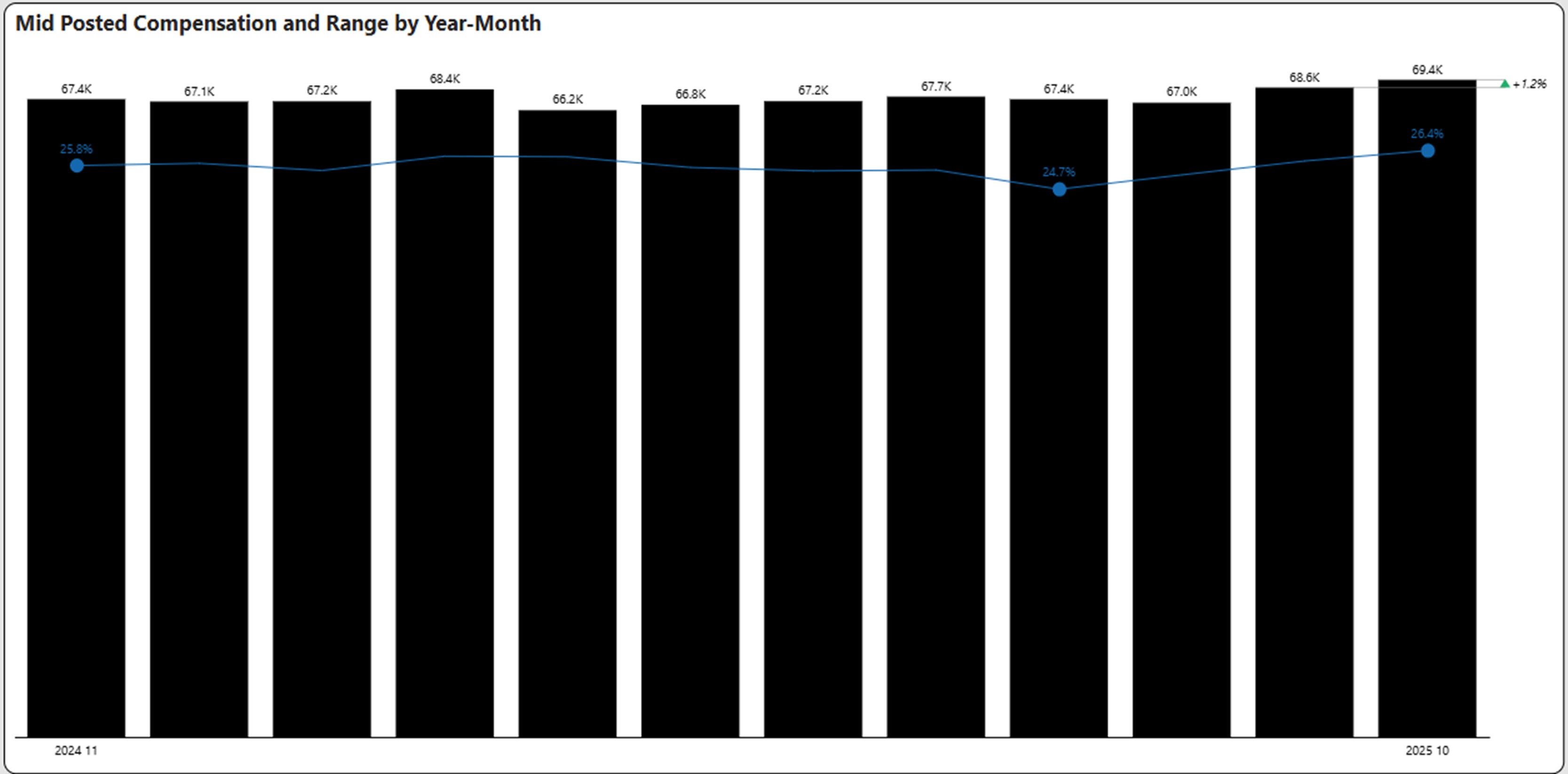

Compensation

Compensation Continues Increase in October

In this October 2025 Jobs Report, we see that Mid-posted compensation increased 1.2% to $69,400, a 12-month high. This continues the meaningful increase from September. In addition, the range of pay between max and min compensation as a percentage of the midpoint also continued to increase from 26.0% to 26.4%, suggesting some flexibility in negotiated pay. This range also is at a 12-month high.

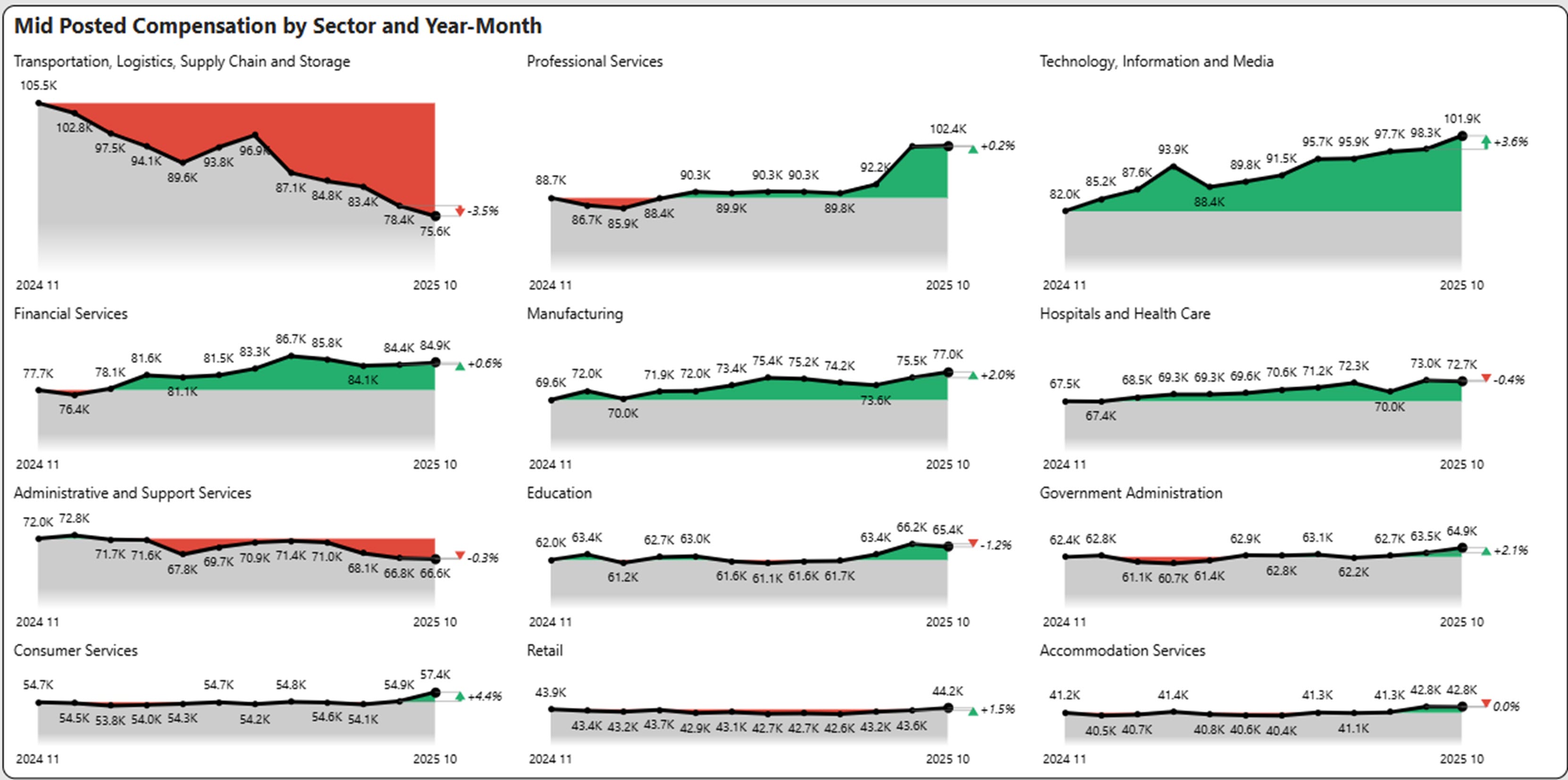

Compensation by Industry Sector

- Transportation continued its decline with an additional 3.5% and is now down 28% compared to 12-months ago.

- Technology and Financial Services after a prolonged slump in 2023-2024 continues to set new 12-month highs, increasing 3.6% in October.

- Consumer Services increased 4.4% in October, the highest sector performer after months of sluggishness.

- Government Administration (which includes federal, state, and local) increased 2.3% in October.

Supply and Demand

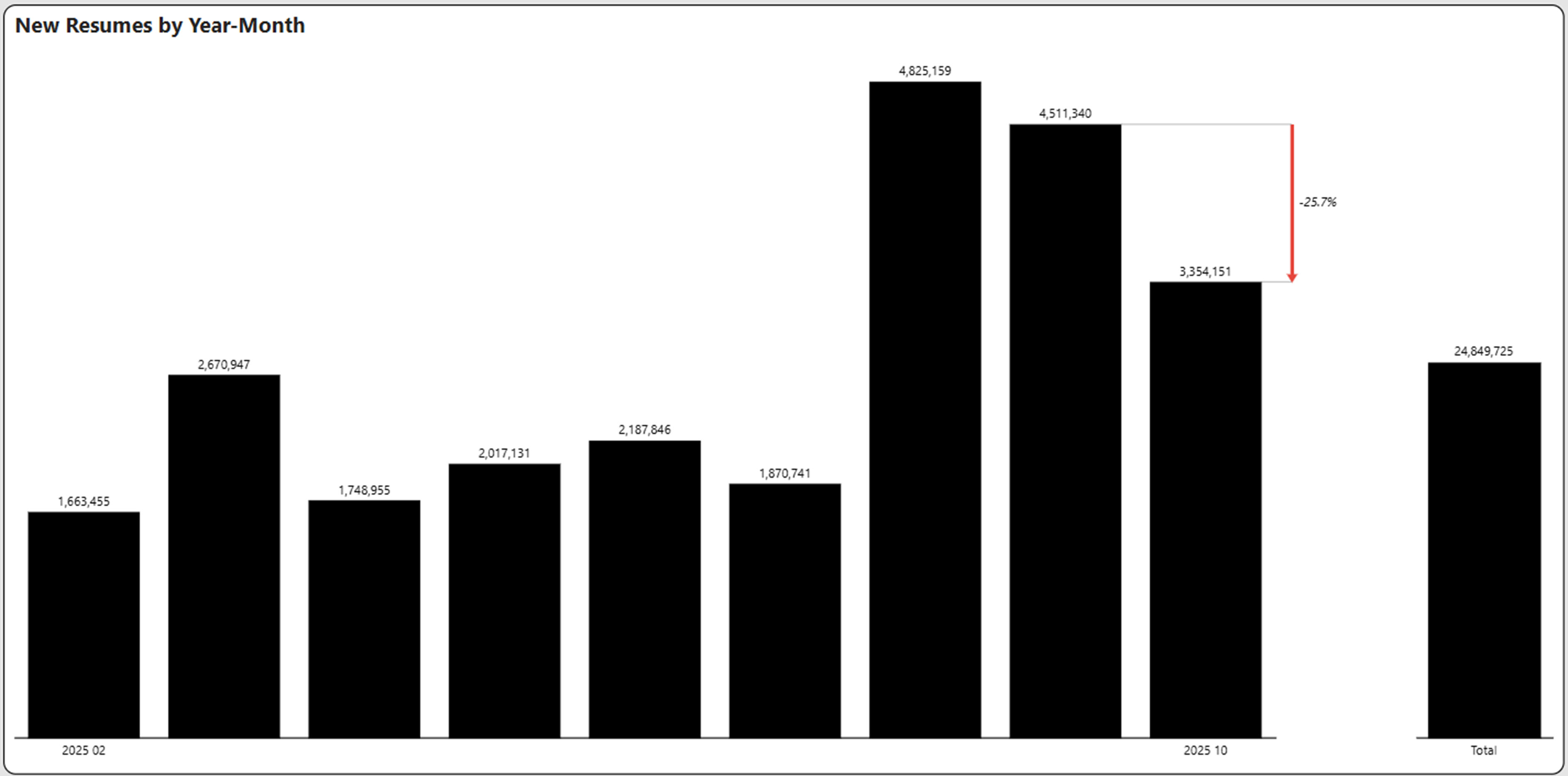

Resumes Moderate After Late Summer Surge

The total number of resumes over the trailing nine months declined from 25.5 million to 24.9 million. Resumes, which surged during the summer have now moderated, but are still at a relatively high level indicating a surge of job seeker interest (and perhaps some nervousness).

Supply/Demand Imbalances Tilt Towards Demand

To highlight supply/demand imbalances, we superimpose job seekers based on resumés over net job postings (black bar). We can then look at this supply and demand in diverse ways. The graphs highlight a supply surplus (more job seekers than net postings) shown in green, or a supply shortage (less job seekers than net postings) shown in red. We picked a time period of nine months which highlights the current market surplus or shortage. The total bar reflects the summaries of openings and resumés for that time period.

In the graph below, we see that Administrative and Support Services and Healthcare sectors maintain their shortage trend, and after an oversupply in August/September several sectors came back to a shortage in October. These include: Professional Services, Transportation, Manufacturing, Technology, Government Admin, Financial Services and Construction.

Supply/Demand Scorecard

We highlight the current state at the end of October as well as the state at nine months ago. A change is not necessarily good or bad, but we have highlighted changes (in blue, green or orange text) in supply/demand gaps that significantly impact the current trends.

Overall net positions for the trailing nine months decreased from 23.1 million to 22.3 million while resumes also declined, but not as much over the time period. Thus, little has changed in the supply/demand positions from February to October.

Those sectors with unmet demand continue to have unmet demand. However, the resumes are very backloaded. If this trend continues, we would expect these indicators to tilt more and more towards supply exceeding demand.

| Sector | Current State | Previous State |

| Hospitals and Health Care | Heavy Unmet Demand | Heavy Unmet Demand |

| Accommodation Services | Moderate Oversupply | Moderate Oversupply |

| Retail | Moderate Oversupply | Moderate Oversupply |

| Professional Services | Heavy Unmet Demand | Heavy Unmet Demand |

| Manufacturing | Parity | Parity |

| Transportation, Logistics, … | Heavy Unmet Demand | Heavy Unmet Demand |

| Construction | Heavy Unmet Demand | Heavy Unmet Demand |

| Technology, Information, … | Slight Unmet Demand | Slight Unmet Demand |

| Financial Services | Heavy Unmet Demand | Moderate Unmet Demand |

| Education | Moderate Unmet Demand | Moderate Unmet Demand |

| Consumer Services | Slight Oversupply | Parity |

| Entertainment Providers | Parity | Parity |

| Wholesale | Moderate Unmet Demand | Moderate Unmet Demand |

| Administrative and Support Services | Heavy Unmet Demand | Heavy Unmet Demand |

Worker Sentiment

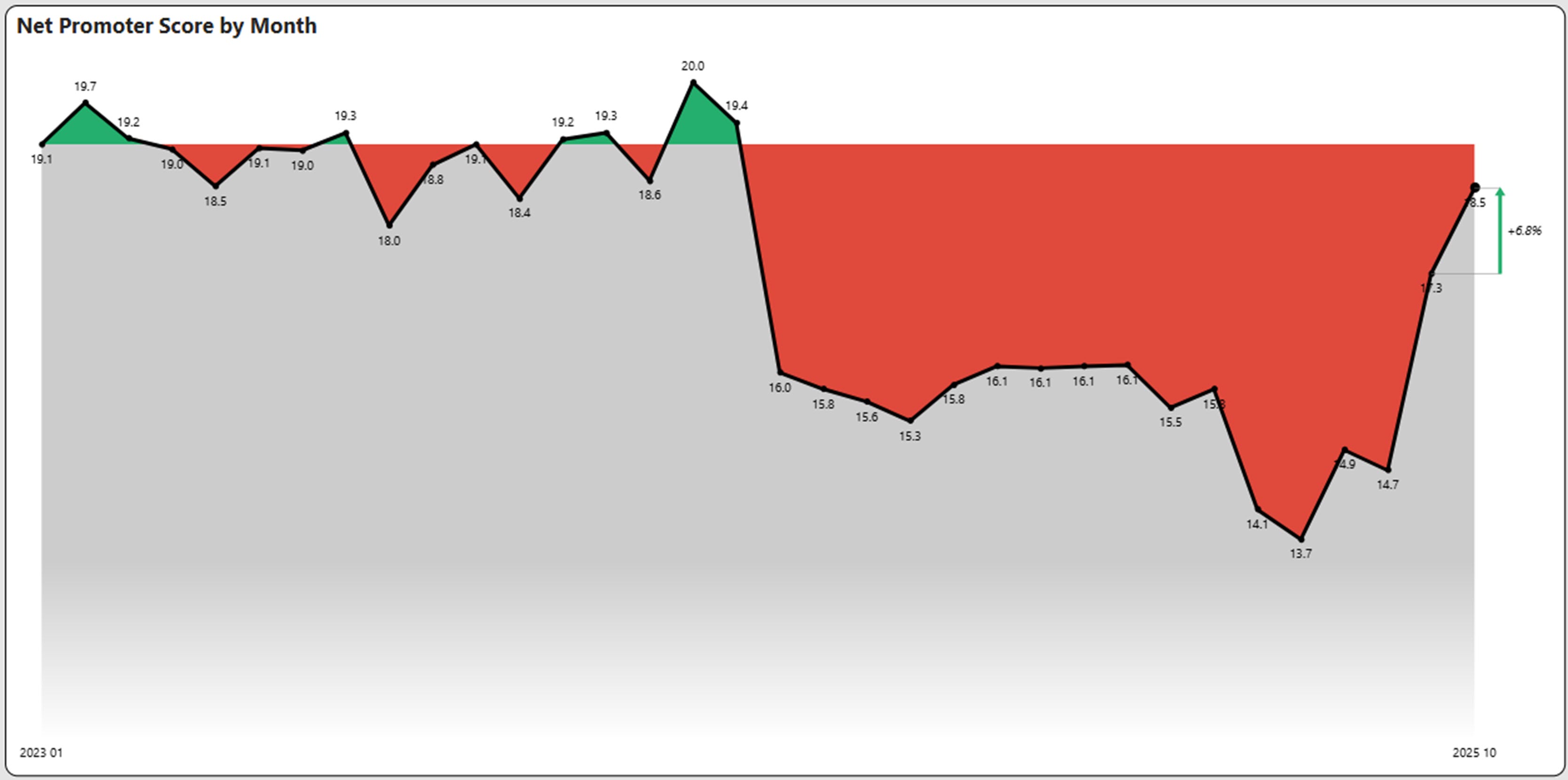

Net Promoter Score Maintains Improvement

Net Promoter Score continued its upward trend.

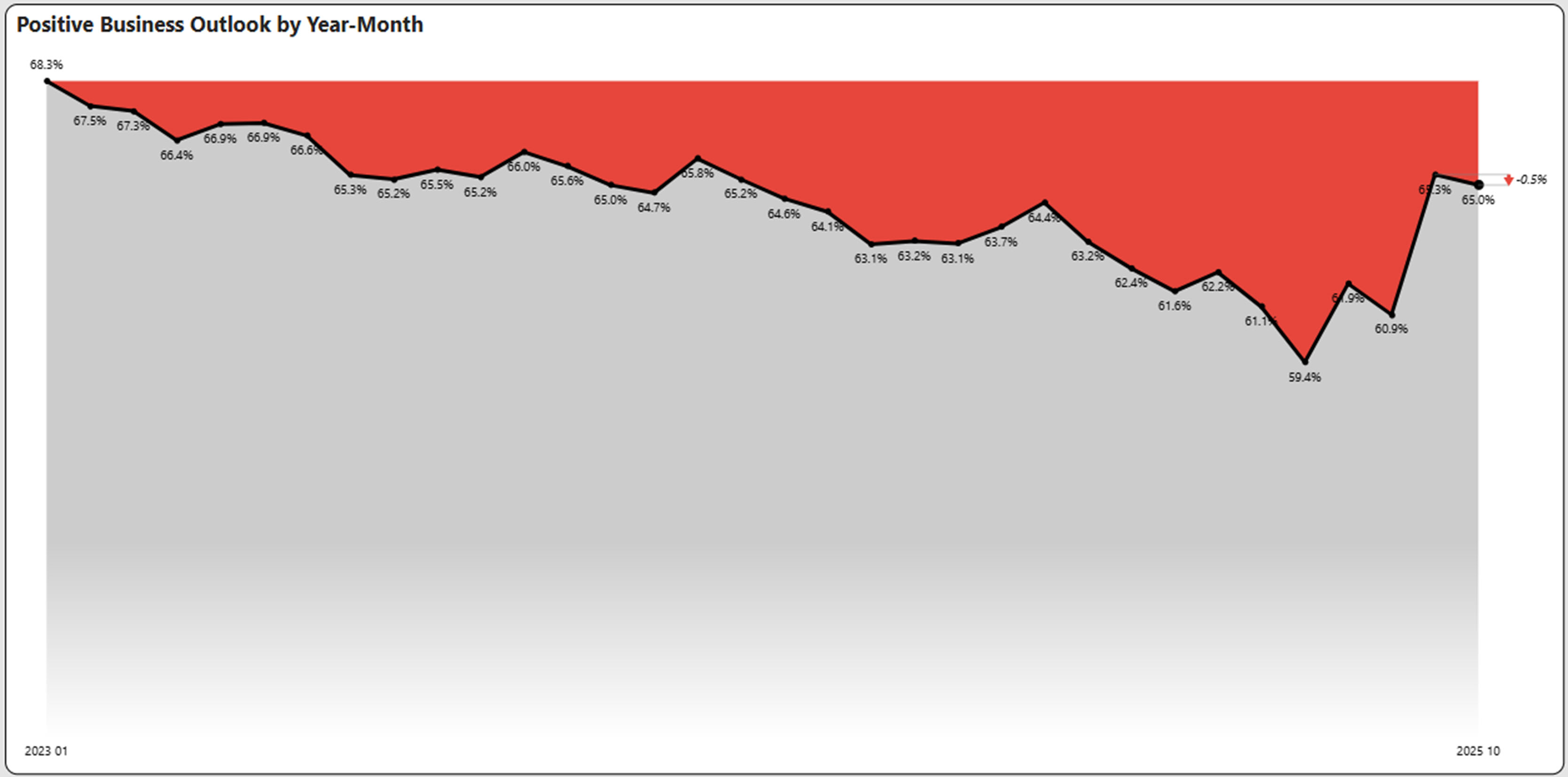

Positive Business Outlook based on Glassdoor reviews was flat in October after a substantial improvement in September.

Labor Market

Due to the government shut down, this analysis is paused for this month.

If You Liked the October 2025 Jobs Report – Get More Insights!

Try Our Free Version of TalentView to Get Instant Compensation, Postings, and Fill Days By Title, Company and Location (No Sign Up Required)

How Would Your Company, Industry and Job Titles Compare?

Current competitive and market intelligence is powerful.

What is TalentView?

Public Insight develops TalentView, a talent market intelligence solution that generated these insights. The most current and detailed insights are available by title, employer, location, industry and more. We provide flexible ways to utilize talent market intelligence, which include data licensing, interactive dashboards and reports.

How Can Our Must-Have Market Insights Help You?

- Inform/Justify Recruiting Decisions and Utilize Data to Tell Your Story

- Inform Recruitment Marketing Budgets, Strategies and Priorities

- Benchmark Employers Against Competitors

- Enhance Your Solution Offering (Solution Providers)

- Identify Business Development Opportunities (Solution Providers)

- Develop Content for Account Management and Marketing (Solution Providers)

Get Started!

Schedule a Call – Let’s discuss and demonstrate how you can leverage talent market data and insights

Sign Up for a Trial – Try out our interactive dashboards or get sample data