Many prognosticators are projecting a coming economic crisis caused by student debt. This is typically focused around an inability to pay off the principal of the loan. But it really appears that we are also setting ourselves up for a real problem with the cost of debt.

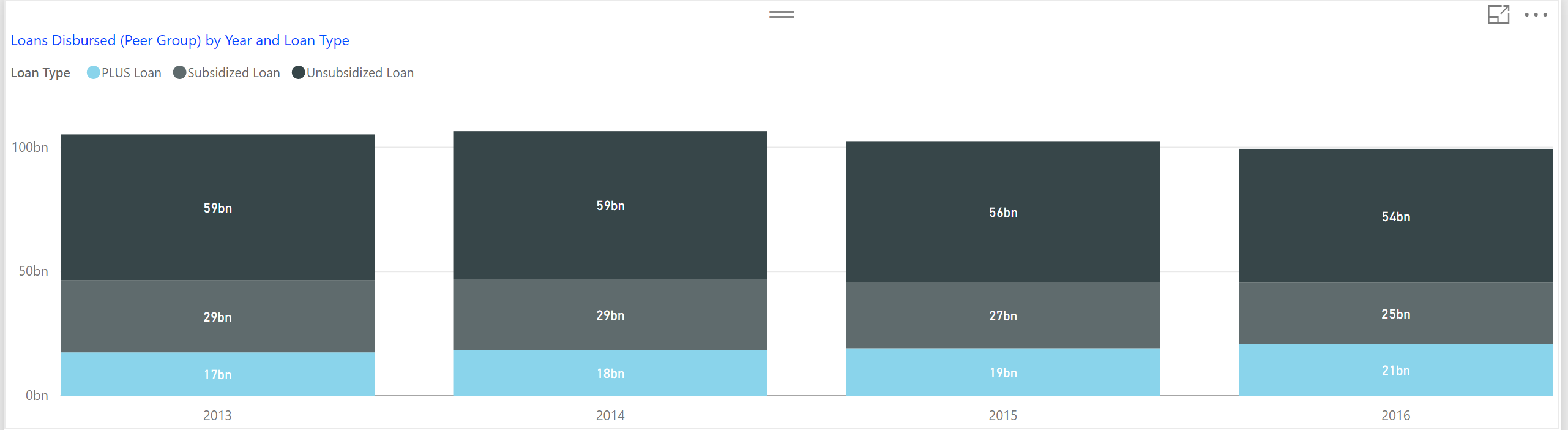

Overall new loans from the direct loan program have been relatively flat for the past four years except the loan programs are increasingly shifting to higher cost PLUS loans as indicated by the following graph.

Unsubsidized and subsidized loans have declined while PLUS loans continue to increase. Why is this a problem? Because PLUS loans carry much higher interest rates. The new PLUS loan rate effective July 1, 2017 is 7% compared to the unsubsidized and subsidized loan rate of 4.45%. This incremental debt cost is monumental when looking at it over the lengthy repayment cycles of student loans.

And it seems like it is getting worse. We extrapolated the direct loan program costs through June 30, 2017 by taking the actual through March 31, 2017 and adding last year’s fourth quarter ending June 30, 2016. The results if they hold are very alarming. PLUS loans will have increased nearly 6% and the number of PLUS borrowers will have increased 12%.

Unfortunately students have the perspective the PLUS loans are essentially free money. There is also the perspective that sometime down the line, these loans will be forgiven. This recent article in Forbes highlights that concern.