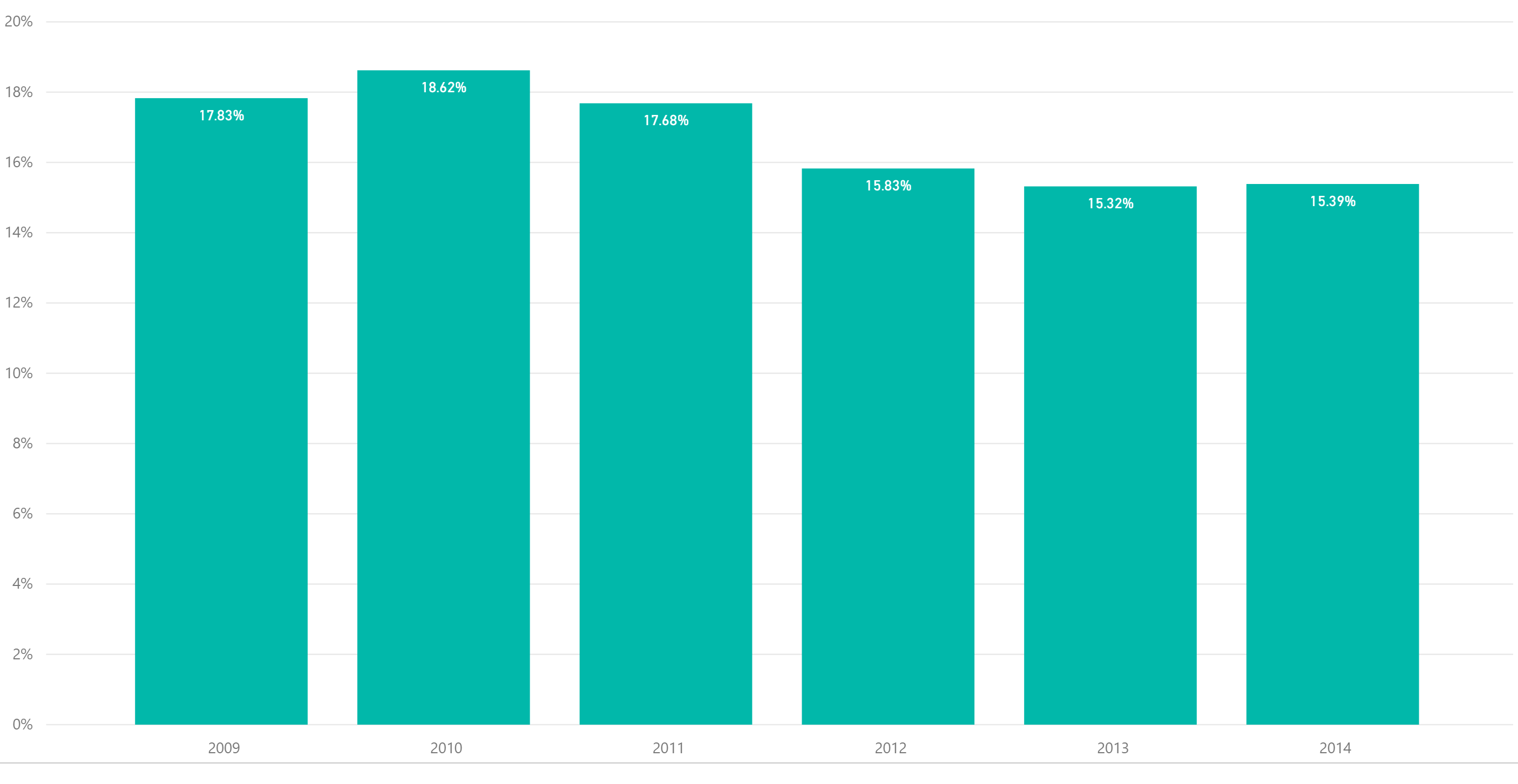

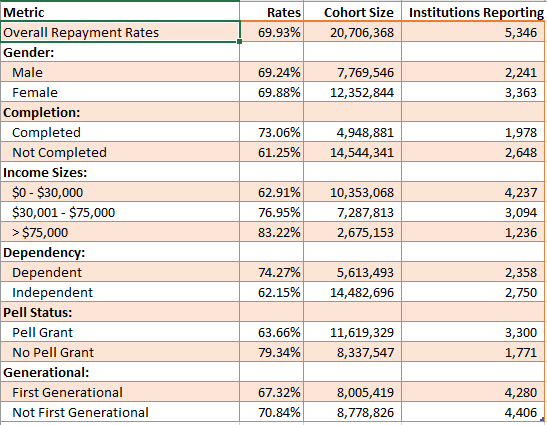

How financially fit is your institution? One of the measures that Forbes has used in assessing the financial fitness of postsecondary institutions is endowment assets per FTE. This metric takes the value of endowment assets at the end of the year and divides it by the number of FTE’s. In applying this data to over 2,000 institutions, we discovered that endowment per FTE decreased a little over 2% from 2015 to 2016. However, there are wide variations in and among institutions.

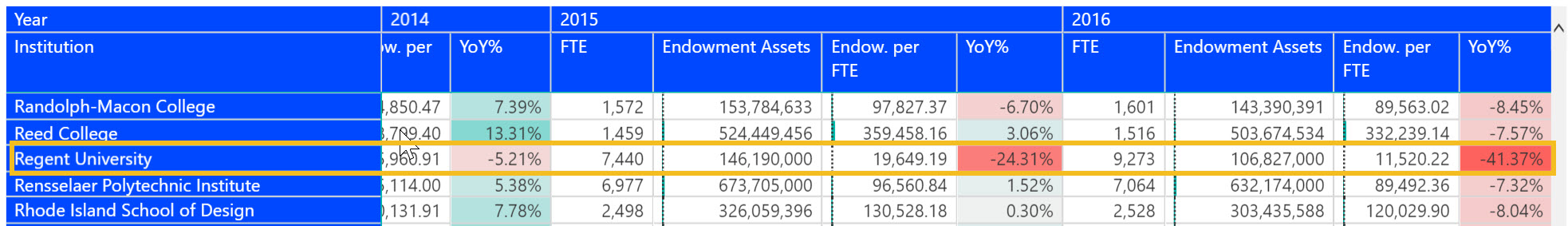

Clearly Ivy League schools can distort this metric. Princeton for example has an endowment per student of over $2 million. Endowments also can ebb and flow based on market returns. But discounting for this, you can see how an eroding endowment combined with a rising head count could have implications on financial margin. Regent University for example has had endowment assets decline to five year lows while FTE has actually gone up in 2016. This has resulted in an endowment per FTE decline of 41% and 21% over the past two years.

We recently updated the Finance Interactive to the most recent data released from IPEDS. This Interactive analyzes a whole host of financial metrics including endowments. You can purchase individual Interactives or license them under our Higher Education Institution library. Individual Interactives are priced between $195 and $295.

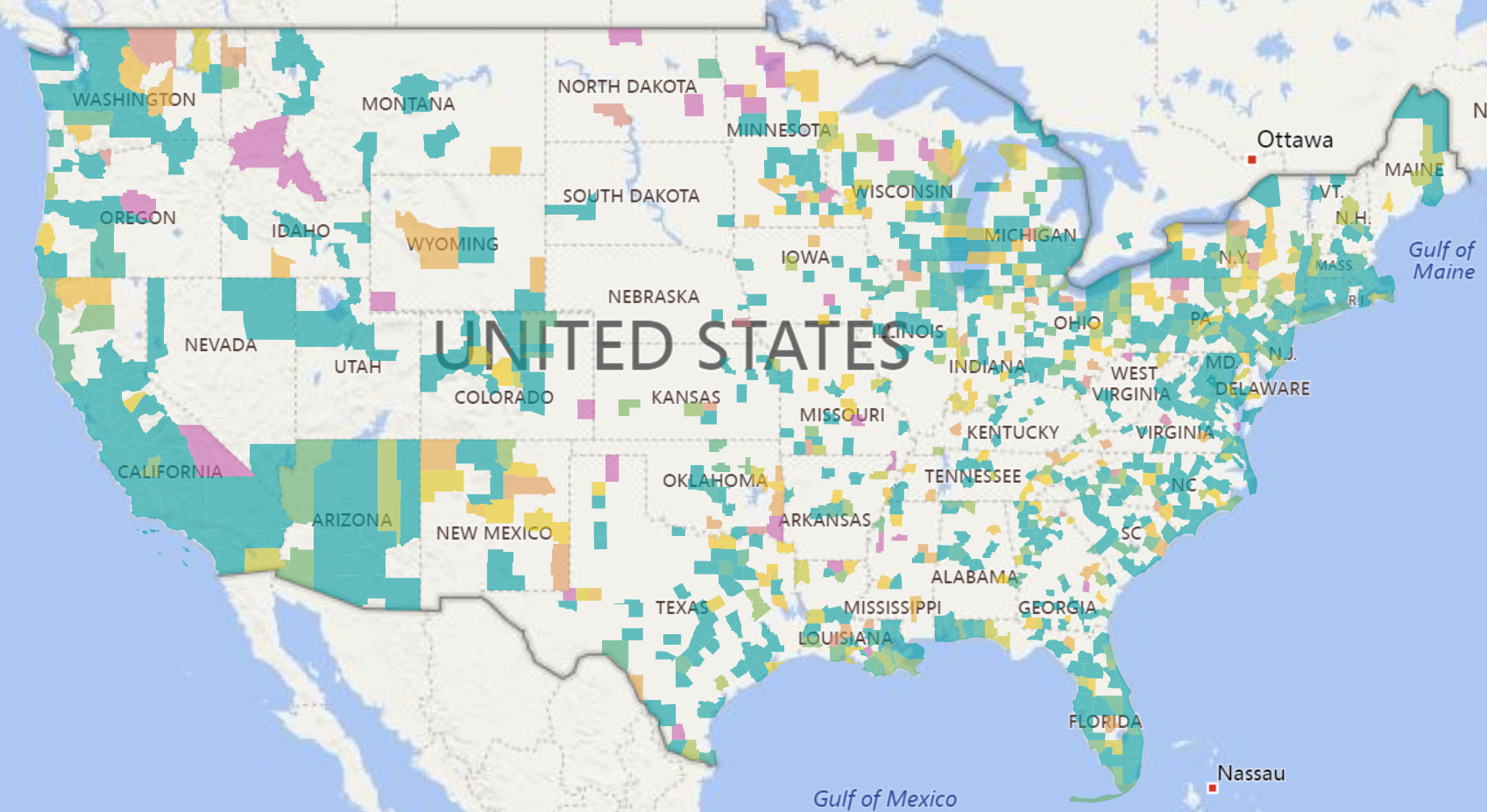

We have also created a free Interactive that allows you to see what the trailing five year endowment per student is by institution. You can individually select sectors or institutions and can also manipulate the thresholds of endowments and students.