They are building three new homes across from my house here in Northeast Ohio. It seems we are past the time of the severe slowdown of housing starts and there has been a mini-housing resurgence. Home inventory levels remain low. The problem is, like my new neighbors, new housing tends to be on vacant land.

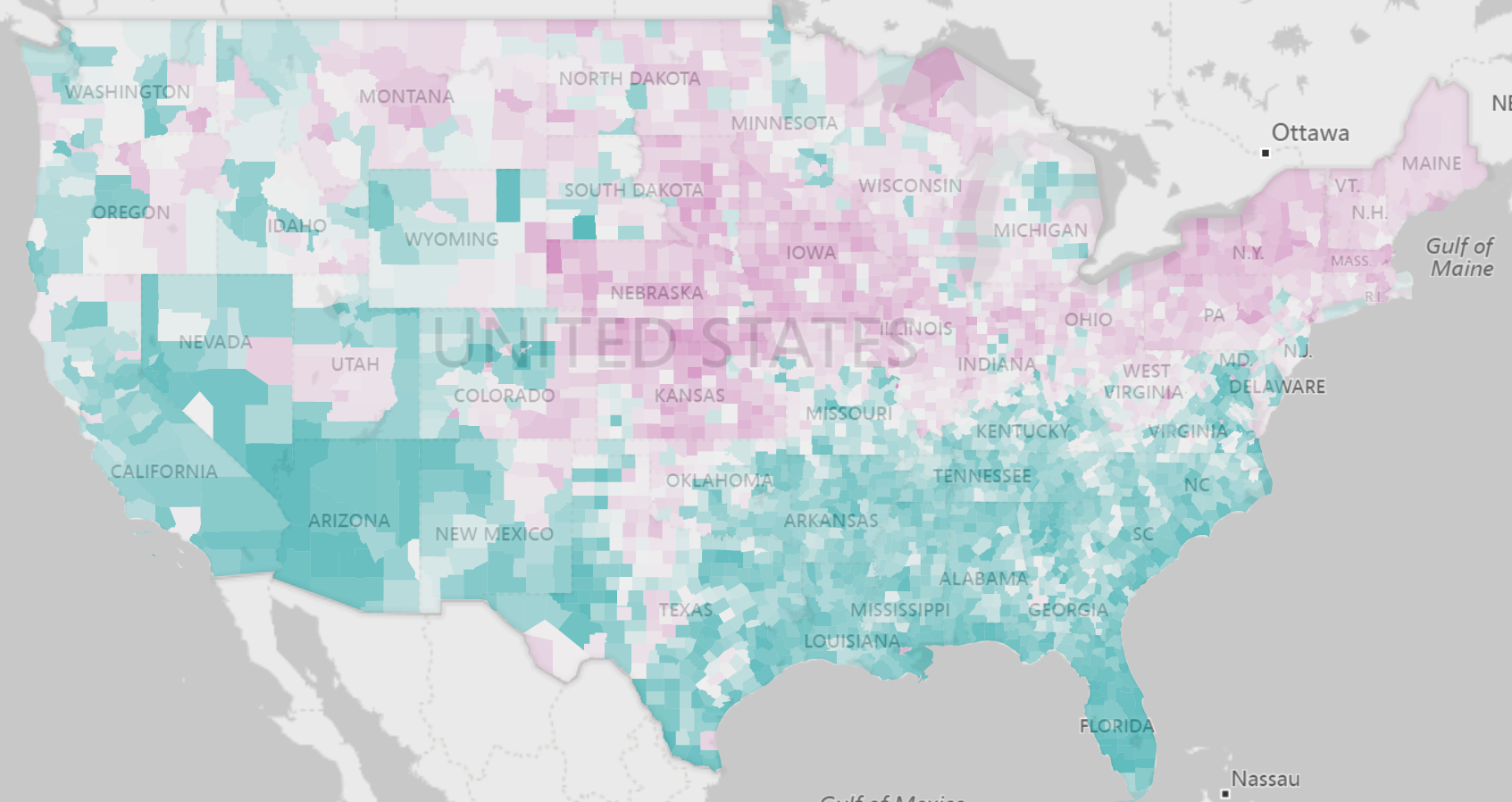

A very high percentage (12.9%) of homes still exist in the U.S. that were built prior to 1940. Next to homes built in the 1970’s, this is still one of the highest home categories based on age. These homes primarily dot the landscape of our urban areas. There are 208 counties where 30% or more of the homes were built prior to 1940 and the weighted average population is just under 1 million. These homes also are heavily concentrated in the north as indicated by the magenta colors in the map below.

There are numerous issues associated with older housing ranging from blight to upkeep to fire hazards. This article provides a nice overview.

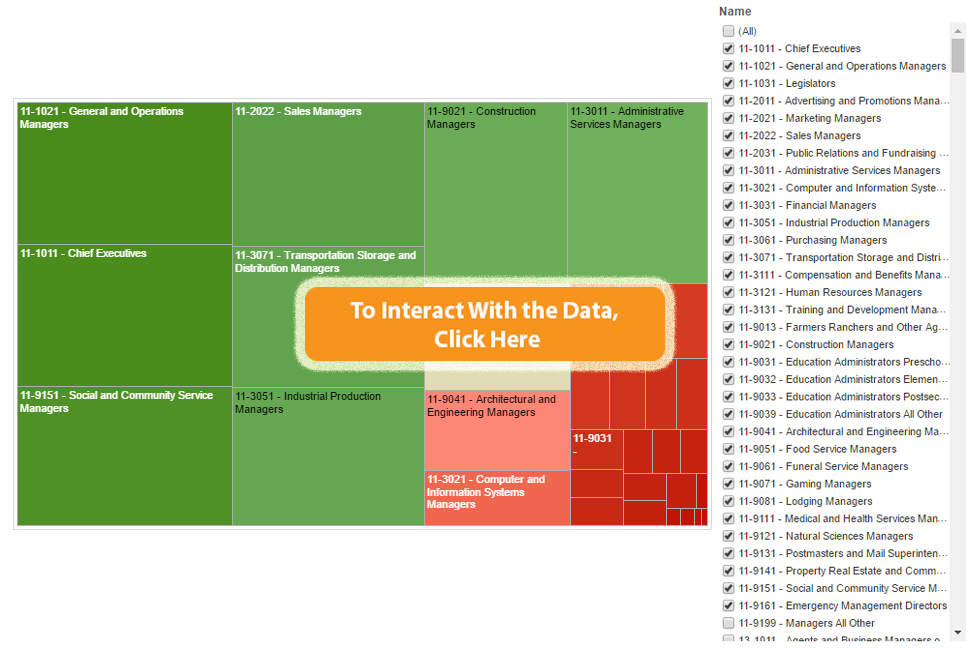

We have curated housing data from the American Community Survey into 25 indicators as part of the Population Analysis Interactive including age of structure. We are committed to bringing disparate community data to life to inform community health and regional prosperity.