Public Insight’s January 2026 Jobs Report summarizes market insights from the millions of job postings, resumé updates and employer ratings/reviews available in our TalentView talent market intelligence platform.

Summary Dashboard – January 2026 Jobs Report

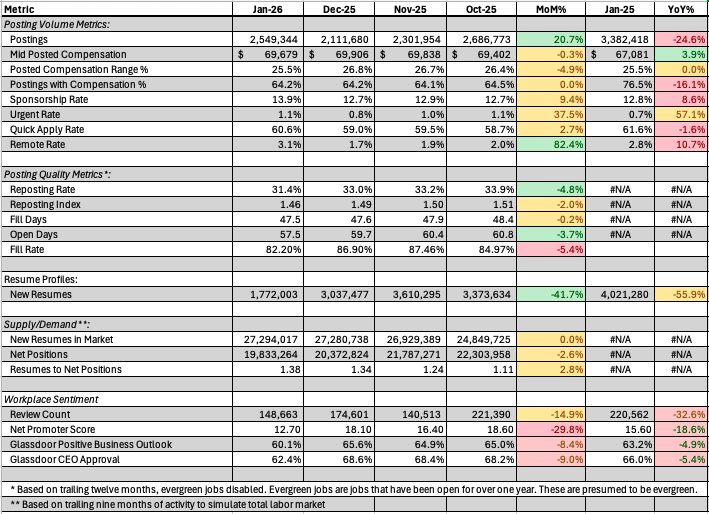

Comparisons of Key Metrics from January to December, November and October 2025 and to January 2025

Postings

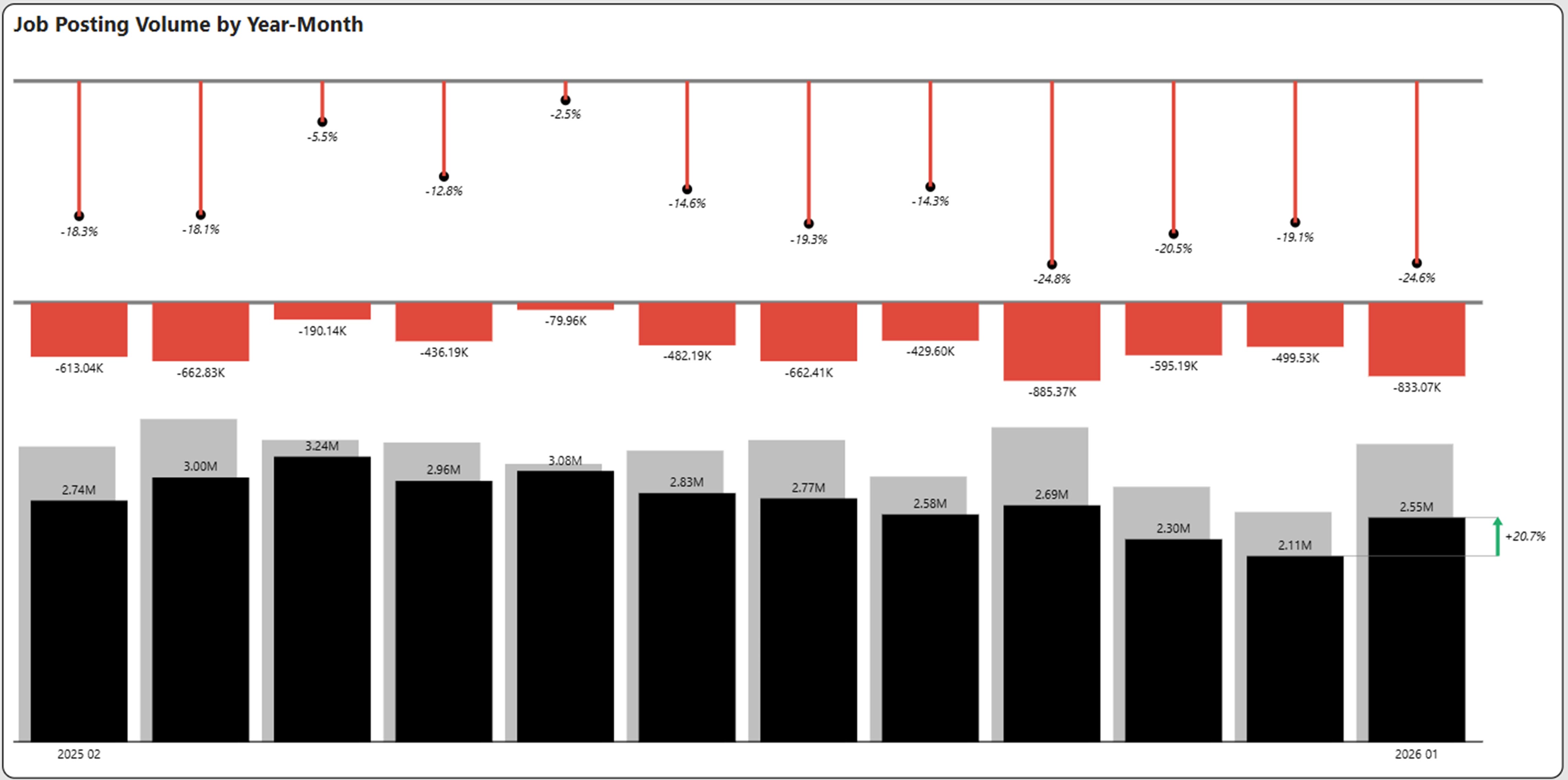

YOY Declining Posting Volume: The Trend Continues

January 2026 job postings declined 24.6% from the same period last year to 2.55 million. The decline was the second largest year-over-year percentage decline in the past twelve months.

A little solace can be found in the fact that January postings were up 20.7% from December.

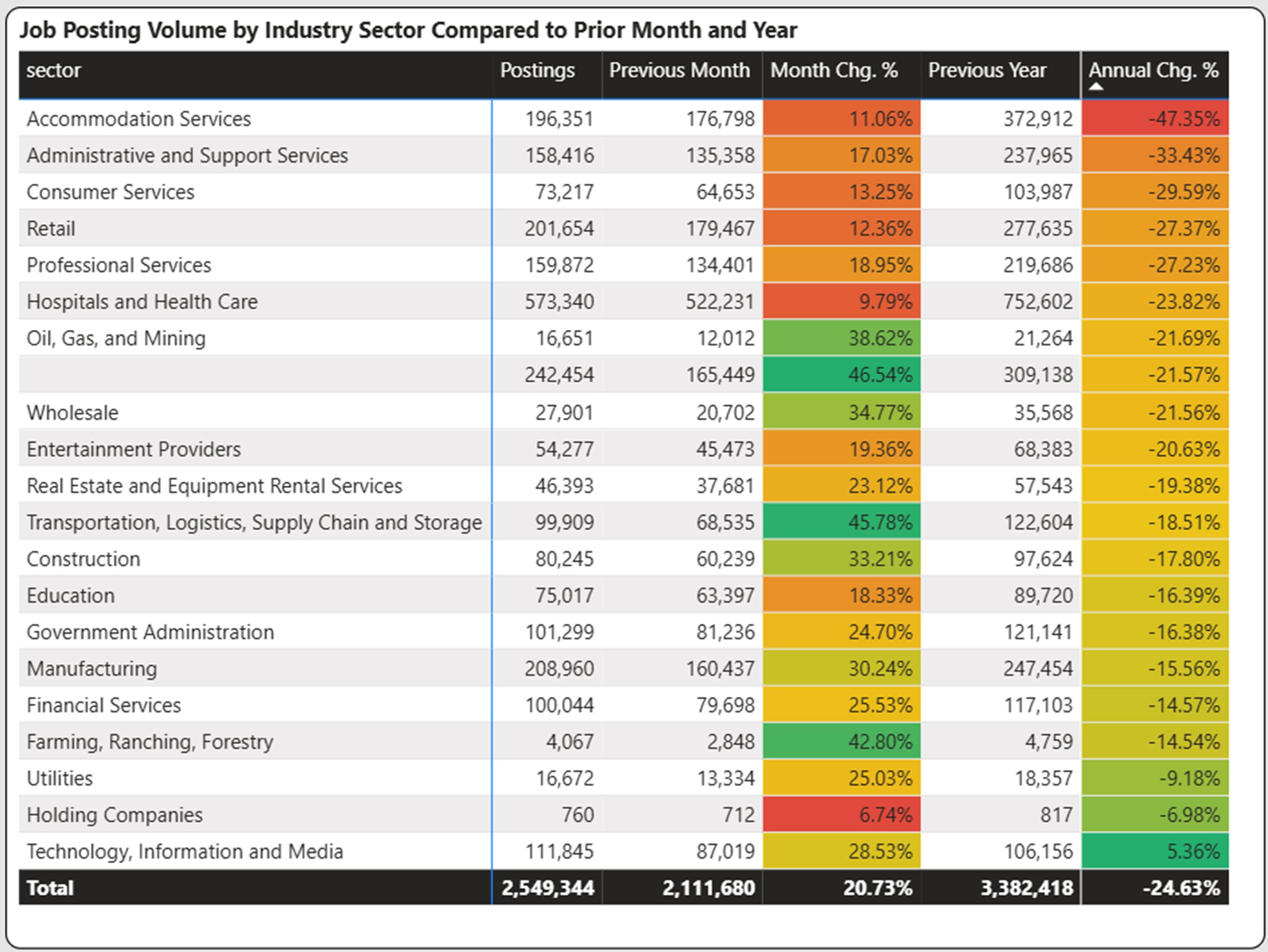

Industry Posting Analysis

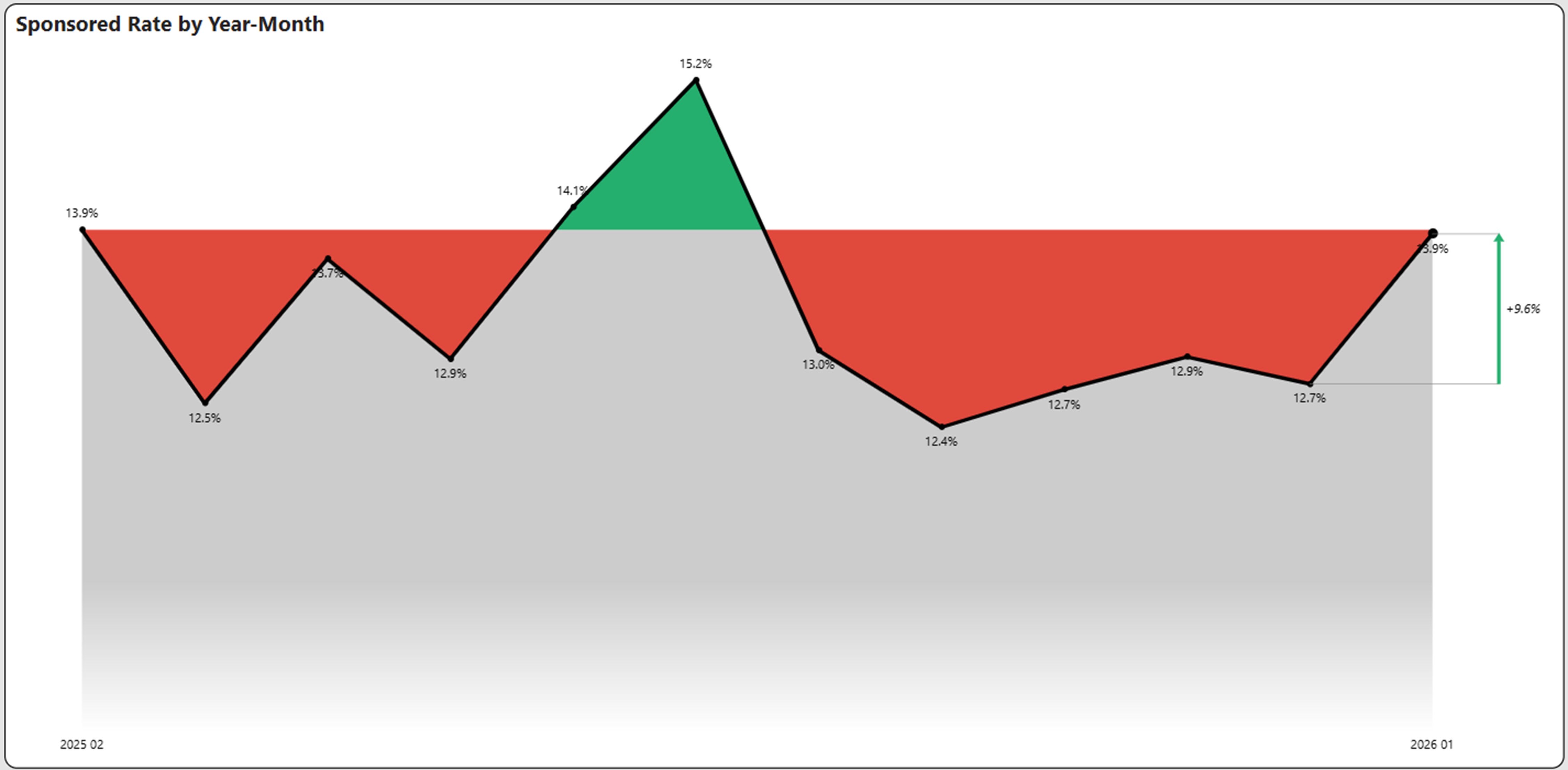

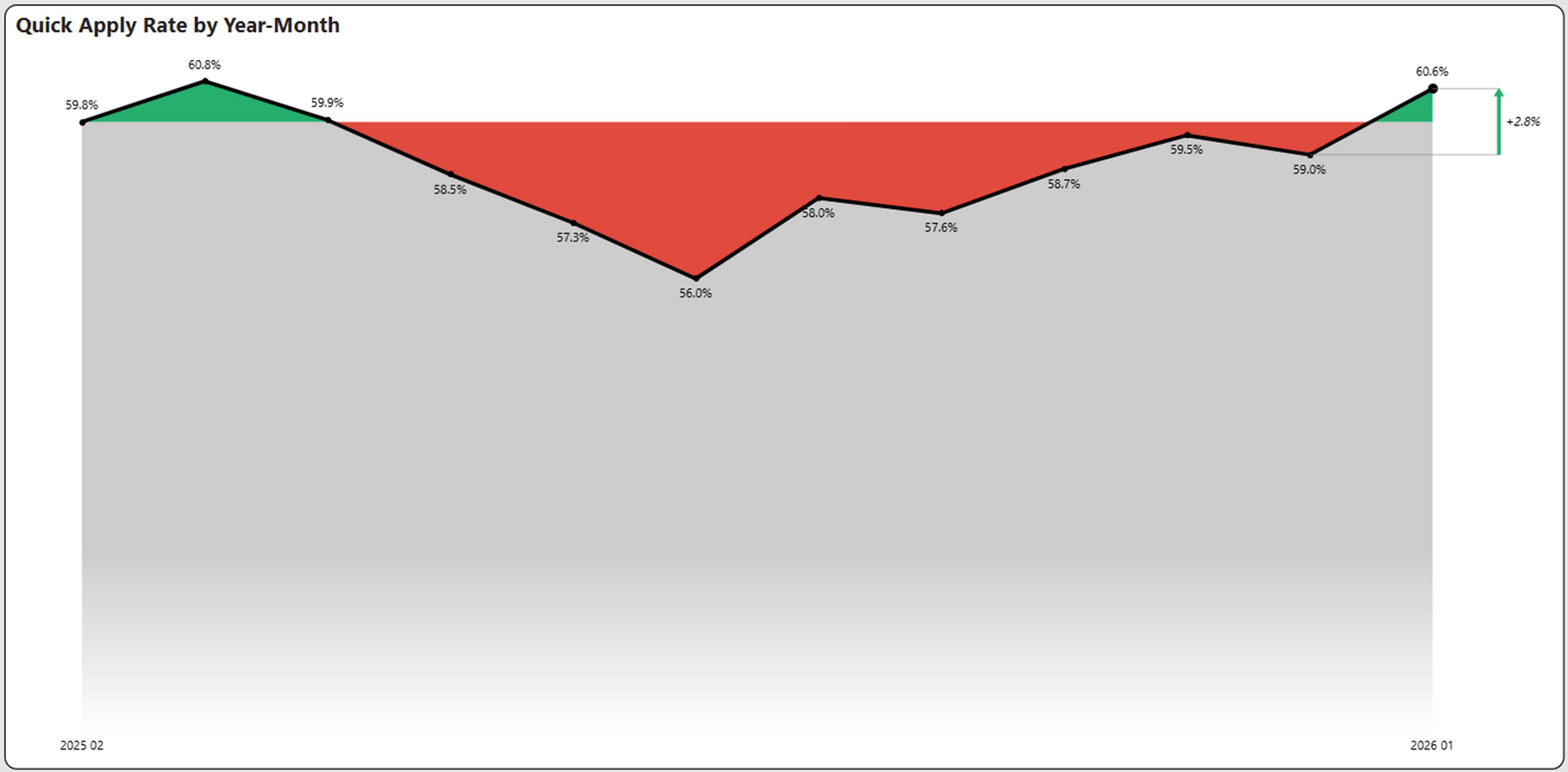

Indicator Rates – Sponsored and Quick Apply

Sponsored rate is the percentage of job advertisements that have had a paid sponsorship at some point over the time period. This is a measure of job boards’ activity.

Sponsored rates showed some strength in January, increasing to 13.9%. This is still below the peak of the past twelve months of 15.2%, but at the third highest rate in the past twelve months.

Quick apply rate is an indicator of whether a job posting has the quick apply feature. This rate increased to back above 60% for the first time since March 2025.

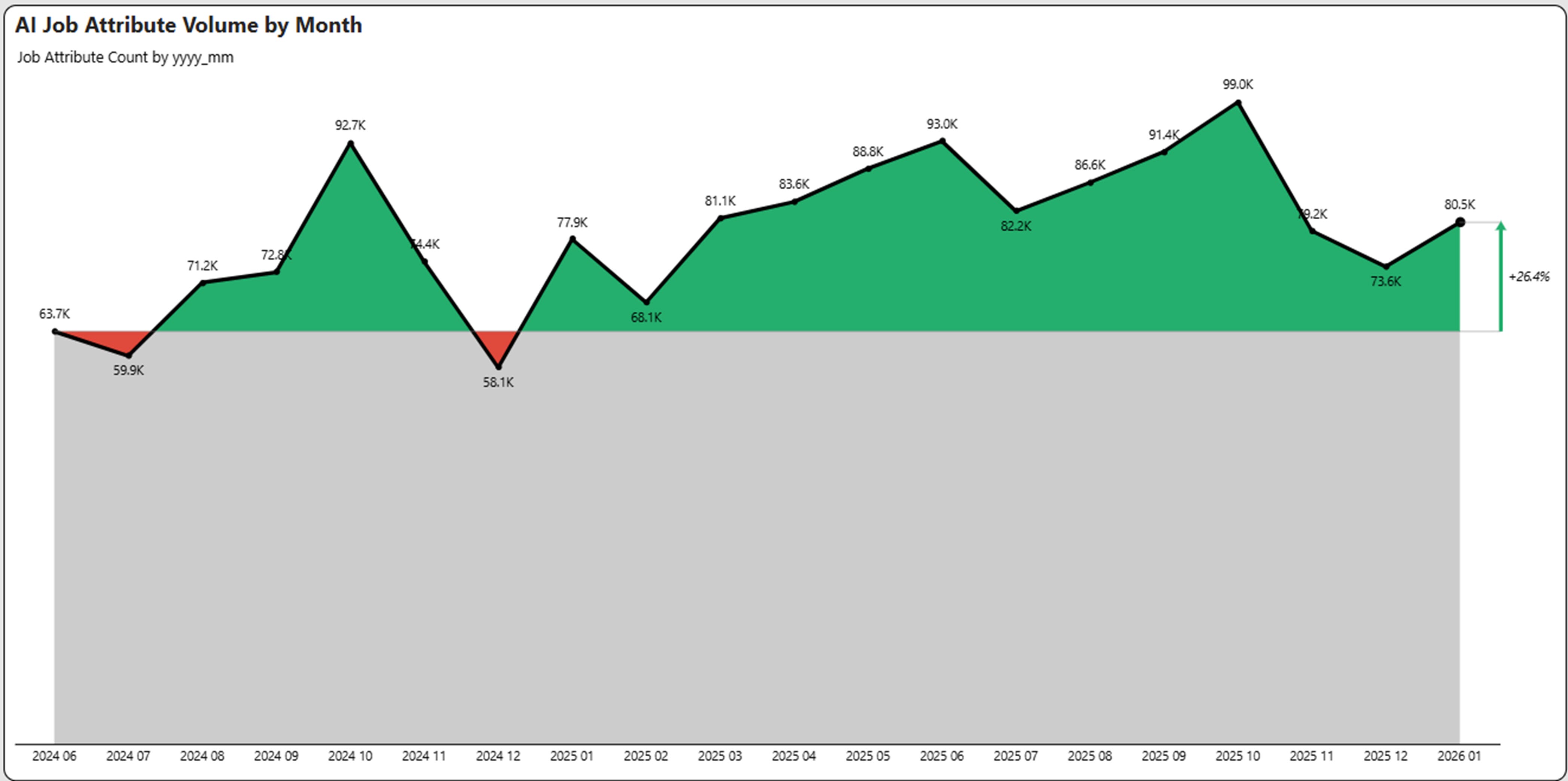

Artificial Intelligence (AI) Skills Growth

Job attributes are categories of skills, benefits or credentials that are included in a job posting. We have flagged AI related categories and plotted the trailing 19-month (earliest data available) growth as shown below.

AI attributes have increased over 25% over the time period despite overall market declines.

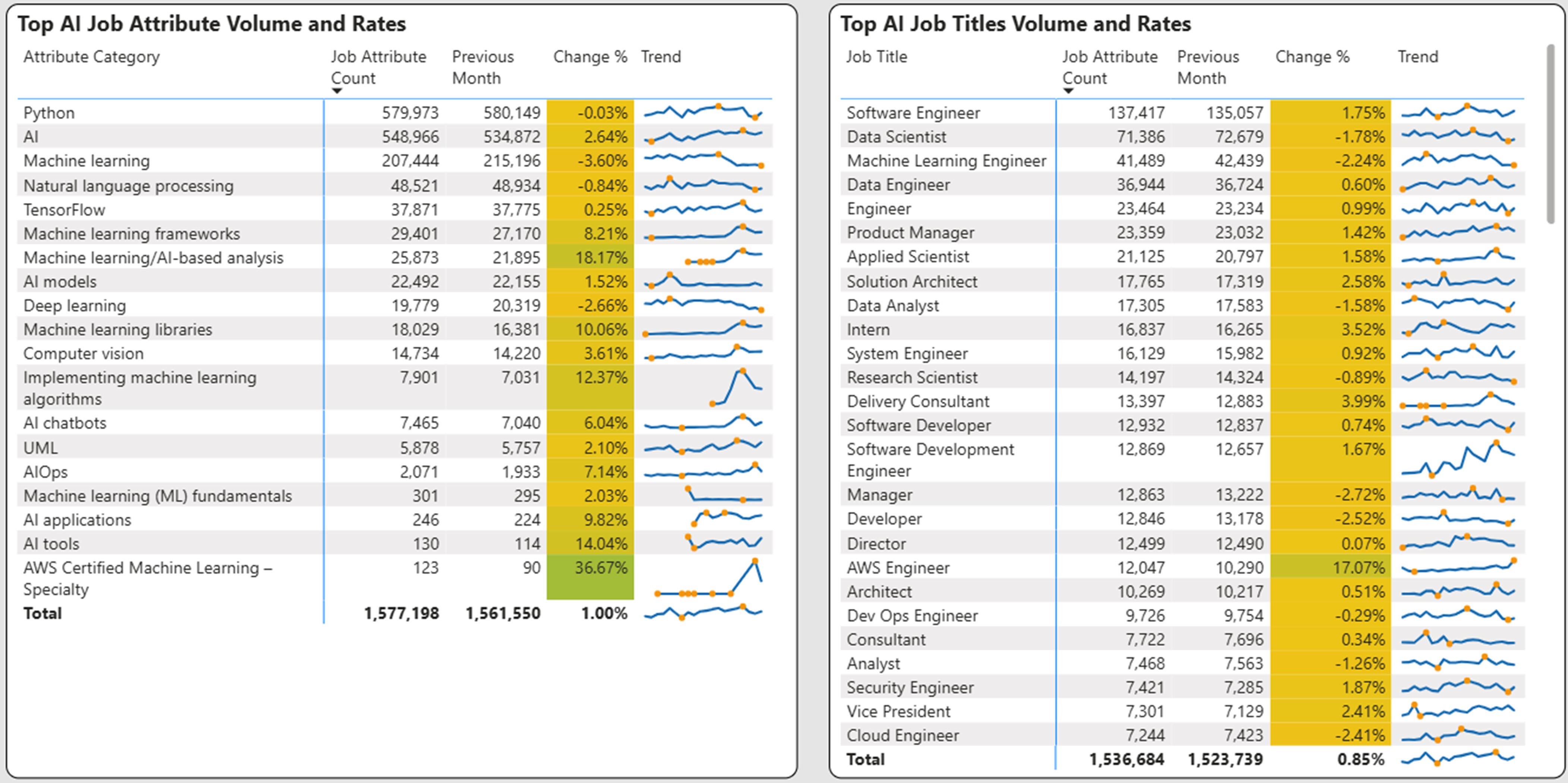

The top AI skills are shown below along with the corresponding job titles.

Python has remained the top mentioned attribute while machine learning related attributes and TensorFlow continue to show the most growth.

These attributes are infused across multiple technology job titles, but are also increasingly showing up in non-technical job titles. These titles include product manager and delivery consultant.

Notable in January is the rise of the job title for AWS Engineers, which increased 17% in January.

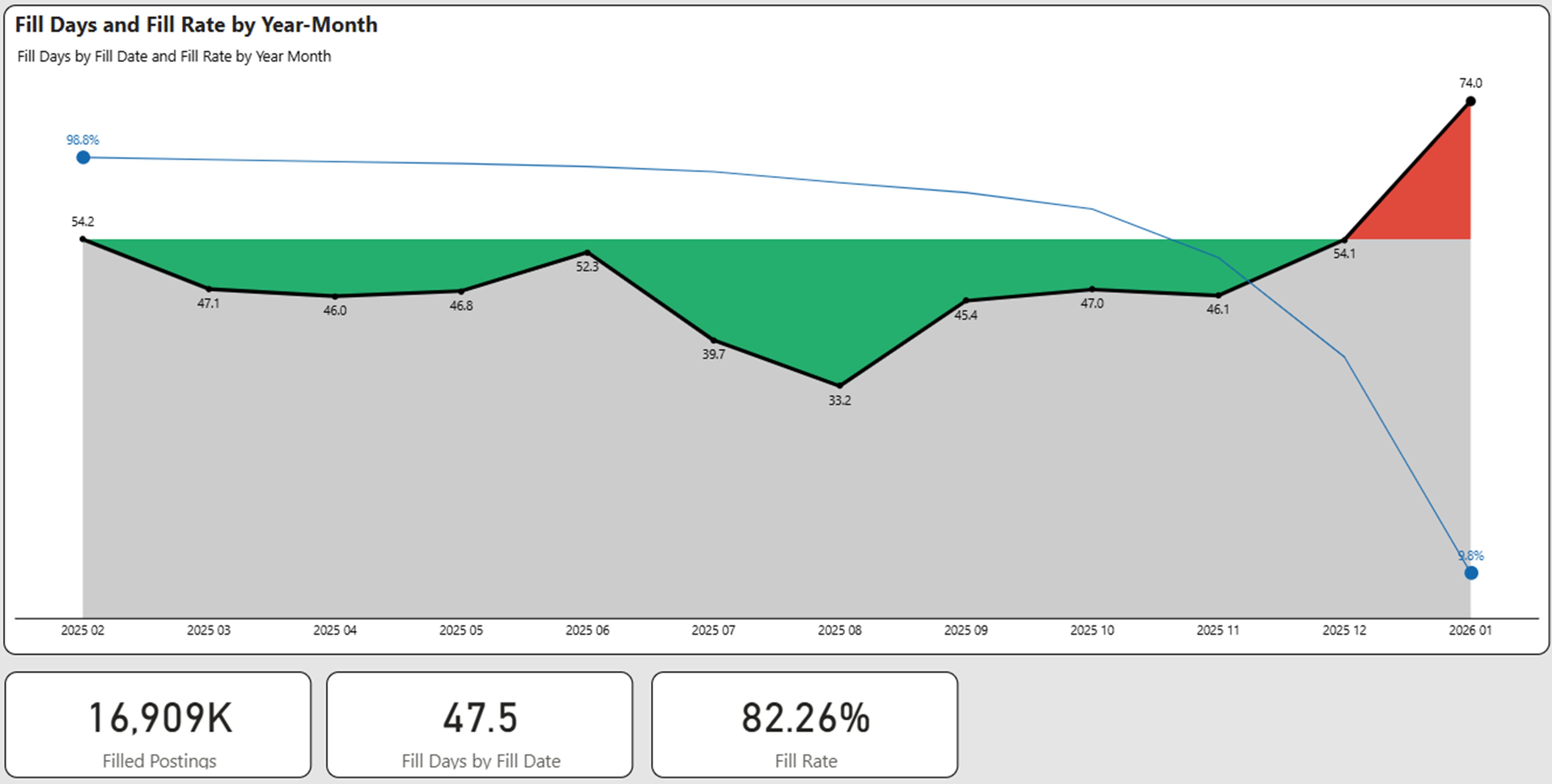

Fill Days are Flat – Fill Rate Declines

For fill days we use ad expiration and ad removal to determine a presumptive hire. When measured over a prolonged period of time and over millions of postings, this provides a strong view of the overall market. The trailing 12 months is used as a time period for our analysis.

In the graph below, we show the fill days by month along with the percentage of ads (blue line) that have been filled. Obviously, the newer ads have a lower fill rate.

Fill days were flat in January compared to December. However fill rates over the comparable time period declined from 86.9% to 82.3%. This may reflect some seasonality, because this rate is the lowest over the past twelve months.

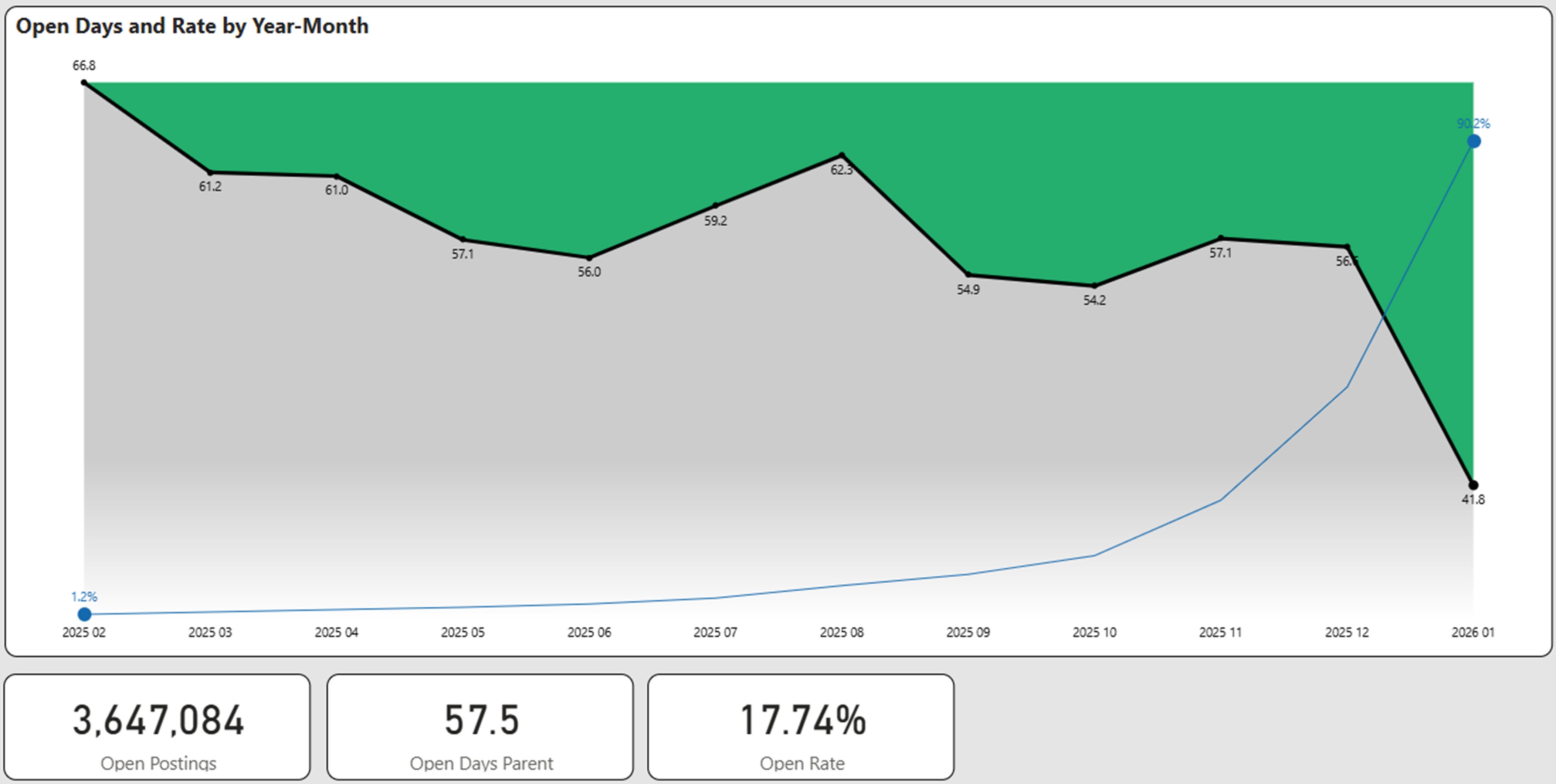

Open Days Declines in January and Open Rates Increase

We track every job posting uniquely and ascertain its fill status on a weekly basis. Open days is the average age of postings that are still determined to be open. Generally, we have found that 12 months to be a suitable time period to evaluate the age of open days. Older postings may distort the open days as they may represent “evergreen” postings. For this reason we eliminate implied evergreen ads that are older than one year from our analysis.

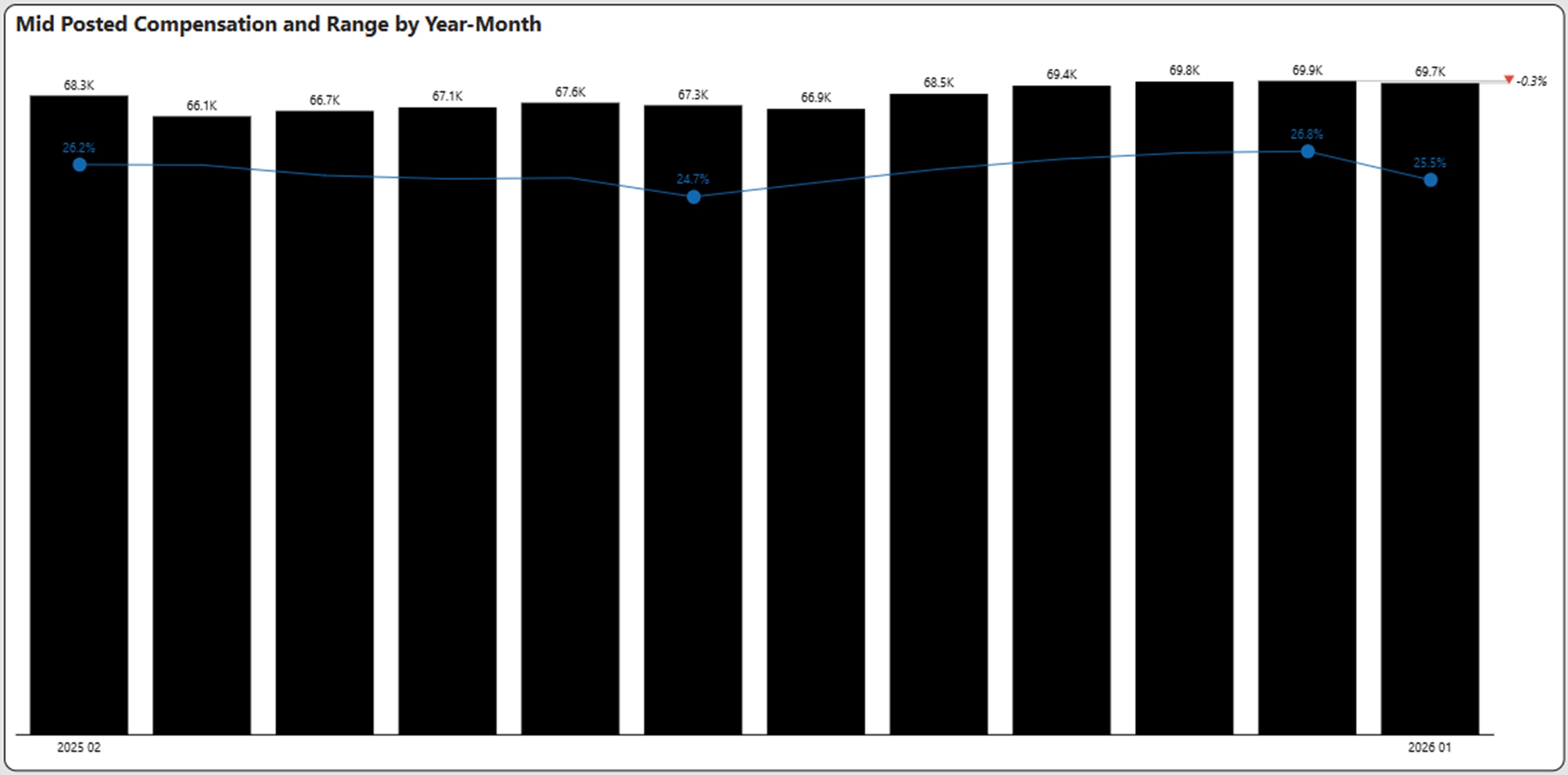

Compensation

Comp Remains Flat at $70k

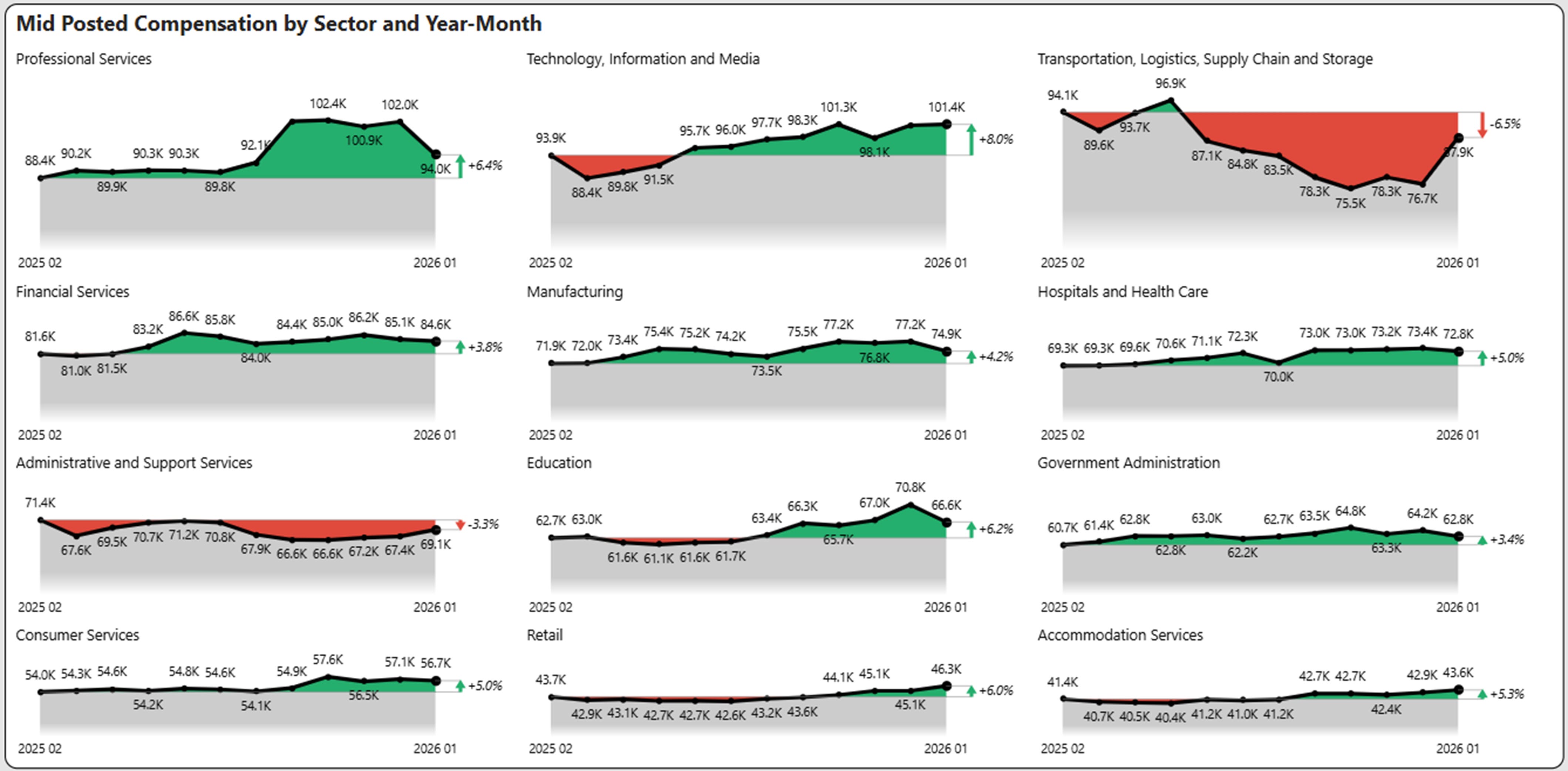

Industry Sector Compensation

The chart below shows the compensation by industry sector for the past 12 months, highlighting the winners and losers.

Supply and Demand

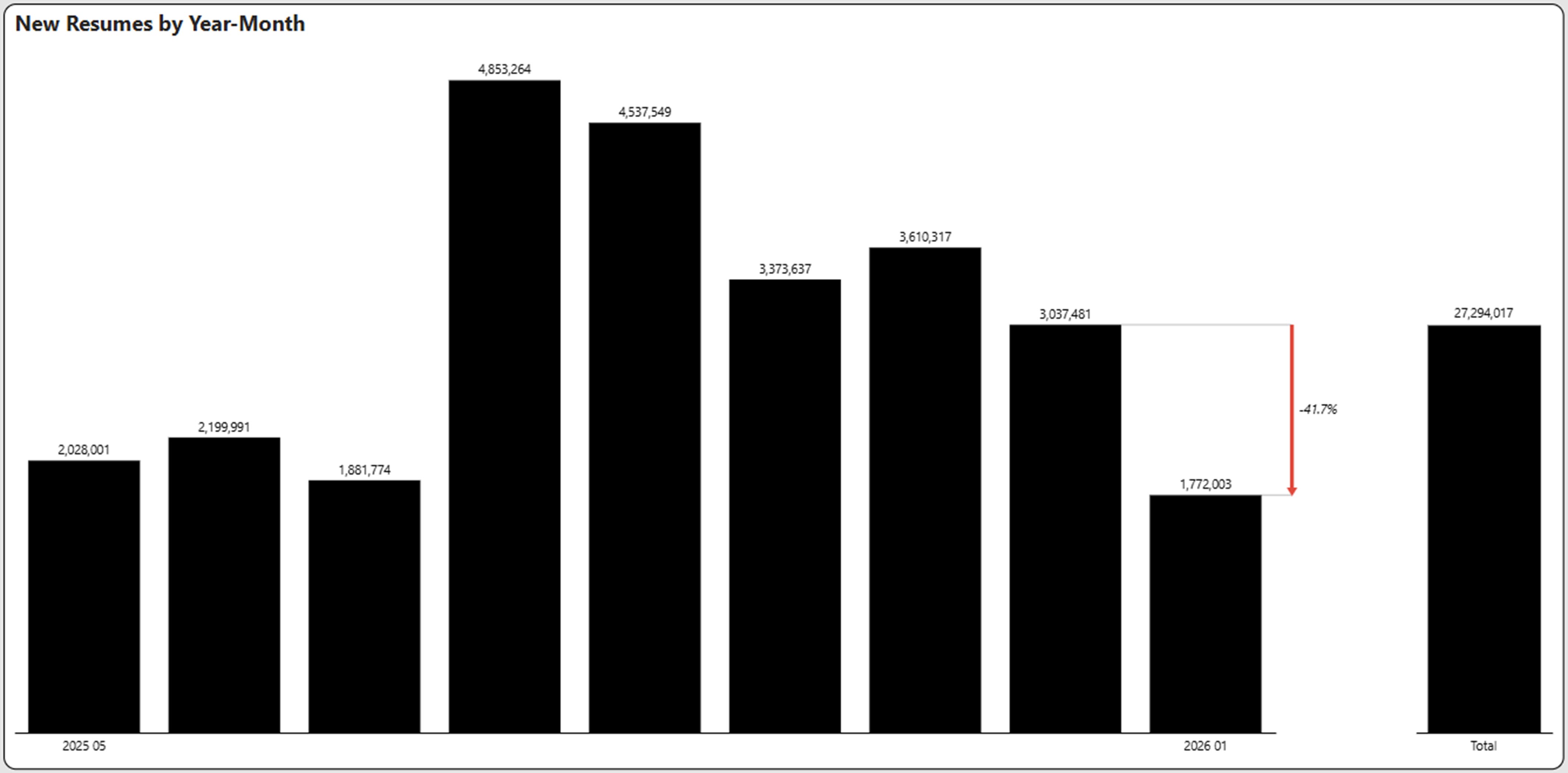

Trailing New Resumes Increase

We use total resumes over the trailing nine months as an indicator to measure overall job seeker interest. Total new resumes increased by more than 13,000 in January compared to the trailing nine months ending in December, indicating increasing job seeker interest.

In a month-to-month comparison, new resumes decreased 41.7% in January compared to December.

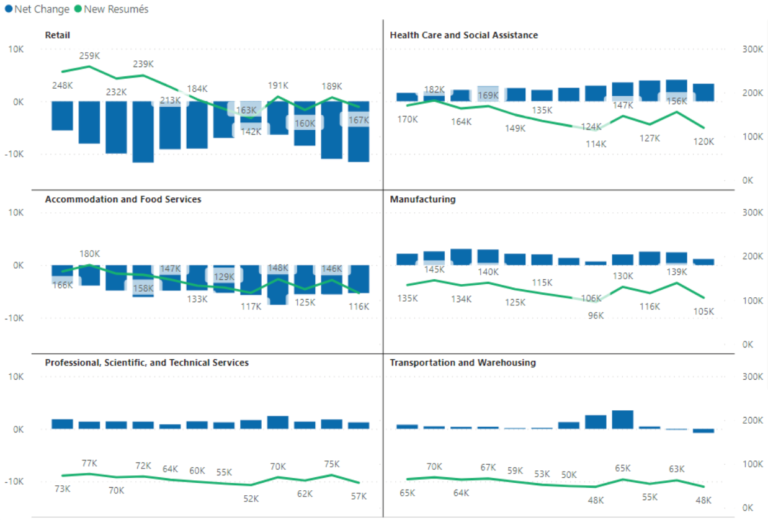

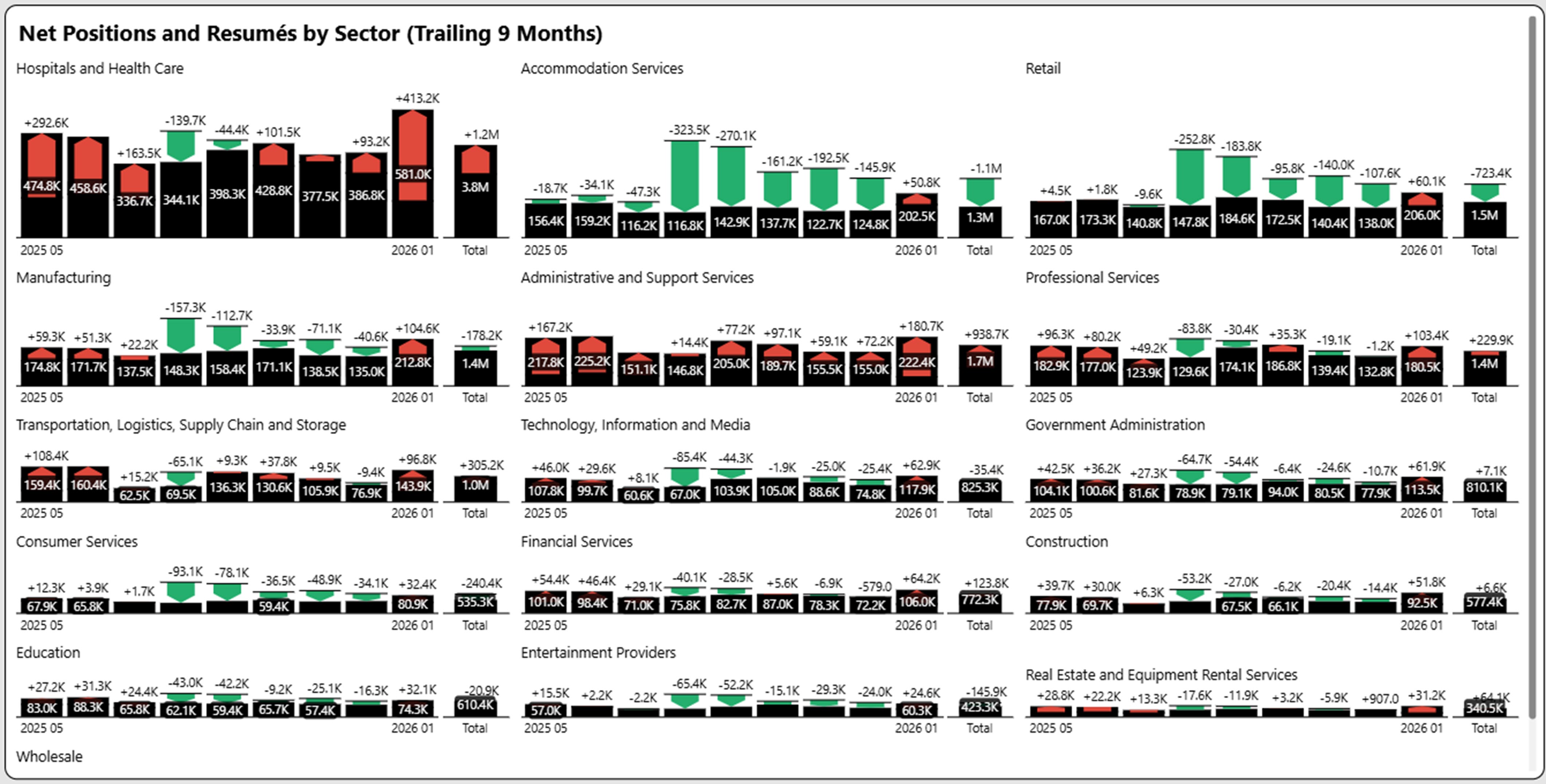

Supply/Demand by Industry Sector

To highlight supply/demand imbalances, we superimpose job seekers based on resumés against net job positions (hires based on unique postings) in black bar. The graphs highlight supply surplus (more job seekers than net postings) shown in green or supply shortage (less job seekers than net postings) shown in red. We picked a time period of nine months, which highlights the current market surplus or shortage. The total bar reflects the summaries of openings and resumés for that time period.

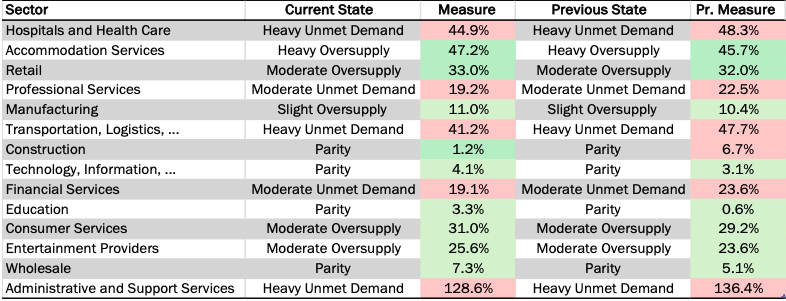

Supply/Demand Scorecard – Not Much Change

We highlight the current state at the end of January as well as the most recent changes over the last nine months. Change is not necessarily good or bad, but we have highlighted changes in supply/demand gaps that significantly impact the current trends.

In the graph below, the Measure column shows the percentage of excess supply over demand (green) or demand over supply (red). The current monthly state is then compared to the previous monthly state with changes (if applicable) highlighted in yellow.

In January there has been no material change in each sector, but overall the trend has been towards a supply centric market.

Overall net positions for the trailing nine months decreased from 20.4 million to 19.8 million, the lowest rate in twelve months. Resumes meanwhile are up 10% over the past four months.

Worker Sentiment

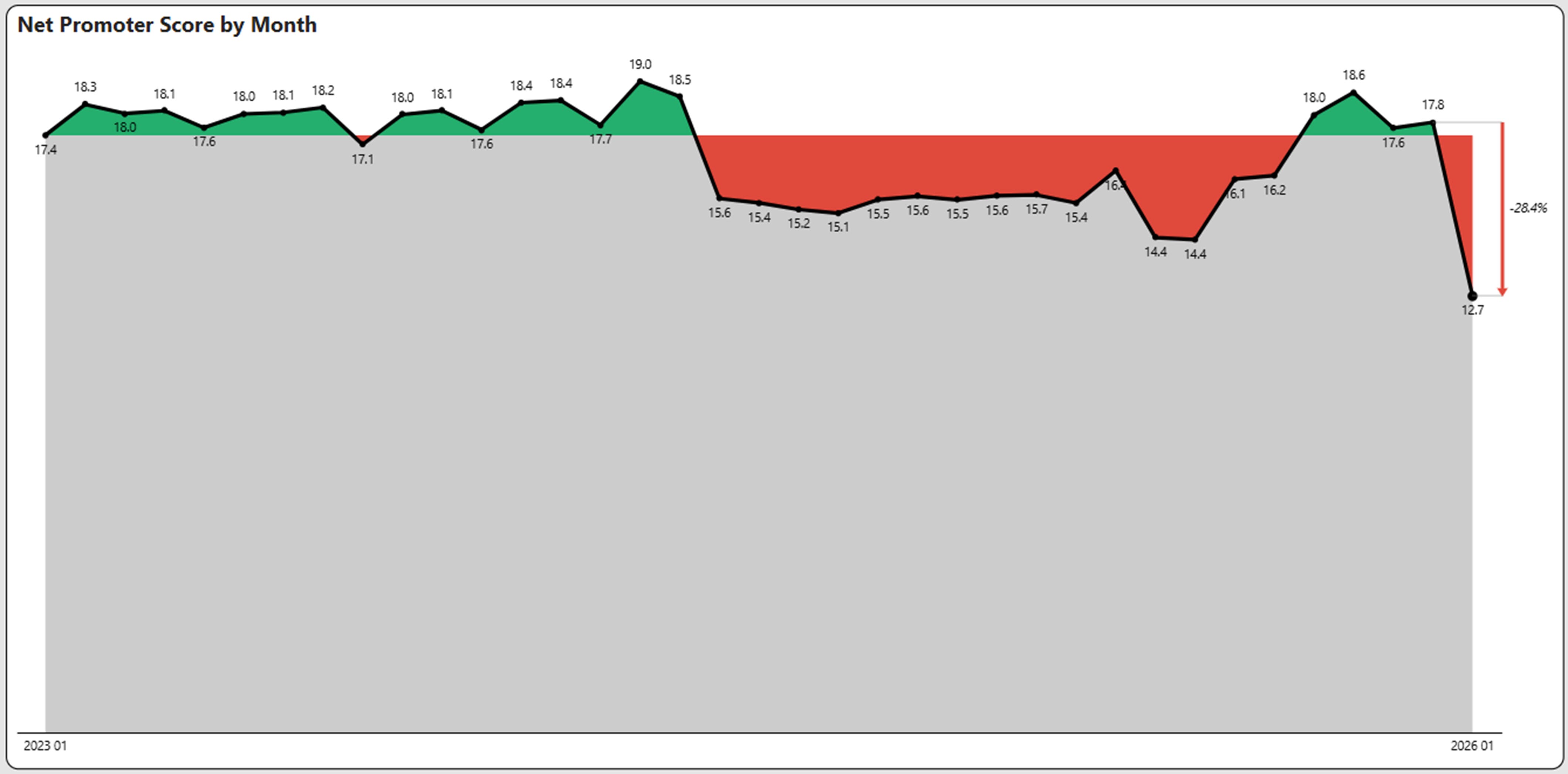

Net Promoter Score (NPS) – Takes a Dive in January

The Net Promoter Score (NPS) decreased 28.4% in January after several positive months. Net Promoter Score is defined as the percentage of positive reviews over negative reviews. NPS for January reviews was 12.7 and is 33% below the peak of 19 and at the lowest point since January 2023. Likewise Positive Business Outlook and CEO Approval declined significantly from December.

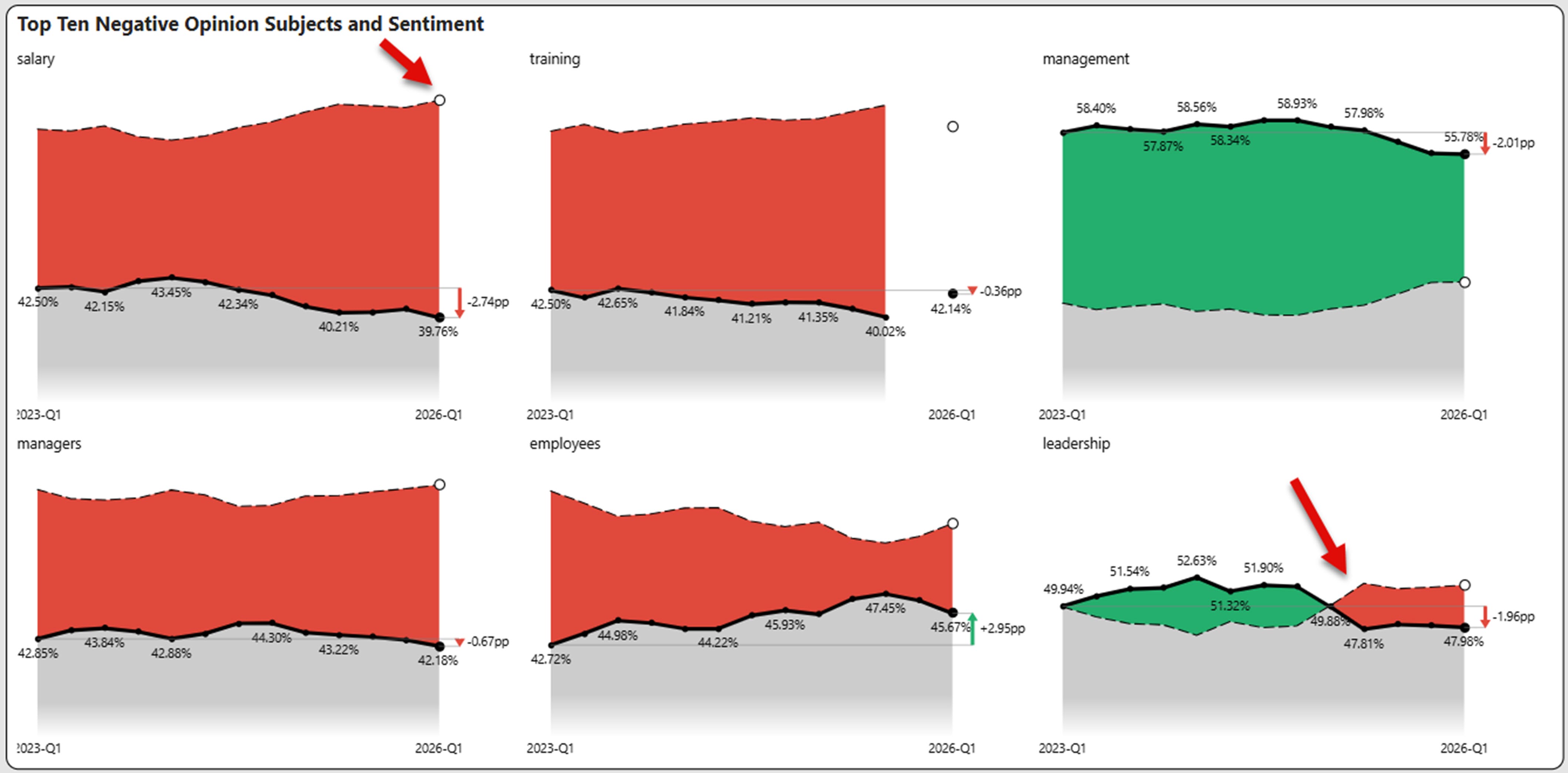

Worker Sentiment Hot Buttons

The graph below shows the percentage of negative reviews vs. positive reviews by subject.

Salary and training negativity increased to a multi-year low based on reviews thus far in 2026. Leadership crossed the threshold from predominantly positive to predominantly negative.

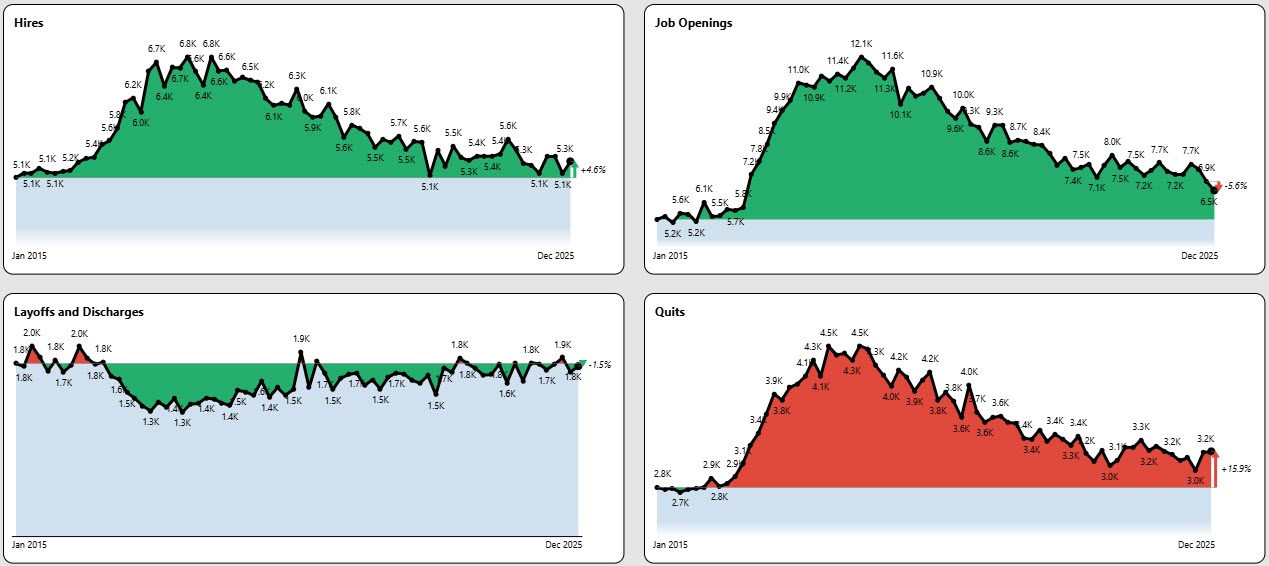

Labor Market

Key Labor Market Takeaways

If You Liked the January 2026 Jobs Report – Get More Insights!

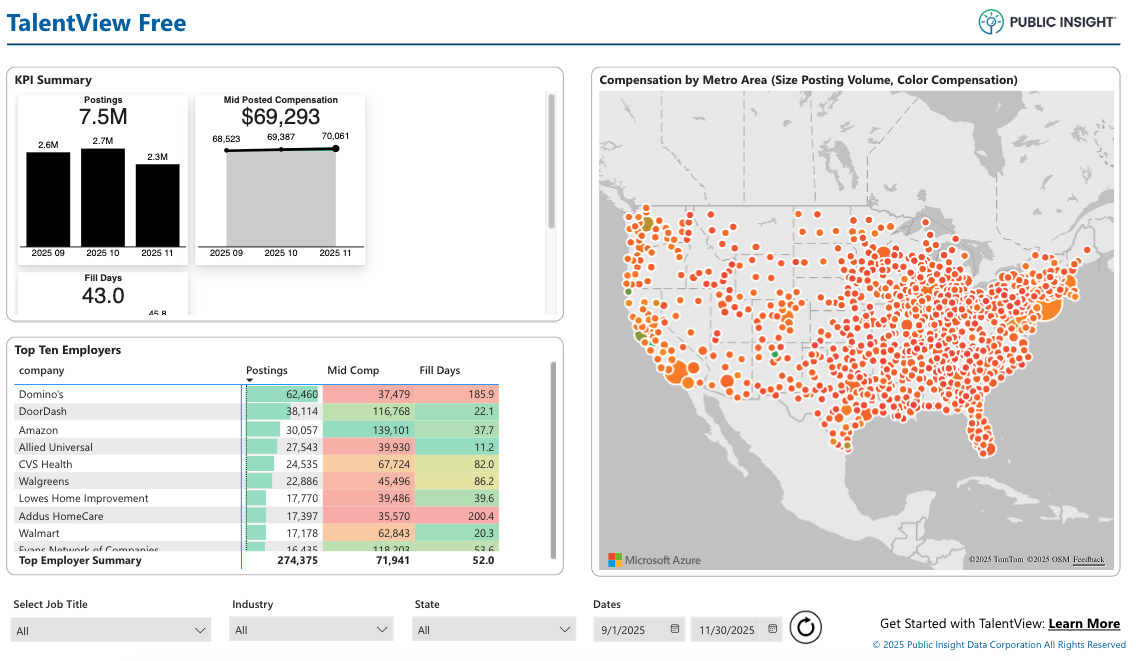

Try Our Free Version of TalentView to Get Instant Compensation, Postings, and Fill Days By Title, Company and Location (No Sign Up Required)

Example Insight: Employers with the most job postings Sept-Nov, 2025.

Current Competitive and Market Talent Intelligence is a Powerful Tool

What is TalentView?

Public Insight develops TalentView, a talent market intelligence solution that generated these insights. The most current and detailed insights are available by title, employer, location, industry and more. We provide flexible ways to utilize talent market intelligence, which include data licensing (API/feeds), interactive dashboards and reports.

How Can Our Must-Have Market Insights Help You?

- Justify Recruiting Decisions and Utilize Data to Tell Your Story

- Inform Recruitment Marketing Budgets, Strategies and Priorities

- Benchmark Employers Against Competitors

- Enhance Your Solution Offering (Solution Providers)

- Identify Business Development Opportunities (Solution Providers)

- Develop Content for Account Management and Marketing (Solution Providers)

Get Started!

Schedule a Call – Let’s discuss and demonstrate how you can leverage talent market data and insights

Sign Up for a Trial – Try out our interactive dashboards or get sample data