Public Insight’s June 2025 Jobs Report summarizes market insights from the millions of job postings, resumé updates and employer ratings/reviews available in our TalentView talent market intelligence platform.

Summary Dashboard

Comparisons of Key Metrics fromJune 2025 to May 2025 and to June 2024

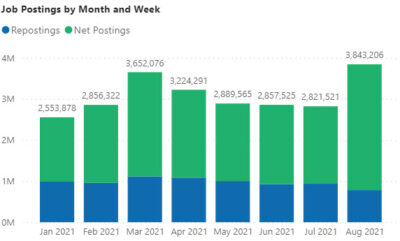

Postings

Posting Volume Declines Continue

June job postings declined 9.1% from the same period last year to 2.83 million and sequentially 2.1% from May. Postings have declined from the prior year in each month in 2025. The good news is that declines for two of the last three months are below 10%.

Industry Analysis

Year-over-year volume posting declines occurred in 17 of the 20 sectors.

Highlights Include:

Fill Days Remains Largely Unchanged

Fill days use ad expiration and ad removal to determine a presumptive hire. When measured over a prolonged period of time and over thousands and millions of postings it provides a strong glimpse of the overall market. The trailing twelve months is used as a time horizon for our analysis.

In the graph below, we show the fill days by month along with the percentage of ads (blue line) that have been filled. Obviously, the newer ads have a lower fill rate.

Fill days as a composite slightly increased in our June analysis from 49.3 days to 49.5 days. The percentage of ads filled during the analysis timeframe however decreased from 86% to 83%.

Open Days Holds Steady

Open days are postings that are still determined to be open. We track every job posting uniquely and ascertain its fill status on a weekly basis. Generally, we have found that twelve months to be a suitable time horizon to evaluate the age of open days. Older postings may distort the open days as they may represent “evergreen” postings. For this reason we eliminate implied evergreen ads that are older than one year.

The graph below shows the aging of open postings for the past twelve months. This value has held fairly steady, ranging from 64 to 67 days. The current number of open postings is 3.6 million, which is substantially higher than last month. The percentage of all open ads increased from 14% to 17%. It is too early to tell at this point whether this will have a downstream effect on fill days or whether we will see these jobs continue to age in place.

Compensation

Compensation Composite Remains Flat

Mid-posted compensation continued to remain largely unchanged at just under $67,000. Compensation has remained mostly flat since November 2024. The range of pay between max and min as a percentage of the midpoint also remained steady at 25.4%.

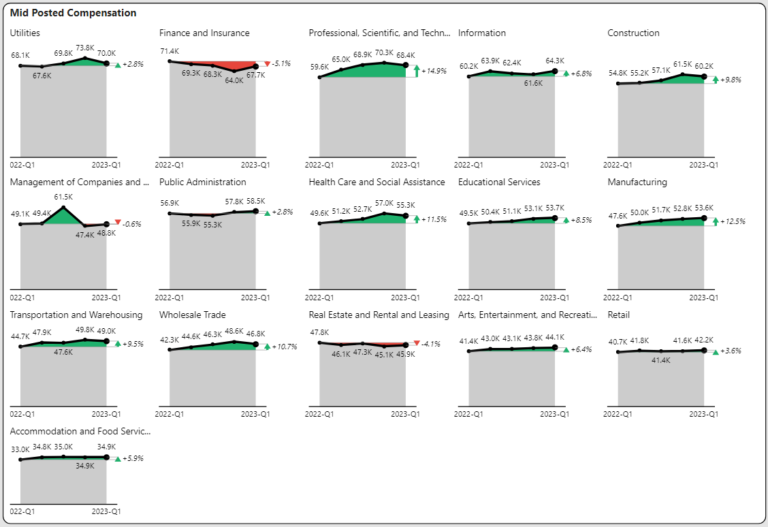

Compensation by Industry Sector

Supply and Demand

Resumes Decline Indicates Passive Job Seeker Market

The number of unique resumes that were published on the Indeed platform increased 8.3% in June. This is an encouraging sign, but still well below the highly active job seeker market at the end of 2024. The number of resumes published over the past twelve months declined from 28.1 million to 26.1 million. Individuals are holding onto jobs and are not as active in job seeking.

Supply/Demand Imbalances Tilt Towards Demand

To highlight supply/demand imbalances, we superimpose job seekers based on resumés against net job positions (hires based on unique postings) in black bar. The graphs highlight supply surplus (more job seekers than net postings) shown in green or supply shortage (less job seekers than net postings) shown in red. We picked a time period of nine months, which highlights the current market surplus or shortage. The total bar reflects the summaries of openings and resumés for that time period.

Supply/Demand Scorecard

We highlight the current state at the end of June as well as the most recent changes over the last nine months. A change is not necessarily good or bad, but we have highlighted changes in supply/demand gaps that significantly impact the current trends. As we saw with composite resumes, there is a lack of interest in changing jobs. Any unmet demand will have to be met with a resurgence in interest perhaps accompanied by compensation sweeteners.

Many sectors as a result of lack of interest in the workforce have tilted towards demand heavy. The movement below highlights movement toward unmet demand in blue vs. movement towards oversupply in green.

Construction and Professional Services have moved into heavy unmet demand, while Technology, Education and Wholesale have progressed to moderate unmet demand. Consumer Services is approaching parity.

| Sector | Current State | Previous State |

| Hospitals and Health Care | Heavy Unmet Demand | Heavy Unmet Demand |

| Accommodation Services | Moderate Oversupply | Moderate Oversupply |

| Retail | Moderate Oversupply | Moderate Oversupply |

| Professional Services | Heavy Unmet Demand | Moderate Unmet Demand |

| Manufacturing | Parity | Parity |

| Transportation, Logistics, … | Heavy Unmet Demand | Heavy Unmet Demand |

| Construction | Heavy Unmet Demand | Moderate Unmet Demand |

| Technology, Information, … | Moderate Unmet Demand | Parity |

| Financial Services | Moderate Unmet Demand | Moderate Unmet Demand |

| Education | Moderate Unmet Demand | Parity |

| Consumer Services | Slight Oversupply | Moderate Oversupply |

| Entertainment Providers | Parity | Parity |

| Wholesale | Moderate Unmet Demand | Parity |

| Administrative and Support Services | Heavy Unmet Demand | Heavy Unmet Demand |

Worker Sentiment

Net Promoter Score Maintains Improvement

After a significant jump in May, Net Promoter Score (NPS) dipped slightly in June. However this is still significantly above the negative trends of the past year.

Positive Business Outlook (shown below) declined again to 59.4% setting a 30-month low. This may be a reflection of the overall business climate and job security than specific issues with the companies.

Labor Market

Key Labor Market Takeaways

Get More Insights!

Try Our Free Version of TalentView to Get Instant Compensation, Postings, and Fill Days Insights By Title, Company and Location (No Sign Up Required)

How Would Your Company, Competitors, Industry and Job Titles Compare?

Wouldn’t you want these insights for your industry, job titles, locations and to compare against competitors?

What is TalentView?

Public Insight develops TalentView, a talent market intelligence solution that generated these insights. The most current and detailed insights are available by title, employer, location, industry and more. We provide flexible ways to utilize talent market intelligence, which include interactive dashboards, reports, analytics feeds and data integration via API.

How Can Our Must-Have Insights Help You?

- Inform/Justify Recruiting Decisions and Prepare For Hiring Manager Discussions

- Inform Recruitment Marketing Budgets, Strategies and Priorities

- Benchmark Employers Against Competitors

- Enhance Your Solution Offering (Solution Providers)

- Identify Business Development Opportunities (Solution Providers)

- Develop Content for Account Management and Marketing (Solution Providers)

Get Started!

Schedule a Call – Let’s discuss and demonstrate how you can leverage job/talent market insights

Sign Up for a Trial – Try out our interactive dashboards or get sample data for proof of concept