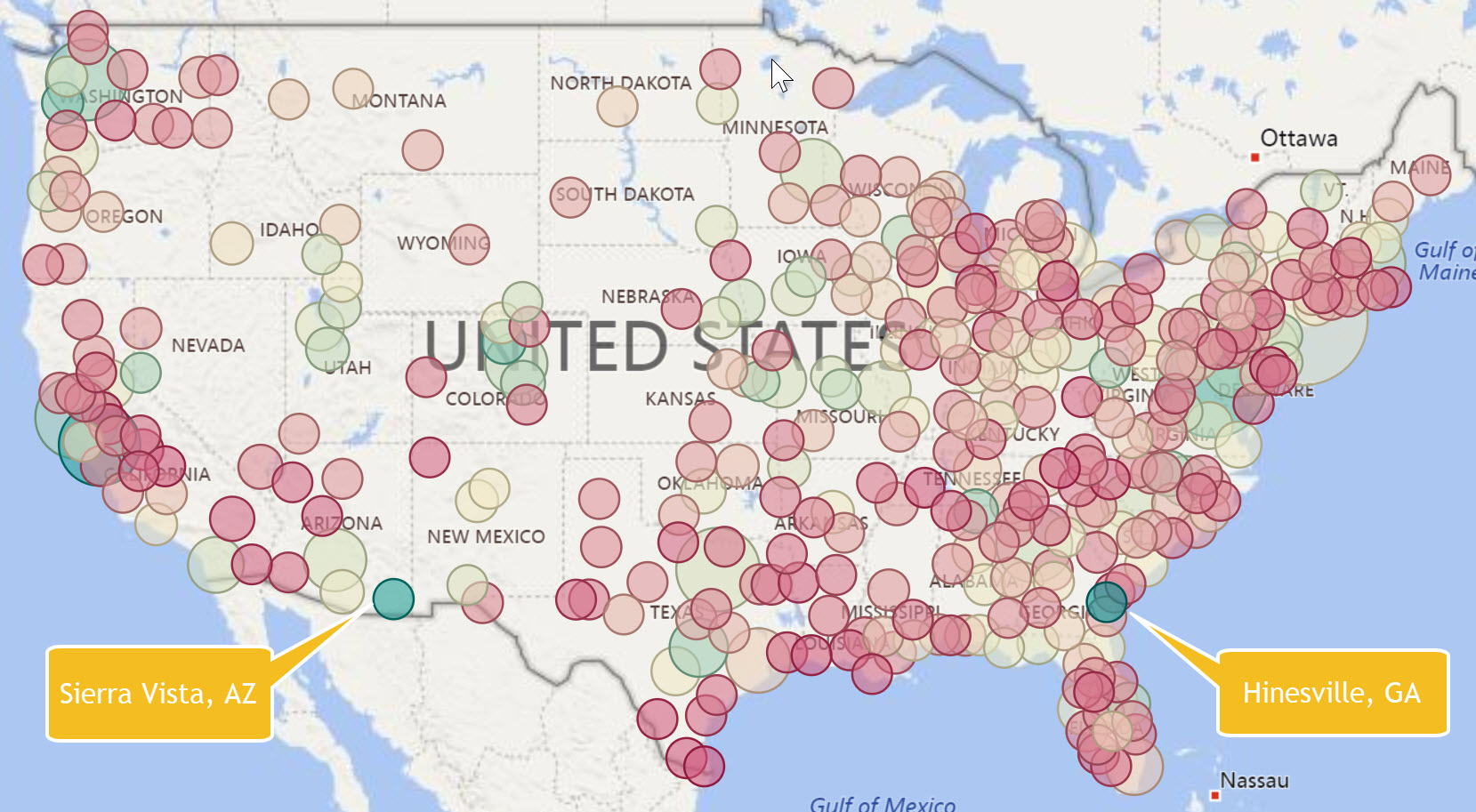

Sierra Vista, AZ and Hinesville, GA probably don’t seem to have much in common. One is in eastern Arizona and the other is in southeast Georgia. They are both very small cities with populations of around 40,000. What they have in common is a market concentration for computer occupations with a location quotient of around four times the national average. These two markets pop out when you show a map of metropolitan areas color coded for location quotient as shown below. Markets with a high saturation for computer occupations are a cyan color while those with lower saturation are in red.

Location quotient reveals market concentration because it compares the local region (metro area in this case) to the nation. The size of the points in the map above is the absolute number of jobs (computer occupations in this case). A market like Chicago has a high number of computer jobs but it is not concentrated compared to the nation. In other words, it has the expected number of computer jobs compared to all other occupations for that size market.

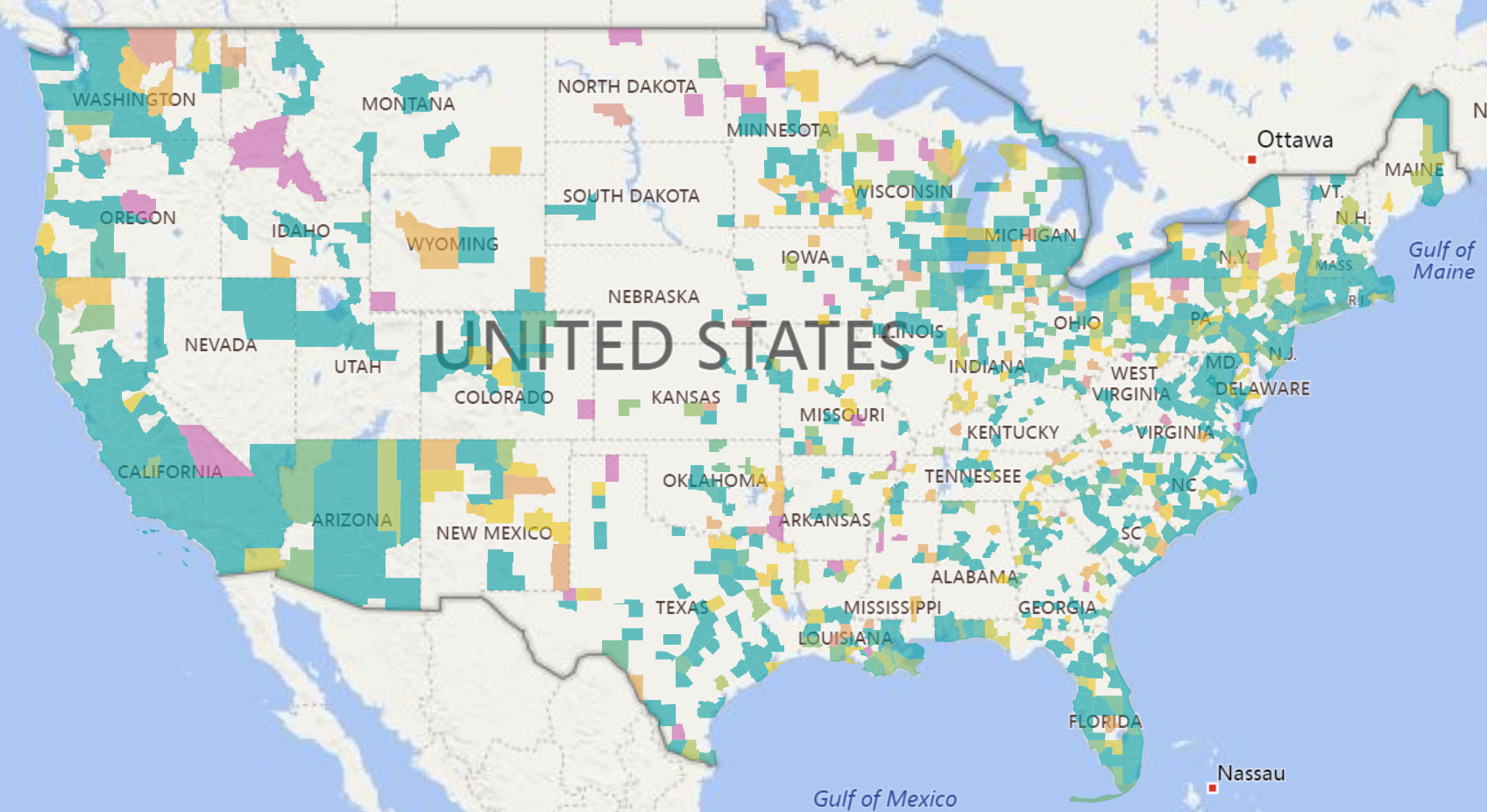

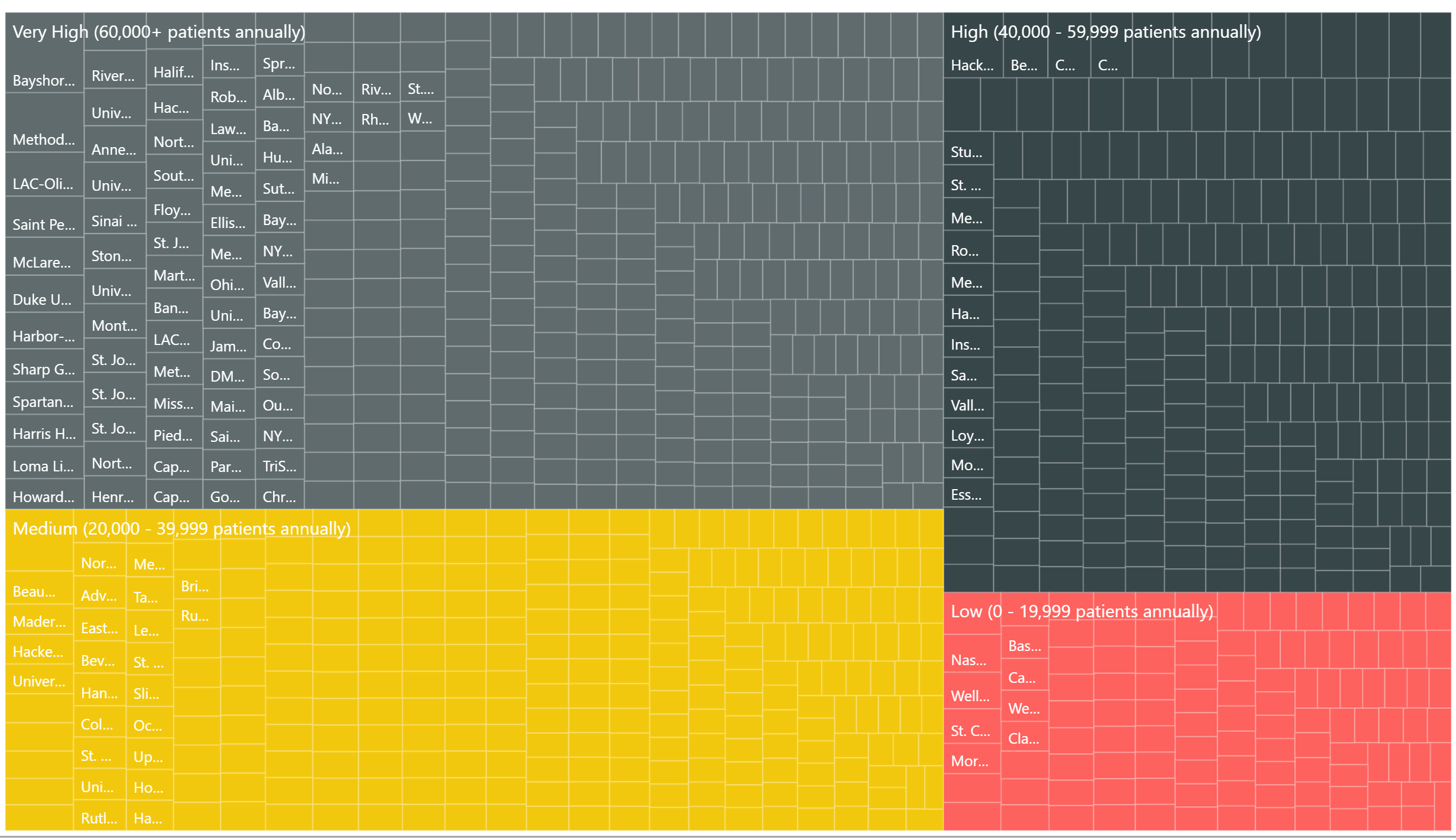

We have updated the popular Degree-to-Jobs Interactive to include the latest data from the Occupational Employment Statistics survey for 2017. This Interactive includes job and wage analysis by market for over 800 job occupations with crosswalks to CIP codes for program planning and analysis. This update is automatically available to our subscribers. You can purchase this as an individual Interactive for $295 or as part of the Higher Education Institution library.