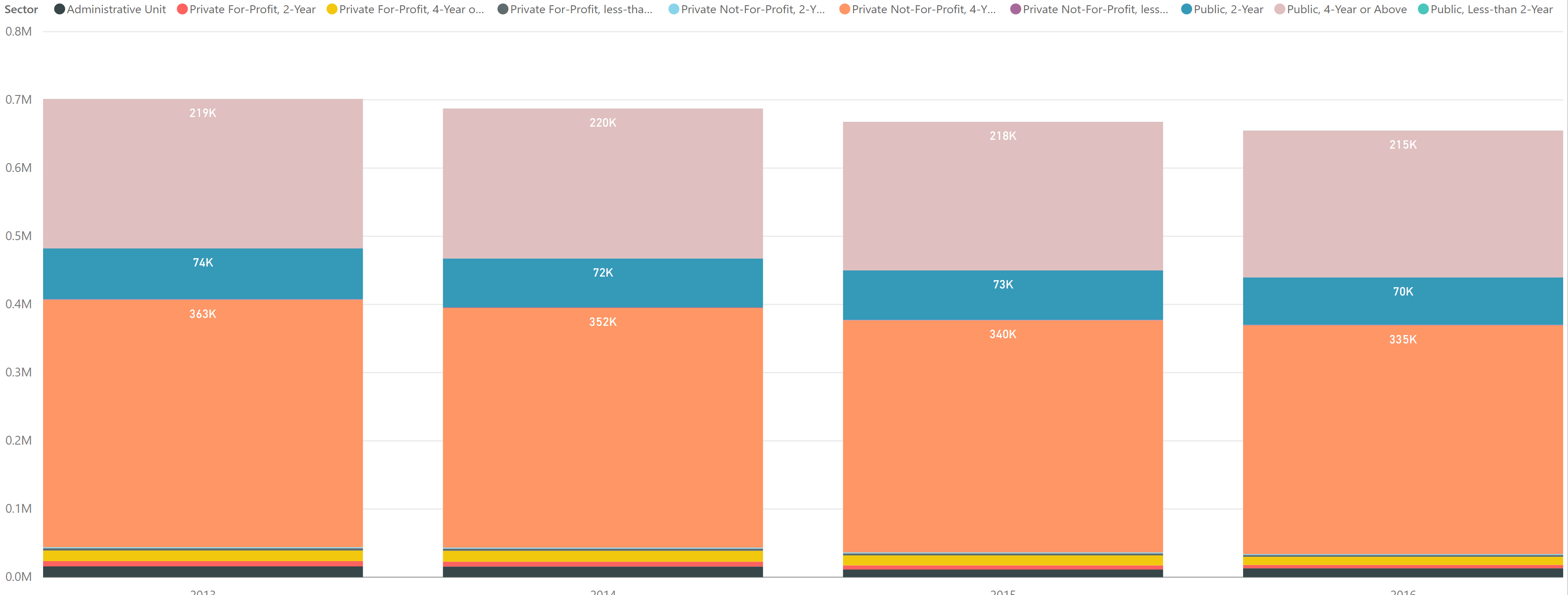

Last week, we observed that the PLUS loan program continues to escalate both in terms of dollars borrowed and in terms of recipients. Using the newly published Financial Aid Interactive, we projected the number of dollars borrowed by PLUS loan borrowers will increase 1.25 billion for the year ending June, 2017. PLUS loans carry an interest rate of 7% compared to a subsidized rate of 4.45%. So what does that mean to student debt?

Being a former CPA, I couldn’t help myself but calculate the incremental debt service cost.

The incremental debt service cost for $1.25 billion of higher interest debt is nearly $200 million over the life of the loan. We calculated the debt using both the higher and lower rates over a 10 year period. This is not an insignificant number when you consider that this additional debt service cost could continue each year if the trend towards PLUS debt continues. What it does to downstream loan defaults is hard to project.

More and more colleges are considering how to limit the cost of student borrowing, especially given the potential loss of Pell Grants. We will look at that issue next week.